A Flaw in My Plan to Get & Stay in þe Work Zone Before Lunch, &

BRIEFLY NOTED: For 2022-03-24 Th

CONDITION: My Plan Has a Big Flaw:

The clever plan was to exhaust the dog early in the morning so that I could work, and get and stay in the Zone until lunchtime without interruption, because the dog would be taking a nap. This plan has a huge flaw…

First: Inflation Expectations: A Twitter Exchange, & a Project-Syndicate Piece:

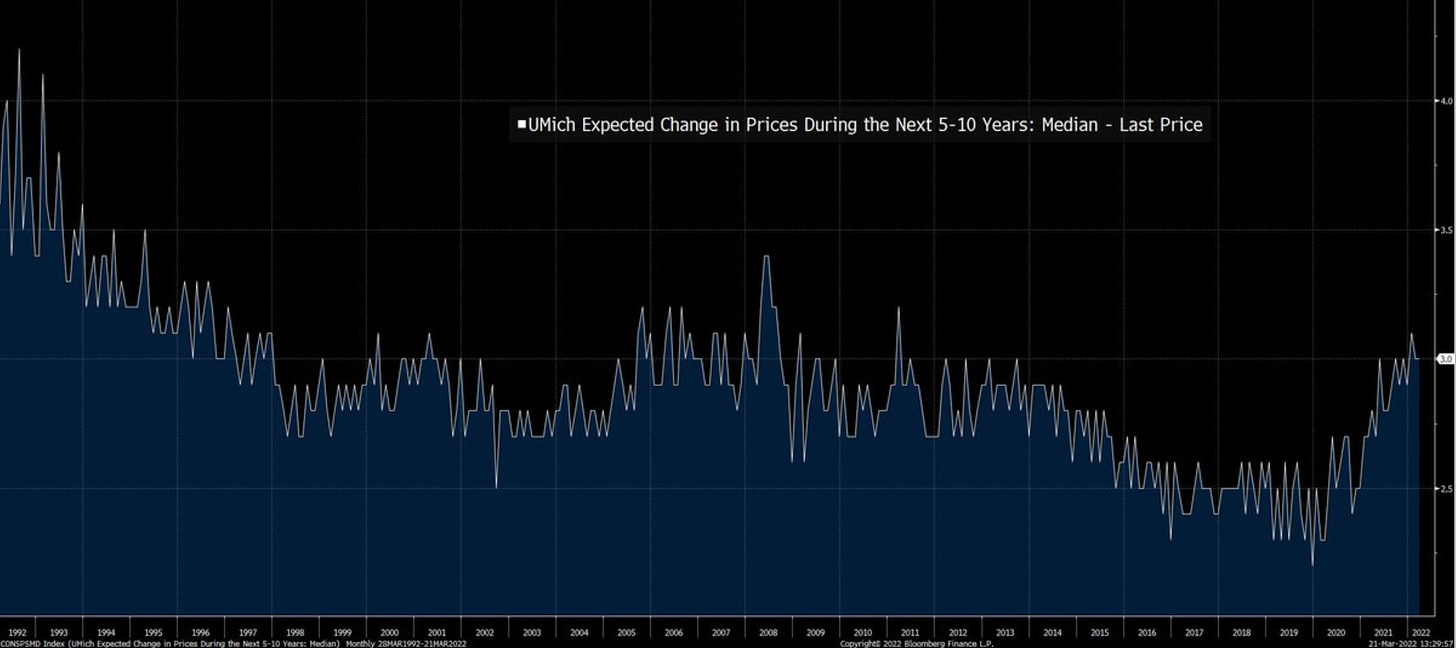

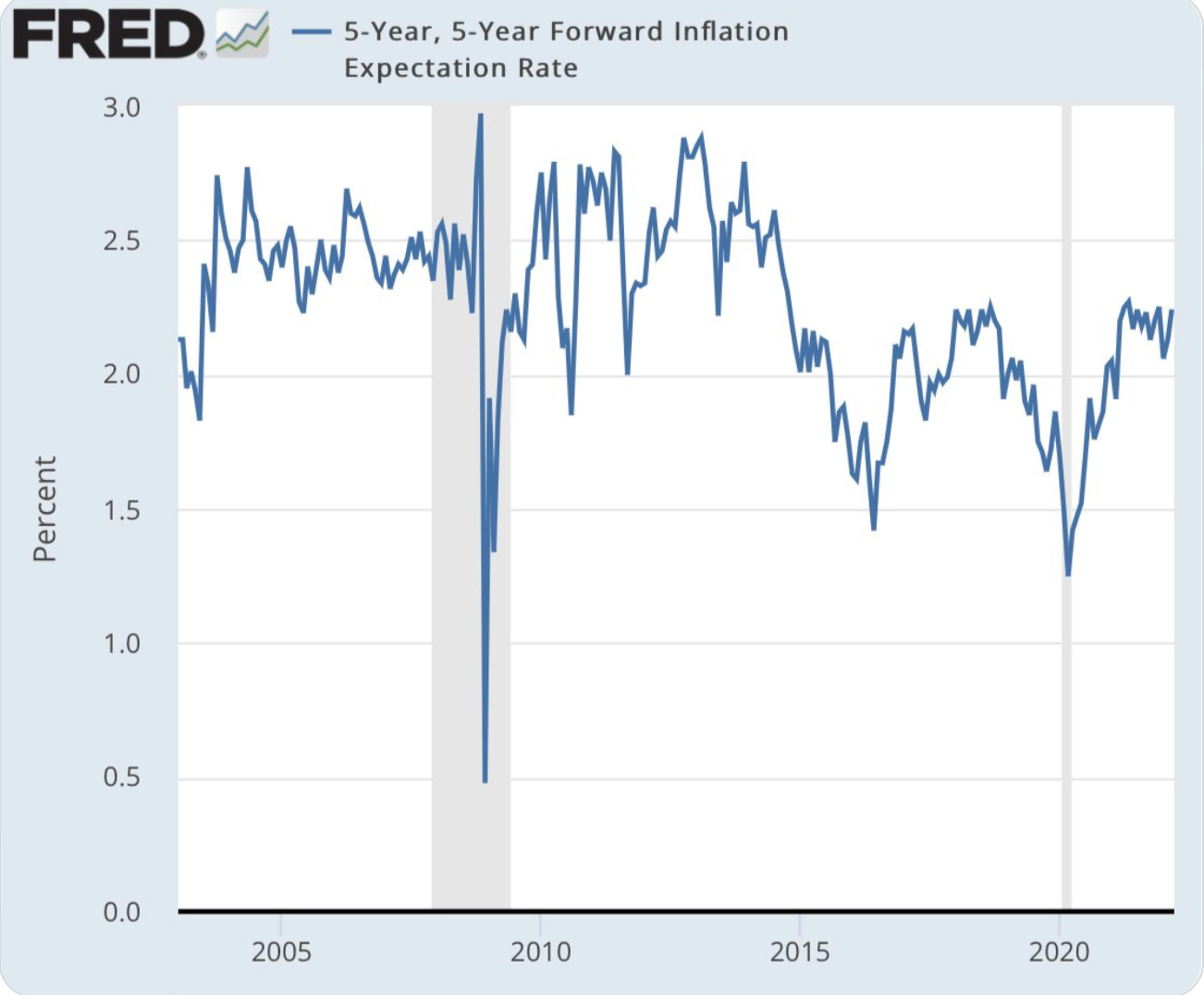

With both the people surveyed by the University of Michigan and the bond market strongly betting that inflation will be back to its normal of 2% in the medium- and long-term—I do not see how a wage-price inflationary spiral can get established. Is it possible that workers and business owners are more fearful of and willing to act on the chance of medium-term inflation than general consumers or bond traders? Consumers perhaps. Bond traders Dash I simply do not see that. Thus 1947 and 1951 still seem better historical analogies to me than 1974 or 1980. And 1920—when the Fed raised interest rates from 3.75% to 7%, and Milton Friedman judged that it had overreacted—seems definitely something to avoid:

Joe Weisenthal: ’Is there any evidence in either market-based measures or surveys of inflation expectations becoming unmoored?

Noah Smith: [Tweets a picture of the five-year inflation breakeven] <https://pbs.twimg.com/media/FOY_ImOVkAAQurI?format=png&name=small>

