BRIEFLY NOTED: For 2023-10-06 Fr

Michael Lewis’s Stockholm Syndrome; the Great Mortality Shift; “modern” browsers; very briefly noted; & Jonathan Levin, Joe Weisenthal, & Tim Kane on the Phillips Curve, on the Fed, & blaming the...

Michael Lewis’s Stockholm Syndrome; the Great Mortality Shift; “modern” browsers; very briefly noted; & Jonathan Levin, Joe Weisenthal, & Tim Kane on the Phillips Curve, on the Fed, & blaming the Democrats; & me on bond-market vigilantes, gambler’s ruin, afterthoughts on Slouching Towards Utopia, & briefly noting…

MUST-READ: Michael Lewis Definitely Does Not Understand How to Play the Probabilities—or Even Read the Evidence:

The $8 billion that Alameda borrowed from FTX without providing any real collateral is gone. It traded that many real dollars away to other people in return for FTT and other SBF crypto tokens that had value only as long as people believed in SBF. And nobody does—except for Michael Lewis, who thinks that lending all your money to someone who then uses it to buy s***coins is a great real business:

Michael Lewis: ‘[Sam Bankman-Fried and FTX] isn’t a Ponzi scheme: ‘Like, when you think of a Ponzi scheme, I don’t know, Bernie Madoff, the problem is—there’s no real business there. The dollar coming in is being used to pay the dollar going out. And in this case, they actually had—a great real business. If no one had ever cast aspersions on the business, if there hadn't been a run on customer deposits, they'd still be sitting there making tons of money…

And yet people are still tiptoeing around ML’s Stockholm Syndrome here:

Gideon Lewis-Kraus: Michael Lewis’s Big Contrarian Bet: ‘Almost everyone in the world believes that Sam Bankman-Fried is guilty. In “Going Infinite,” the writer takes the kind of risk that his characters often do, and asks us to question that assumption…. Lewis very gently insinuates that Ellison, in over her head, might have made some very bad decisions… reserves an unusual contempt for John Ray… oversee[ing] the bankruptcy, for a variety of purported forensic errors… concludes the book with the suspicion that the mystery of the missing funds might not be a mystery at all—it seems possible, he writes, that the bankruptcy proceedings thus far have in fact accounted for all of it. Bankman-Fried’s insistence that the whole thing was a series of accounting and management errors seems, to most people who have been following this for the last year, ridiculous on its face…. The trial will make him look like a fool or it will make him look like a genius…

Let’s remember what the state of affairs really was: highly illiquid—which a properly run exchange can never be—and presumptively insolvent, unless a miracle were to occur:

Arash Massoudi & al.: Wall Street grabs its popcorn for the FTX trial: ‘Readers may remember that the FT obtained documents FTX sent to investors last year, which revealed that the exchange—remember this isn’t a bank—held just $900mn in easily sellable assets against $9bn of liabilities the day before it collapsed into bankruptcy…. [That] didn’t strike us as a “great” business. It’s also debatable whether SBF’s trading operations were more legitimate than Madoff’s market-making operation, which was large and separate to his infamous Ponzi scheme…

And what the state of affairs really is: SBF engaging in witness tampering:

Molly White: A preview of the Sam Bankman-Fried trial: ‘Caroline Ellison… is likely to be the government’s star witness, as she was Bankman-Fried’s top lieutenant. However, she is also likely to face the fiercest cross-examination over her role in the collapse, and she has already been the target of Bankman-Fried’s attempts to shift blame…. His decision to leak some of her personal diary entries to the New York Times in July was described by Judge Kaplan as an attempt to tamper with a witness (the second such incident), and was what finally landed him back in jail in August….

Blaming his subordinates in the Alameda-FTX polycule:

Molly White: A preview of the Sam Bankman-Fried trial: ‘In a draft of a long Twitter thread that he never ultimately published… he blamed “Alameda’s failure to hedge” on Ellison and described her as unsuited for her role [I39]. He also claimed that their strained personal relationship influenced her actions, in what seems to be an ongoing attempt on his part to portray her as a jilted ex who singlehandedly tanked his empire. The extent to which this strategy has been endorsed by his legal team, versus being a scheme Bankman-Fried came up with on his own, is not quite clear….

