FIRST: Alan Blinder’s Monetary & Fiscal History:

A History of Economic Whac-A-Mole :: Project Syndicate: Alan S. Blinder’s new book, A Monetary and Fiscal History of the United States, 1961-2021…. There has been neither linear development nor much “progress” in figuring out how to manage modern economies in the interest of macroeconomic stability. Instead, Blinder describes:

wheels within wheels, spinning endlessly in time and space … [with] certain themes … waxing and waning … monetary versus fiscal … the intellectual realm … the world of practical policy making … the repeated ascendance and descendance of Keynesianism…

Problems appear and are either solved or not solved…. The response sets the stage for a new and different problem to emerge…. Actions taken in the recent past left the economy more vulnerable in some way…. Can inflation be expected to ebb, or does it tend to be highly persistent, with each shift in the rate becoming permanently embedded in the likely future? When Blinder “entered graduate school in the fall of 1967 … empirical evidence virtually screamed out that [it could be expected to ebb] .... Theory and empirics clashed sharply. As Groucho Marx memorably asked, ‘Who are ya gonna believe, me or your own eyes?’” Going with your own eyes was not the right thing to do. As economist Thomas J. Sargent soon showed in a “beautiful five-page paper” that was “underappreciated at the time,” much of the theoretical debate “was beside the point”…. Now, the same problem is back. Do inflation expectations remain well-anchored or not? Is the answer the same as it was in the 1970s? It might well be, or it might not be….

Blinder… lets us ride shotgun along the extremely rocky road that US policymakers have traveled in their quest for price stability, full employment, financial resilience, and robust investment. Each episode produced by the Wheel of Fortuna is strikingly and – I believe – almost completely accurately described. Read and absorb Blinder’s account, and you will be qualified to present yourself as a respected elder statesmen who has seen much macroeconomic policymaking up close, and whose advice warrants attention….

While history (correctly handled) can be very useful in helping us understand current situations, theory (at least currently fashionable theory) is not…. Monetary policymakers who make their decisions on political grounds should count on their reputations being permanently tarnished…. Using fiscal policy properly to manage demand and support growth is incredibly complex… in ways that are impossible for the political system to comprehend in real time…