Brad DeLong: ’But: [Tweets a picture of the five-year ahead five-year inflation breakeven] <https://pbs.twimg.com/media/FOZAlMoVkAEBdjc?format=jpg&name=medium>. Larry Summers is whomping me in email, but I have decided to die on this hill: until the 5/5 crosses 2.5% heading upward, I won’t call for the Fed to start raising rates faster. & until the 5/5 crosses 3%, I won’t panic. Asymmetry in the loss function still rules!

Joseph Gagnon: ’To be clear, I agree not because I think the market is a good predicter of inflation but because it is a reasonable gauge of the “expectations” component of the Phillips curve. When demand and supply settle down, so will inflation…

Andy Harless: ’I wouldn’t go that far—but instead of complaining that the Fed is behind the curve, economists should be celebrating that the there is once again a curve for the Fed to possibly be behind. Things were better before 2008 when there were sometimes reasons to raise rates…

Tyler McClellan: ’This is wrong on so many levels. Why would market participants price 5y5y inflation expectations to dramatically exceed the central bank’s target ever? No such thing would have shown in the 70s either!

Brad DeLong: ’The market does it whenever it believes there is a chance the target will be maintained. See “peso problem”…

*Strange Hours: ’Using market information to make policy decisions, what kind of charlatan are you?