With his co-conspirators in the embezzlement scheme having already pled guilty:

Molly White: A preview of the Sam Bankman-Fried trial: ‘Gary Wang… coded the secret “backdoor” that allowed Alameda Research to borrow billions in FTX customer funds. He pleaded guilty to four fraud charges filed in December…. Nishad Singh… falsified records at Bankman-Fried’s instruction to inflate FTX’s supposed revenue, then lied to auditors about it [I21]. He was also a recipient of at least $543 million in “loans” from FTX…. Ryan Salame… served as a straw donor for Bankman-Fried… in charge of funneling FTX money to Republican candidates…

And now the trail begins: From Wired:

Jody Godoy & Luc Cohen: Sam Bankman-Fried's reassurances about FTX were false, ex-lieutenant testifies: ‘Gary Wang… FTX's former chief technology officer… when he told Bankman-Fried that Alameda owed the exchange $8 billion, Bankman-Fried responded with what Wang described as a “neutral” demeanor, “That sounds about right”…. Earlier on Friday, he testified about several changes Bankman-Fried asked him to make to FTX's software code to allow Alameda to withdraw unlimited funds from the exchange. He said no other FTX users had those special privileges, which the exchange did not disclose to its investors or customers…

And more:

Angela Chen: ‘Wang’s testimony made clear that Alameda was treated differently in many ways: other companies with a line of credit couldn’t withdraw off the platform and the credit had to be used for collateral but this was not true for FTX. Over time, the line of credit extended to Alameda grew from $1 million to $1 billion to, finally, $65 billion. Other companies who received a line of credit were allowed amounts in the double-digit millions only…

With bonus recognition as of September 2022 by Gary Wang at least that FTX-Alameda was insolvent, and gambling for resurrection:

Angela Chen: ‘September 2022… had SBF sending him and Singh (but not Ellison) a Google Doc with arguments for shutting down Alameda. Wang claimed he pointed out that Alameda actually could not shut down because there was no way of repaying its debt…

It is not clear whether SBF recognized that the $8 billion was gone.

