ScratchPad: John Maynard Keynes Was too Concerned with Wealth & Income Distribution...: 2024-04-21 Su

A scratchpad…

A scratchpad….

Economics: This from the extremely sharp Branko is just wrong:

Branko Milanovic: Why not Keynes?: ‘Keynes’ uneasy relationship with income distribution: I was asked several times, and most recently only a couple days ago, why in Visions of Inequality I do not discuss Keynes. He doesn't have a chapter like the other six authors and when I mention Keynes it is only in passing and simply in relationship to the marginal propensity to consume. My answer is twofold. First, I think that Keynes was not interested in income distribution. And, more importantly, at one point where he clearly could have, or even should have, brought income distribution into discussion he declined to do so and decided to ignore it… <branko2f7.substack.com/p/why-not-keynes…>

Cf.: The very beginning of Chapter 24 of Keynes’s General Theory:

John Maynard Keynes (1936: The General Theory of Employment, Interest & Money: Chapter 24. Concluding Notes on the Social Philosophy towards which the General Theory might Lead: ‘THE outstanding faults of the economic society in which we live are its failure to provide for full employment and its arbitrary and inequitable distribution of wealth and incomes. The bearing of the foregoing theory on the first of these is obvious. But there are also two important respects in which it is relevant to the second… <marxists.org/reference/subject/economic…>

I think much of Keynes’s argument about the effect of thoroughgoing Keynesian policies on wealth distribution and plutocracy is wrong, but he is concerned with it—” arbitrary and inequitable distribution of wealth and incomes”—and does make an argument. And much of Keynes’s argument about the effect of thoroughgoing Keynesian policies on wealth distribution and plutocracy is right.

