BRIEFLY NOTED: For 2024-01-17 We

Remarkably bad manufacturing-conditions survey from New York; Mohamed El-Erian thinks we are a mile away from where we actually are; Patrick Wyman on great historical human cruelty; British...

Remarkably bad manufacturing-conditions survey from New York; Mohamed El-Erian thinks we are a mile away from where we actually are; Patrick Wyman on great historical human cruelty; British national debt; Ada Palmer on how ideas evolve; very briefly noted; & Henry Farrell & Cosma Shalizi on the zombie dance of human society; the world economy in the 20th century lecture 1; Martin Luther King, Jr.; & BRIEFLY NOTED: FOR 2024-01-14 Su…

SubStack NOTES:

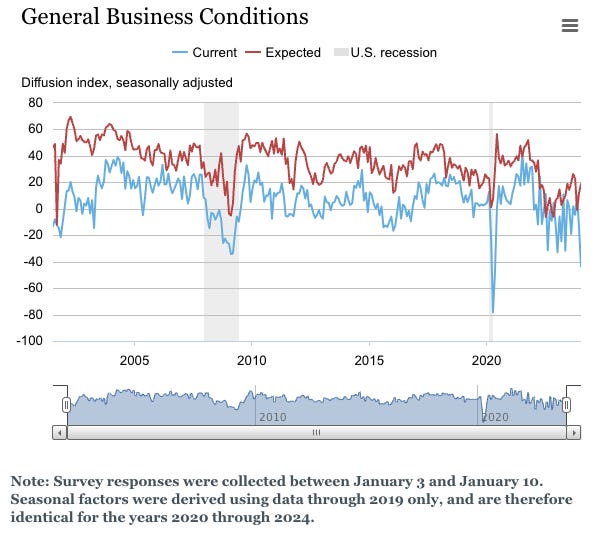

Economics: A remarkably bad manufacturing-conditions survey from New York state. Remarkably bad. Of course, seasonals matter, and are often wrong. Of course, one swallow does not make a summer. But if you weren’t thinking that maybe the Fed is behind the curve and a recession is on the way, you should definitely be thinking so after this:

Federal Reserve Bank of New York: Empire State Manufacturing Survey: ‘Business activity dropped sharply in New York State, according to firms responding to the January 2024 Empire State Manufacturing Survey. The headline general business conditions index fell twenty-nine points to -43.7, its lowest reading since May 2020. New orders and shipments also posted sharp declines. Unfilled orders continued to shrink significantly, and delivery times continued to shorten. Inventories edged lower. Employment and the average workweek declined modestly. The pace of input price increases picked up somewhat, while the pace of selling price increases was little changed. While firms expect conditions to improve over the next six months, optimism remained subdued… <newyorkfed.org/survey/empire/empiresurv…>