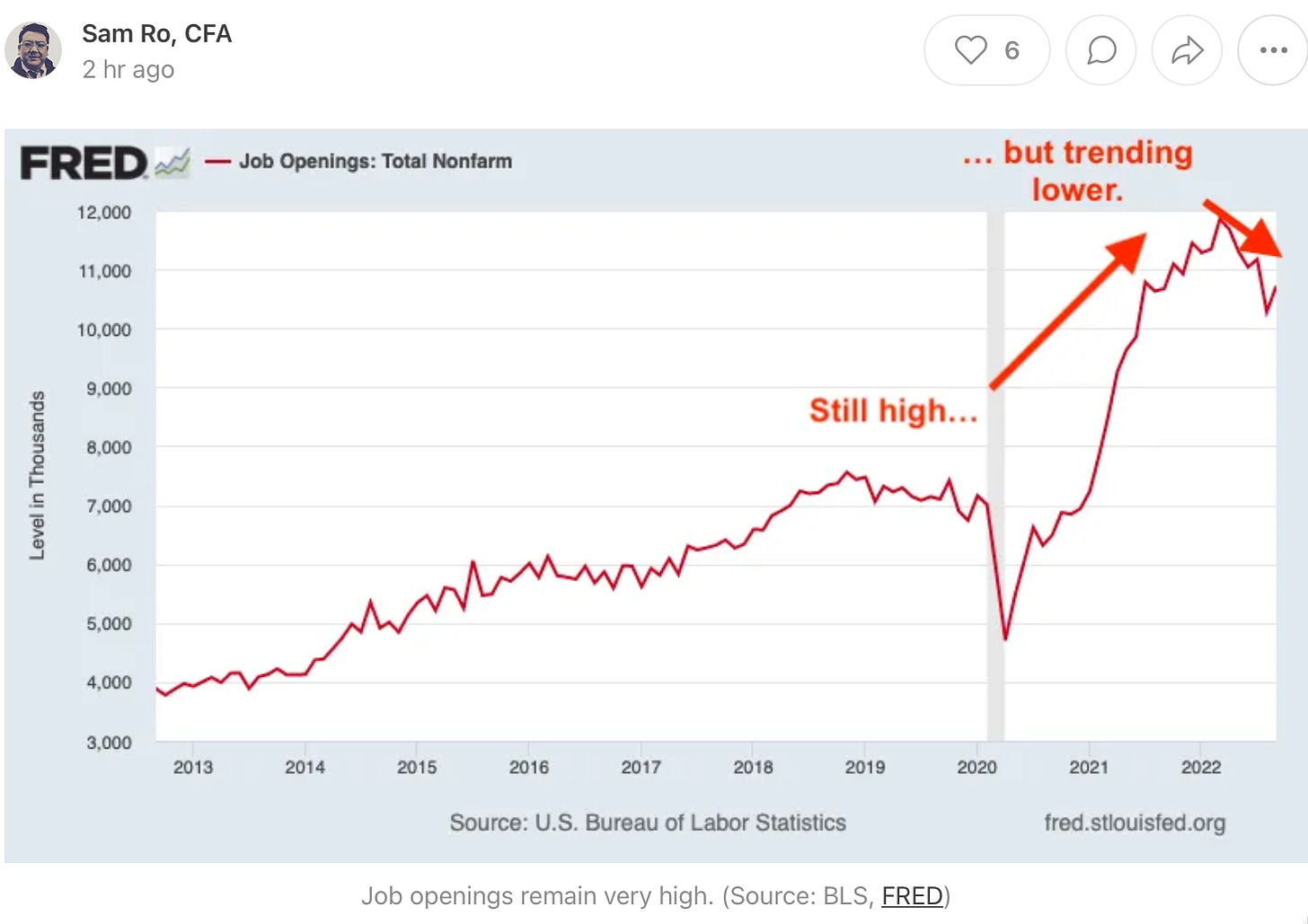

One Image: Þe Labor Market:

One Audio: Ezra Klein & Matt Yglesias on Elections:

<https://overcast.fm/+oiPVSsJk0>

Must-Read: Matt Levine Is at þe End of His Rope:

Matt Levine: Elon Musk is busy with Twitter: ‘Elon Musk showed up for his first day of work as Twitter’s… Chief Twit — and said “hey, do you have any other contracts I could violate?”.... He fired Twitter’s chief executive, chief financial officer and other executives.… "Mr. Musk also appears unlikely to pay the golden parachutes.... Mr. Musk terminated the executives 'for cause'…”. I cannot believe we’re doing this again. Another point is that he absolutely did not fire them for cause.... Elon Musk doesn’t care.... Will his lawyers try to clean up the mess by pretending that he had cause?… Obviously. Will he eventually have to pay them their full severance? Obviously. Is this exactly in every respect like his decision to ignore the merger agreement? Pretty much, except that Musk essentially ended up having to pay Twitter’s legal bills for that, but these executives will have to pay their own lawyers to go after Musk for this money…. The basic problem with Musk’s efforts to walk away from his deal to buy Twitter — beyond the transparent nonsense of his actual arguments — was that if he could walk away from this deal then no merger agreement would be binding; every buyer could change their mind and go to court and say “meh, contracts, they don’t matter.” That did not work out for him; the system held…

O þer Things Þt Went Whizzing by…

Very Briefly Noted:

Chance: Tornetta v. Musk: The Tesla Compensation Case: ‘Trial begins November 14th. What will this "new" old case bring?…

Brendan Murray: The Workhorses of Global Trade Are Ringing Recession Alarms: ‘The market for $29 trillion in international commerce is “moving backwards.” That’s the bleak assessment from Soren Skou, the CEO of Maersk, in an interview Wednesday on Bloomberg Television. (Read the full story here.) The Danish company said Wednesday it expects global container demand to decline 2% to 4% this year…

Barry Ritholtz: When Your Only Tool is a Hammer…: ‘CPI is… an imperfect depiction of reality. It reports price increases with a very distinct lag…. The FOMC seems to believe that middle-class purchases of homes and automobiles are where they can best strangle inflation. This is needlessly damaging at best…

Tommi Johnson: Momentum Factor Investing: 30 years of Out of Sample Data

Martin Wolf: Geopolitics is the biggest threat to globalisation: ‘Humanity has, alas, done this before. Since the industrial revolution in the early 19th century, we have had two periods of deepening cross-border economic integration and one of the reverse…. History hardly suggests that a period of deglobalisation is likely to be a happy one…. In all, it was an epoch of catastrophe…

¶s:

The Economist: What went wrong with Snap, Netflix and Uber?: ‘Three business models… losing steam: the movers (which shuttle people or things around cities), the streamers (which offer music and tv online) and the creepers (which make money by watching their users and selling eerily well-targeted ads)…. all turn out to face the same main pitfalls: a misplaced faith in network effects, low barriers to entry and a dependence on someone else’s platform...

