BRIEFLY NOTED: FOR 2023-08-28 Mo

Nvidia's moment; Assyrian dog pack; hype & reality in contemporary GPT-LLM-ML; very briefly noted; & Golden Gate Lab Rescue, equilibrium-restoring economic forces AWOL, a low-pressure economy is a...

Nvidia's moment; Assyrian dog pack; hype & reality in contemporary GPT-LLM-ML; very briefly noted; & Golden Gate Lab Rescue, equilibrium-restoring economic forces AWOL, a low-pressure economy is a slow-growing economy, dealing with zombie neoliberal ideas, neolibveralism dead-enders, “causing” vs. “enabling” disinflation, LTCM’s collapse, Dean Baquet & James Comey & many others simply did not do their jobs, & Château Mission Haut-Brion…

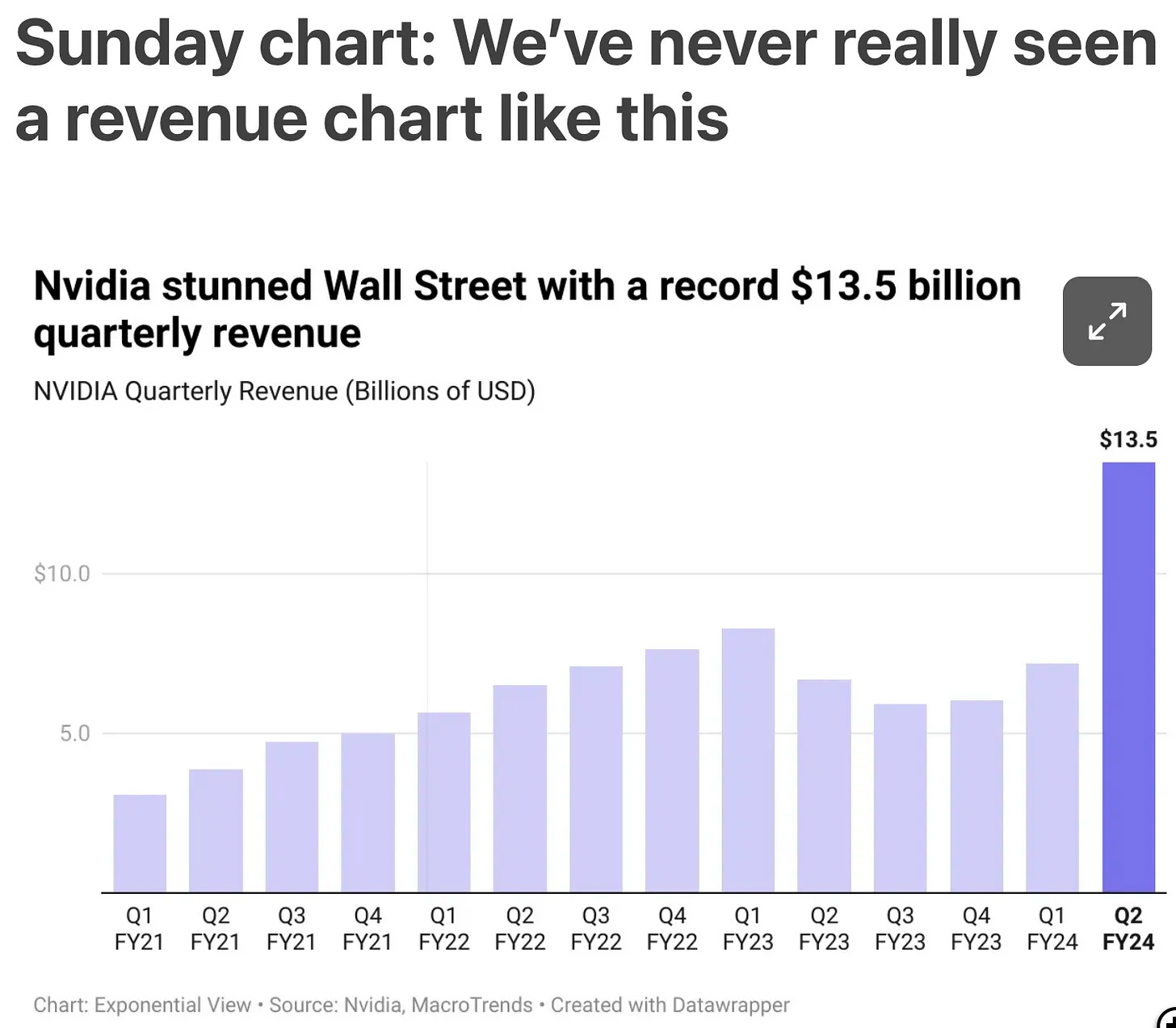

MUST-READ: Nvidia’s Moment:

Up through the beginning of Nvidia's fiscal year 2023, revenue had grown 2.5-fold in two years, driven by the crypto bubble and the usefulness of its chips designed for graphics as the best processors on which to run costly, dissipative, and societal-destructive crypto mining.

Then came the crypto winter. Not only were crypto firms no longer buying Nvidia-designed chips, but crypto firms were ditching their Nvidia-designed chips and selling them back into the graphics market. It was turning out that the crypto bubble had not boosted demand for Nvidia-designed chips, but simply moved demand forward in time by perhaps a year and a half.

By late in its fiscal year 2023 Nvidia looked to be in real trouble—never mind that its chip designers were best-in-class, and that its Cuda framework was clearly the best way for humans to figure out how to get the stone to actually think.

And then came Midjourney and Chat-GPT…

The big questions now are three:

How fast can (or maybe will—lot of short-run monopoly power here) Nvidia (and TSMC) ramp up production of Nvidia-designed chips in order to meet demand?

Can competitors who lack CUDA nevertheless be good enough either to provide an alternative for people pushing modern ML forward?

How large will the modern ML market segment turn out to be?

