WORÞY READS: From 2021-01-08 Fr

Something I do every week for þe extremely-worthwhile Washington Center for Equitable Growth

The real place where this will be deployed is over at <http://equitablegrowth.org>. I put it here in case you want an advance look…

==============

Worthy Reads from Equitable Growth:

1. Once more out of my wheelhouse. Well, that January 6 was a very interesting Feast of the Epiphany, wasn’t it? In the story, the Magi brought gifts of gold, frankincense, and myrrh to the newly-born Anointed One. In 2021 the MAGA—“American patriots”, in the words of First Daughter Ivanka Trump—brought riot and destruction to the U.S. Capitol, which was invaded and ransacked for the first time since the British occupation of Washington in the War of 1812.

On the one hand, the United States tradition of a peaceful transfer of power instituted by President John Adams in 1801 has now been broken by President Donald Trump: at least five people are dead.

On the other hand, the number of rioters making the assault is described by Wikipedia as being only in the “hundreds”—albeit with a follow-on curious crowd wandering around inside the Capitol taking photographs, some of whom spent their time collecting souvenirs. It seems much more a failure of policing. But the role played by Trump, Trump appointees, and the Trump administration in delaying reinforcement support to the U.S. Capitol police has not been explained. Neither has the bypassing of the chain of command and the approval of reinforcement support not by Trump but by Vice President Pence been explained. Perhaps we have a soft invocation of the XXV Amendment here. Perhaps not.

I have some preliminary—and quite probably wrong—thoughts on why the mob did what it did, with a very small number of well-equipped would-be terrorists, a much larger number of unequipped violent rioters, and a supportive crowd of perhaps a thousand or so willing to go along:

Brad DeLong: Why Storm the Capitol Building & Then Do Nothing But Take Selfies?https://braddelong.substack.com/p/why-storm-the-capitol-building-and: ‘Suppose that you believed that the President of the United States was a serious person, rather than a demented, lying clown... was telling the truth[?]... What would you conclude?... That you should march down to the Capitol, and get in their face, and so give Vice President Pence, Majority Leader McConnell, and all of the senators in the Republican caucus who were not the brave thirteen the backbone to halt the certification, send the fake certificates back to the states, and ask the states to send the real certificates. And you would be willing to push past police, break windows, ascend scaffolding, and keep pushing as long as you could to get into the face of the legislators and give them backbone.

And you would succeed.

But then you would find that, even though you had done your job, you still had not given the senators backbone—that in fact your actions caused the number of “brave” senators to fall in half, to seven. (But do note that you would neither increase nor decrease the numbers of the 130 Republican House caucus members on your side—although it is not clear how many of those voted for the objections just because they knew they were not going to pass). And then you would go home, puzzled…

2. Attend the launch of our Ideas to Boost Wages in the New Economy book after lunch (EST) on Th Jan 14:

Equitable Growth: Ideas to Boost Wages in the New Economy: Ten Essays on Raising Wages for U.S. Workershttps://equitablegrowth.org/event/ideas-to-boost-wages-in-the-new-economy-ten-essays-on-raising-wages-for-u-s-workers/: ‘When: January 14, 2021 2:30PM - 4:00PM. Where: Event will be virtual and not held in person, The Washington Center for Equitable Growth, 15th Street Northwest, Washington, DC, USA. The Washington Center for Equitable Growth will hold a launch event for a new essay series on how to raise wages on January 14, 2021, from 2:30 p.m. – 4 p.m. EST. The forthcoming book collecting the series, Ideas to Boost Wages in the New Economy, features 10 essays by leading scholars on policies to boost wages for U.S. workers by addressing underlying structures and dynamics in our economy.

The series—developed in partnership with the Institute for Research on Labor and Employment at the University of California, Berkeley and with funding from the Bernard and Anne Spitzer Charitable Trust—guides policymakers on how to deliver broadly shared economic prosperity by making wages a key outcome to structural economic policy at the federal and state levels. The virtual event will include a series of fireside chats to discuss how to reimagine the U.S. economy so that workers are able to share in the value that they create, highlighting policy priorities and proposals to balance power and foster an equitable economy.