Dan Davies: ’The target should have been 5% in the first place

Brad DeLong: ’Well, yes, as Larry Summers & I said back in 1992. But time changes us all: the owl was once a baker’s daughter, after all…

Dan Davies: ’I am an irredentist on this one. 5y5y5% or fight!

LINK:

And here is my Project Syndicate piece on this:

J. Bradford DeLong: America’s Macroeconomic Outlook: Given the depth of the recession caused by COVID–19 in early 2020, the current state of the US economy and labor market is nothing short of spectacular. And though an inevitable increase in inflation has rained on the parade, there is still good reason to think that it will subside in the medium term…. This time, the re-knitting [of the division of labor] happened much faster. Employment rose by 5% in the space of just a year, because the Fed and US President Joe Biden’s administration did not take their feet off the accelerator too soon…. Everybody making arguments about the likely course of today’s inflation is arguing not from theoretical principles but from… historical analogies…. My sharp former teacher Olivier Blanchard, see the 1970s as the best analogy. But while that may prove to be correct, they have a weak case. The 1974 outbreak of inflation came after a previous inflationary bout that had shifted expectations…. In addition to a wage-price spiral, the other two commonly named culprits for non-transitory inflation are supply-chain bottlenecks and self-fulfilling expectations. Among these three, the only potentially serious risk is that we may not be able to resolve key supply-chain disruptions. That brings us to the bad news. Supply-chain risks may have grown more acute now that Russia’s war against Ukraine…

One Audio:

Dani Rodrik & al.: You’re Invited: Can Industrial Policy Solve the Climate Crisis?: ‘Industrial policy is hot again, back with a new name (mission innovation) and a new target (climate change). Detractors point to past failures and the risk of costly mistakes and argue that governments should avoid picking winners and stick to carbon pricing…. David, Sara, Ed, and industrial policy expert Dani Rodrik of Harvard University discuss government-directed innovation as a tool for decarbonization on Episode 30 of Energy vs Climate…