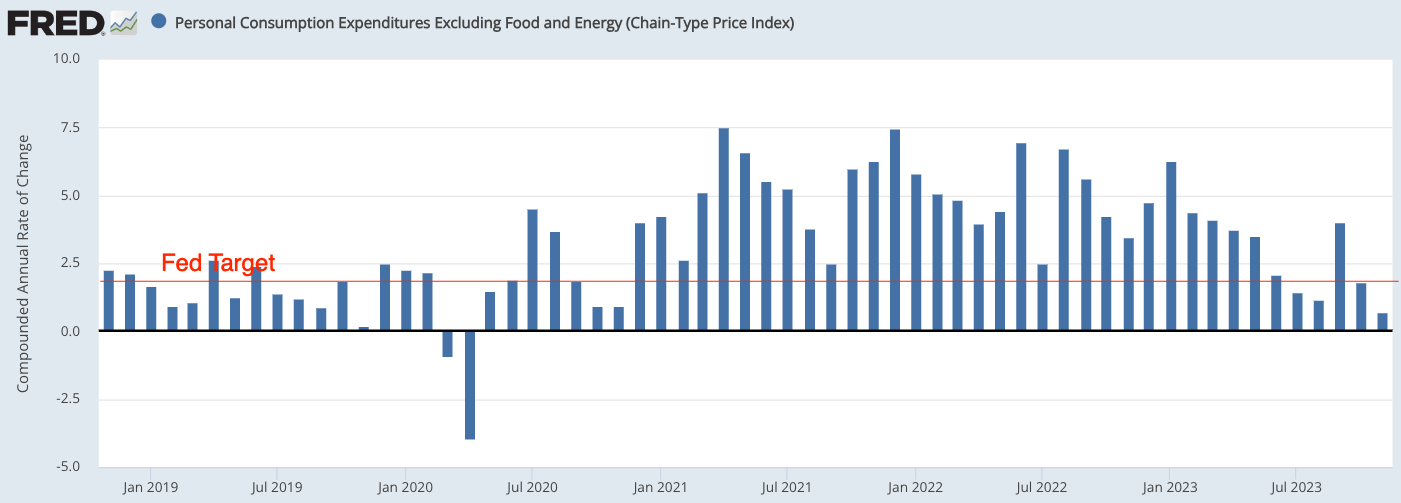

Economics: WAIT!! WHAT!? There is no “last mile” in inflation reduction needed. According to the Fed’s target, we are there. Yes, shocks could cause inflation to rise in the future. But shocks could also cause inflation to fall in the future. Give me a real reason why policy now should not be near-neutral, please:

Mohamed El-Erian: A warning shot over the last mile in the inflation battle: US data highlights the challenges facing the Fed in attaining its 2% inflation target…. Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of ft.com ft.com and ft.com. Email ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be ft.com. ft.com core inflation edged lower from 4.0 per cent to 3.9 per cent in the month, this was higher than consensus market forecasts of 3.8 per cent. Meanwhile, the data is yet to reflect cost pressures already in the pipeline. The current disruption to Red Sea navigation will impact inflation directly, by increasing input and final goods prices, and indirectly, by delaying the availability of goods. The economy will also need to absorb higher labour costs…. Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of ft.com ft.com and ft.com. Email ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be ft.com. ft.com quickly to 2 per cent was never going to be easy for the US economy, especially considering the Fed’s initial mistakes of analysis and policy reaction. The recent data serves as a surprisingly early warning of the long and winding road ahead in the last mile of the inflation battle… <ft.com/content/497499b1-0e9f-4215-a536-…>

Economic History: The excuse in the past was that pretty much the only way to get enough for yourself and your family was to find a way to join the force-and-fraud domination-and-exploitation gang that was society’s élite and took 1/3 of the crop and the manufactures from the farmers and the craftsman. Become a thug-with-a-spear (or a gunpowder weapon), one of their bosses, or one of their tame accountants, bureaucrats, and propagandists. That was their excuse. What is our excuse?

Patrick Wyman: Ordinary People Do Terrible Things: ‘Evil acts are easily normalized…. Two people I think about from time to time…. Nanaya-ila’i. That wasn’t the name she had been given… but one that was foisted upon her… [and her] daughter…. Slavers who ripped the two from their place of birth in… Elam and took them to captivity in Assyria… more than 2,600 years ago…. [A] merchant… Mannu-kī-Aššūr, paid the price of one mina of silver, about 500 grams for the adult woman and her daughter…. This is the only time Nanaya-ila’i and her daughter appear in the historical record…. Nanaya-ila’i and her daughter were just two of the thousands upon thousands of victims of the Assyrian Empire…. As long as grasping rulers and would-be warlords have sought to expand their power, common people have suffered the consequences…. But those ambitious politicians and conquerors didn’t do the dirty work themselves. They had underlings, generals and officers and common soldiers and bureaucrats… <patrickwyman.substack.com/p/ordinary-pe…>

