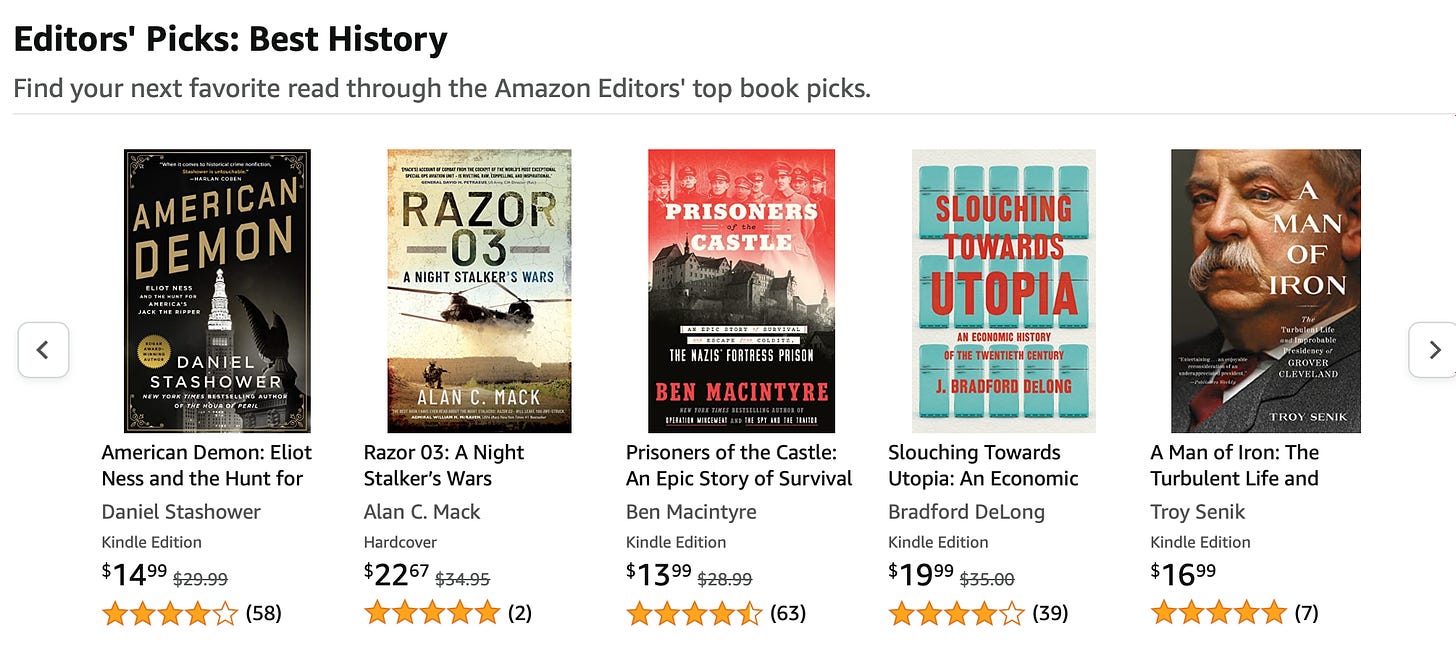

Amazon Editor’s Pick: Best History; & Adam Tooze “Slouching” Review in þe FT, &

For 2022-09-27 Tu

FIRST: Amazon Editor’s Pick: Best History:

And the Adam Tooze Review in the “Financial Times”:

This is a wonderful treat for me, and a great pleasure to see:

Adam Tooze: Fueling America’s Global Dream: ‘This duality of production and destruction gives the 20th century a claim to be the most radical in… history of our species…. Grand narrative.…Hobsbawm… organised his account… the rise and fall of the Soviet project…. Milanovic… globalisation, deglobalisation and reglobalisation…. DeLong’s version of the 20th century is more parochial… centred on the political battles that raged around the growth regime of modern American capitalism and continue to shape policy debate in governments and central banks today. This is, you might say, the in-house, post-Clintonian history of the 20th century….

The first British-centred industrial revolution… by modern standards it proceeded at a snail’s pace. The American-led growth phase… was different…. The laboratory, the corporation and globalisation. Migration enabled tens of millions to raise their standard of living. Global investment put them to work. From the laboratory poured forth the magic of modern technology…. The ensemble acquired such momentum that it promised to give history a deterministic logic dominated by… economic development [that] would realise utopia in the sense of freedom from want. But… the liberal development engine was fragile…. On the question of whether… [WWI] was itself the result of combined and uneven economic development, or nationalist passion and happenstance, DeLong prevaricates...

Oooh! This is going to be fun! I can see I am going to have a lot to say!

At this point, I would like to stop and make two points:

1/ “Parochial”. Yes and no. Yes, in that Slouching Towards Utopia <bit.ly/3pP3Krk> is a history written by someone who when younger thought he was engaged in restoring and perfecting American social democracy—reviving the New Deal Order—under cover of Left-Neoliberal sheep’s clothing, and is still trying to figure out what went wrong. No, to the extent that you believe with Leon Trotsky’s that in the 20th century America was “the furnace where the future was being forged”. Since I do agree with Lev Davodovich from Yanovka here, I assert that my parochial perspective is in fact the general and universal one.