LINK: <https://www.energyvsclimate.com/youre-invited/>

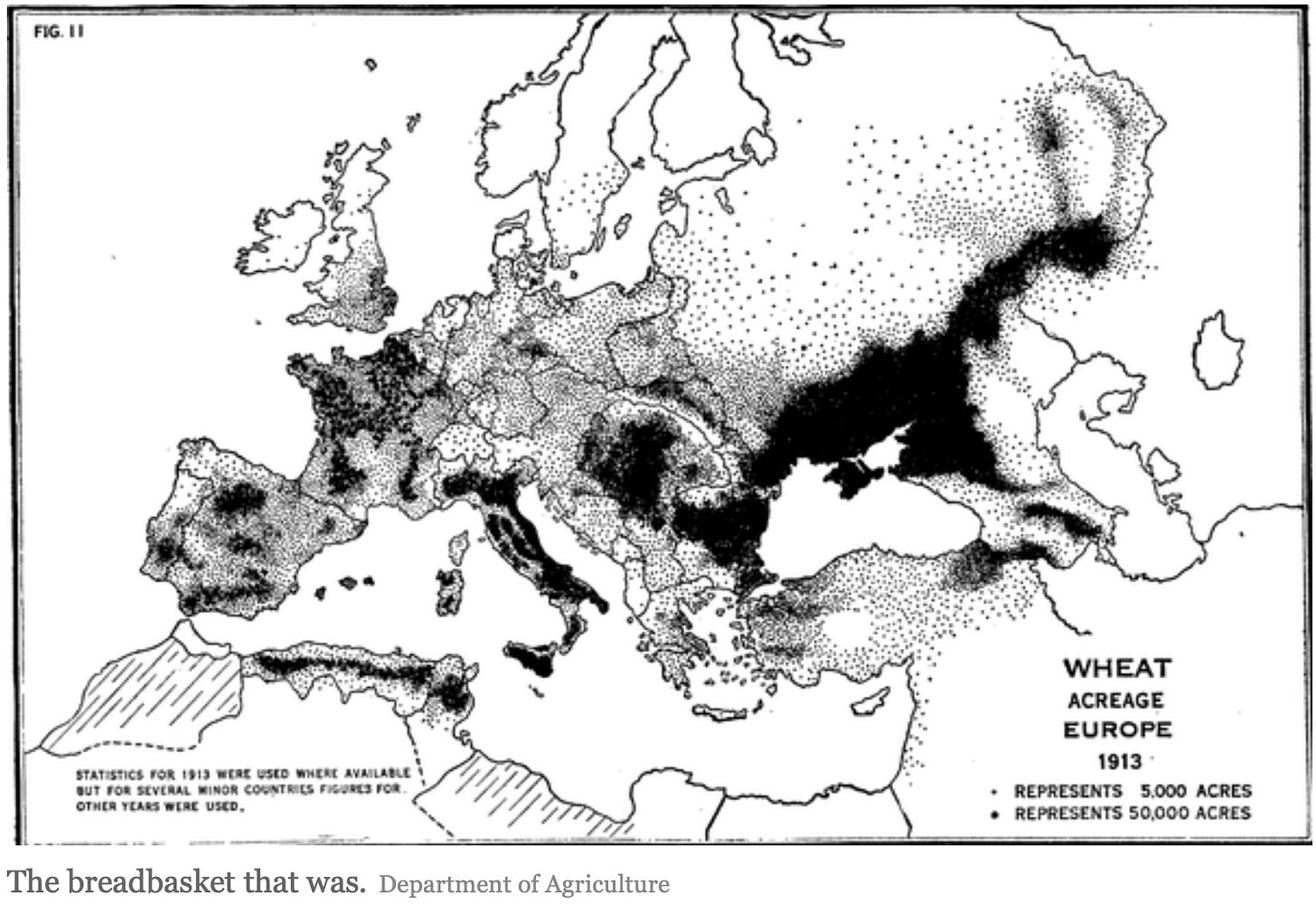

One Picture: European Wheat Production ca. WWI:

Very Briefly Noted:

Stephen Broadberry: Accounting for the Great Divergence: Recent Findings from Historical National Accounting: ‘A European Little Divergence, as Britain and the Netherlands overtook Italy…. An Asian Little Divergence as Japan overtook China… <https://voxeu.org/article/accounting-great-divergence-recent-findings-historical-national-accounting>

Mackenzie Gray: ’Singh is asked if this deal might actually benefit the Liberals, who could say during the next election they delivered on phramacare or dental care “People might say someone else did it, not us. Frankly, I don’t care. I want this to be done because I think it’s good for people”… <https://twitter.com/GrayMackenzie/status/1506287603720638478>

Laura Tyson & John Zysman: From Sanctions to Semiconductor Resilience & Security <https://www.project-syndicate.org/commentary/how-the-west-can-secure-its-semiconductor-supply-chain-by-laura-tyson-and-john-zysman-2022-03>

Paul Krugman: Odessa & the Ukraine That Should Have Been: ‘Maybe remembering what Odessa might have become will help remind us how important it is that this attempt at conquest fail… <https://messaging-custom-newsletters.nytimes.com/template/oakv2>

Peter Carr & Umberto Cherubini: _Generalized Compounding & Growth-Optimal Portfolios: Reconciling Kelly and Samuelson_ <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3529729> Matthew Rabin & Richard H. Thaler (2001): Anomalies: Risk Aversion: ’The expected-utility framework has misled economists… <https://www.aeaweb.org/articles?id=10.1257/jep.15.1.219>

Steve M..: John Harris Is Wrong Again: ‘Oh, look! Politico’s John Harris says Donald Trump is losing his grip on the GOP!…. Understanding the psychology of Trumpism is the kind of thing elite media figures should be good at—it doesn’t require them to give up their precious bothsiderism or take GOP threats to democracy seriously. But they can’t even do this right… <https://nomoremister.blogspot.com/2022/03/john-harris-is-wrong-again.html>

Ole Peters & Alexander Adamou: The Time Interpretation of Expected Utility Theory: ‘[If] individual agents maximise the time average growth rate of wealth, known widely as growth optimality…. [For] growth optimality and expected utility theory… the ergodicity transformation in the former is identified as the utility function in the latter… <https://arxiv.org/abs/1801.03680>

Leaked Resignation Letter Squeezes Manhattan DA, Who Suspended Trump Case, Between a Rock & a Very Hard Place: ‘PThe evidence, Pomerantz said, would show Trump is “guilty of numerous felony violations of the Penal Law…. We believe that the prosecution would prevail if charges were brought and the matter were tried to an impartial jury”… <https://www.editorialboard.com/leaked-resignation-letter-squeezes-manhattan-da-who-suspended-trump-case-between-a-rock-and-a-very-hard-place/>

David Byrne: Democracy Comes to Michigan: ‘After a citizen-led campaign to draw fairer voting maps, this year Michigan voters will finally choose their politicians—instead of the other way around… <https://reasonstobecheerful.world/democracy-michigan-gerrymandering-voters-not-politicians/>

Alan Cole: The Strongest Case for Urban Density Isn’t Aesthetics, It’s Math <https://fullstackeconomics.com/the-strongest-case-for-urban-density-isnt-aesthetics-its-math/>

Buce (2008): The Luckiest Horse in the Fifth Millennium BCE <http://underbelly-buce.blogspot.com/2008/08/luckiest-horse-in-fifth-millennium-bce.html>

Silvercrest: Patrick Chovanec CPA <https://www.silvercrestgroup.com/team/patrick-chovanec-cpa/>

Molly Jong-Fast: What Working Mothers Heard in Judge Jackson’s Words: ‘Even the eminently accomplished Ketanji Brown Jackson knows the struggle of trying to balance a career and parenthood… <https://newsletters.theatlantic.com/wait-what/email/76b40e48-fb0e-400c-80ed-cb5a688c6171/>

