First: A Great Labor Report!

I still do not understand why the Federal Reserve is not extraordinarily gleeful about the recovery that it (plus the Biden administration, plus the Democratic congressional caucuses) have managed.

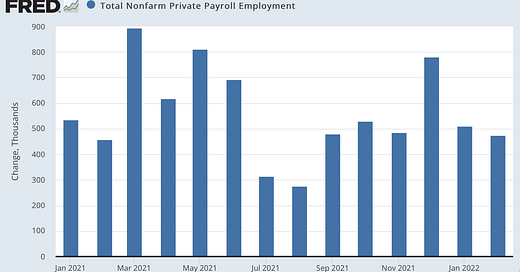

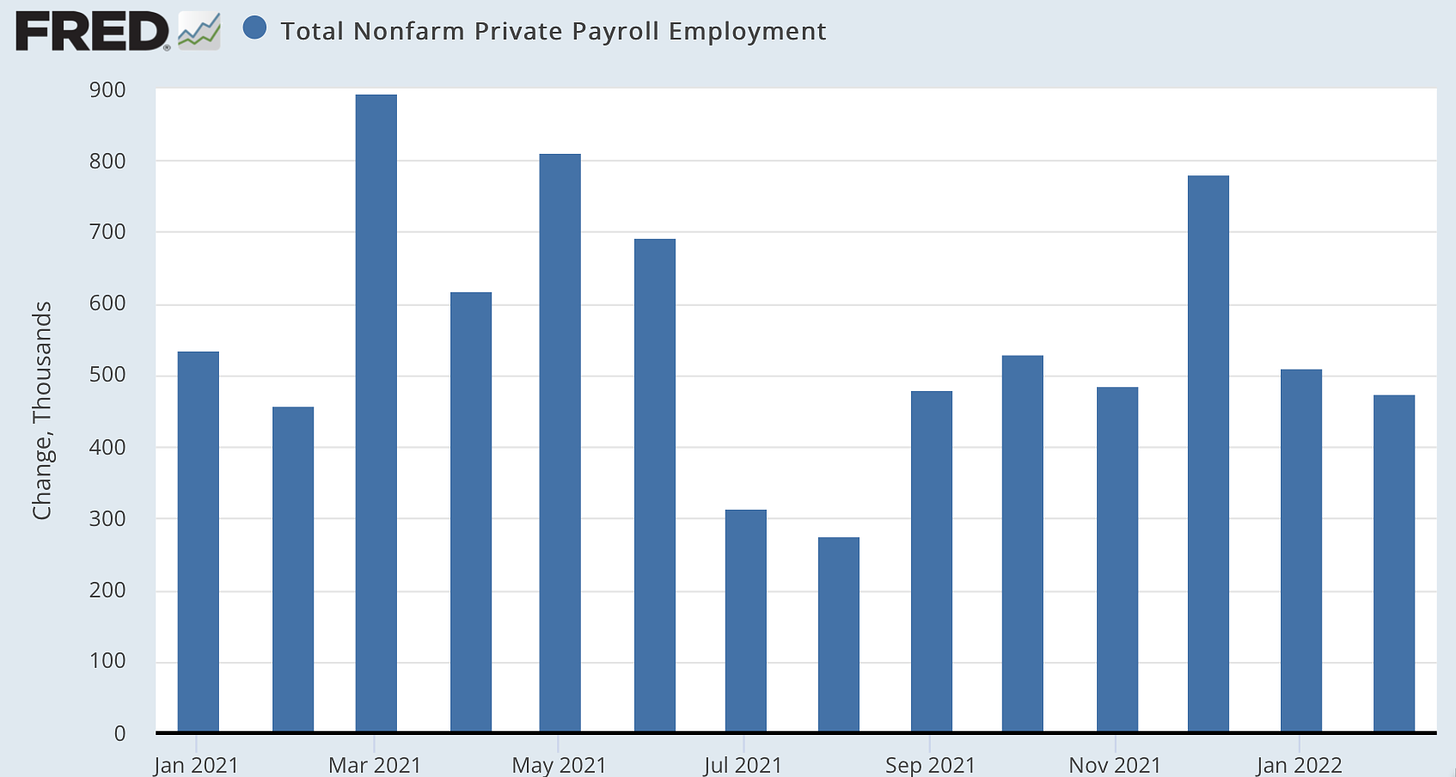

When have we ever seen such rapid recoveries in the labor-force? No, we are not back to pre-plague levels. But we are certainly getting there. And a full recovery is certainly attainable: we could have another 7 million jobs over the next two years, if we are lucky and skillful:

Ellen Ioanes: Understand the News: ‘The labor market added 678,000 jobs in February, driving the unemployment rate down to 3.8 percent from 4 percent in January, the lowest level since the start of the pandemic…. The strong employment numbers are a good sign for the labor market and reflect a rebound from the latest wave of Covid–19 infections due to the omicron variant — and post-pandemic recovery overall. But employment is not yet back to pre-pandemic levels, and many people need to negotiate child care and health concerns. The employment boom isn’t hitting everyone equally; the unemployment rate for Black women rose from 5.8 percent to 6.1 percent in February from the previous month. Their participation in the workforce also decreased by .2 percentage points last month. Nevertheless, the positive jobs numbers are part of the calculus that goes into the Federal Reserve’s decision to raise interest rates in an effort to combat inflation…. Fed Chair Jerome Powell said Thursday that “hindsight says we should have moved earlier” on rate increases…

LINK: <https://www.vox.com/>

And let me disagree with Powell: I see no reason why the Fed should have “moved earlier” on rate increases. Bond-market expectations of medium- and long-term inflation are still extraordinarily well-anchored. And one of the major benefits of maintaining the anchor is that then it gives you policy flexibility to do whatever is optimal in the short run to attain maximum feasible employment and productivity growth.

That means that the Federal Reserve’s task is to craft a path for interest rates and for the short-term inflation rate that gets the economy to the place where a well-functioning frictionless flex-price macroeconomy would go if it could. We cannot have a frictionless flex-price macroeconomy. We have sticky prices. We have, for very powerful human psychological reasons, downward-sticky wages. We have sticky debts. (In the context of sticky debts, the standard 20th-century austerian belief that a business-cycle free macroeconomy could be attained in a straightforward way by a war to destroy labor unions appears more than usually silly.) The fact that we are repeatedly kissing up to and sticking to the zero-lower bound means that the nominal interest-rate degree-of=freedom is simply not enough to do the job.

Plus we do need for relative prices to move to provide the incentives for the structural sectoral adjustment that we need to undertake.

So why, again, should the Fed have moved earlier to hike interest rates? If medium- and long-term inflation expectations were on the move, I would get the point. But where is the evidence that they are?

One Picture:

Very Briefly Noted:

Thomas Piketty: On Economic Ideology: ‘The best books on Historical Change and Economic Ideology…. The Great Demarcation… by Rafe Blaufarb. Gold and Freedom… by Nicolas Barreyre. Citizenship between Empire and Nation… by Frederick Cooper. Castes of Mind… by Nicholas B. Dirks. The Emergence of Globalism… by Or Rosenboim… <https://fivebooks.com/best-books/economic-ideology-thomas-piketty/>

Matthew Brooker: Did China’s Xi Jinping Get Played by Putin on Ukraine?: ‘The “no limits” partnership announced between China and Russia on the eve of the Winter Olympics… doesn’t look flattering for Chinese President Xi Jinping…. Was Beijing aware of Putin’s plans and went ahead with its pact with Russia regardless?… The alternative… hardly helps to burnish Xi’s reputation as a master strategist steering China’s path back to greatness… <https://www.bloomberg.com/opinion/articles/2022-03-01/did-china-s-xi-jinping-get-played-by-putin-on-ukraine>

Thomas Piketty: A Brief History of Equality <https://www.hup.harvard.edu/catalog.php?isbn=9780674273559>

Lindsay Beyerstein: The J6 Committee Says Trump Did Some Criming. A New Video Suggests Roger Stone Knew It: ‘If ordinary goons are guilty of disrupting an official proceeding, then the ringleaders who incited them are guilty as well… <https://www.editorialboard.com/the-j6-committee-says-trump-did-some-criming-a-new-video-suggests-roger-stone-knew-it/>

Tecumsah Court: Shoot, Move, & Communicate: ‘Giv[ing] a 22-year old Ukrainian architecture student advice about how to handle his first day of combat. And his second. And his third…

Nish Kuma: _’Funny seeing these stupid fucking op-eds saying “Putin feels like he can attack Ukraine because we are all too woke” instead of saying “it’s because he literally owns our Prime Minister”… <

Michael Kofman: _’Given all the problems in the Russian campaign, delusional assumptions, an unworkable concept of operations, little prepared for a sustained war like this, I give it ~3 more weeks before this is an exhausted force…. I fear folks may read this too positively. A lot can happen in a few weeks. A ceasefire is often not the end of a war, but rather may enable its continuation…

Paragraphs:

Noah Smith: I Can Only Promise You that It’s Going to Get Weirder: ‘Artificial wombs would significantly reduce the physical strain that pregnancy places on women’s bodies…. We relegate the gory details to the realm of parenting classes and raunchy comedy. But it’s absolutely real. We’ve eliminated many of our burdens through the magic of technology—carrying water all day, washing laundry by hand in the river, chopping firewood to heat our homes—but pregnancy remains. Unless you’re rich, of course. My wealthy friend, whose first pregnancy required a hysterectomy due to placenta accreta, will have her second child via a surrogate, using pre-frozen embryos. This costs upwards of $100,000, which is approximately equal to the entire median wealth of an American household. Who would begrudge my friend this? And even if she were able to bear a second child herself, who would begrudge her the opportunity to outsource it? Artificial wombs are simply a way to take a privilege for the upper class, and make it possible for other classes of society to enjoy it as well. And this is how it’ll almost certainly be received. Angry Twitter people always seem to envision new technologies as something that government imposes on the populace, possibly at the behest of mad billionaires. In the real world, what usually happens is that people simply adopt a new technology because they realize it makes life easier for them…

LINK:

John Stoehr: The Real Americans Versus The ‘Real Americans’: ‘For the followers of the former president, and for the GOP leaders paving the way for his return, freedom is about power. It’s about what they can do to you without consequence and what you can’t do to them without consequence. The social contract is tyranny. They owe nothing to you. You, however, owe everything to them. They call themselves the “real Americans.” For everyone else, freedom is democracy and self-government. That requires respect for social contract, which itself requires respect for the truth, as the truth is independent from human agency. The truth not only binds equal citizens but enables compromise between them. At root is the recognition that the common interest and common good are achievable through shared purpose and sacrifice. We are all in this together. Only when we honor that can we all of us be truly free. In my view, these are the real Americans…

LINK: <https://www.editorialboard.com/the-real-americans-versus-the-real-americans/>

Jordan Schneider & Chris Miller: What Happens to China Now That Autocrats Are Bad News?: ‘Jordan Schneider: “After Crimea [Russian foreign minister] Sergei Lavrov had this enormous shit-eating grin on his face. I don’t have the words for the contrast between this and what we saw at the Security Council meeting. They looked like they were staring death in the face…. What happened [on Sunday]. There was a lot of weirdness and not particularly coordinated messaging. What gives?” Chris Miller: “I think the Security Council meeting is the greatest puzzle of what we’ve seen over the past couple of weeks. Although it was publicly described as a live broadcast, if you zoom in on the watches in the meeting, it was prerecorded…. Every key member of the Russian political elite… every single one of them seemed a little bit uncertain about where things were going…. The technocrats and the government… seeming very nervous and unsure…. Putin laughed twice at [Director of the Foreign Intelligence Service] Sergei Naryshkin. It was almost as though the Kremlin wanted to show that the elite was being whipped into shape. But I’m surprised that Putin felt like the elite had to be whipped into shape….” Jordan Schneider: “It’s a weird dynamic when this is your team who you’ve had 20 years to pick. You’re about to go to war alongside them and then you dress them down in public and then you record it and then five hours or however long later you have the whole world watching, it’s just an odd series of events.” Chris Miller: "Before this week we’d been talking a little bit about Putin becoming more isolated during the pandemic… a very rigid regime of quarantine…. The pandemic does seem to have affected him on a personal level and cut off his access to information. I think this has impacted him in a way that we didn’t fully understand…. I can’t wait for Sergei Lavrov’s memoirs. But I hope they’re written from The Hague…

LINK:

Lawrence Freedman: Russia’s Plan C: ‘If there was ever any possibility that this war would end with the complete subjugation of Ukraine by force of arms this has now gone. Nor will it end with Russian forces being chased out of the country. Most likely there will be a negotiated conclusion…. It is now as likely that there will be regime change in Moscow as in Kyiv…. What will matter most will be rumblings among the elite as they see the consequences of their leader’s recklessness. When we know more about how this war ends we will understand better how his regime ends…

LINK:

PAID SUBSCRIBER ONLY Content Below:

Subject: Big-Books Seminar on Economic Growth?

Well, it looks like I may be teaching a small undergraduate course—a big-books seminar on economic growth in perspective this fall.

Is this the right way to organize it? And are these the right things to read?

Economic Growth: Seminar

Description

This seminar course will analyze how scholars think about modern economic growth and how people thought about the idea of economics growth before the onset of modern economic growth in the 19th century. Students will read major works by scholars trying to understand economic growth from different perspectives and discuss what these scholars got right and what they got wrong.

For it is very much the case that there ia a new thing under the sun since 1870: economic growth at the pace we are used to—roughly 2% per year—with associated creative-destruction revolutionizing the economy every generation per generation and then rerevolutionizing it again. How have people thought about this process? And how did people think about the idea of economic growth before we had it?

