BRIEFLY NOTED: For 2023-05-02 Tu

Transistors; bread; platform workers & mandated benefits; Fed after-action report on SVB, Farrell on properly incluing the uninformed, & the logic of JPM's absorption of 1st Repub...

ONE VIDEO: The Transistor (1953):

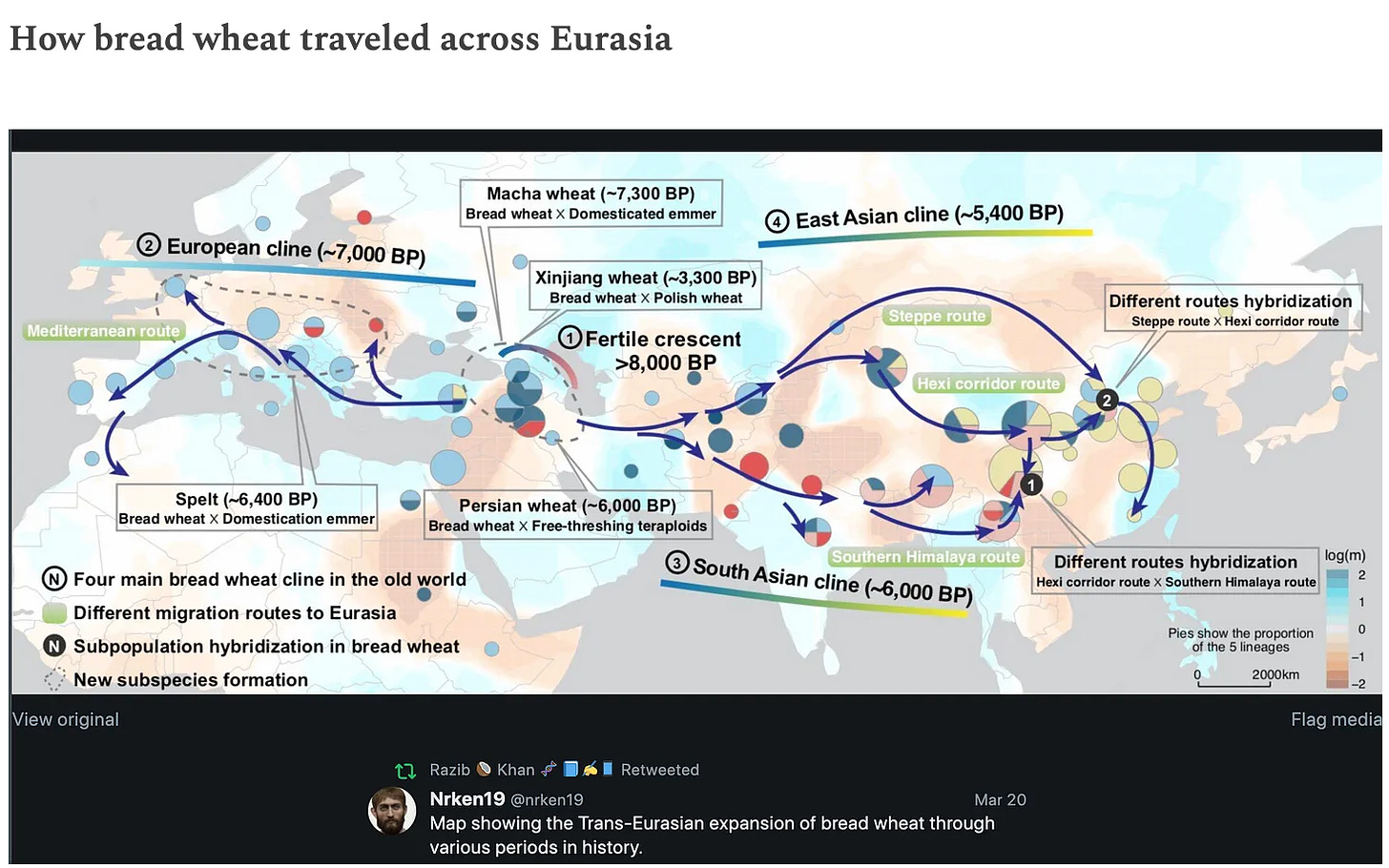

ONE IMAGE: Man Pretty Close to Lives by Bread Alone:

Via Adam Tooze.

MUST-READ: The End of “Welfare Capitalism”:

The “welfare capitalist” movement of the 1920s claimed that government did not have to provide socialistic benefits because forward-looking firms would find it good business to provide their workers with a full and attractive benefits package, and we could thus avoid socialistic overregulation without degrading the working class. Judah, move, governments, imposed, mandated, benefits—those are just what you say forward-looking firms will provide on their own, right? Now platform companies are trying to engage in a little regulatory arbitrage to cut their own costs and boost their own bottom lines. But I think Danny Quah is wrong here. We should either move the benefits package into the public sector for all, or place the same burden on platform companies we place on other large employers. This halfway house does not seem to me to be very sustainable:

Danny Quah: Is the Platform Worker the Future of Workers?: ‘Societies protected employees because they decided it was a matter of basic human decency to help care for those who have contributed so much to the public well-being. It is a technical loophole that there are those who do as much for society as do employees but are, nonetheless, not protected as much—simply because they are not called employees…. The technology-driven gig economy provides vital services to Singaporean society…. Platform-work flexibility is good for the worker. Platform-company innovation opens up new opportunities…. Platform workers [should] not be classified as employees but.. basic protections be provided them: these protections include work injury compensation insurance, co-financed housing and retirement adequacy, and formal representation, all tuned to match Singapore practice more broadly in the rest of the economy…