John Gruber: The Math on Twitter’s Debt: 'Lauren Hirsch.... "Musk... loaded about $13 billion in debt on the company, which had not turned a profit for eight of the past 10 years.... [Interest] will now balloon to about $1 billion a year. Yet the company’s operations last yeargenerated about $630 million in cash flow.... That means that Twitter is generating less money per year thanwhat it owes its lenders. The company also does not appear to havea lot of extra cash on hand..." Interest payments are a bitch. The optimistic take on Musk taking Twitter private is that it frees Twitter from pursuing increased revenue at all costs to please shareholders. But what’s the point if Twitter now needs to pursue increased revenue at all costs to service its debt?...

• Sylvia Varnham O'Regan: Zuckerberg is Spending Billions on the Metaverse—Here’s Where It’s All Going: ‘Apple has about 3,000 employees working on its mixed reality headset…. Meta, in contrast, has more than five times as many people working on multiple virtual reality headsets, augmented reality glasses and associated software…. 2,400 people working in a research team led by the division’s chief scientist, Michael Abrash… 1,900 people are working on content such as the Horizon Worlds… reporting into Vishal Shah, head of the metaverse team...

In my days as a securities and corporate governance lawyer I often worked with the kind of executive compensation arrangements that will be at issue in Musk’s quarrel with the former Twitter executive officers whom he claims to have fired “for cause.” If you take a look at Twitter’s Change Of Control And Involuntary Termination Protection Policy (as supplemented and modified by their respective offer letters, this is Twitter’s version of a “golden parachute”) (available on the SEC’s website (https://www.sec.gov/Archives/edgar/data/1418091/000156459014003474/twtr-ex10_20140630634.htm), you will see that “Cause” is a defined term, and a narrowly defined defined term at that, to the benefit of the executive officer participant.

This is by design: these plans are intended to preclude exactly what Musk is trying to pull here. In fact, the “strategy,” if you can call it that, that he is starting to follow here is strikingly similar to that employed in the Delaware Chancery case relating to the merger agreement, and has many of the same problems.

Under the terms of the merger agreement, these people would be entitled to receive the merger consideration in exchange for their Twitter shares. Additionally, the golden parachutes would automatically vest, and cash out, at maximum targeted payouts where applicable, all their unvested equity awards and unearned salary, bonus and other cash incentive compensation. This may well amount to several years’ worth of max compensation.

They get all of these goodies unless Musk can prevail on his claim to have fired them for cause. Unless there are some unknown bad facts concerning the executives, this is quite unlikely.

I haven’t chased it down through the documents, but these kinds of executive compensation arrangements would typically also provide that Twitter would have to pay the executives’ legal and other costs incurred in enforcing their rights against Twitter. They may even be entitled to have their legal and other expenses advanced to them in the course of the litigation. Thus, ultimately, it will not necessarily be the case that the executives will be significantly out of pocket at all when the dust settles.

It’s really a Trumpian strategy. At best, the executives may be persuaded to accept less than their due in order to shorten their journey through the litigation mill.

Dear Brad, Some info on specific performance from a civil procedure teacher. You can only get specific performance (and equitable remedies in general)

if you can show no adequate remedy at law (or irreparable injury, which amounts to same thing). This been the rule for centuries.

Sales of real property, however, can be enforced by injunctions—prior to the Industrial Revolution, wealth was in land.

So how come Delaware court issued an injunction? Delaware grants injunctions freely in corporate takeover case. If the buyer was to provide synergy and special expertise, money damages would not make the target corporation whole.

Allen Kamp, Professor Emeritus, Un. Ill. Chicago Law School ( B.A. Berkeley, English, 1964)