BRIEFLY NOTED: For 2023-05-09 Tu

non-linearities in the Phillips Curve, payrolls, and bond-market inflation expectations; the New Deal and Neoliberal Orders; the New York Times in the tank for Theranos grifter Elizabeth Holmes, &...

MUST-READ: Thinking About Non-Linearities in The Phillips Curve:

Standard and tone tested ways of thinking about the Phillips curve, see it as composed of a number of components:

current inflation,

an expected-change term—is inflation expected to stay stable, to rise, or to (if elevated) return to normal?

a wage pressure/slack term,

possibly a pricing pressure/slack term,

and a bottlenecks term.

Unless (5) feeds-back and causes the elevation of (2), it is not a problem. It is, rather, part of the functional von Hayekian workings of the price system in crowdsourcing attention to places where there is low-hanging fruit in terms of boosting economic productivity. There is no sign of that. The bottlenecks are now ebbing away. And there are strong signs that (1) and (2) are working in a healthy direction—that expectations are strongly that the Federal Reserve has got this.

That leaves (3) and (4) as potential sources of worrisome inflation. But there is every expectation that a little bit cooler aggregate demand will eliminate (4). That leaves only (3) as a source of trouble—the possibility that there is a wage-inflation ratchet in the system.

Now come Benigno and Eggertsson with a largely theoretical paper saying: not so. There is, they say, little reason to worry that such a ratchet will require high unemployment to return inflation near to the Federal Reserve’s target:

Pierpaolo Benigno & Gauti Eggertsson: It's Baaack: The Surge in Inflation in the 2020s and the Return of the Non-Linear Phillips Curve: ‘This paper proposes a non-linear New Keynesian Phillips curve (Inv-L NK Phillips Curve) to explain the surge of inflation in the 2020s. Economic slack is measured as firms' job vacancies over the number of unemployed workers. After showing empirical evidence of statistically significant nonlinearities, we propose a New Keynesian model with search and matching frictions, complemented by a form of wage rigidity, in the spirit of Phillips (1958), that generates strong nonlinearities. Policy implications include the thesis that appropriate monetary policy can bring inflation down without a significant recession and that the recent inflationary surge was mostly generated by a “labor shortage”—i.e. an exceptionally tight labor market…

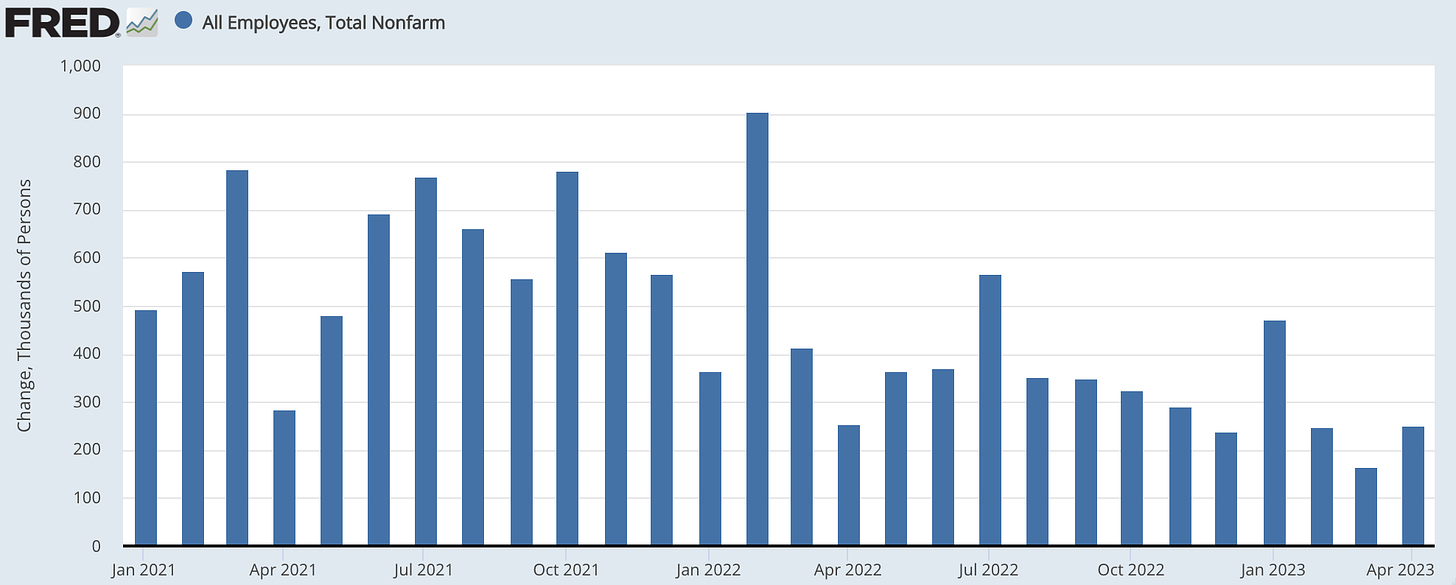

ONE IMAGE: A Beautiful Economy Indeed:

There is very, very little not to like here: Employment growth continues very strong indeed:

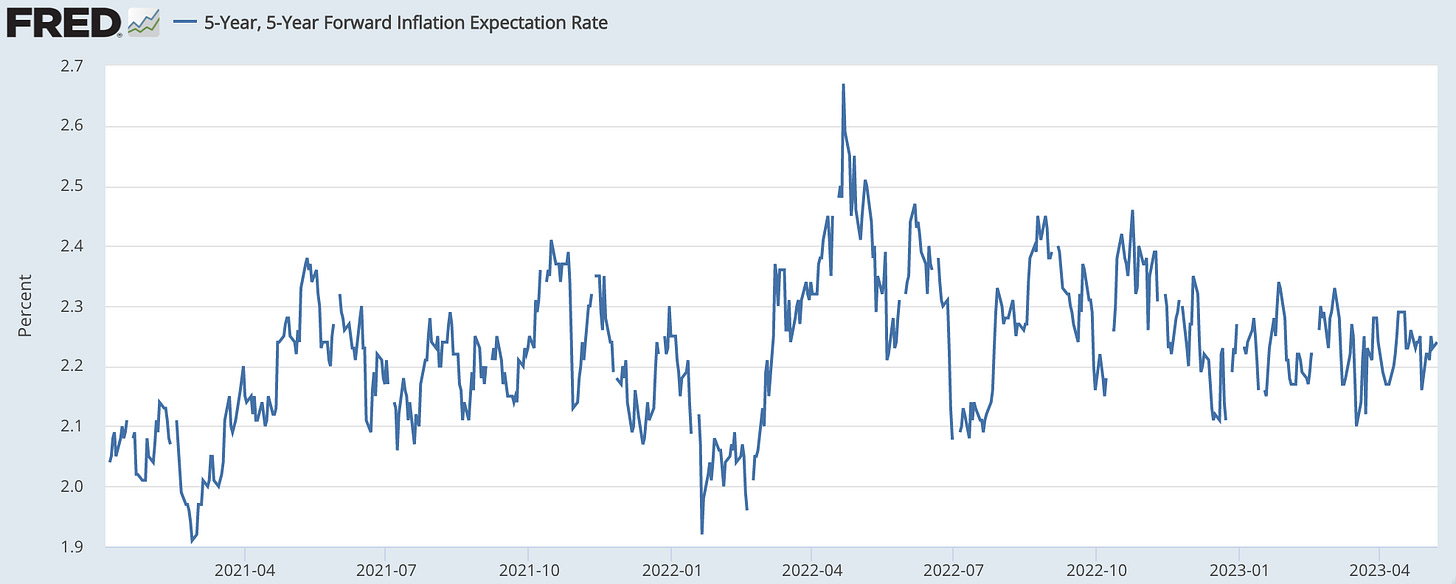

While five-year five-year-ahead bond-market inflation expectations continue to be absolutely nailed where the Federal Reserve wants them to be:

With an inflationary spiral primarily an expectational animal, you simply cannot have one without expectations that the Federal Reserve will fail to return the economy to its inflation target.

ONE AUDIO: After Neoliberalism?

Gary Gerstle, Felicia Wong, & Michael Tomasky: HOW TO SAVE A COUNTRY: ‘Political orders are a new way to conceptualize political time, Gary explains to Michael and Felicia. They are political movements that are able to popularize certain norms and ideas with the general public, and also sway opposing political parties to align with said norms and ideas…. Gary takes Felicia and Michael on a historical journey spanning nearly a century to discuss domestic and international factors that led to the ascension and demise of the New Deal and neoliberal orders.,,

<https://overcast.fm/+8KagfSuyc>

Very Briefly Noted:

Todd N. Tucker & al: Industrial Policy Synergies: Reflections from Biden Administration Alumni…

Robin Wigglesworth: This US jobs market absolutely slaps:

‘Economists can’t keep up…. The 13th straight month where US job creation has surpassed the median forecasts of economists polled by the Borg….

Janet Yellen: Letter on the Debt Limit…

Felix Salmon: The Phoenix Economy: ‘It's out today!…. The New Not Normal… Time and Space; Mind and Body; Business and Pleasure….. How we should get used to unexpected things that don't make a lot of sense…

Economist: What the First Republic deal means for America’s banks: ‘Regulators had to make it sweet enough for JPMorgan Chase to bite…

Alexandra Scaggs: No ‘winner’s curse’ in the First Republic auction…

Jonathan Guthrie: The Lex Newsletter: US banking eats itself, tail end first: ‘How did we get here?… Rates go up some more. Depositors… lies, half-truths and occasional reality that is social media… spooked… shares fall… bank issues a statement saying everything is fine… widely read as a contrary indicator…. The FDIC sells the assets so cheaply that the purchaser has a hefty margin…. Rinse and repeat with the next regional bank people feel anxious about…

