A Personal "ULP!" Moment: Giving a Guest Lecture on Budgeting & Macro Policy

Now I have a whole extra talk to write up, from slides that are not very good as far as notes are concerned...

So I got a phone call from someone at the policy school: would I come to their class on budgeting and give my take on the federal budget. “Sure”, I thought, “collegiality is a good thing. Plus I did this before, the last time being two… three?… years ago, back when John Ellwood was teaching this course. I will simply dust off my notes, update them, and give my take—all the while stressing that this is education-for-citizenship so that the students can fulfill their role as voters, rather than any tools or insights that will be useful in their day jobs.”

Then came the “ULP!!” moment. I discovered that it had not been two or three years, but rather six since I had last given: Budgeting & Macro Policy: A Primer <https://github.com/braddelong/public-files/blob/master/2015-02-23-budgeting-%26-macro-primer.pdf>. And I discovered that my thoughts had changed considerably since 2015, as the situation had changed and as, yes, my judgments of how the world works with respect to the entire government budget had changed as well.

So now I have a whole new, different talk to write up, for which I only have slides at <https://github.com/braddelong/public-files/blob/master/budgeting-%26-macro-policy-TICKLER.pptx>, and copied below. They do not make very good notes for reconstructing the argument I made:

(Remember: You can subscribe to this… weblog-like newsletter… here:

There’s a free email list. There’s a paid-subscription list with (at the moment, only a few) extras too.)

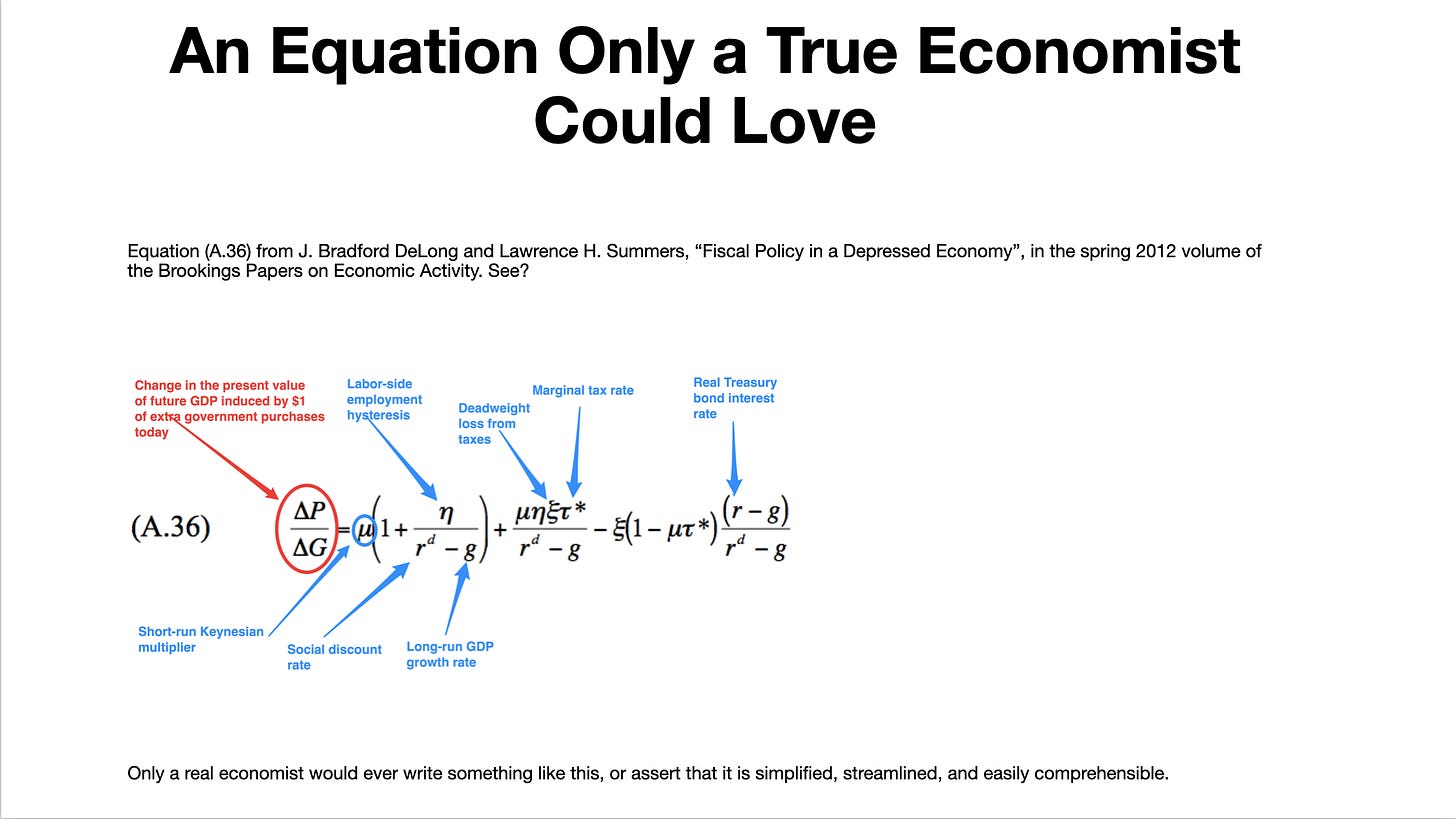

If you assume that deadweight loss from taxes is zero (and that it cannot be negative, which I admit being uncomfortable with as a concept but suspect is generally considered a condition), then the only way to have dP/dG be positive is for (r^d - g) to be more negative than employment hysterisis.

That seems to eliminate the possibility of the market being efficient by making investors (who demand r^d) believe the opposite of workers (g^[exp] < g). If you are requiring "premature capital optimism" as a condition for growth, the role of government should be to sustain lower rates for longer than necessary (the Powell Doctrine?).

Given that, the Second Run (which I doubt more than the third, while the first is obvious) doesn't require a surplus, but just a reduction in deficit, assuming that fiscal policy is run rationally; that is, that the power to tax that is required for sovereignty is available and used. (G spends an extra $1B in a recession; over the next five years, it spends less than that/taxes back some of the capital gains made due to sustained lower rates. No requirement to balance the budget so long as debt service is maintained and pay downs are possible.)