BRIEFLY NOTED: For 2023-07-10 Mo

Three on "emergence"; plus Dan Davies on "greedflation"; Antarctic sea ice; & Elder, El-Erian, & Macaulay on keeping your investors as the market goes mad, a conventional take on þe Fed, & why...

…economists should actually, you know, talk to real people…

MUST-READ: “Greedflation” Properly Characterized:

The original Galbraithian economics of the 1950s was all about how both corporations and unions (and quite possibly other groups that could find levers to exert social power, e.g. public citizen) were strategic and political. That was, after all, the whole point of “countervailing power”: strategic forward-looking actors negotiating one-off deals with their counterparties one after the other. The government’s job was then to try to ringmaster it all:

Dan Davies: spotty and unspotty: ‘markets are islands in the stream, that is what they are…. If you take out the g[reedflation]-word, it’s quite natural to understand that the markup element of pricing contains within it a material proportion of pricing that is the subject of strategic decisions… affected by all sorts of considerations, of which immediate supply and demand are often a relatively minor element. This is really easy to see on the other side of the equation. Labour markets are much less spotty than goods markets, so there’s much less resistance to thinking of them as being subject to strategic and subjective considerations…. Big union settlements have importance well beyond the proportion of actual union members.… It’s actually banal to note that unions behave strategically and politically… understanding the wage side… has to take into account the power, morale and popular acceptance of unions…. Why wouldn’t it be the same on the other side? But, as numerous embarrassing central bank gaffes have recently shown, it’s difficult for economists to think this way. Methodological choices can have policy consequences…

The collapse of this view into neoliberal monetarism—just control the money supply and the market will sort it out, for the market giveth, the market taketh away: blessed be the name of the market—was one of the things that made academic economics much less useful than it could have been in the years of High Neoliberalism from 1980 to 2010. Nobody wanted to hear about the importance of Big Government, Big Bureaucracy, or Big Labor (which hardly even exists). Among economists (excluding economic historians), the 90-year-olds have read Galbraith and think he is very important; the 65-year-olds have read Galbraith and know that the 90-year-olds think he is important but are not sure why; and the 50-year-olds and below have not even read him.

It is thus nice to see a recognition that Galbraithian economics has a place bubbling up more and more theser days. The discussion around “greedflation”—when it is not a pure political play—is an important straw in the wind. The hope is that it can be more than just another political foodfight.

Plus go read:

DeLong <https://www.foreignaffairs.com/reviews/2005-05-01/sisyphus-social-democrat>

