Ben Friedman: REVIEW of “Slouching Towards Utopia” for “Harvard Magazine"

2022-10-14 Fr

Where We Went Wrong

A sweeping history of society and the economy in the twentieth century

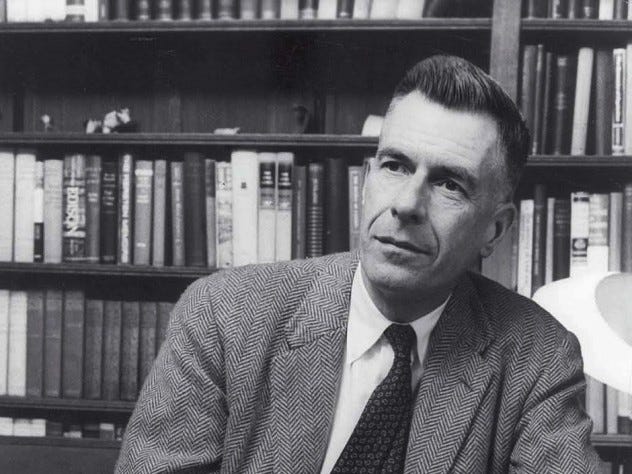

DeLong’s analysis resembles John Kenneth Galbraith’s (shown 1965) critique of the “affluent society.”

Photograph by Hulton Archive/Getty Images

Slouching Towards Utopia: An Economic History of the Twentieth Century by J. Bradford DeLong (Basic Books, $35)

MORE THAN 60 years ago, just past the midpoint of the twentieth century, Warburg professor of economics John Kenneth Galbraith assessed the trajectory of America’s increasingly “affluent society.” His outlook was not a happy one. The nation’s increasingly evident material prosperity was not making its citizens any more satisfied. Nor, at least in its existing form, was it likely to do so. One reason, Galbraith argued, was the glaring imbalance between the opulence in consumption of private goods and the poverty, often squalor, of public services like schools and parks. Another was that even the bountifully supplied private goods often satisfied no genuine need, or even desire; a vast advertising apparatus generated artificial demand for them, and satisfying this demand failed to provide meaningful or lasting satisfaction.

Now economist J. Bradford DeLong ’82, Ph.D. ’87, looking back on the twentieth century two decades after its end, comes to a similar conclusion but on different grounds. Our national prosperity—still advancing, albeit these days much more slowly than during the “glorious years” in the midst of which Galbraith was writing—may be taking us toward some vision of a material utopia. But for most Americans, the outcome seems empty and unsatisfying. Instead of attributing this failure to structural factors like Galbraith’s private-public imbalance, however, or the subversive role of advertising, DeLong, professor of economics at Berkeley, looks to matters of “contingency” and “choice”: at key junctures the economy suffered “bad luck,” and the actions taken by the responsible policymakers were “incompetent.” And behind those missteps in policy stood not just failures of economic thinking but a voting public that reacted perversely, even if understandably, to the frustrations poor economic outcomes had brought them.

DeLong’s ambition in his deeply engaging new book is broader than Galbraith’s was, however. While The Affluent Society focused largely on the American economy, DeLong’s look back over the twentieth century energetically encompasses political and social trends as well; nor is his scope limited to the United States. The result is a work of strikingly expansive breadth and scope. His treatment of the origins of World War I; of the economically confused response to the Great Depression; of the rise of fascism in the interwar period (he dismisses the familiar misperception that the early-1920s hyperinflation had much to do with Hitler’s rise to power, but attaches too much importance to the reparations imposed after World War I, which the Germans never paid anyway); of the postwar plight of the economically developing world (which all too often wasn’t actually developing); and of the contrast between Karl Marx’s utopian vision and what DeLong labels “really-existing socialism” are all well worth reading on their own. Indeed, DeLong is ill-served by his title: Slouching Towards Utopia: An Economic History of the Twentieth Century. Wholly apart from the puzzling reference to the 1996 screed by hard-right judicial ideologue Robert Bork—or was it supposed to be Joan Didion’s 1968 essays on California, or maybe the last line of Yeats’s “The Second Coming”?—labeling the book an economic history fails to convey its sweeping frame.

THE CENTURY that is DeLong’s focus is what he calls the “long twentieth century,” running from just after the Civil War to the end of the 2000s when a series of events, including the biggest financial crisis since the 1930s followed by likewise the most severe business downturn, finally rendered the advanced Western economies “unable to resume economic growth at anything near the average pace that had been the rule since 1870.” By his reckoning, these were “the most consequential years of all humanity’s centuries.” The changes they saw, while in the first instance economic, also “shaped and transformed nearly everything sociological, political, and cultural.”

