A Few Lessons in Monetary Economics That the World Has Taught Us Over the Past Four Years

Yes, it looks like inflation is very often and in most places an expectational phenomenon…

Yes, it looks like inflation is very often and in most places an expectational phenomenon…

This weekend in the Financial Times:

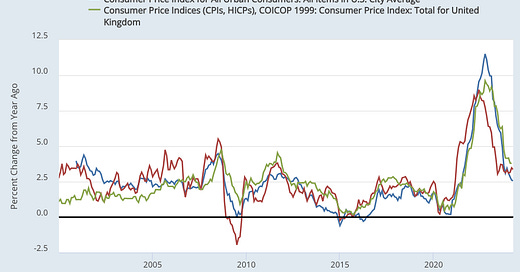

Adam Posen: The curious case of central bank convergence: ‘Similarly sized and paced interest rate moves by central banks on both sides of the Atlantic had apparently the same effect…. Do differences in labour market institutions, fiscal paths or even labour productivity, really make no difference to monetary transmission and the persistence of inflation?… An independent central bank with a transparent low inflation target… anchor[s] longer-term inflation expectations… mean[s] that monetary policy could respond flexibly to shocks… inflation still return[s] to target if policy remained consistent. Over the past four years, that has turned out to be the case…. Labour market differences… were second order…. People in high-income democracies still really dislike inflation, so this… [has] considerable political legitimacy…. There really are no credible alternative[s]…. Independent central banks and low and transparent inflation targets are a killer combination…. Where autocratic leaders in India and Turkey have leaned on their central banks and pushed down interest rates despite rising inflation, they have paid an evident price… <https://www.ft.com/content/8f14e64a-153b-4dbe-99aa-55eb24e80933>

Indeed:

The key, I think, is this “People in high-income democracies still really dislike inflation, so this… [has] considerable political legitimacy…” “This”, here, is an independent central bank committed to effective price stability—to a low and transparent medium- and long-run inflation target.

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.