I do not have any answers to these questions. And, as Friedrich von Hayek pointed out long ago, they are not the kinds of questions that we have enough information for anyone to answer. We have to let the market grope forward to solutions.

But we do know the bull case for NVIDIA and its ecosystem. Here is Ben Thompson summarizing NVIDIA CEO Jason Huang from last May:

Ben Thompson: Nvidia Earnings, Jensen Huang’s Defense, Training Versus Inference: ‘“The CPU[‘s] ability to scale in performance has ended and we need a new approach. Accelerated computing is full stack….” This is correct…. [To] run one job across multiple GPUs… means abstracting complexity up into the software…. “It’s a data-center scale problem….” This is the hardware manifestation of the previous point…. “Accelerated computing is… domain-specific… computational biology, and… computational fluid dynamics are fundamentally different….” This is the software manifestation of the same point: writing parallizable software is very difficult, and… Nvidia has already done a lot of the work…. “After three decades, we realize now that we’re at a tipping point….” You need a virtuous cycle between developers and end users, and it’s a bit of a chicken-and-egg problem to get started. Huang argues Nvidia has already accomplished that, and I agree with him that this is a big deal….

Huang then gave the example of how much it would cost to train a large language model with CPUs… $10 million dollars for 960 CPU servers consuming 11 GWh for 1 large language model… $400k… [2 GPU servers] 0.13 GWh…. The question, though, is just how many of those single-threaded loads that run on CPUs today can actually be parallelized…. Everyone is annoyed at their Nvidia dependency when it comes to GPUs…. Huang’s argument is that given the importance of software in effectively leveraging those GPUs, it is worth the cost to be a part of the same ecosystem as everyone else, because you will benefit from more improvements instead of having to make them all yourself….