This conference will feature three essay authors: Ioana Marinescu, Assistant Professor of Economics, University of Pennsylvania, on addressing market concentration and employers’ ability to undercut wages. Jesse Rothstein, Professor of Public Policy and Economics, University of California, Berkeley, and Faculty Director, California Policy Lab, on supporting policies to broadly share economic risks. Andria Smythe, Assistant Professor of Economics, Howard University, on making higher education more accessible. Register for the launch event…

3. Reread on how race amplifies class by super-amplifying blockages to upward economic mobility. I used to think, back in the late 1970s, that the African-American economic trajectory was like the standard immigrant economic trajectory if you set the clock so that the migration that counted was the Great Migration after World War II from the rural U.S. south to the urban U.S. north. That was just completely wrong. And stupid:

Bradley Hardy & Trevon Logan: Race & the Lack of Intergenerational Economic Mobility in the United Stateshttps://equitablegrowth.org/race-and-the-lack-of-intergenerational-economic-mobility-in-the-united-states/: ‘Key Takeaways: The evidence: U.S. intergenerational economic mobility—the likelihood that children achieve a higher standard of living than the household in which they were reared—varies considerably by race and ethnicity. There are significant racial and gender differences in mobility that exacerbate racial differences in other areas such as housing, education, and health. The solutions: Policy remedies for persistently low intergenerational economic mobility include more equitable housing and educational opportunities, better income security and wealth accumulation, and investments to improve school quality, lower crime, and encourage private-sector amenities to improve infrastructure in the poorest neighborhoods…

4. It was a disaster of a jobs report for December—the absence of lockdowns did not keep the coronavirus from sending the economy back into recession, as people got scared. Kate Bahn and Carmen Sanchez Cumming have the receipts:

Kate Bahn & Carmen Sanchez Cumming: _Equitable Growth’s Jobs Day Graphs: December 2020 Report Edition _ https://equitablegrowth.org/equitable-growths-jobs-day-graphs-january-2020-report-edition-2/: ‘On January 8th, the U.S. Bureau of Labor Statistics released new data on the U.S. labor market during the month of December. Below are five graphs compiled by Equitable Growth staff highlighting important trends in the data…

Worthy Reads from Elsewhere

1. Again, out of our wheelhouse. But very important to note that Trump administration national security bureaucrats—and Republican leaders up to Senate Majority Leader McConnell—are acting as they would act if indeed further violent attempts to disrupt the transfer of power to the Biden administration are being planned by Trump and his supporters:

Erin Banco & Asawin Suebsaeng: Trump Officials Rush to Keep Him From Sparking Another Conflict—at Home or Abroadhttps://www.thedailybeast.com/after-inciting-capitol-riot-trump-whines-to-advisers-why-cant-i-tweet?ref=scroll: ‘Trump is increasingly unhinged. Top national security officials are trying to keep the whole world from paying the price: High-ranking national security officials have spent the last 24 hours scrambling to figure out how to keep their commander-in-chief, Donald Trump, from inciting further violence at home to spilling national secrets to sparking last-minute confrontations with international foes... fears inside the Pentagon that the president will do or say something that effectively throws the U.S. into a military confrontation with another country... anxieties in the intelligence apparatus that Trump will divulge classified intelligence on his way out....

“This isn’t a hypothetical anymore,” said one senior administration official. “This is real. What happened yesterday changed the calculus. People are concerned about [the president’s] state of mind.”... Several high-ranking national security and White House officials were on the edge of resigning.... Several did step down, including deputy national security adviser Matt Pottinger. But after a series of calls from prominent GOP lawmakers, including Sen. Mitch McConnell (R-KY), leading national security officials decided to stay in office, at least for the time being, in order to preserve cohesiveness but also to provide safeguards in the coming weeks. One of those individuals asked to stay on is national security adviser Robert O’Brien....

For those who have decided to stay on, their main focus is preventing President Trump from pushing the country further into chaos.... Officials have contacted leading lawmakers on Capitol Hill to informally brief them about the situation, according to two congressional aides familiar with the matter. “The president was trying to stage a coup. There was little chance of it happening, but there was enough chance that the former defense secretaries had to put out that letter, which was the final nail through that effort. They prevented the military from being involved in any coup attempt. But instead, Trump tried to incite it himself,” said Fiona Hill, Trump’s former top Russia adviser. “This could have turned into a full-blown coup had he had any of those key institutions following him. Just because it failed or didn’t succeed doesn’t mean it wasn’t real.”