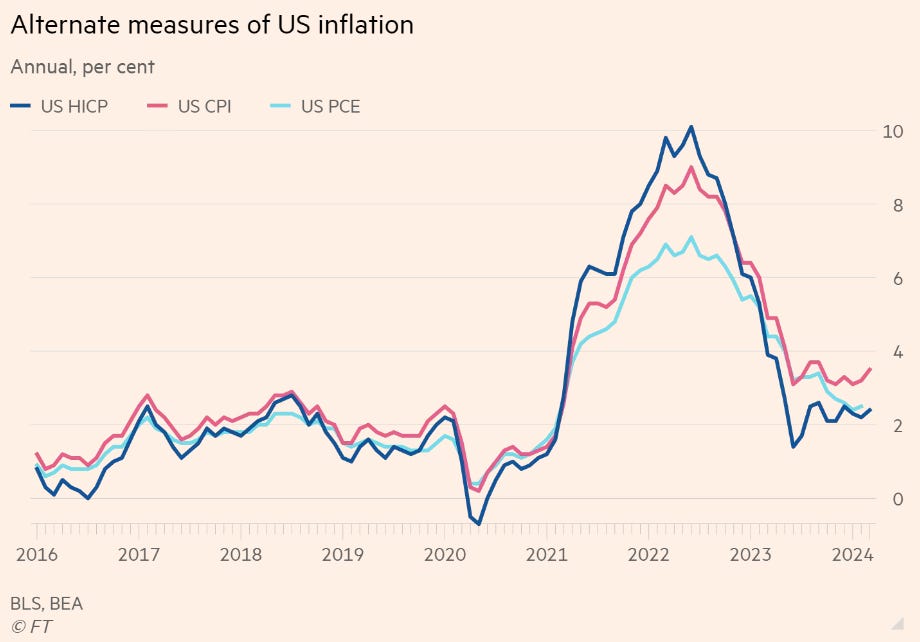

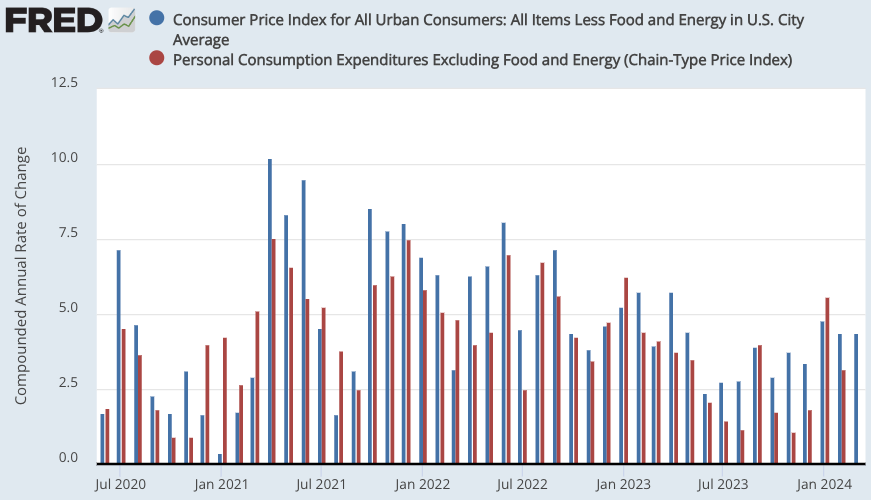

Economics: Trying to look through the monthly dataflow at the underlying economic realities, I think Tej Parikh has got this one right. Wages do appear to be moderating. Higher-for-longer interest rates will produce tighter financial conditions. The laggy shelter data points reported in the future should drag monthly inflation measures down. The Federal Reserve should look through the monthly data and the lags, should have focused in March on where the economy is likely to be in September 2025, and should focus in June on where the economy is likely to be come December 2025. It, in my estimation should have and should cut rates at both meetings, rather than validate the market-driven further tightening of monetary conditions:

Tej Parikh: A contrarian take on the US inflation freakout: ‘Not as bad as it looks—better for the Fed to keep calm, and carry on?…. Last week’s core CPI growth for March came in at a 0.359 per cent month-on-month, against a consensus of 0.3. A ‘whopping’ 0.059 percentage points higher…. Best to understand why it came in higher than expected first…. Shelter is itself driven by “Owners’ Equivalent Rent of Residences”. This is the BLS’ estimate of what owner-occupiers would pay if they rented their homes. It gets a chunky 34 per cent weight in core CPI…. The Fed targets PCE inflation. That measure places less emphasis on OER (core PCE gives it only a 13 per cent weight). It also measures insurance inflation net of claims.… The Fed’s emphasis on data dependence has tied its hands. It is finding it hard to ignore the run of three above expectation CPI prints, despite the detail, forward dynamics, and PCE all looking benign. Given how restrictive real rates are, pockets of economic weakness and where underlying inflation is—excluding all the noise—the Fed probably still needs to cut rates… <https://www.ft.com/content/39af38ed-f493-4ad6-b6e3-3e4777ecdbbb>

I mean: there have now been 75 basis-points of real monetary tightening since late 2022-early 2023. Tell me what things that have changed about inflation outcomes and the inflation outlook would justify that:

Neofascism: All of the cries for Trump not to be prosecuted—for anything—no matter where on the political spectrum they come from are, at base, claims that Donald Trump is the kind of person whom the law ought to protect but ought not to bind:

Josh Micah Marshall: The Dominating & The Dominated: One of Trump’s great powers is that he is like a heavy magnet of distorted thinking. When he comes into proximity people start thinking stupid things, asking stupid questions. What opinion should we, who are not prosecutors, have toward a chronic lawbreaker who is charged with breaking the laws he broke? Will it make him stronger? Were the laws broken enough? On the simplest level the first question has always seemed easy to me…. One of Trump’s accomplices literally already went to jail for this. Indeed, he did so on charges brought by the Trump Justice Department…. This trial… in its substance is less grave than the other three prosecutions. Let’s stop there. How could it not be? Two of the others are tied to an attempted overthrow of the federal government. Perhaps the gravest crime possible. The other is absconding with boxes and boxes of highly classified documents… <https://public.hey.com/p/y8KNXAP4K1z3kdCPFcNV8a7d>

Economics: Trying Again to Understand Recent Monetary Policy in the United States: Aha! Here is a veritable pivot!:

Craig Torres: Powell Signals Rate-Cut Delay After Run of Inflation Surprises: ‘Fed chair said appropriate to give policy further time to work. Central bank can keep rates steady for ‘as long as needed’…. “The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence,” Powell said Tuesday in a panel discussion alongside Bank of Canada Governor Tiff Macklem at the Wilson Center in Washington. “Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us,” he said… <https://www.bloomberg.com/news/articles/2024-04-16/powell-signals-high-rates-for-longer-due-to-persistent-inflation