Huang’s arguments are good ones, which is why I thought it was worth laying them all out; the question, though, is just how many loads look like LLM training?… Nvidia is very fortunate that that the generative AI moment happened now, when its chips are clearly superior…. The number of CUDA developers and applications built on Nvidia frameworks are exploding…. There are real skills and models and frameworks being developed now that, I suspect, are more differentiated than… the operating system for Sun Microsystems was…. Long-term differentiation in tech is always rooted in software and ecosystems, even if long-term value-capture has often been rooted in hardware; what makes Nvidia so compelling is that they, like Apple, combine both…

ONE IMAGE: Cry “Havoc!”:

ONE AUDIO: Hype & Reality in Contemporary GPT-LLM-ML:

Ben Thompson: An Interview with Daniel Gross and Nat Friedman about the AI Hype Cycle: ‘I previously spoke to Gross and Friedman last October, December, and March; even with that history, developments in AI are happening so rapidly that we had more than enough topics to discuss, including the AI hype cycle, what products are working, the current state of ChatGPT, the data constraint, and Nvidia…

Very Briefly Noted:

Economics: Luca Fornaro: ‘Monetary contractions depress innovation and future productivity, as predicted by Keynesian growth framework. Really interesting presentation by Yueran Ma...

Adam Ozimek: ‘Land rents destroy the entire agglomeration wage premium. Folks, housing is really, really important right now…

China: Ian Johnson: Xi’s Age of Stagnation: ‘The Great Walling-Off of China…. These economic problems are part of a broader process of political ossification and ideological hardening… signs of a new national stasis, or what Chinese people call neijuan…

GPT-LLM-ML: Paul Kedrosky: AI Isn’t Good Enough: ‘Current-generation AI is mostly crap…. We need much better AI. Or we need much worse AI…. Much worse AI would have minimal worker displacement effects, making it less economically fraught…. We need to look past the limits of current AI… to break free from… so-so automation and compensate for the gravitational forces dragging the U.S. workforce into that wormhole…

Optimism of the Will: Jamelle Bouie: ‘I have a whole monologue about… the antislavery movement as… doing the work with no expectation of ever seeing it come to fruition…. Take the subjectivity of the past seriously and understand that an abolitionist in 1830, to just pick a year, has NO EXPECTATION THAT THEY WILL EVER LIVE TO SEE THE END OF THE SLAVE SYSTEM…

Journamalism: Duncan Black: Freeze Peach: ‘We really don't mock this New York Times editorial enough: “Americans are losing hold of a fundamental right as citizens of a free country: the right to speak their minds and voice their opinions in public without fear of being shamed or shunned…” Imagine thinking anything these pickle-brained people say is worth listening to after that…

Will Bunch: Journalism fails miserably at explaining what is really happening to America: ‘GOP debate, Trump's arrest gets 'horse race' coverage when the story's… about…authoritarianism… None of the eight people on that stage “won”—only Trump, his angry mob, and a 21st-century brand of American fascism that is the enemy of democracy…

The Crypto Grift: Franck Leroy: ‘Exactly 14 years ago, Satoshi Nakamoto designed the most pathetic / inefficient system ever invented… blockchain… weighs 60,000 tons, wastes constantly 10 gigawatts (more than Belgium or Chile) to process less than 7 transactions per second… a joke if it didn't have such gigantic environmental impact, wasn't enabling billion dollars ransomware industry…

Ukraine War: Phillips P. OBrien: ‘Now that the Kremlin has confirmed the death of Prigozhin, we can categorically say the decision of the Ukrainians to fight for Bakhmut (which ended up devastating Wagner) was… right…. They decided to do it to cause maximum casualties to the Russians. It was these casualties (intended) which caused the Wagner crisis…

Fascism: National Security Archive: The Coup In Chile: CIA Releases Top Secret 9/11/1973 President's Daily Brief…

NOTES & Substantive Posts:

Up through the beginning of Nvidia's fiscal year 2023, revenue had grown 2.5-fold in two years, driven by the crypto bubble and the usefulness of its chips designed for graphics as the best processors on which to run costly, dissipative, and societal-destructive crypto mining.

Then came the crypto winter. Not only were crypto firms no longer buying Nvidia-designed chips, but crypto firms were ditching their Nvidia-designed chips and selling them back into the graphics market. It was turning out that the crypto bubble had not boosted demand for Nvidia-designed chips, but simply moved demand forward in time by perhaps a year and a half. And by late in its fiscal year 2023 Nvidia looked to be in real trouble—never mind that its chip designers were best-in-class, and that its Cuda framework was clearly the best way for humans to figure out how to get the stone to actually think.