Twitter, ‘Stack, & c:

Barry Ritholtz: Masters in Business on Apple Podcasts

Alex Power: Life Without Facebook: ’For a variety of reasons, the Newslettr is not on Facebook. The simplest reason is: after 17 years, I have suffered enough…

Jonathan V. Last: Ukraine Is on the Offensive in Kyiv

Jonathan V. Last: The Triad: ‘Ketanji Brown Jackson…. When she takes the bench it’ll be a great moment for America…

Timothy Burke: Academia: Rules & Their Breaking: ‘I am no fan of rigid rule-based or regulatory approaches to institutional governance and work, but when we want to work around rules, we should do so transparently, as critics of those rules who aspire to change, erode or overthrow them…

Zachary D. Carter: Lessons From Keynes for the Crisis in Ukraine: ‘Top-down [wartime] management of the economy was a mess. But it worked. For Britain. And the chief reason it did not work for Germany and Austria is that the British had an extremely powerful navy which they used to physically block imports… <

Aaron Rupar: “It’s constituent service, but the constituency is nuts.”: ‘Judge Ketanji Brown Jackson’s hearing demonstrated the rapid QAnoning of the GOP… <

Kieran Healy: ’Proud to announce… Falangist Monthly, a bold new magazine crossing America’s political divide. Neither contract nor covenant, our vision is of an expansive political community built on solidarity, tolerant of human frailty, yet not afraid of ethnic cleansing… <

Paul Waldman: ’"I’m not an attorney. I watch ‘Law & Order’ from time to time" says Thom Tillis, making a strong case for his presence on the Senate Judiciary Committee…

Tom Nichols: ’This is a meandering “everyone is being stupid” argument built around a belief, apparently, that the Biden administration intends to intentionally prolong the war in Ukraine in order to topple Putin, but with no alternate suggestion of what, actually, to do:

Julie B.: ’When asked by a Fox News reporter, “What should we do about Ukraine?” Trump answers: "Well what I would do, is I would, we would, we have tremendous military capability and what we can do without planes, to be honest with you, without 44-year-old jets, what we can do is enormous, and we should be doing it and we should be helping them to survive and they’re doing an amazing…

Andy Harless: ’Instead of complaining that the Fed is behind the curve, economists should be celebrating that the there is once again a curve for the Fed to possibly be behind. Things were better before 2008 when there were sometimes reasons to raise rates… <

Dan Davies: ’The [inflation] target should have been 5% in the first place…

Director’s Cut PAID SUBSCRIBER ONLY Content Below:

Paragraphs:

My favorite bread has long been Semifreddie Bakery’s Odessa rye. Odessa was, as Paul Krugman says, the Chicago of Europe in the years before World War I. But instead of John Peter Altgeld, Clarence Darrow, Jane Addams, and Eugene V. Debs, Odessa had Lev Bronstein, alias Trotsky. All went smash when the Bolsheviki arrived. And then the Nazis showed up as well:

Paul Krugman: Odessa & the Ukraine That Should Have Been: ‘Communism did many things badly, but one of the things it did worst was produce food. Joseph Stalin’s collectivization of agriculture led to the Ukraine famine of 1932–33…. In its final years, the Soviet Union wasn’t starving, but it was dependent on large-scale imports of grain. After the Soviet collapse, however, this turned around. Starting around 20 years ago, Ukraine, taking advantage of the fertility of its famous “black soil” and the rise of globalization in general, began to export ever-larger quantities of grain…. [Ukraine] initially became a huge wheat producer during that first era of globalization…. What was the epicenter of this great agricultural complex? The city of Odessa, which in an economic sense became more or less the Chicago of the East, the place where railways gathered the abundance of a vast agricultural heartland and shipped it to the world. The city wasn’t even founded until 1794—by Catherine the Great‚but it mushroomed along with the region’s foreign trade, becoming the fourth-largest city in the Russian Empire, after St. Petersburg, Moscow and Warsaw…. And the Odessa of 1913 seemed well on its way to becoming one of the world’s great cities, and not just economically. As a gateway to the world, it attracted an unusually diverse population. As part of the Pale of Settlement—the part of the Russian empire in which Jews were allowed to reside—it was especially attractive to thousands of young people seeking escape from the confines of the shtetl; Jews made up roughly a third of its population. (My own maternal grandparents came from somewhere near Odessa.) This mixing of people seeking freedom as well as opportunity led to a cultural efflorescence. Odessa was famed for its cafes, its literature, its music. Then history intervened. I don’t think it’s silly or anachronistic to say that the things that made Odessa special, that should have made it one of the world’s great metropolises, were precisely the things that ethnonationalists, then and now, hate: ethnic and religious diversity, intellectual curiosity, openness to the world. On the eve of the Russian invasion, it looked as if Ukraine was finally managing to recover some of those things—which is, in turn, surely part of the reason Vladimir Putin decided it had to be conquered. And maybe remembering what Odessa might have become will help remind us how important it is that this attempt at conquest fail…

LINK: <https://messaging-custom-newsletters.nytimes.com/template/oakv2>

An oldie but a very very goodie. Economists have relied and continue to rely on the declining marginal utility of consumption as their justification for the extra return on investment gained by bearing risk, and on observed willingness-to-pay for insurance. But you simply try to do the math, and you immediately conclude that you should be approximately risk-neutral for all but for most consequential of the gambles and decisions under uncertainty that you take during your life.