Within this 140-year span, DeLong identifies two eras of “El Dorado” economic growth, each facilitated by expanding globalization, and each driven by rapid advances in technology and changes in business organization for applying technology to economic ends: from 1870 to World War I, and again from World War II to 1970. His periodization therefore precisely matches that of fellow economist Robert J. Gordon ’62, who in his monumental treatise on The Rise and Fall of American Economic Growth (reviewed in “How America Grew,” May-June 2016, page 68) hailed 1870-1970 as a “special century” in this regard (interrupted midway by the disaster of the 1930s).

But DeLong’s explanation for the ending of this golden era of economic growth differs from Gordon’s. Gordon highlighted the role of a cluster of once-for-all-time technological advances—the steam engine, railroads, electrification, the internal combustion engine, radio and television, powered flight—and argued that by 1970 frontier economic powers like the United States had largely harvested the resulting not-to-be-repeated gains. Pessimistic that future technological advances (most obviously, the computer and electronics revolutions) will generate productivity gains to match those of the special century, Gordon therefore saw little prospect of a return to the rapid growth of those halcyon days.

DeLong instead points to a series of noneconomic (and non-technological) events that slowed growth, followed by a perverse turn in economic policy triggered in part by public frustration: In 1973 the OPEC cartel tripled the price of oil, and then quadrupled it yet again six years later. Federal Reserve chairs Arthur Burns (appointed by Richard Nixon and reappointed by Gerald Ford) and G. William Miller (appointed by Jimmy Carter) were reluctant to accept the temporary economic losses that would have slowed rising prices. For all too many Americans (and citizens of other countries too), the combination of high inflation and sluggish growth meant that “social democracy was no longer delivering the rapid progress toward utopia that it had delivered in the first post-World War II generation.”

Frustration over these and other ills in turn spawned what DeLong calls the “neoliberal turn” in public attitudes and economic policy. The new economic policies introduced under this rubric “did not end the slowdown in productivity growth but reinforced it.” Further, the tax and regulatory changes enacted in this new climate channeled most of what economic gains there were to people already at the top of the income scale. Meanwhile, progressive “inclusion” of women and African Americans in the economy (and in American society more broadly) meant that middle- and lower-income white men saw even smaller gains—and, perversely, reacted by providing still greater support for policies like tax cuts for those with far higher incomes than their own.