Defense and intelligence officials have discussed attempting to prevent the president and his loyalists at the Pentagon—especially Kash Patel, the chief of staff to Acting Defense Secretary Chris Miller—from tampering with classified information or carrying out their own political agendas that could threaten the security of the United States, three currently-serving senior officials told The Daily Beast.... Part of the problem, officials said, is that Trump’s inner circle has been even further cut off from the rest of the administration. And those who are left and are still communicating with him are “not going to rock the boat,” one senior official said. “There is no one to tell the truth to him at all anymore,” another former senior national security official said. “That’s the problem. Even if they did, he wouldn’t listen.”...

In the past 24 hours, several senior administration officials have quietly sought to tamp down internal chatter of invoking the 25th Amendment... motivated in part by... concerns that more talk, even if fleeting, of the 25th amendment could further enrage Trump and cause him to tweet or announce to his extremist fans that they should fight against that as well....

Joe Grogan, who was the top White House domestic policy adviser to Trump until May of last year... didn’t exude confidence about certain former colleagues who are still advising the president during this crisis, bluntly describing some current aides surrounding Trump as “psycho[s]”…

2. A very interesting—and I think smart—point from the highly intelligent Adam Ozimek. Larry Summers was half right, and half wrong. $2000 checks would be fine, but not right now. They should be issued after vaccination has reached the critical point and when the division of labor is reuniting in its new pattern. Then is when we want to see people spend their money in the sectors where employment will be buoyant in the future:

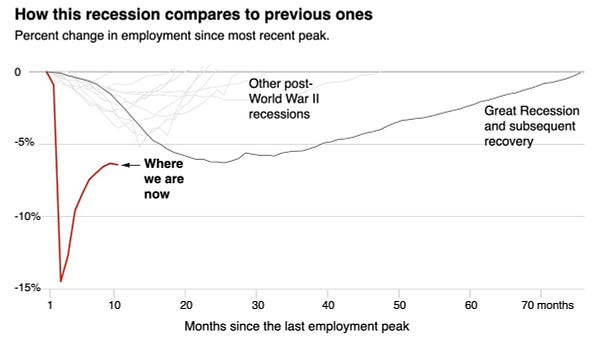

Adam Ozimek: Quick Thread

Quick thread on the why and how of fiscal stimulus given the state of the economy. First it's important to understand the size of the damage. We have *still* lost more jobs than the worst of the Great Recession. That's a remarkable level of job loss (chart from @crampell)...: ‘The why and how of fiscal stimulus given the state of the economy. First it's important to understand the size of the damage. We have still lost more jobs than the worst of the Great Recession.... Now it's true, there are a lot of ways that this recession is a lot less damaging than the Great Recession. The housing market is fine, household and business balance sheets have been to a significant extent bailed out by massive amounts of relief. That is all very good. We also have a lot of pent us savings, which should be released when the pandemic is over. A lot of the job loss is also temporary, a business is still there, there customers will be back, but they are at 30% staff bc of the pandemic. That all suggests fast bounceback.

However, 2.1 million workers who have lost their jobs post-pandemic say their job loss is permanent. This can be from business resizing or the elevated level of business failure in some sectors. Either way, you cannot put that back in the box quickly. So even if we have a lot of temporary job loss bounce back as the pandemic ends, and we have pent up savings being released, I don't think we should assume the recovery will simply be self-correcting at an efficient speed. 2.1 million permanent lost jobs is a lost, and we businesses to create new jobs there. In addition, we have all the population growth that would have translated to new jobs that we haven't created. That's probably another 1 million at least.

So does this call for fiscal stimulus? The truth is we are in brand new macroeconomic territory here. We have never paused the economy for an entire year, and attempted to fill the gap with federal spending. I think it would be a serious error lacking in humility to jus assume the economy will self correct and make up the 3 million or more jobs we need it to create in a quick manner. What's more, the costs are entirely asymmetric here. If somehow the economy miraculously creates 3 million NEW jobs (not just the old ones coming back) overnight and we do fiscal stimulus, guess what? We still weren't at full employment in 2019. The risk of overheating is low.