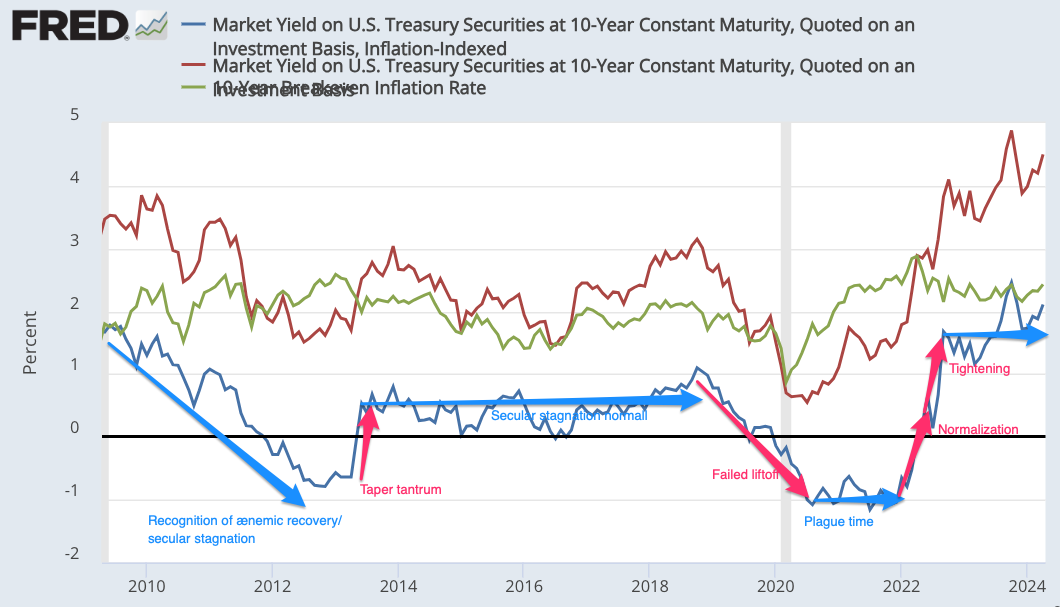

Over the past fifteen years, since April 16, 2009, I see eight suberas of monetary policy in the United States:

Up until late 2013: gradual recognition that we are in an era of secular stagnation and that the monetary (and fiscal!) policy stimulative response has been insufficient and subpar.

Mid-2013: the “Taper Tantrum”—a significant monetary policy mistake that further stretched out the period of ænemic recovery.

Late-2013 through 2017: The full secular-stagnation normal.

2017 to March 2020: Failed liftoff away from the zero interest-rate lower bound.

March 2020 to February 2022: plague time.

February to July 2022: post-plague normalization.

July to September 2022: shift to restrictive monetary policy.

September 2022 to present: waiting for a shoe—any shoe—to drop.

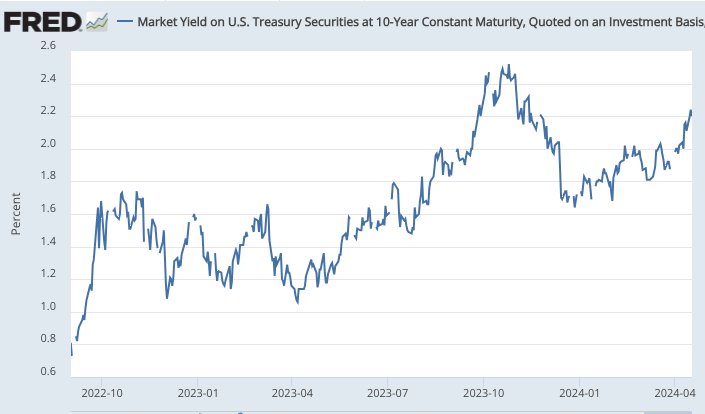

I track these suberas by the behavior of the interest rate that ought to be key for managing the interest-sensitive segments of aggregate demand—structures and, through the exchange rate, net exports—the inflation-indexed Ten-Year Treasury TIPS, the blue line in the graph below:

(The red line is the Ten-Year Treasury nominal rate; the green line is the inflation breakeven.)

The February to July 2022 normalization brought the stance of monetary policy back to its high secular-stagnation era level. The July to September 2022 tightening brought the stance of monetary policy considered as the slope of the safe and collateralizable-asset numeraire intertemporal price system back to its pre-Great Depression level. (Do note that that level was, back then, seen as depressed: it was a time of “global savings glut”, after all.)

