BRIEFLY NOTED: For 2023-06-03 Sa

Trying to make sense of a very strange debt-ceiling process; Martin Wolf sketches out our big political problem; the technology side of the green transition rolls forward; Smith on decoupling...

…Levine on the misapprehensions of regional banks, Wells’s “Witch King”, & Engst on our need for much better notification systems on our smartphones…

MUST READ: Looking Back at a Very Strange Debt Ceiling Process:

I said that one thing that made the debt-ceiling debate a dangerous episode of playing with fire was that afterward the press would insist on judging that one party had won, and that the other party had lost.

And, indeed, the press is doing that. That raises the chances of big trouble in the future:

Edward Luce: Game, set and almost match to Biden on the debt ceiling: ‘Republican drama barely dents US president’s agenda…. The question is why he made such extravagant demands if he knew he would have to give way on most of them…. The result is a win for Biden that prudence stops him from celebrating. This charade’s key lesson is that people who call themselves “fiscal conservatives” are guilty of fraudulent branding—aided by a process-obsessed media…. Threatening a catastrophic default unless the tax-collecting Internal Revenue Service is… fiscal incontinence…. The chief beneficiaries would have been the super-rich. The IRS mostly lacks the money to investigate the heavily lawyered wealthy, so most of its audits now are of people on lower incomes…

But, and here is the rub, one party did win and the other party did lose.

As of this September 30th, we will be where we would have been had Kevin McCarthy never said that he was going to hold the debt ceiling “hostage”, and had simply passed a clean debt ceiling raise back in February. Biden did that he would not offer policy concessions in exchange for a debt-ceiling increase. Indeed, the only policy concessions Biden offered were those that would have been dictated in any event by the fact that the Republicans have a House majority. And he did not even offer many of those.

What I guess is going on is that:

Kevin McCarthy believes, almost surely correctly, that he hast to look really tough and aggressive in order to remain Speaker.

Kevin Murphy cannot pass anything through the house without the active consent of Hakeem Jeffries.

Thus there is really a co-Speakership, as long as Hakeem Jeffries does not rub that into the noses of the now more than half of the Republican House members who are crazies.

This is because, as I quote Janan Ganesh below, the Republicans crazies do not want to pass policies but rather to belong to a tribe that is aggressively waging a War on the Woke!

But I could be wrong. They are pretty crazy.

ONE AUDIO: No Good Answers, But at Least a Statement of Our Big Problem:

Martin Wolf on Saving Democratic Capitalism <https://overcast.fm/+3_n_gWens>

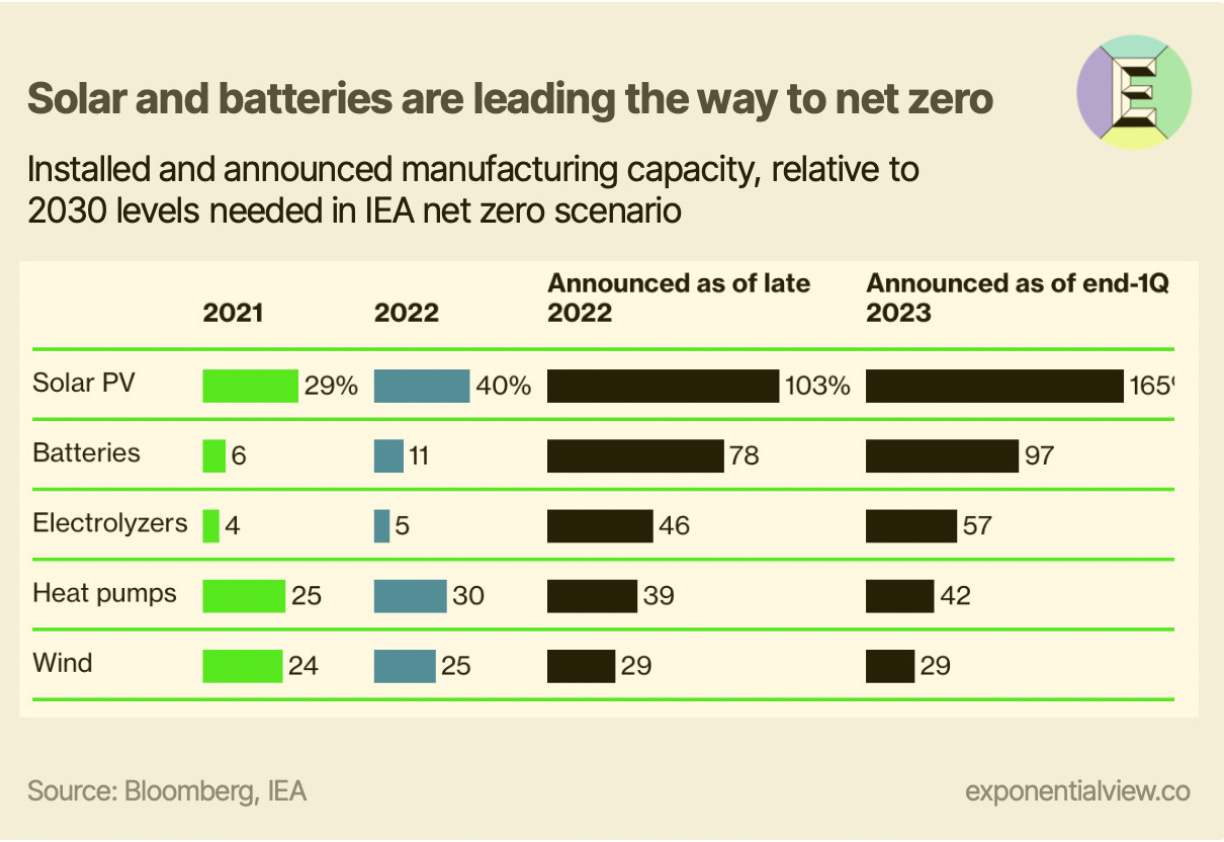

ONE IMAGE: The Technology Side of the Green Transition Rolls Forward:

Very Briefly Noted:

Lauren Michele Jackson: The Case That Being Poor and Black Is Bad for Your Health: The public-health professor Arline T. Geronimus has spent a forty-year career researching how inequality takes a “weathering” toll on the body….