Very Briefly Noted:

Steven Bogden: Capital Is Making a Comeback: ‘Tangible investment will have to increase to meet climate goals, supply-chain pressures, shifting demographics and defense needs…. From 1985 to 2021, tangible investment—including property, factories and equipment—decreased from 12.5% to 8.5% of private gross domestic product…

Ashton Pittman: ‘Taylor Swift began her career… under the shadow of the Dixie Chicks being banned from country radio…. 5 years ago… she told her dad and managers she was done being polite and quiet about politics…

Michael Pettis: Can China’s Long-Term Growth Rate Exceed 2-3 Percent?: ‘What may seem like a brutal adjustment for the overall economy does not need to be a brutal adjustment for ordinary Chinese people. But this also implies a much more rapid decline in the share of income retained by other sectors, mainly local governments…

Nathan Nunn & Raul Sanchez de la Sierra (2017): Why Being Wrong Can Be Right: Magical Warfare Technologies & the Persistence Of False Beliefs: ‘While the spells serve a range of functions, many of them provide individuals with a greater sense of security and confidence, which can serve to increase the effort provision of villagers for activities that are strategic complements and therefore otherwise underprovided in equilibrium…

Zeke Hausfather: Will global temperatures exceed 1.5C in 2024?: ‘With a growing El Nino event next year is shaping up to be a record-breaker. But by how much?…

Rajiv Sethi: ‘If someone sent you a gift box containing a couple of dead and decomposing rats, a dozen live cockroaches and a large glop of excrement, would you be pointing out that the sender also threw in a nice bottle of wine and a box of your favorite chocolates?: Jonathan V. Last: “In which Cathy Young takes a pick-axe to Bari Weiss and Andrew Sullivan <https://www.thebulwark.com/you-do-not-under-any-circumstances-gotta-hand-it-to-tucker-carlson/>: ‘You Do Not, Under Any Circumstances, “Gotta Hand It to Tucker Carlson”: The anti-anti-Carlson crowd sings his praises…

MMitchell: ‘Finally have a moment to read MSR's "Sparks of AGI" paper. I'm going to do something very crazy and *live tweet* my thoughts as I read. You ready? Let's go!….

Ethan Mollick: It’s starting to get strange: ‘GPT-4 been around forever (or at least for about a month, which is forever in AI terms)? Yes, but the last week has seen a massive expansion in the system’s capabilities, and that is starting to bring into focus how large an effect AI is going to have on work. What has happened is that a number of GPT-4 systems, from both OpenAI and Microsoft, have been given the ability to use tools, with dramatic effects on their abilities, and their relevance to real-world tasks…

Adam Engst: The 46 Mac Apps I Actually Use & Why…

Marcy Wheeler: Where the Trump Investigations Stand: Georgia, Stolen Documents, & January 6 Conspiracies…

¶s:

Alexandra Scaggs: Here’s the full Fed report on SVB: ‘“Textbook case of mismanagement” etc…. Regulators have been studying why, exactly, they didn’t better identify the risks of having the country’s 16th-largest bank keep more than 90 per cent of its deposits uninsured….. Four key takeaways… 1. Silicon Valley Bank’s board of directors and management failed to manage their risks. 2. Supervisors did not fully appreciate the extent of the vulnerabilities…. 3. When supervisors did identify vulnerabilities, they did not take sufficient steps…. 4. The [Federal Reserve] Board’s “tailoring approach” in response to… EGRRCPA and a shift in the stance of supervisory policy impeded effective supervision…

Henry Farrell: “Red Team Blues” & the As-You-Know-Bob problem: ‘And sometimes, it just gives you a sense of how different it is for the very rich – what wealth management involves and enables. I don’t know whether Cory has read e.g. Brooke Harrington’s book on the anthropology of wealth management, but the feeling of just being able to call, and have things magically arranged for you by people you don’t ever really need to know…

Prokrustes: ‘First Republic made loans and didn’t hedge interest rate risk, but no regional bank does. They had uninsured deposits. Wealthy, well informed coastal elites watched the news and pulled. And then they dithered for a month. Had the Feds had given First Republic the same deal they offered JPM, perhaps First Republic could have raised equity and carried on. But perhaps not. The rescue might not have stuck. And even if it had stuck, no bankers would have been punished. After having been dragged through the mud in the aftermath of Bear-Stearns, there was no way JPM was buying First Republic without the liability cleanse of an intervening receivership…

·

I talked to some bankers - from a top tier bank - yesterday. I've known these two for a long time. Their take is, "First Republic was very well managed. It had a good business plan. The run was a Twitter-fueled panic induced by a certain group. This should never have happened."

While it was in motion, MS fielded several approaches from people with investment accounts at FRB who wanted out, and wanted out now. Of course, MS took the accounts, but they are shaking their head. One of them, a woman I have known for almost 20 years now, notes that FRB's management had several younger women. She has also noted to me how rare women are in her industry...

Platform work is good for employers but not workers. It socializes risk while privatizing profits. When business is good workers are brought in and when things slow down they are kicked to the curb. But they do not get paid extra for their risk. They do not get any fringe benefits. In fact employers like this because its a way of reducing costs without impacting the ability of the firm to get the job done. But one of the reasons for making sure most workers have a decent pay is not out of basic human decency but because of the social instability that not doing that causes.