And then came Midjourney and Chat-GPT:

Golden Gate Lab Rescue of San Franciso wants pictures for their 2022 calendar. I offered them nine:

How Strong Are þe Economy’s Equilibrium-Restoring Forces?:

Microsoft’s argument for why it should be allowed to buy Activision-Blizzard is that that is the only way it can possibly compete with Sony. It is the “sumo wrestler” theory of antitrust—letting the #2 player in a market bulk up is the best way to diminish the market power that really matters, which is the market power of #1:

A low-pressure economy is a slow-growing economy:

DRAFT: How Can We Deal wiþ Zombie Neoliberal Ideas:

Adrienne Mayor, still in the Other Place That No Longer Has a Proper Name:

I must say, these are bizarre habits of thought we see here. Xi Jinping’s embrace of a “no limits” partnership with his fellow dictator Vladimir Putin followed by Putin’s attack on Russia leaves a prudent U.S. with no option but to try to slow China’s military rise—with China’s economic rise as collateral damage. For the Economist to complain about this makes me think it really needs to get a clue:

I do not grok this distinction between actions that “cause” disinflation, and actions that do not “cause” disinflation but instead were merely “necessary to permit disinflation caused by other forces. Perhaps there is a philosopher in the house who could elucidate this for me?

More people should be subscribving to Marc Rubinstein than are. Here he is on LTCM, which collapsed 25 years ago.

There is a sense in which MacKenzie is wrong: classes of “events” periodically happen, and if you are so leveraged that a mere “event” of the class that periodically happen would bankrupt you, you will go bankrupt and it is somewhat silly to look for any other root cause than leverage. The “event” determines the timing of bankruptcy. It does not determine the fact of bankruptcy.

In my view, investing in illiquid assets was equally important to leverage in determining the fact (if not the timing) of bankruptcy. As Rubinstein writes: ‘illiquid markets gave counterparties leeway in how to mark positions, and they used the opportunity to mark against LTCM to the widest extent possible so that they would be able to claim collateral to mitigate against a possible default’. And so LTCM went bankrupt, even though there was no way it was insolvent. Why couldn’t it raise capital and survive, if it was solvent? Because its principles were greedy—they thought Warren Buffett’s offer of $250 million was too low, turned it down, and got nothing:

In nearly all postmortems of the 2016 election there is one very important factor that almost always gets short shift: To a remarkably large degree, Hilary Rodham Clinton was weak in 2016 because she was strong. Lots of non-Republicans in 2012 saw Obama's 2008 victory as largely a result of the then-ongoing financial crisis. They feared that Romney, a serious guy, had a serious chance. And so they ran through the tape working for Obama.

By contrast, a great number of worthies saw America in 2016 as less sexist than racist and thought HRC had it in the bag. Hence they were eager to nip at her heels in order to better position themselves for what they thought would be the HRC administration. They did not do their jobs. I am thinking primarily of you, James Comey; and of you, Dean Baquet. But there were lots of others as well.

Had HRC not had a constant polling lead since the end of the conventions, I think her odds would have been better, because I do not think Baquet and Comey and the rest of their clown posse would have dared act like they in fact did:

My mother-in-law is 70! Bottle not from the Bordeaux region vineyard name-checked by English bureaucrat Samuel Pepys in his diary in the 1600s during the reign of the Merry Monarch Charles II Stuart, but from the vineyard next door…

Your insight re 2016 is most perceptive and appreciated and dare I say invaluable for anyone writing the history of that awful outcome.

NVidia GPUs are an interesting market. The large scale ML use of high end GPUs can only have a limited market as few players can afford the scale needed for data and training. High end GPUs will not be suited to any consumer market for decades at the earliest. GPUs to accelerate graphics and smaller scale analytics, that is a more feasible growth market - declining prices driving volume. I would buy a better GPU for computational work, although the games market must be the main driver.

Is there a market for a high end GPU in every humanoid robot in the future?