First: One Video:

Barry Eichengreen: In Defense of Public Debt: ‘Recent years have seen shifts in views of public debt. In the 1980s and 1990s, growing debt was a massive fear, leading people to believe that government spending and debt were out of control. The Global Financial Crisis led to a “wobble” in beliefs, but they were dismissed as no more than a temporary deviation. Covid–19 led governments around the world to run unprecedented deficits, which begs the questions: are these changes in attitudes justified, and will they last? It is clearly justified, given the extraordinary circumstances…. With the Covid–19 crisis, a war-like response was necessary…. However, the change in attitudes may pre-date the pandemic. There has been growing recognition of the need for the government to provide public goods in education, health care, research, infrastructure, and climate change that markets do not adequately supply. Heavier debts are more sustainable because of the lower interest rates around the world… Today, there are possibilities of crises that would be large enough to warrant a war-like response. Climate change, future pandemics, and unknown crises…. The U.S. is able to borrow at favorable rates, but poor behavior may preclude this in the future if the dollar grows too volatile…

LINK: <https://www.youtube.com/watch?v=OUqpgYf09Vw&t=1s>

Very Briefly Noted:

Conor Dougherty: How a Single Family Home From the 1950s Is a Vision of California’s Future: ‘A single-family home from the 1950s is now a rental complex and a vision of California’s future… <https://www.nytimes.com/2021/10/08/business/economy/california-housing.html>

Jonathan Fisher & al.: Estimating the Marginal Propensity to Consume using the Distributions of Income, Consumption, & Wealth: ‘We examine the conjoint distributions… find that the overall marginal propensity to consume (MPC) is 0.10… 0.15 for the lowest… and 0.06 for the highest quintile… LINK: <https://equitablegrowth.org/working-papers/marginal-propensity-consume/>

Wikipedia: Old Shatterhand: ‘Karl May… <https://en.wikipedia.org/wiki/Old_Shatterhand>

Jordan Schneider: Invisible China: How the Urban-Rural Divide Threatens China’s Rise: ‘It’s a lot easier to solve poverty for 20 million people than it is to solve the low-income problem for 900 million people…

Paragraphs:

Chye-Ching Huang & Nathaniel Frentz (2014): What Really Is the Evidence on Taxes and Growth? | Center on Budget and Policy Priorities: ‘A 2012 Tax Foundation report assert[ing] that “nearly every empirical study of taxes and economic growth published in a peer-reviewed academic journal finds that tax increases harm economic growth”… mischaracterized, exaggerated, or selectively described the findings of six of… 19 [studies]. When one adds to these six studies the three state-level studies that the Tax Foundation misrepresented and the three studies that the Tax Foundation correctly identified as showing a “neutral” effect of taxes on growth, 12 of the 26 studies that the Tax Foundation cites do not support its flat assertion that tax increases harm growth. The Tax Foundation’s review omitted dozens of relevant studies published in major journals or edited compilations since 2000, many of which conclude that levels of taxation have little if any impact on economic growth or that adverse impacts are limited to particular taxes or time periods. The Tax Foundation’s assertion of a growing “consensus among experts” that taxes harm growth is false…

LINK: <https://www.cbpp.org/research/what-really-is-the-evidence-on-taxes-and-growth>

Alan M. Jacobs & al.: Whose News? Class-Biased Economic Reporting in the United States: ‘The tone of the economic news strongly and disproportionately tracks the fortunes of the richest households…. This “class bias” emerges… from the interaction of the media’s focus on economic aggregates with structural features of the relationship between economic growth and distribution. The findings yield a novel explanation of distributionally perverse electoral patterns…

Matthew O. Jackson: Inequality’s Economic & Social Roots: The Role of Social Networks & Homophily: ’The entanglement of people’s information, opportunities, and behaviors with those of their peers and communities leads to persistent differences in outcomes across groups in education, employment, health, income and wealth…. A network perspective’s policy implications… [suggest] the importance of “policy cocktails” that include aspects that are aimed at both the economic and social forces driving inequality…

LINK: <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3795626>

Edward Chancellor: Evergrande Is All China’s Woes In One: ‘Former Chinese Premier Wen Jiabao called China’s economy “unstable, unbalanced, uncoordinated and unsustainable” 14 years ago. Whether he foresaw that China would one day be beset by a massive real estate bubble, over-investment, excessive buildup of debt and a wobbly credit system is not known—but it has come to fruition…. China is becoming a more dangerous place for foreign investors…. Xi talks about the “Chinese Dream”, a collectivist project that exalts the nation state and places the party he leads in total control. Socialism with Chinese Characteristics is starting to look a lot like old-fashioned communism. Except this time, its technology is more advanced…