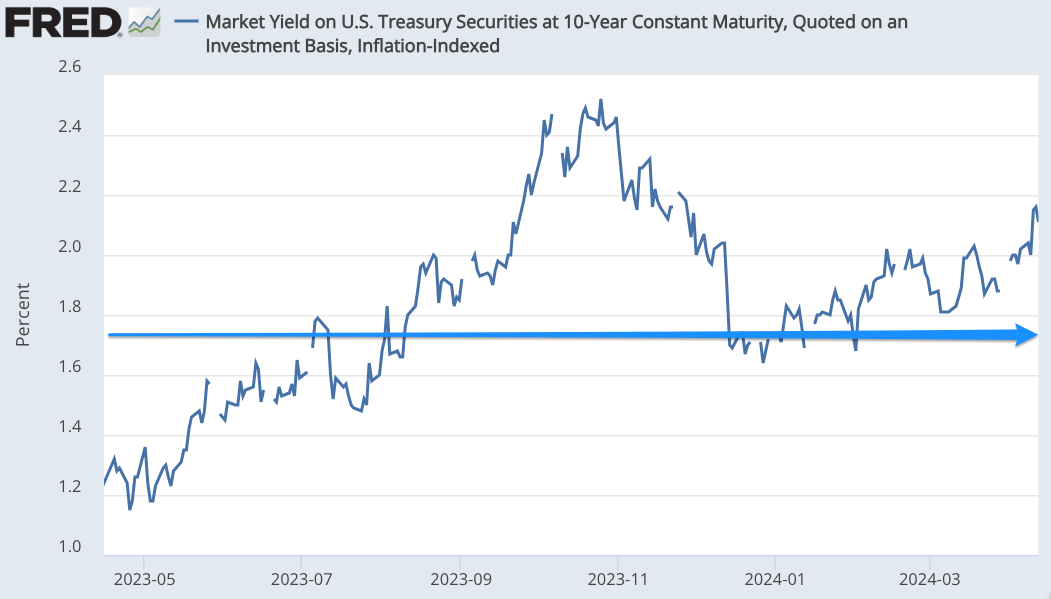

I confess that I thought that during the current subera (8)—waiting for a shoe, any shoe, to drop—the Federal Reserve would manage interest rates in an attempt to keep the long real rate—the Ten-Year Treasury TIPS—at a level of about 1.75%. Thus I was very surprised last fall when they let it march upwards to 2.5%, before using their jawbones to talk it back down to the pre-Great Recession level. But now they are allowing it to rise again. And I am not sure why. These interest rates will have effects that will inflict their full force on the economy in eighteen months. Do they really think that in the Fall of 2025 the economy will be in a state in which hitting it with demand-relevant real interest rates higher than any seen so far in this millennium will be appropriate?

I read this as the Federal Reserve hivemind having reached two conclusions:

It no longer believes that considerations as to what it thinks r* is can guide monetary policy and its adjustment.

The major risk is not a deep recession and a return to the zero interest-rate lower bound, but rather some sort of rebound in inflation and a consequent de-anchoring of inflation expectations.

We shall see:

Related:

Sundowning in America: Yastreblyansky is puzzled by what Donald Trump is trying to say:

Yastreblyansky: So Vicious, So Horrible, So Beautiful: ‘Trump finds a poem…. There is no evidence that Robert E. Lee ever said "Never fight uphill, me boys!"…. I'll note that the case against his being a good general makes Gettysburg its main example… because he insisted on sending attacking forces uphill, against his staff's advice…. "Never fight uphill" could have been a good summary of what he did wrong in the battle, but there's no evidence he ever recognized it…. I don't find any suggestions that there was one "big general" whose death made the crucial difference.… When you try to find out what story Trump is trying to tell here, you find only examples of Trump trying to tell the same story, three times, going back to May 2018…. It's a Lost Cause story, clearly, about how Lee's genius really was going to achieve the impossible, except for this dead general who failed to tell him about the uphill fighting thing before he died. If only he could have called! He was the one who said, "Never fight uphill, me boys!" but the message never reached the commander. (Incidentally, I'm pretty sure the one who really said "Never fight uphill" was the Western Zhou–dynasty master strategist Sunzi, in his Art of War: "It is a military axiom not to advance uphill against the enemy, nor to oppose him when he comes downhill")… <yastreblyansky.substack.com/p/so-viciou…>

If you wanted to turn what Trump is saying here into coherence, it would be this:

Thomas Jonathan “Stonewall” Jackson was Robert E. Lee’s chief lieutenant in the Army of Northern Virginia.