====

Readings

Week 1: Tomasso Companella: The City of the Sun: Thomas More: Utopia; Francis Bacon: The New Atlantis <https://archive.org/details/idealcommonwealt00more>, selections

Week 2: Edward Bellamy: Looking Backward <https://archive.org/details/lookingbackward0000bell>, Aldous Huxley: Brave New World <https://archive.org/details/bravenewworldand0000huxl_g4e4>, selections

Week 3: Joseph Henrich: The Secret of Our Success <https://archive.org/details/secretofoursucce0000henr>; Jared Diamond: The Third Chimpanzee <https://archive.org/details/thirdchimpanzeee0000diam>, selections

Week 4: Yuval Noah Harari: Sapiens <https://archive.org/details/isbn_9780099590088>; Ian Morris: Why the West Rules—for Now <https://archive.org/details/whywestrulesforn00morr_1>, selections

Week 5: Greg Clark: A Farewell to Alms <https://archive.org/details/farewelltoalmsbr00clar>; Jared Diamond: Guns, Germs, and Steel <https://archive.org/details/j.m.diamond2017gunsgermsandsteel>

Week 6: Elizabeth Wayland Barber: Women’s Work—the First 20000 Years <https://archive.org/details/womensworkfirst20000barb>; Sally Coulthard: Follow the Flock: How Sheep Shaped Human Civilization, selections

Week 7: Josiah Ober: The Athenian Revolution <https://archive.org/details/isbn_9780691001906>; Peter Temin: The Roman Market Economy <https://archive.org/details/RomanMarketEconomy>, selections

Week 8: Joseph Tainter: The Collapse of Complex Societies <https://archive.org/details/collapseofcomple0000tain>; Walter Scheidel: Escape from Rome, selections

Week 9: Phillip Hoffman: Why Did Europe Conquer the World?; Ken Pomeranz: The World That Trade Created <https://archive.org/details/worldthattradecr0000pome_c7r1>, selections

Week 10: Robert Allen: The British Industrial Revolution in Global Perspective; Global Economic History—A Very Short Introduction, selections

Week 11: John Maynard Keynes: The Economic Consequences of the Peace <https://archive.org/details/theeconomicconse15776gut>; Essays in Persuasion <https://archive.org/details/essaysinpersuasi00keyn>; The General Theory of Employment, Interest and Money <https://archive.org/details/in.ernet.dli.2015.115101>; Karl Polanyi: The Great Transformation <https://archive.org/details/greattransformat0000pola_o9l4>, selections

Week 12: David Landes: The Unbound Prometheus <https://archive.org/details/unboundprometheu0000land_a8r2>; W. Arthur Lewis: Growth & Fluctuations <https://archive.org/details/growthfluctuatio0000lewi>, The Evolution of the International Economic Order <https://archive.org/details/evolutionofinter0000lewi>, selections

Week 13: Robert Gordon: The Rise and Fall of American Growth <https://archive.org/details/risefallofameric0000gord_h2k2>; Robert Reich: The Work of Nations <https://archive.org/details/workofnationspre0000reic>

Week 14: Robert Bates: When Things Fell Apart <https://archive.org/details/whenthingsfellap00bate>; Robert Allen: Farm to Factory; David Landes: The Rise & Decline of Nations <https://archive.org/details/wealthpovertyofn00land>, selections

Week 15: Richard Baldwin: The Great Convergence<https://archive.org/details/greatconvergence0000bald>; Ben Friedman: The Moral Consequences of Economic Growth <https://archive.org/details/moralconsequence0000frie>, selections

FINAL PROJECT: Week 16: Erik Brynjolfsson &Andrew McAfee: The Second Machine Age <https://archive.org/details/secondmachineage0000bryn>;

Matthew Kahn: Adapting to Climate Change, selections

====

Assignments & Grading

In-class presentation on one of the books on the syllabus (20%)

Ten-page summary, analysis, and critique of the book presented—positive and negative lessons learned about economic growth and the perception of it (20%)

Fifteen-page final-project positive or negative assessment of the possibilities for economic growth in the future, focusing on either global warming or information technology (30%)

Five short 200-word “lessons learned” memos, each on one of the books on the syllabus (10%)

Active seminar attendance and participation (20%)

I agree that the Fed and the Administration should be celebrating the Fed's management of the rapid recovery in real GDP and employment.

That does not mean that the Fed was perfect. A better estimate of the effects of Delta and then Omicron on LFPR and supply chain problems would have allowed the Fed to start dialing back monetary stimulus sooner, at least in September when the TIPS showed expectations of inflation rising. I agree with Powell, "hindsight says we should have moved earlier." And the rebound in expectations in December after having fallen in November indicates that the Fed needs to be seen as "doing something" to bring expectations down towards target.

I’ve been traveling quite a bit this week. Every airport is packed. I didn’t even know Des Moines HAD a satellite lot when I had to park. Des Moines! Denver was a zoo. People are spending like they are on spring break and don’t care what the price of Hurricanes at the beach bar cost. Disneyland and Disneyworld are booked solid. Hall reservations for marriages nearly back to prepandemic levels. I agree with Krugman, the disconnect between how people are acting and what they are telling pollsters about the economy is weird.