Galbraith <https://www.amazon.com/dp/B003ZSIT1Q/>

Parker <https://www.amazon.com/dp/B00VE4Y3TK>

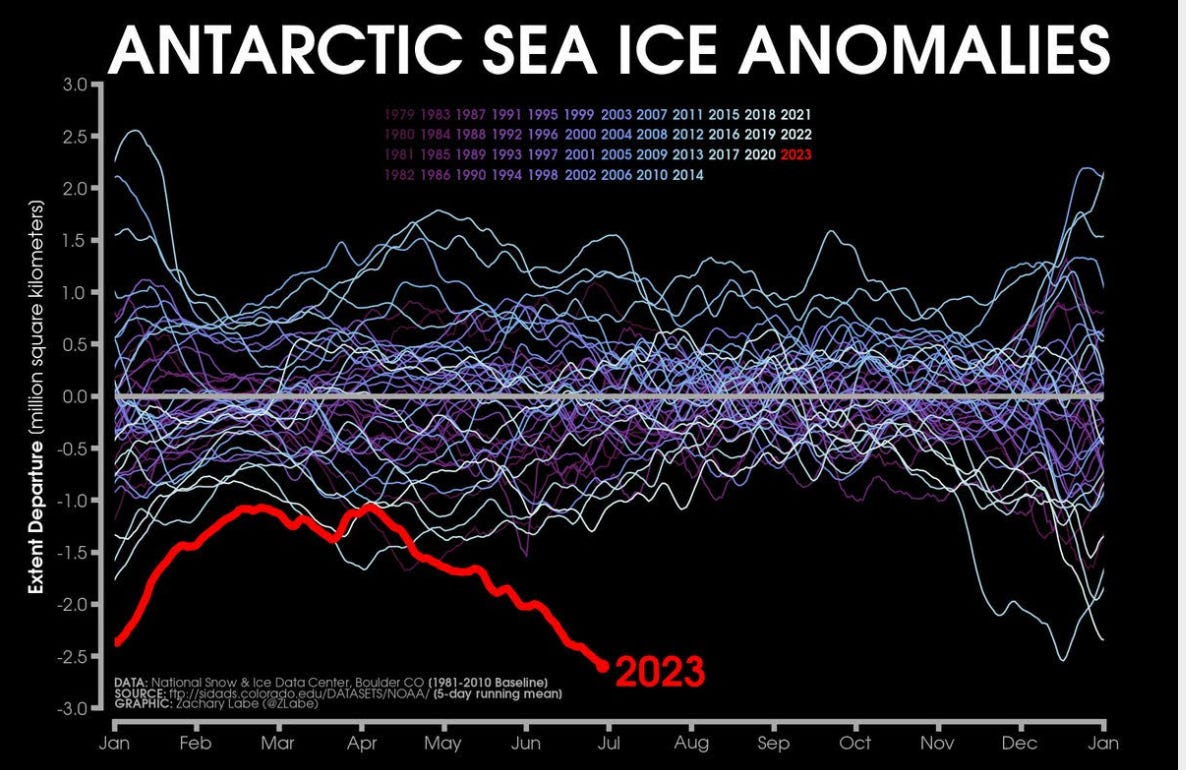

ONE IMAGE: No, I Do Not Know What þe First-Order Effect of Decreased Antarctic Sea Ice Will Be on World Climate:

ONE VIDEO: Sean Carroll’s Take on “Emergence”:

“None of us is Laplace's Demon, so how are we able to successfully model the world even though we have incomplete information about it?”

Very Briefly Noted:

Erik P Hoel: When the map is better than the territory: ‘Recent research applying information theory to causal analysis has shown that the causal

structure of some systems can actually come into focus (be more informative) at a macroscale…

Fisher Investments: Chartflation: Five Charts Showing Inflation Isn’t as ‘Sticky’ as Feared: ‘Forward-looking indicators show inflation slowing more…

Mary McDougall & Katie Martin: Bond fund giant Pimco prepares for ‘harder landing’ for global economy: ‘CIO Daniel Ivascyn says the market is “too confident in the quality of central bank decisions”…

Tracy Alloway & Joe Weisenthal: What Could Go Wrong for the US Labor Market?: ‘A labor market built on expectations of a future recovery is going to be one that is also vulnerable to sudden shifts… if you’re looking for a major vulnerability in the economy right now…

Tracy Alloway & Joe Weisenthal: ‘Whether Bluesky, Threads, or something else can actually displace Twitter is TBD. But in the meantime, at least, Elon Musk is doing a good job at encouraging some of his users to look elsewhere…

Ethan Mollick: What AI can do with a toolbox... Getting started with Code Interpreter: ‘Democratizing data analysis with AI…

Johannes Gerschewski: The three pillars of stability: legitimation, repression, and co-optation in autocratic regimes: ‘How do these pillars develop their stabilizing effect?… [By] exogenous reinforcement, self-reinforcement, and reciprocal reinforcement… empirical examples…

Practical Engineering: ‘Desalination… seems so simple on the surface, but when you add up all the practical costs and complexities, it gets really hard to justify… [and] it is harder to predict hidden technical, legal, political, and environmental challenges…

Adam Ozimek: The Simple Mistake That Almost Triggered a Recession: ‘Leading economists said we’d need higher unemployment to tame inflation. Here’s why they were wrong…

Kamil Kazani: Sovmerica: How Americans built the Soviet war machine. Part 1. The Military Communism: ‘They targeted the bottlenecks in the Soviet supply and production chains, filling in the holes broken by the German advance…. The wound made by the German strike would have been mortal, unless the US put the USSR on the life support…

¶s:

Cosma Shalizi has the last of our three takes on “emergence” today:

Cosma Shalizi: Emergent Properties: ‘The weakest sense is also the most obvious. An emergent property is one which arises from the interaction of "lower-level" entities, none of which show it…. Prediction… now we add the caveat that “the new property could not be predicted from a knowledge of the lower-level properties”…. Note… we can only know that it cannot be predicted by us, with our current abilities…. Explanation… a higher-level property, which cannot be deduced from or explained by the properties of the lower-level entities." This is almost troubling. The key is in “properties”…. if we are allowed both our properties and our [inter]relations… “emergence” is a notion with teeth…. But… I don't see how “X is an emergent property (strong sense)” could be established. At best we could say “X may be an emergent, since we have been unable to deduce it from the lower-level properties {Y}”…. I'm pretty sure I know how to define “emergence,” in the first, weakest, and most intelligble sense, in a quantitative, operational and objective way. One set of variables, A, emerges from another, B if (1) A is a function of B, i.e., at a higher level of abstraction, and (2) the higher-level variables can be predicted more efficiently than the lower-level ones, where “efficiency of prediction” is defined using information theory…

The problem with being someone who manages other people’s money is that with short-run underperformance you leak assets: trigger withdrawals. Yet to chase overvaluation is to fail to do your job, and it avoids the big win relative to the S&P Composite that you get from a smart beta position when what is euphemistically called “rotation” takes place. Finessing this problem is possible, but difficult. It involves (a) convincing people that the appropriate benchmark is not 100% S&P but rather something like 60%, and (b) generating enough alpha to mask your underperformance while passive and lazy-money does its passive lazy-money thing:

Bryce Elder: What exactly is your problem with stock index concentration?: ‘Selling alpha by the pound…. The trillion-dollar IT club makes up approximately a quarter of the S&P 500 index by weight—because of AI hype, or possibly, the result of a rotation by investors after the same stocks sold off a year earlier…. Equity-market wealth creation comes from a tiny proportion of winners, as a general rule. And in a time like this, when passive and lazy money is flowing into value-weighted indices that are already top heavy, any fund manager with convictions is pretty much guaranteed to underperformestors after the same stocks sold off a year earlier…

I find this hard to grok because (a) there have been no “risks to growth” from the Fed’s hiking late and fast; (b) financial instability was generated but has been well-handled; and (c ) I see no sign that the Fed has lost any credibility with people who have put their money on the line, and so I see claims that it has as political fluff from people who want to elect Donald Trump President again, or from their useful idiots:

Mohamed El-Erian: Why the Fed Is Hard to Predict: ‘The US Federal Reserve…. Its top priority now should be to address the structural weaknesses that led it astray in the first place… dug itself a hole when it mishandled the critical initial responses to the return of inflation…. The Fed… [had] to play massive catch-up, which it did by implementing the most concentrated set of rate hikes in decades. Such a big, sudden tightening generates greater risks to both growth and financial stability. Yet the catch-up process came too late to prevent inflationary pressures from migrating from the goods sector to services and wages…. Having missed a wide-open window for implementing the best possible response, they now find themselves in a quagmire of second-best policymaking…. Hike again… you increase the risk of tipping the economy into recession…. Refrain from hiking, and you risk losing even more credibility…

Central bankers do spend too little time talking to market participants to figure out which asset classes that are small now might grow to cause financial stability problems in the future:

Robert McCauley: ‘Probably the best that can be done is to train economists how to talk to people in the market [such as bankers and traders]. In the early 1980s, I learned how to do it at the New York Fed without even realising what I was doing…. The practice of economists talking to market participants atrophied at the New York Fed before the 2008 crisis and at the Bank of England as well…. Hy Minsky taught us that during good times, market participants find new means of funding themselves that make the system less stable…. When the crunch comes, the Fed finds it necessary to sustain more and more forms of near money. In 2008 and 2020, the Treasury and Fed came to the rescue of money market funds holding commercial paper and Eurodollars. In 2020, the Fed bought corporate bond exchange-traded funds, and even junk bond funds…

"I find this hard to grok because (a) there have been no “risks to growth” from the Fed’s hiking late and fast; (b) financial instability was generated but has been well-handled; and (c ) I see no sign that the Fed has lost any credibility with people who have put their money on the line, and so I see claims that it has as political fluff from people who want to elect Donald Trump President again, or from their useful idiots:"

This has been going on for a while. It is dangerous and unnecessary to have that narrative take hold. But yet, but yet, the usual suspects stick to it. Either there is a method to this madness or some of these people don't see the risk in drinking too much of their own bathwater.

2 areas that I suspect aren't in the Fed's view: private placement debt and equity derivatives (all time high in nominal to GDP). Fed rate hikes may not do much to household debt payments, but they'll hurt like hell to highly leveraged firms owned by PE's and such. Since those firms aren't publicly traded, and their debt may not be traded bonds or bank debt, they can be a mystery until the day they file bankruptcy.