But while I think the totality of the evidence calls for fiscal stimulus, I think when is very very important. If we send out $2,000 checks this month it will be pushing on a string. We should wait to send out fiscal stimulus when the pandemic is over. Ironically Larry Summers had this half right. Stimulus that leads another $300 to be spent at home depot, or bids up new home prices, will not be putting demand into the parts of the economy that need it. The checks should come when the pandemic is over, so they can supercharge pent up demand for the service sector which is where the permanent job loss & business failure has happened and thus new job creation is going to be concentrated…

3. And this is very smart from EPI’s Heidi Shierholz:

Heidi Shierholz: Grim Findings

Another grim finding is that we are down 1.4 million state and local government jobs over the last 10 months—most of it (more than 1.0 million) in education. THIS IS A MINDBOGGLING UNFORCED ERROR. Fortunately, given the new senate, Congress can pass aid to state & local govts. 5/: ‘Here we are, astonishingly, at the first #JobsDay of 2021. As we are all taking stock of where things stand in our democracy, it’s a moment to also take stock of where things stand in the labor market, after 2020. Brace yourselves. After months of slowing gains, we lost 140,000 jobs in December as the virus surged. The labor market is in turmoil. We have nearly 10 million fewer jobs than we did 10 months ago. Further, in the year before the recession, we added 194,000 jobs per month on average, so from February to December, we could have added around 1.9 million jobs. That means the total gap in the labor market right now is on the order of 11.8 million jobs. THIS is the shape of the recovery Biden will be inheriting. Another grim finding is that we are down 1.4 million state and local government jobs over the last 10 months—most of it (more than 1.0 million) in education. THIS IS A MINDBOGGLING UNFORCED ERROR. Fortunately, given the new senate, Congress can pass aid to state & local govternments…

4. I think Joe Gagnon is being very smart here, and my almost always wise teacher Olivier Blanchard... not so much here. A very brief twitter discussion:

Olivier Blanchard: 'The good and the bad of tweeter: Me: If we spend money, may make sense to try to give it to those who need it. (sounds trivial/reasonable to me...) Choir (1.5 m impressions): Communist, imbecile, academic (not a compliment), ignorant, economics is a garbage science, and worse.'

Brad DeLong: 'I repeat: I too see many better things to do þan $2000 checks. I also see many things þt could get 10 Republican votes in þe senate and so clear þe filibuster. I am not sure I see an intersection. Do you see an intersection? If you do, please say what. If you don't, please say so.'

Joseph Gagnon: 'I think that intersection could be extending $300 weekly unemployment supplement. Might be doable with 50 votes. But it is not clear that negotiations will lead to this particular either-or. Depending on alternatives, I could support doing both...

5. Let’s shift gears, and look at the bright side—the sunny side of things, in the long run at least:

Noah Smith: Why I'm so Excited About Solar & Batteries https://noahpinion.substack.com/p/why-im-so-excited-about-solar-and: ‘In the 19th century we switched to coal... in the 20th century we upgraded to oil.... After World War 2, a global extraction regime and price controls allowed us to keep cheap oil flowing. That ended with the Oil Shocks of the 70s. And though oil became cheaper again in the 80s and 90s, it never attained its former lows, or its low volatility. Then in the 00s it got expensive again.... We didn’t get anything better than oil during this time....

More expensive energy makes physical innovation harder in every way.... This stagnation in energy technology almost certainly contributed to the productivity slowdown of the 1970s.... Why didn’t bits fill the gap?... IT did drive the re-acceleration of productivity that began in the late 80s and continued through the early 00s.... But around 2005... that productivity growth faded.... Some have argued that digital services are substantially undervalued in our economic production statistics....

Physical technology is less “skill-biased” than IT, meaning that pretty much anyone can be a factory worker but only a few people can use computers productively and effectively... [or] IT simply touches less of our lives than energy does.... “Bits” innovation sometimes drives fast productivity growth, and sometimes doesn’t.…

The cost declines in solar and batteries — and to a lesser extent, in wind and other storage technologies—comprise a true technological revolution.... And there’s no end in sight to this revolution. New fundamental advances like solid state lithium-ion batteries and next-generation solar cells seem within reach, which will kick off another virtuous cycle of deployment, learning curves, and cost decreases…

6. Matt Notowidigdo does this as a tradition. And it is great!:

Matt Notowidigdo: 10 Favorite Economics Papers Published in 2020

Just under the wire again, but I continue my annual tradition -- my 10 favorite economics papers published in 2020, ordered alphabetically [Was pretty tough this year; might have to do an "honorable mention" list in January...]: ‘Just under the wire again, but I continue my annual tradition—my 10 favorite economics papers published in 2020, ordered alphabetically. [Was pretty tough this year; might have to do an "honorable mention" list in January...]

1)... whether immigration responds to the generosity of a country's welfare benefits.... Using administrative data from Denmark, paper reports large changes in flow of immigrants from outside the EU in response to policy that reduced welfare benefits for non-EU immigrants, but not EU immigrants....