Matt and Dick explicated this magnificently back in 2001.

But has that made any difference to economist practice, especially orthodox finance economists’ practice? No. This is what my former roommate Robert Waldman says annoys him the most about economics: The standard model is tested. It is rejected. People applaud the paper that rejects it. And then the system resets. Tthe standard model continues as the baseline default assumption economists use:

Matthew Rabin & Richard H. Thaler (2001): Anomalies: Risk Aversion: ’Economists ubiquitously employ a simple and elegant explanation for risk aversion: It derives from the concavity of the utility-of-wealth function within the expected-utility framework. We show that this explanation is not plausible in most applications, since anything more than economically negligible risk aversion over moderate stakes requires a utility-of-wealth function that is so concave that it predicts absurdly severe risk aversion over very large stakes. We present examples of how the expected-utility framework has misled economists, and why we believe a better explanation for risk aversion must incorporate loss aversion and mental accounting…

LINK: <https://www.aeaweb.org/articles?id=10.1257/jep.15.1.219>

Are we serious about building geo olitical robustness into and trying to capture some of the positive externalities from the communities of engineering practice that surround high-end semiconductor manufacture? I very much hope that we are. But it will not be easy, will not be cheap, and will not be accomplished with simply a wave of some politicians’ hands. Laura and John:

Laura Tyson & John Zysman: From Sanctions to Semiconductor Resilience & Security: ‘Construction of a new fabrication facility is estimated to require 3–5 years, at a cost of $10–20 billion…. Building and operating competitive new fabrication capacity in the US and Europe will call for more than capital investment. It will also require regulatory support to facilitate environmental reviews and permitting… as well as complementary investments…. Revitalizing US semiconductor production thus requires both physical and human capital. In the medium term, that means issuing more visas for highly skilled and experienced foreign workers; and, over time, it means increasing the number of Americans graduating from college with engineering degrees…. Russia’s war in Ukraine has highlighted an essential feature of the semiconductor industry. The technology and trade sanctions come at a moment when the US, Europe, and other key nodes in the semiconductor supply chain are planning large investments to address both economic and national security concerns. There is no better time to collaborate in developing a CRSS global supply of semiconductors…

Another thing I owe to Robert Waldmann: the Kelly Criterion—maximizing the expected growth rate of your wealth—is, for independent sequential gambles, utility-maximizing if and only if you possess logarithmic utility.

If your marginal utility of wealth declines less steeply than the log, then you should leverage yourself more than if you were maximizing your expected wealth growth rate. Then in the limit you will be almost certainly almost broke because the variance of the distribution of your log wealth will be high. But the extraordinary wealth of the potential future self of yours that strikes it lucky produces so much utility that it is in some sense "worth it". This is an unattractive conclusion.

If your marginal utility of wealth declines more steeply than the log, then you should leverage yourself less than if you were maximizing your expected wealth growth rate. Then in the limit your wealth will almost surely be less than the wealth of somebody following the Kelly criterion. But it will be in some sense "worth it" because you will avoid the small chance of an extremely painful lower-tail outcome because your wealth distribution has low variance. This is also an unattractive conclusion.

Peter Carr & Umberto Cherubini: Generalized Compounding & Growth-Optimal Portfolios: Reconciling Kelly and Samuelson by Peter Carr, Umberto Cherubini: ‘We generalize the Kelly criterion and the growth-optimal portfolio (GOP) concept beyond log-wealth maximization. We show that models of speculative price dynamics with time change require different compounding algebras leading to GOPs that do not coincide with log-wealth maximization. In particular, in the Variance Gamma (VG) and the Normal Inverse Gaussian (NIG) models the GOP concepts mimick well-known utility models, namely power utility and the mean variance approach, with a parameter that, in both cases, is the variance of the stochastic clock. The standard log-wealth maximization model is obtained if the variance of the stochastic clock is set to zero…

LINK: <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3529729>

DRAFT: How to Think About What Used to Be Called “Western Civilization”, & c.:

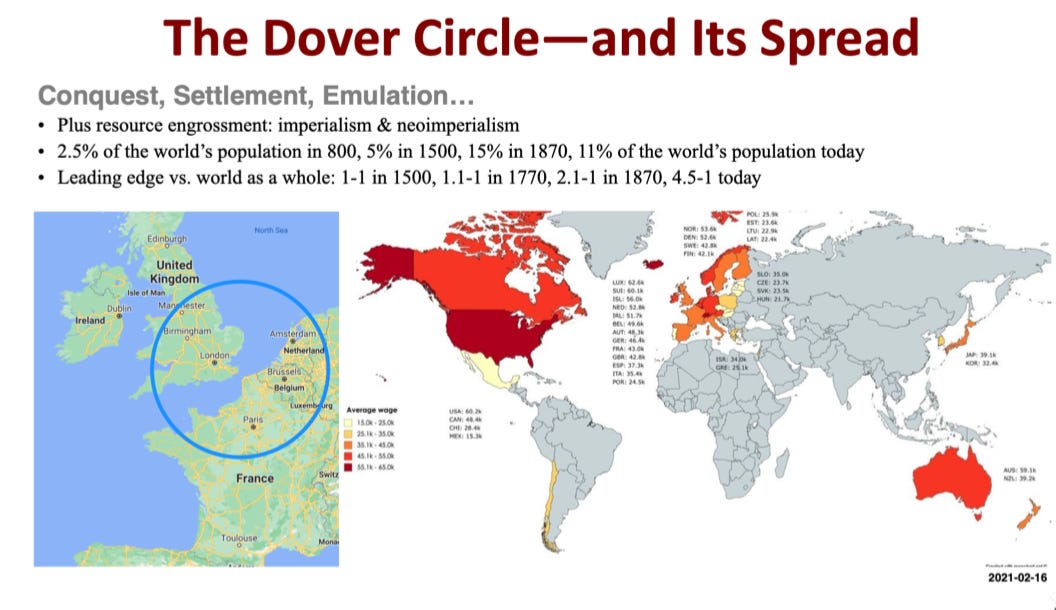

Consider a 300-mile radius circle around the port of Dover at the southeastern corner of Great Britain. Before 1500 that Dover Circle was no place special. In 1500 it looks to a civilization normal measured by the yardsticks provided by the other high civilizations of Asia. There is little special in terms of technology, cultural sophistication, political organization, wealth, or population density. It does have an edge in making machinery like clocks, and gunpowder weapons, and printing via metal movable type. But that is it.

After 1500 states at the western edge of Eurasia, first Portugal and Castile in Iberia, and then those of the Dover Circle, and then those that directly through settlement or indirectly through emulation derive from the Dover Circle—well, over the next 450 years they conquer the world. Even today the Dover-Circle-Plus societies engross a much larger share of the world’s resources than the 1/20th or so of the world’s resources in the Dover Circle, and thus controlled by the Dover-Circle societies in 1500. They have gained those resources via conquest, settlement, theft, and purchase. The populations and the world population share in the Dover-Circle-Plus societies have expanded enormously, through natural increase inside the Dover Circle itself through natural increase and immigration; outside through conquest, settlement, further expansion; and outside through emulation, as people elsewhere decide that the Dover-Circle civilizations are ones that they need to emulate, or else something not-good is likely to happen to them.

Simon Kuznets in his Nobel Prize lecture back in 1971 pointed to:

Factors… [that] have limited the spread of modern economic growth…. Japan is the only nation outside of those rooted in European civilization that has joined the group of developed countries…. The increasingly national cast of organization in developed countries made for policies… clearly inhibiting [convergence]… colonial status… imperialist exploitation… [neutralizing] the remarkable institutions by which the Sinic and East Indian civilizations produced the unified, huge societies that dwarfed in size any that originated in Europe until recently….

Back when my father was at Harvard College in the late 1950s, he was privileged to take what was by all accounts one of the greatest college courses ever taught: Sam Beer’ss “Western Thought and Institutions”. “Western” meaning that he placed their origin and development at the western edge of the Eurasian supercontinent, in the Dover Circle. “Institutions” being ways of organizing human beings. “Thought” being the set of ideas and concepts that underlay the patterns of institutional development found in what I am calling the “Dover Circle’

The premise of the course was that these “Western Thought and Institutions” were things of uniquely remarkable power and value for humanity. The conceit was that this pattern of intellectual and institutional—and psychological, sociological, political, military, and economic—development—was the result of the coming together of five interacting strands:

Jerusalem: the enduring value of each individual ass an equal, and the sovereignty of the individual’s conscience.

Athens: debate, discussion, knowledge, inquiry, and democracy as what humanity was made to do.

Sparta: the disciplined submission of the individual to the organization of the collectivity, in order to achieve our common purposes: for the needs of the many outweigh the needs of the one.

Rome: the continent-spanning Imperial Peace and its civilization of prosperity, production and trade based on one law for everyone, with membership restricted not to some real or fictitious-imagined kin group, but rather open to all who would pledge to the purposes of civilization.

The Schwarzwald: from the forests of western Germany, the idea of society and its organization as a contract among freemen, with pledges of trust of man to man, of man to group, and of group to man, with leaders and purposes not decreed by a god but chosen by men so that they can protect their lives and their liberties, and pursue their various happinesses.