2/ “[WWI]… result[ing from]… combined and uneven economic development, or nationalist passion and happenstance…” PORQUE NO LOS DOS?

“Happenstance” in the sense of traditional élites fearing that they were on the downside of Schumpeterian creative-destruction, and desperate to demonstrate that they still had (or perhaps find a new) social role by leading a Short Victorious War.

“Nationalist passion” in that, as Ernest Gellner stressed most stridently, nationalism was the preeminent popular response to Schumpeterian creative-destruction: Find yourself in a world in which “the market giveth, the market taketh away: blessed be the name of the market” is the Gospel and property rights are the only rights that matter—the only source of social power? Then ethno-nationalist mobilization against the rootless-cosmpolite princes of the market seems the best road to vindicating your Polanyian rights to land—the community and built environment you deserve—finance—stability of the money flows that support your occupation and, indeed, your community, industry, and livelihood—and labor—vindicate your right to the income and status and respected social role that you deserve (and also vindicate your right to keep the others from gaining more income and status and respect than they deserve).

Thus “nationalist passion” is the response to “combined and uneven development”—to the technology-driven Schumpeterian creative-destruction that doubles the potential wealth of humanity every generation, but at the cost of grinding sectors, industries, livelihoods, occupations, and communities into dust.

And do not forget Social Darwinism: if you are to justify market-produced individual inequality as harsh for the individual but progressive for the race, it is only a very small step from applauding market struggle and the flourishing of the “fittest” to applauding military struggle.

And as for John Maynard Keynes’s belief—wish—hope—that wiser technocrats before WWI could have prevented and wiser technocrats after WWI could have stabilized pseudo-classical semi-liberalism and kept humanity on a largely peaceful road to El Dorado? He did claim that the ruling point-of-view was a belief that the progressive

state of affairs [was]… normal, certain and permanent—except in the direction of further improvement[, with] any deviation from it… aberrant, scandalous and avoidable. The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions and exclusion, which were to play the serpent to this paradise, were little more than the amusements of his daily newspaper…

Had I actually written this book during the 1994-2000 years when I thought that someone should write it, I should have agreed with Keynes that the problem of rewriting the econo-social relations-of-production software running on top of the massively transformed technology-driven forces-of-production hardware in such a way as to avoid catastrophe should have been possible. And I might have been triumphalist that we had finally gotten it right in a 1990s Frank Fukuyama vein.

But not anymore. Not now.

Must-Reads:

And:

Dambisa Moyo: Why US Inflation Is Headed Down: ‘Supply-chain disruptions… China’s… zero-COVID… the Russia-Ukraine war… largely fall outside of what the Fed can control. The US economy, however, is uniquely positioned to overcome this particular species of inflation, owing to its relative energy and food independence, abundance of immigrant labor, strong production capacity, and access to the capital needed to maintain and increase domestic manufacturing…. There are already signs that US inflation might be cooling…. Core inflation… fell to 5.9% in July from a high of 6.5% in March, before rising again in August…. That said, we cannot expect inflation to return to the Fed’s target of 2% anytime soon. But we can expect inflation to stabilize…. It is hard to find another economy that can match what the US offers: ample natural resources, effective governance, a history of immigration, and a global reserve currency. That is an ideal inflation-busting toolbox. By comparison, most other countries are far more dependent on the global economy. In today’s world, that leaves them more exposed…

This seems to me to make sense. But it may well be that Vladimir Putin has changed the situation, so that not even a clever navigator can find a path between the Scylla of depression and secular stagnation, and the Charybdis of unmanaged and persistent inflation.

Other Things I Note:

SubStack HQ: Announcing the all-new Substack Reader for web: ‘Read all your Substack subscriptions—and more—in a clean, simple, and fast web reader. Everything stays in-sync with your Substack app for iOS. Want to add a publication from outside Substack? No problem—just select “Add RSS feed” from the left sidebar…

Jeremy Reimer: A history of ARM, part 1: Building the first chip

Samuel Hammond: Nonprofits are under-theorized: ‘Te devolution of US politics into a jungle of waring activists, each claiming to be building the one true “movement,” is a reflection of that same low church Protestant ethic. It’s enough to make me miss those old Anglican ladies and their triangular sandwiches…

Matt Stoller: Congress to Vote on New Antitrust Laws This Week

Nicole Chung: Do Authors Need an Online Platform?

Noah Smith: Why the UK is having an economic crisis: ‘Fortunately, the UK doesn’t have the other two things that make many emerging markets vulnerable to a currency crash: pegged exchange rates and foreign-currency debt...

Matt Yglesias: Beating climate change absolutely requires new technology: ‘When California votes to keep Diablo Canyon open… that does absolutely nothing to slow renewable buildout. And the idea that investments in hypothetical carbon capture technologies are preventing the deployment of already existing decarbonization technologies in the present day is just wrong…

Claudia Sahm: ‘The Fed has a choice: Core PCE in prior three months averaged 4.2% at an annual rate, about 2 percentage points above target. inflation has been high for a year and a half and expectations are anchored. pushing us into a global recession and social unrest is not worth it. it’s not necessary…