Izabella Kaminska: Error alert! A key formula that underpins bank stability may be acting up: ‘[Bank] assumptions… David Mericle explained… may be outdated due to erroneous calculations of ‘deposit beta’…. The abrupt nature of the Fed’s rate-hiking move, technological changes facilitating the speed of withdrawals and a larger than-appreciated share of run-prone deposits in the system…

Oliver Willis: A.I., TikTok And The Moral Panic Trap: ‘We're Already Dumb, We Don't Need Robots To Help…. It wasn’t a viral TikTok meme that got millions of voters convinced that Bill and Hillary Clinton were an elite pair of assassins, taking out everyone who stood in their way…

Casey Newton: Apple prepares for a platform shift: ‘Will the Reality Pro be the metaverse’s iPhone moment?… Through steady iteration… the company’s devices eventually break through. I waited to buy an Apple Watch until series 5…. Today I can’t imagine not having the device…. The division made $41 billion last year…

Punchbowl: ‘The Senate’s unanimous agreement to move quickly… was hatched only after a meeting of GOP defense hawks… [who] came up with a plan to ensure that Pentagon spending wouldn’t ultimately be capped at $886 billion, as mandated by the debt-limit bill…

Wikipedia: Tollense Valley Battlefield…

Kyle Orland: Activision says UK was “irrational” in blocking Microsoft purchase…

Janan Ganesh: Why DeSantis is losing Republicans to Trump: ‘He mistakenly thinks populist voters want to win power and do something with it…. Modern politics is about doing things. The extent to which it is about belonging—about replacing the group identity that people once got from a church or a trade union—is lost on his rationalist ken…

Dan Drezner: CNN and the Inventory Problem: ‘Licht telling Alberta in the fall of 2022 that when it comes to covering Trump, “The media has absolutely, I believe, learned its lesson.”… Seven months later… the clusterf*** that was Trump’s town hall…. Licht will need to be fired. The other primary takeaway from Alberta’s profile is that Licht is in way, way over his head…

Hookmark: Search less, Do more…

¶s:

Noah Smith: Investment decoupling has been happening for a while now: ‘This is not a very bold prediction… it’s already happening. As a percent of China’s GDP, foreign direct investment is down from 4% of China’s GDP in 2011 to just 1% today, and in total dollar terms it has fallen from $300 billion to around $200 billion. And in addition we always have to remember that a lot of “FDI” into China is fake; it’s just Chinese companies investing in China via Hong Kong…

Matt Levine: Banks Got Rising Rates Wrong: ‘The basic question about this year’s US regional banking crisis is “why weren’t the banks prepared for the very predictable problems that they faced when interest rates went up,” and the basic answer is “because they thought rates going up would be good for them.”… In Theory 2, bank deposits are actually long-term, because the banks have enduring relationships with their customers and their customers are unlikely to leave, or demand higher rates, as interest rates go up. And so banks can use those long-term-ish deposits to fund long-term assets, and as interest rates go up, the banks can earn higher rates, don’t have to pay higher rates, and so make more money. Rising rates are good. Theory 2 is the traditional theory of banking, and it is why many banks were not adequately prepared for rising rates…

Martha Wells: Witch-King: 'Kai watched Bashasa write, as the shadows lengthened over the court. He was well aware he didn’t have a tenth of Bashasa’s self-control. He said finally, “I don’t know if I can do what you want me to do, Bashasa. If I can stay calm and always think ahead, like you do. I’m so angry, I could burn the world.” Bashasa didn’t seem concerned. “Unfortunately, someone else has already burned it. We need to unburn it.” He looked up, his expression serious. “Will you help me do that, Kai?” Kai had already made that decision. “Yes”...

Adam Engst: We Need Notification Alarms: ‘The solution is conceptually simple. If Apple added alarms as a third type of notification alongside banners and alerts, we could choose that as an option for particular reminders and calendar events that cannot be ignored. Apple could extend the feature with an option to display a modal dialog that takes over the screen, like those dialogs that request an iCloud login before you can do anything else. Building alarms into the ecosystem-wide notification approach would make them available to other apps. For instance, the Paprika recipe management app provides quick access to in-app timers from cooking directions. (Good!) But those timers are persistent only if Paprika remains the active app; if you switch apps or lock the iPhone screen, that timer is downgraded to a simple alert. (Not so good!)…

Levine: Theory 2 looks like the reverse of the Swabian hausfrau problem. Deposits of the entire banking system may be collectively long term, have nowhere else to go, but that is not true of the deposits of banks individually. Isn't regulation for "systemic risk" supposed to un-do that illusion?

Luce: So Biden won? Dan Pfeiffer thinks McCarthy won, at least in decreased disprestige.