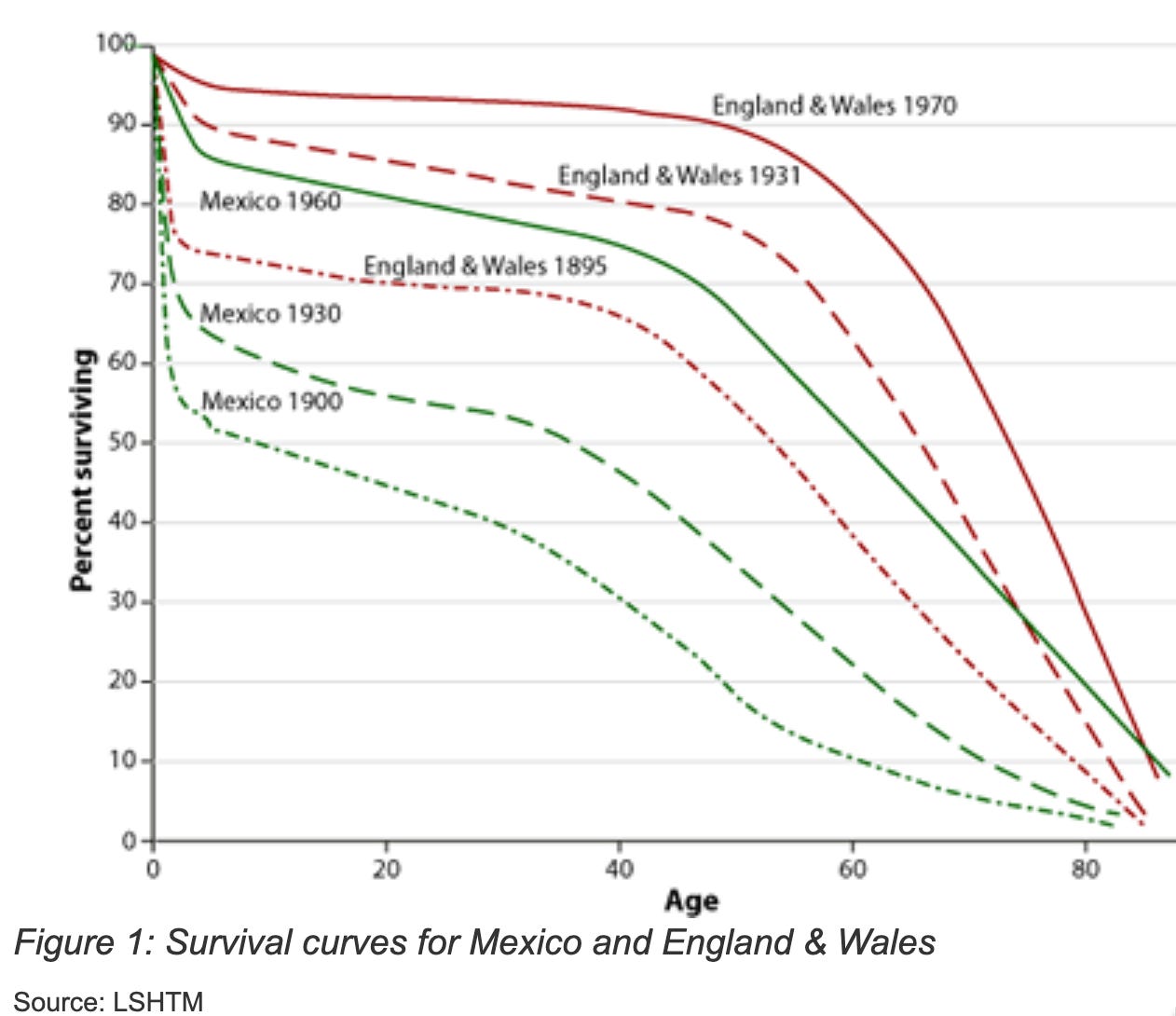

ONE IMAGE: The Great Mortality Shift: Half of the Demographic Transition:

ONE VIDEO: I Would Really Like a Better Browser than All of the Marginally Improved Netscape Navigator Clones:

It has been a generation, after all:

Very Briefly Noted:

New York Times Pitchbot: ‘Is today’s strong jobs report Biden’s Katrina?…

Walt Mossberg: ‘The reason to quit Twitter (X) isn't that it's apparently collapsing financially, or killing important features. It's a moral and ethical issue. Not only are Nazis, racists, antisemites, misogynists, liars and conspiracy theorists being welcomed back, but the owner seems to be actively supporting this. I gave up a 16-year account with over 800,000 followers because I couldn't associate myself with this haven for hate and lies. You should too…

Paul Waugh: TWATs (‘Tuesday, Wednesday & Thursday’ workers) are here to stay: ‘There’s no question that collaborative working and strategising is much easier in person… mental health benefits of meeting colleagues face-to-face…. For younger staff, many of whose cramped flats are a far cry from the luxury studies and large gardens of their older colleagues, firms should take seriously their need to build social and professional networks…. But a mix of remote working and office working makes eminent sense for both staff and companies…

Ken Judd: Economists Knowingly Publish Papers with Errors: ‘In 2001, I became aware of a working paper version of “Equilibrium Welfare and Government Policy with Quasi-geometric Discounting” by Krusell, Kuruscu and Smith (KKS2002). They tried to solve a very difficult problem by linearizing around the steady state…. After my presentation was finished, Krusell and Smith continued the discussion. They asked me a question which was one of the most memorable of my career: “Why do you criticize us? We never criticize your work.”… Criticism is a natural part of any scientific effort, but it should be respectful and on point…. My criticism of Krusell, Kuruscu and Smith was on specific mathematical points, and they have never disputed my claims…