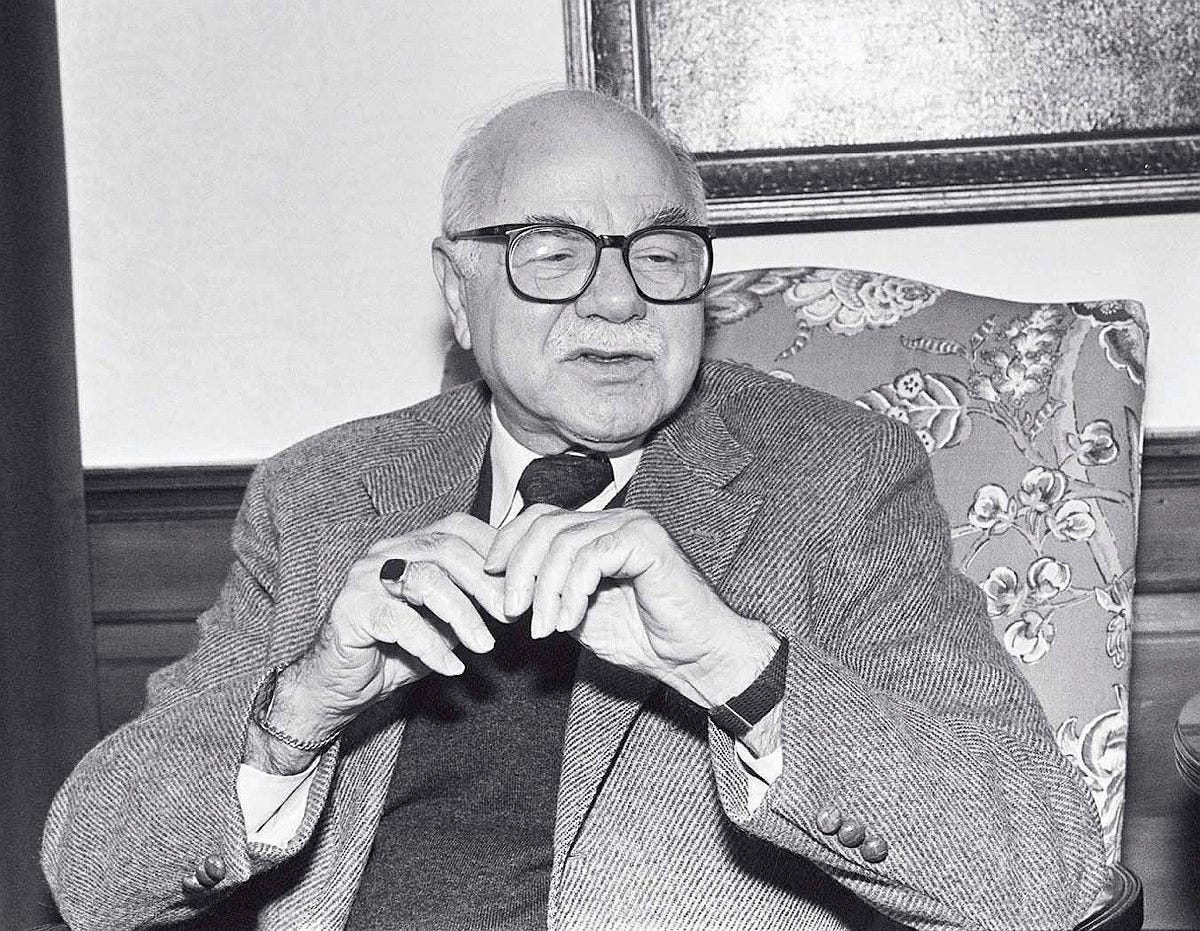

DELONG also offers a deeper, less contingent, explanation for the “sharp neoliberal turn away from the previous order—social democracy—of 1945-73,” one that recalls sociologist and Ford professor of the social sciences Daniel Bell’s argument in his 1976 classic The Cultural Contradictions of Capitalism. Bell famously suggested that the very success of a capitalist economy would eventually undermine a society’s commitment to the values and institutions that made capitalism possible in the first place. In DeLong’s view, the “greatest cause” of the neoliberal turn was “the extraordinary pace of rising prosperity during the Thirty Glorious Years, which raised the bar that a political-economic order had to surpass in order to generate broad acceptance.” At the same time, “the fading memory of the Great Depression led to the fading of the belief, or rather recognition, by the middle class that they, as well as the working class, needed social insurance.”

And there was a further dimension. Given the combination of slower growth overall and wider inequality, from the mid-1970s onward, and now expanded opportunities for women and favored racial minorities, what the economy delivered to “hard-working white men” no longer matched what they saw as their just deserts: in their eyes, “the rich got richer, the unworthy and minority poor got handouts.” As Bell would have put it, the politics of entitlement, bred by years of economic success that so many people had come to take for granted, squeezed out the politics of opportunity and ambition, giving rise to the politics of resentment. Echoing Bell’s central hypothesis, DeLong concludes that “the market economy solved the problems that it set itself, but then society did not want those solutions—it wanted solutions to other problems, problems that the market economy did not set itself, and for which the crowd-sourced solutions it offered were inadequate.” The new era therefore became “a time to question the bourgeois virtues of hard, regular work and thrift in pursuit of material abundance.”

Daniel Bell’s insights into capitalism’s contradictions echo in DeLong’s work.

Photograph courtesy of Harvard Public Affairs and Communications

Although DeLong does not offer any explicit program for future action, his account of this historical experience—like Galbraith’s before him—at least implicitly points a way toward improving matters. (By contrast, Gordon’s emphasis on the never-to-be-repeated technological advances of an earlier era left little room for positive action.) DeLong’s unspoken agenda would surely include rolling back many of the changes made in the U.S. tax code over the past half-century, as well as reinvigorating antitrust policy to blunt the dominance, and therefore outsize profits, of the mega-firms that now tower over key sectors of the economy. He would also surely reverse the recent trend moving away from free trade. Central bankers should certainly behave like Paul Volcker (appointed by President Carter), whose decisive action finally broke the 1970s inflation even at considerable economic cost—not like Arthur Burns. Above all, policymakers should get the economics right.

But offering recommendations is not DeLong’s purpose. His stark sense that the world is different in the wake of the 2008-10 financial crisis is what allows him to draw a Buddenbrooks-like line, ending his rich historical account there. It also precludes drawing firm conclusions from the “long” century that he so thoughtfully examines for the era to follow.

Revisiting The Affluent Society 60-plus years later leaves the reader astonished at how well so much of the book’s analysis has stood up. Not only Galbraith’s main themes but many of his more specific observations as well seem as pertinent, and important, today as they did then. What will future readers of Slouching Towards Utopia conclude? No doubt the historical vignettes—about the Great Depression, the two World Wars, and the other episodes examined—will hold up well. If anything, DeLong’s narratives will become more valuable as those events fade into the past. Alas, his description of fascism as having at its center “a contempt for limits, especially those implied by reason-based arguments; a belief that reality could be altered by the will; and an exaltation of the violent assertion of that will as the ultimate argument” will likely strike a nerve with many Americans not just today but in years to come.

But what about DeLong’s core explanation of what went wrong in the latter third of his, and our, “long century”? I predict that it too will still look right, and important.

Benjamin M. Friedman is the Maier professor of political economy. His books include The Moral Consequences of Economic Growth and, most recently, Religion and the Rise of Capitalism (excerpted in “The American Exception,” January-February 2021, page 43). Friedman is a member of the magazine’s Board of Incorporators.