LINK: <https://www.reuters.com/breakingviews/chancellor-evergrande-is-all-chinas-woes-one-2021-09-30/>

Noah Smith: What Does China Have to Lose From a Real Estate Crash?: ‘Even if the company manages to bamboozle bondholders into thinking they’re going to get repaid for another week or another two months, global uncertainty about the Chinese property market and its related industries is already on the rise, Chinese growth forecasts are being downgraded, Chinese and global asset markets are reacting negatively, and the Chinese government is already in crisis management mode…. Which does NOT mean there will actually be a real estate collapse in China. MacroPolo analyst Houze Song believes that the government will do what it takes to sustain the property sector, at least for a while longer…. China, unlike America in the 2000s or Japan in the 1990s, has a state-controlled banking system that will not collapse if the government does not allow it to collapse. China can bail out the banks, or simply ignore their solvency and tell them to keep lending. And those loans will sustain the economy…. But that doesn’t change the fact that China is in great danger from a real estate crash…. Here are four of the ways I think China will suffer from a real estate crash—even if there’s no severe recession. Danger #1: A shift toward even less productive assets…. Danger #2: Loss of stabilization policy…. Danger #3: Household wealth destruction…. Danger #4: Local government financing crisis…. The danger… long-term [is] a slow-motion collapse of the growth model…. That model has already undergone significant evolution, with a transition from export-led growth in the 90s and early 00s to domestic investment-led growth in the late 00s and 10s…. To transition from fast growth to slow growth without a devastating recession is quite an accomplishment. But a recession isn’t the only kind of scar that the transition can leave…

Jeet Heer: Ostracise John Eastman: ‘The scenario Eastman advocated is all the more shocking because it was based on a knowing lie from the Trump administration…. He was very much part of a larger project with many forces at work converging to execute a coup…. The campaign wing made claims they knew to be false; these false claims were spread far and wide by the media wing (led by Tucker Carlson); the legal wing (with which Eastman was most involved) prepared theoretical arguments to justify overturning the election; the congressional wing (notably Senators like Chuck Grassley and Ted Cruz) signalled they would go along with the plan; and the extra-legal wing (the rioters of January 6) provided muscle…. The plan of course, fell apart, largely because counsel other than Eastman convinced Vice President Mike Pence that he had no right to deny certification. But it came perilously close to fruition and could provide a model for future coup attempts…. Letting Eastman get away scot-free is the equivalent of jailing low level mobsters while ignoring the people whispering in the Godfather’s ears. One viable solution is social ostracism…. He currently has ties to… Chapman University… and University of Colorado Boulder…. Although both schools said they cannot fire him without violating policies protecting academic freedom, their leaders vocally denounced his actions. Daniele Struppa, the president of Chapman, said in a statement that “Eastman’s actions are in direct opposition to the values and beliefs of our institution.” He added that he had brought “humiliation” upon the school. A letter signed by 169 Chapman faculty and members of the Board of Trustees called on the university to discipline Eastman for his role in the insurrection. Eastman subsequently resigned from Chapman…. [But] “Eastman is not only a member of the Federalist Society, the network of conservative attorneys that provided the legal scaffolding for Trumpism. He is the chairman of the organization’s Federalism & Separation of Powers Practice Group and a frequent participant in its public events. The Federalist Society’s refusal to expel, condemn, or distance itself from Eastman in any way indicates that the organization is untroubled by the subversion of American democracy.” The release of the memos where Eastman advocated a scheme of anti-democratic sedition hasn’t changed his status in the Federalist Society one whit…. The Federalist Society maintains a certain academic status by the fact that it is treated by liberal institutions as a voice of mainstream, respectable conservatism…

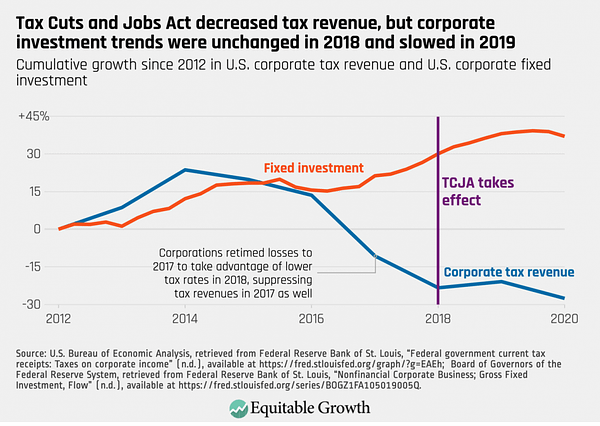

Corey Husak: ’Lots of talk about how investment could be affected by Build-Back-Better tax increases…. Note that when the Trump tax cuts passed, corporate investment (which was growing before the cuts) quickly stalled out (the opposite of what boosters promised)…