Sean McLain: Rivian’s Quest to Build the Ultimate Truck Burns Through Billions: ‘The EV maker has struggled to keep production up and costs down…. Rivian vehicles sell for over $80,000 on average. Yet they’re so expensive to build that in the second quarter the company lost $33,000 on every one it sold…. In two years, Rivian has blown through half of its $18 billion cash pile, in part because it struggled to master the nuts and bolts of manufacturing…

Steve LeVine: Exclusive from The Electric: GM’s New CTO Exits After One Month In the Job: ‘Gil Golan, is leaving the job after one month, according to an internal company memo distributed today, parts of which were seen by The Electric. Golan’s departure, effective Nov. 1…

S. Arora: ‘I remember that Nate hate from then. It was accompanied by the Romney momentum thing a few days before election. The hype was, forget Nate [Silver], momentum favored Romney. All that the momentum hype did was to create a private jet traffic jam on Logan airport on election night. That was funny to watch…

Zeke Hausfather: ‘The first global temperature data is in for the full month of September. This month was, in my professional opinion as a climate scientist—absolutely gobsmackingly bananas. JRA-55 beat the prior monthly record by over 0.5C, and was around 1.8C warmer than preindutrial levels. Here are monthly absolute temperatures (compared to anomalies). This September would not have been out of place as a typical July this decade in terms of global temperatures…

Gary Marcus: Seven Lies in Four Sentences: ‘I am old enough to remember when… hallucinations… were a relic of past systems, supposedly more or less corrected, by the time I spoke with Ezra [Klein] in January [2023]…. 9 months later—an eternity in current AI—it’s stilly common for LLMs to spout complete, utter bullshit…

Elizabeth Lopatto: How the Elon Musk biography exposes Walter Isaacson: ‘One way to keep Musk’s myth intact is simply not to check things out…. We are dealing with not one but two unreliable narrators: Musk and Isaacson himself…. There was a way to find out what’s true here, and it would have been to interview more sources, both Ukrainian and US military ones. Isaacson chose not to. Musk’s word was good enough for him—and so, when Musk contested the characterization, Isaacson rolled over…

NOTES & SubStack Posts:

Economics Watch: This may well not be true: the Fed is still half in a Phillips Curve world—and perhaps more than half. For the Fed, the question is what is the balance between deflationary pressures from past monetary-policy moves that have not yet fully affected the real economy plus those that the return of the bond-market vigilantes will exert on the one hand, and the inflationary pressures that arise in an increasingly full-employment economy. I think—given their unwillingness to rapidly reverse course when their trend gets out-of-sync with the data—it would be foolish for the Fed to raise interest rates any more. But I have zero votes on the FOMC:

Economics Watch: Except the plausible rate-cut story is not for sometime next year, it is—if you buy that there is still a bunch of contractionary monetary policy still in the pipeline—a story for right now:

Neofascism Watch: Liz Cheney said that since Kevin McCarthy went and bent the knee to Donald Trump after January 6, he should be voted off the island as soon as possible—after all, we have to hold the line somewhere.

She is, I think, a better politician than you are.

So do you disagree—think you are a better politician? Or are you just being as Trump-adjacent as you dare?

Brad DeLong

"highly illiquid--which a properly run exchange can never be"

That's the difference between economists and central bankers of the payment persuasion. Central bankers are a lot more paranoid.

Even a properly run exchange has limited liquidity. If one of its major counterparties goes bust, it can only rely on a limited pool of liquid collateral. After that, there is nothing but an unwind (shudder!!!!) or central bank liquidity. And the latter cannot be adequately collateralized unless the exchange is mutualized to the point of unlimited liability. And that is not going to happen in an exchange that is run as a for-profit corporation, as many are today.

And why the hell central banks abandoned unlimited mutualization is beyond me. Probably their market-worshipping instincts. Plus the contingent liability would not look pretty on the exchange's members' balance sheets.