2) Sebastian Bradley & Naomi Feldman study the economic effects of an increase in tax salience coming from a 2012 US DOT mandate that airline fares presented to consumers must incorporate all taxes & fees.... Prior to the DOT mandate, essentially all of the taxes & fees were passed on to consumers, but after the mandate pass-through falls by ~75%. Increasing tax salience thus led to a substantial reduction in the incidence of airline taxes on consumers....

3) Amitabh Chandra & Douglas Staiger study hospital-level variation in heart attack treatments.... One key finding is that many hospitals are overusing expensive heart attack treatments, and as a result there are marginal treated patients who would have had better outcomes if they had instead received less-intensive care.

4)... how the acquisition of independent dialysis facilities by larger chains affects patient treatment decisions and health outcomes.... Authors conclude "along almost every dimension we measure, patients fare worse at the target facility after acquisition"....

5)... how job promotions affect the probability of divorce and find large increases for women, but not for men.... One thing I remember from their presentation is that many in audience were frustrated with the results, but some older women had very different reactions....

6)... the effects of different types of mortgage modifications on default and consumption... "liquidity effects >> wealth effects" for distressed borrowers.... Principal reductions that do not include short-term payment reductions are unlikely to be effective in reducing mortgage defaults....

7)... the "folk wisdom" in labor economics that identification... can be achieved by assuming exogeneity of initial industry employment shares... using pre-existing variation in local industry employment....

8) Katrine Jakobsen, Kristian Jakobsen, Henrik Kleven, & Gabriel Zucman study the effects of wealth taxes in Denmark using a difference-in-differences design.... Wealth taxes have substantial effects on taxable wealth, especially at the top of the wealth distribution, with a long-run elasticity of taxable wealth (with respect to the after-tax rate) of 0.77 for the moderately wealthy & 1.15 for the very wealthy....

9)... the earnings losses of displaced workers using matched employer-employee data from the state of Washington.... Most of the earnings losses from displacement come from reductions in wages rather than from not ending up back in the same kinds of firms.... All of the main results are the exact opposite of what I would have expected....

10)... a large-scale financial aid program in Colombia (Ser Pilo Paga) that targeted extremely high-achieving students in poor households and they find large increases in college enrollment.... The program virtually eliminated the SES-enrollment gradient among high-achieving students in the top decile of the test score distribution...

7. Very interesting evidence that stimulus (as opposed to income support) spending should wait until after the virus plague has been brought under control:

Alan Auerbach, Yuriy Gorodnichenko, Peter B. McCrory, & Daniel Murphy: Fiscal Multipliers in the COVID19 Recessionhttps://www.aeaweb.org/conference/2021/preliminary/1428: ‘In response to the record-breaking COVID19 recession, many governments have adopted unprecedented fiscal stimuli. While countercyclical fiscal policy is effective in fighting conventional recessions, little is known about the effectiveness of fiscal policy in the current environment with widespread shelter-in-place (“lockdown”) policies and the associated considerable limits on economic activity. Using detailed regional variation in economic conditions, lockdown policies, and U.S. government spending, we document that the effects of government spending were stronger during the peak of the pandemic recession, but only in cities that were not subject to strong stay-at-home orders. We examine mechanisms that can account for our evidence and place our findings in the context of other recent evidence from microdata…

8. I find this very surprising, and am eager to dig deeper into it. I will not claim to understand it yet, but I think it is potentially very important:

Martha Bailey, Thomas Helgerman, & Bryan Stuart: The Impact of the 1963 Equal Pay Act on the Gender Gaphttps://www.aeaweb.org/conference/2021/preliminary/1388: ‘The 1963 Equal Pay Act mandated equal pay for equal work for individuals covered by the Fair Labor Standards Act. Drawing on an empirical strategy used in the minimum wage literature, we exploit variation in the “bite” of the Act due to the pre-existing gender pay gap in the same occupation, industry, and Census region. Consistent with the Equal Pay Act binding, the results show that women’s wages increased more sharply in more affected jobs after implementation. However, women in more affected jobs also experienced substantially larger employment reductions by 1970. The resulting reshuffling of women from higher wage (and higher gender gap) jobs to lower paying (and lower gender gap) jobs offset women’s aggregate wage gains entirely. The result was negligible changes in the aggregate gender gap during the 1960s…