These five strands—Jerusalem, Athens, Sparta, Rome, and the Schwarzwald—built on a deeper heritage of civilization, much of which had developed in the Near East before David son of Jesse conquered Jerusalem for the Judeans, before Athana Potnia came to her first sanctuary on the Acropolis in Attica. The references are usually made to Egypt, Babylon, Ur of the Chaldeans, and so on back to the Uruk of Gilgamesh.

To shift metaphors, starting sometime after -1000 in the Jerusalem of the prophets a torch was lit. It was then kindled by fuel from and passed on down the generations: to the Athenians, Spartans, Romans, inhabitants of the Schwarzwald, and on to those who dwelled in the Dover Circle. The Roman Republic picked up the torch from Athens and Sparta. The Later Roman Empire under Constantine and after added the flame of Jerusalem in the form of Christianity, and carried the torch forwards. With the collapse of the Roman Empire kindling was added from the tradition of the German-origin ex-barbarians who ruled the successor states, and the torch was kept burning. Charlemagne. The mediæval Christian church. The High Middle Ages. The twin Renaissances in Italy and the Low Countries. The Protestant Reformation, bringing back Jerusalem, and the sovereignty and independence of individual conscience and thought, to a civilization that had almost lost sight of that part of the package. Ages of Discovery. Globalization. The Enlightenment. The Democratic and Industrial Revolutions. Imperialism—most unfortunate in many ways, but bringing the invaluable gift of the treasures of Western Civilization and “modernity” to the world as a whole.

That was the underlying premise with respect to how history worked underpinning Sam Beer’s great “Western Thought and Institutions”: the torch being passed down from progenitors and ancestors, certainly back to Hellenes and Judeans and perhaps further back to Egyptians and Mesopotamians, to successors and inheritors, all running in the long relay race of civilization that is, as Edmund Burke put it, the Great Contract between the dead, the living, and the unborn.f

This underpinning story is a Grand Narrative. That means that it is useful to think with. Indeed, it is essential to think with such Grand Narratives: we cannot do otherwise. We are narrative-loving animals, and without thinking in narratives we cannot think with any sophistication at all. And yet that that story is a Grand Narrative has another implication: It is that it is very dangerous to believe that it, or any such Grand Narrative, is true.

For the story of the torch of western civilization being passed down in a relay race from progenitor-ancestors to their legitimate successor-inheritors is false. That is simply not the way it happened. To think that it did happen that way is simply bonkers. Roman statesman Marcus Tullius Cicero thought very little of any claim that any inhabitants of Britain would be his legitimate heirs: he saw them as too dumb, uncivilized, and uneducated to even be worth enslaving. Ideas of respect for individuals, of the value of discussion and inquiry, of institutions crafted not to serve the gods but the people—such institutions, patterns, and cultural traditions have had many separate origins, for many people in many places over history have tried many times for such. It is simply not the case that these would be absent from human civilization had Jerusalem, Athens, Sparta, Rome, and the Schwarzwald never existed.

Attempts to understand the absolute and relative wealth and power of the Dover-Circle-Plus—of the Dover-Circle societies and their emulators—in the late 1800s, the 1900s, and continuing often run aground. It is an important part of our history. But, as my old teacher the late David Landes used to say: practically every attempt at understanding soon degenerates into either “the west is so good and the rest are so bad” or “the west is so bad and the rest are so good.” Neither of these is either especially true or particularly helpful.

Indeed, the “Western Thought and Institutions“ way of approaching human history is only one that could be thought up by somebody from the island of Great Britain, or from northern France, or from the Low Countries, or from western Germany. It would never occur to anyone from anywhere else to think of things in this way.

So we should strive to move beyond the presuppositions of Sam Beer’s version of history. I know he would want us to. But how do we do so?

I always thought that insurance was about limited liquidity and time horizons, rather than risk preferences. People with an income of $200K are fools to insure their cars, since their savings should be able to cover a collision w/o transferring wealth to the insurer. People with an income of $60K are wise to insure their cars. Nothing to do with risk preferences, but just another cost of not having enough money.

I love and respect your friend Robert Waldmann - follow him on Twitter - but framing Kelly Criterion as being about *utility* rather than *maximizing payoff* is unhelpful. Kelly Criterion maximizes returns to a *risk-neutral* agent if the amount bet is a monotone function of current wealth. Admittedly, the Kelly criterion obscures this because it was devised in the context of gambling, where the stakes are plausibly independent of winnings.

But that is not true of your retirement account - by the premise of retirement accounts. You invest for retirement because you assume that your wealth will grow and you plan to reinvest that growth. In that case the 'expected return' is the *instantaneous* expectation. To get the expectation over a finite interval you have apply Ito's Lemma. Seriously, the difference between the 'expected return' and the Kelly criterion is just the difference between the continuous SDE for, say, GBM and the difference equation!