Thomas Jonathan “Stonewall” Jackson was killed by friendly fire at the Battle of Chancellorsville on May 10, 1863.

On July 3, 1863, Major General George Pickett commanding his three brigades (Kemper Garnett, and Armistad) plus four others (Lane, Brockenbrough, Marshall, Davis) charged uphill at the center of the Union Army of the Potomac line on Cemetery Ridge.

Nobody had told Robert E. Lee that the Army of the Potomac troops deployed on Cemetery Ridge were on, like, a ridge.

If anybody had, Lee would not have ordered the assult.

But Stonewall Jackson was dead, and there was nobody else in the Army of Northern Virginia to tell him.

Nor, apparently, did Robert E. Lee have eyes…

Economics: I agree that a 25 basis-point Federal Reserve rate cut in June would as a mistake be one "comparable to… [those] the Federal Reserve was making in the summer of 2021…”, but that is because I believe that there was no mistake then—that the Federal Reserve was playing it completely right in the summer of 2021.

That is because of the asymmetry in the loss function. You cannot effectively stimulate the economy if you land at the zero interest-rate lower bound. By contrast, you can always effectively restrict the economy by raising interest rates wherever you are.

Thus waiting to raise rates until you were almost sure that you would not soon be back at the zero lower bound, and then moving fast and far, was in fact optimal monetary policy in the summer of 2021. And that is what the Fed did.

There was no error.

There would be no error in cutting by 25 basis points in June.

But even if it would be an error to cut by 25 basis-points in June, that would be a small beer policy move compared to Fed forbearance in the early Biden years. Monetary conditions as indexed by the Treasury Ten-Year TIPS were kept very loose by the Fed until the start of 2022. Between then and August it tightened by 350 basis points: lowering the real value of the future ten years out by about 35%. That is a huge shift in the intertemporal price system.

A 25 basis-point cut in June with an 0.4 gearing to the Treasury Ten-Year TIPS would raise the real value of the future ten years out by about 1%.

How can these possibly be seen as moves comparable in magnitude?

Lawrence Summers: ‘On current facts, a rate cut in June would be a dangerous and egregious error comparable to the errors the Federal Reserve was making in the summer of 2021. We do not need rate cuts right now… <bloomberg.com/news/articles/2024-04-10/…>

Spam-Spam-Spam-Spam-Spam: This is the best article I have seen in at least a year about the advertising-attention-ecosystem-driven en****ification of the world wide web, making it a hive of scum and villainy rather than a useful information utility. Nilay Patel is a genius, and the genius of this article is that it makes its point and also makes an example of its point by also partaking of the quintessence of SEO-spam, and thus is both en****ified and not en****ified in a positive Schrödinger’s Cat superposition of the Last Days of the Useful Web:

Nilay Patel: Best printer 2024, best printer for home use, office use, printing labels, printer for school, homework printer you are a printer we are all printers/After a full year of not thinking about printers, the best printer is still whatever random Brother laser printer that’s on sale: ‘Tech/Artificial Intelligence…. It’s been over a year since I last told you to just buy a Brother laser printer, and that article has fallen down the list of Google search results because I haven’t spent my time loading it up with fake updates every so often to gain the attention of the Google search robot. It’s weird because the correct answer to the query “what is the best printer” has not changed, but an entire ecosystem of content farms seems motivated to constantly update articles about printers in response to the incentive structure created by that robot’s obvious preferences. Pointing out that incentive structure and the culture that’s developed around it seems to make a lot of people mad, which is also interesting!… My only ask is that you make this article go viral by sharing it in faux-outrage that the EIC of The Verge has published an article partially generated by AI, because after the buttons I am going to include a bunch of AI-generated copy from Google’s Gemini in order to pad this thing out…<theverge.com/2024/4/2/24117976/best-pri…>

I think Dr. Delong puts the lie to the notion that academics cannot be commercial. I find the good doctor makes it very easy to give him and his friends money. Getting out of email lurker status was relatively painless.

Separately, I would like to put on the table the following idea. Given that the Fed has last mover advantage in macroeconomic policy, the appropriate measure of current monetary "tightness" is the likely rate of growth of aggregate demand (nominal if you like) at the policy horizon. The level of nominal 10-year Treasury yields or their change is not a great summary measure of that.