Rational Walk: Berkshire-Hathaway Meeting Links: ‘A compilation of articles published over the past year…

Josh Marshall: GOPs Write Their Own Debt Ceiling Adventure: ‘Republicans’ willingness to… live in their own bubble… adds a lot of uncertainty and danger…. Republicans are not just willing to shoot their hostage. For many it’s too fun an opportunity to let slip by…

Ganda Suthivarakom: Cancel your bad meetings and watch mmhmm TV instead…

¶s:

Duncan Black: ‘New York Times Pitchbot: ‘Michael Barbaro: “Totally engrossing profile of Elizabeth Holmes by Amy Chozick that openly wrestles with the author’s own journalistic dilemma—how much to believe a proven liar”…. Flashback…. There is much made by people who long for the days of their fourth form debating society about the fallacy of "argumentum ad hominem". There is, as I have mentioned in the past, no fancy Latin term for the fallacy of "giving known liars the benefit of the doubt", but it is in my view a much greater source of avoidable error in the world…

Noah Smith: Why the U.S. should fight Cold War 2: ‘And what it means to “fight" in this case”…. Ukraine will be the model for our military involvement…. Military technology looks like it’s shifting toward the defense… which makes it possible for small countries to resist invasions by larger ones if properly equipped…. “Helping smaller nations resist aggression by big ones” seems like it’ll be a consistent motif…. Much of the competition, though, will be economic…. What I don’t expect—and what I wouldn’t recommend—is to see the U.S. engage in a comprehensive effort to destroy China’s economic prosperity…. A fair amount of decoupling will happen, for many reasons, but in fact I think much more of this pressure will come from the Chinese side…. I think the U.S.’ economic measures in Cold War 2 will be mainly limited to: a. preventing China from getting a narrow range of technologies that would give it a military edge over the U.S., and b. making sure that the U.S. has enough domestic production capacity to be able to survive a cutoff of Chinese imports in the event of a full-fledged military conflict, and c. helping to build up the economies of countries that don’t want to be dominated by China. So that’s basically what it’ll mean to “fight” Cold War 2. Not much of a “war” compared to WW2 or even Cold War 1, but again, that’s the entire point…

Michael Spence: In Defense of Industrial Policy: ‘The CHIPS and Science Act… three main components. The first is investment in science and technology and the associated human capital…. The second… shifting numerous links in complex global semiconductor supply chains either to the US or to friendly or reliable trading partners… overrides market outcomes in a crucial sector… for the sake not of improving efficiency, but to bolster national security and economic resilience…. The third… restrictions on trade, investment, and technology flows to China…. Again, efficiency is not the goal. Rather, the US hopes to impede China’s progress in advanced technologies, including semiconductors and artificial intelligence. The first component is not particularly contentious. Nor is the third, at least domestically…. The second component, however, has proved divisive. Critics point out that selective public investment in any industry’s productive capacity amounts to picking winners and losers….. In fact, industrial policy can be essential…. The real question is not whether industrial policy is worth pursuing, but how to do it well…

Dani Rodrik: Washington’s New Narrative for the Global Economy: ‘Some important questions remain unanswered…. Were the export controls on advanced chips well-calibrated?… [Are] the so-called “straightforward” national-security concerns cited by Sullivan and Yellen are genuine or merely a pretext for unilateral action[?] Is the US ready to accept a multipolar world order in which China has the power to shape regional and global rule-making? Or is the administration still committed to maintaining US primacy, as Biden’s national-security strategy seems to suggest?…

Thinking About Non-Linearities in The Phillips Curve: And a natural market solution is to let the labor market participation rate take its course. While the overall participation rate was unchanged in the April jobs report, the one for prime age people (25-54) grew 0.2 percentage points from 83.1% to 83.3%. We want more of this to narrow the labor market gap. Job openings = about 9.5 million. Available supply = Unemployed (5.6 million) + Marginally attached to labor market (but not counted in the labor force (about 1.4 million) + Those who report they want a job but are not yet in the labor force (5.3 million) = 12.3 million potential workers. An increase in the participation rate may raise the unemployment rate, but the job creation has been so strong (as you point out) that the unemployment rate has fallen. More of this could still happen and policy ought to encourage it. Lift the employment/population ratio. There are people out there looking for work. The median duration of unemployment has fallen from about 20 weeks a year or so ago to 8.4 weeks. A major friction in the matching of people to jobs could be that the job openings are in, say, CA, and the available people are in TN and they do not want to move (or vice versa). Nonetheless, policy should try and the Fed should let this happen. Fingers crossed.

Thinking about: what I’ve always thought but it’s nice to have a model. So now the only problem is to get the Fed to solve the model for the instrument settings needed to return inflation to target without recession And El Erian et al tell it to do so 😀