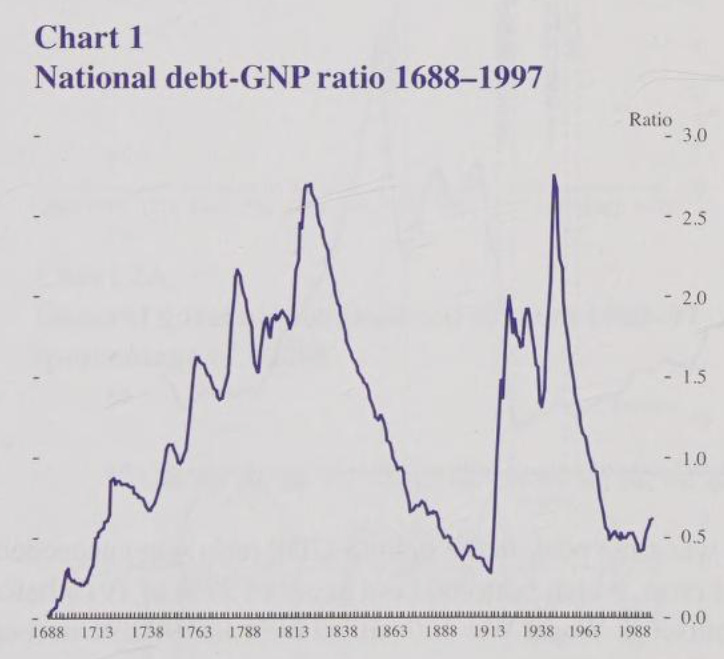

ONE IMAGE: The British National Debt:

ONE VIDEO: Ada Palmer: The Nature of Intellectual Transformation:

Very Briefly Noted:

Economics: Olivier Blanchard (March 14, 2022): Why I worry about inflation, interest rates, and unemployment: ‘The only potentially valid comparison (with all the caveats listed below) is between the 1975–83 episode and the current one… when the Fed got seriously "behind the curve" in 1974–75…. In early 1975, core inflation was running at 12 percent and the real policy rate was equal to about −6 percent, a gap of about 17 percent. Today, core inflation is running at 6 percent and the real policy rate is equal to −6 percent, a gap of 12 percent—smaller than in 1975, but still strikingly large…. It then took 8 years, from 1975 to 1983, to reduce inflation to 4 percent, with an increase in the real rate from bottom to peak of close to 1,300 basis points, and a peak increase in the unemployment rate of 600 basis points from the early 1970s…. No catchup, expectations remain anchored, and the Phillips curve remains flat… delivers an optimistic message…. But make the opposite set of assumptions…. The issue… is how much the past few decades, characterized by stable inflation and nothing like COVID-19 or war shocks, are a reliable guide to the future… <https://www.piie.com/blogs/realtime-economic-issues-watch/why-i-worry-about-inflation-interest-rates-and-unemployment>

Charles Goodhart (1999): Monetary Policy & Debt Management in the UK: Some Historical Viewpoints… <https://archive.org/details/governmentdebtst0000unse/page/n2/mode/1up>

Louise Sheiner: ‘I see several countervailing forces: rent inflation seems likely to continue running high… and goods prices seem likely to continue running low… [all] part of the unwinding of the pandemic inflation episode…. There is uncertainty about inflation in non-housing services…. The recent slowdown in wage growth will mean a slowdown in inflation, but much depends on the strength of the underlying economy…. It is hard to know what inflation will look like over the next year…. Iit may be a number of years before the full pandemic inflation cycle is completed… <https://www.brookings.edu/articles/the-pandemic-inflation-episode-is-still-unwinding/>

Trevon Logan (2023): Can Discrimination Thrive in a Free Market?: ‘While the market may punish firms who discriminate, the market is powerless when consumers are the ones who value discrimination… <https://econofact.org/can-discrimination-thrive-in-a-free-market>

Trevon Logan (2022): Historical Roots of Economic Disparities for African-Americans: ‘The Civil Rights Act of 1964…. W think about it largely in terms of what it did for say labor markets in terms of banning discrimination [in] employment and these other aspects. But the most contentious issue at the time in 1964 was about public accommodations…. You really just don't think about not being able to go to Macy's or Target…. But that really is a very modern feature of the United States and it's amazing how that change happened instantaneously with the passage of the Civil Rights Act in 1964…. American society didn't crumble, we didn't see large scale riots and we didn't see businesses revolt… which… is really surprising given the discussion that people had up to the passage…. It says something about the power of federal legislation to end these entrenched practices of racial discrimination and thinking about groups that might need protection today… <https://econofact.org/wp-content/uploads/2022/09/EFChats-Transcript-Trevon-LoganHistorical-Roots-of-Economic-Disparities-for-African-americans.pdf>

Dan Davies: The Thing that Makes the Thing-in-Itself: ‘On the oddness of British exports: The sectoral breakdown of the UK export statistics has one rather unique industry. It’s five times as big an export earner as automobiles, more than twice as big as financial services and about a fifth of our entire exports…. Britain is the Saudi Arabia of “Other business and professional services”. We dominate the world when it comes to “doing miscellaneous stuff”. Nobody can touch us when it comes to “things that don’t fit in any other category”…. This weird catch-all that basically describes “services exports which aren’t tourism or finance or anything else that’s easy to identify”. A hell of a lot of it is lawyers; the British services sector is where you have to go to if you want to interact with the world’s single largest and most valuable intangible asset, which is called “The Commercial Common Law Of England And Wales”. Some of the rest is… higher education…. But a lot… is… small consultancies, often built around one or two experienced professionals who have had half a career in management roles in some other industry or in public service, and have then gone into business providing advice…. Anything from the optimisation of a specific software package to the care of drainpipes in historic buildings. This is the British Mittelstand…

Goldman Sachs: Macro Outlook 2024: ‘More disinflation is in store over the next year…. Core [CPI] inflation should fall back to 2-2½% by end-2024. We continue to see only limited recession risk and reaffirm our 15% US recession probability. We expect several tailwinds to global growth in 2024…. When rates ultimately do settle, we expect central banks to leave policy rates above their current estimates of long-run sustainable levels…. The market outlook is complicated by compressed risk premia and markets that are quite well priced for our central case... <https://www.goldmansachs.com/intelligence/pages/gs-research/macro-outlook-2024-the-hard-part-is-over/report.pdf>

Economic History: Karen Horn: Challenging the clichés: How recent scholarship refreshes the interpretation of Adam Smith’s oeuvre: ‘Vernon Smith… argues… [for] a major difference between personal exchange in the small group that relies on reciprocity, on the one hand, and impersonal exchange in the anonymous, competitively structured large society, on the other hand. “In impersonal markets, people behave noncooperatively, and this maximizes the gain from exchange”…. Weingast… [extracts that] although the division of labor, savings, capital accumulation, and good economic policies are important, they cannot exist without the necessary condition of overcoming the “violence trap.”… If a way out of the trap is found, then the transition from a “limited-access” society to an “open-access” society becomes possible…. in the pre-modern world, the poor were considered a reprehensible class. Until the late 18th century, people believed that God had provided a hierarchical structure for society… “More than anyone else before him, Smith urged an attitude of respect for the poor, a view of them as having equal dignity with every other human being, and without this view, the notion that they deserve not to be poor could not have gotten off the ground,” writes Fleischacker…. This set the course for modernity… <https://www.degruyter.com/document/doi/10.1515/pwp-2023-0055/html>

Ali Almelhem & al.: Enlightenment Ideals & Belief in Progress in the Run-up to the Industrial Revolution: A Textual Analysis: ‘There was a separation in the language of science and religion beginning in the 17th century…. Scientific volumes became more progress-oriented…. Industrial works—especially those at the science-political economy nexus—were more progress-oriented beginning in the 17th century. It was therefore the more pragmatic, industrial works which reflected the cultural values cited as important for Britain’s takeoff… <https://docs.iza.org/dp16674.pdf>

Nescio13: Friedrich Engels, Foucault on Chicago Economics & the social demand for criminality: ‘It is fair to say that Friedrich Engels’ (1843/44) “Outlines of a Critique of Political Economy” ([Umrisse zu einer Kritik der Nationalökonomie]: hereafter Umrisse) is close to the Stunde Null of Marxism. We know that Marx really admired the piece. The relatively short essay anticipates many themes that are developed with much greater sophistication in the collaboration between Marx and Engels during the next few decades…

CPI inflation is dominated by shelter inflation, which is measured as rental inflation, that's dominated by owners equivalent rent, which is driven by the rental market of single family houses. There's a shortage of single family houses, so rent increases are high, as opposed to the much larger apartment rental market, where there is rising new construction supply.

So the headline CPI, which gets much more attention than core PCE, is increasingly dominated by the risible assumption that homeowners with fixed rate mortgages are leasing their houses back to themselves at a rental price which is based on a very small share of the total shelter market. I fear we will impute and assume ourselves into a recession.

Logan [Can Discrimination Thrive in a Free Market?] answers DeLong's perpetual question, "Why can't we have a better press corps?" :)

The Civil Rights Act public accommodations solved the coordination problem of business that did not want to discriminate.