Discover more from Brad DeLong's Grasping Reality

CONDITION: WEIRD:

My sometime student Glory Liu faces an unhinged and incompetent Wall Street Journal review of her new book Adam Smith’s America!:

FOCUS: Contra Vince Reinhart: The Fed Has Done Very Well Indeed!

I disagree pretty strongly with the extremely smart Vince Reinhart here. He says that the past few years have revealed “cracks” in how the Federal Reserve makes monetary policy.

But I cannot see any cracks: to date, to me, monetary policy since the plague began has been well-nigh perfect.

Vince Reinhart thinks that the Fed moved “late” and moved “fast”, as if those are bad things. But in the situation it was optimal to be late, and good to then move fast. Indeed, if I had my druthers and had been running things, I would have moved later and then faster. The optimal monetary policy strategy coming out of the plague was to:

delay raising interest rates until inflation was high enough to grease a rapid reopening recovery of and shift in economic activity into its new post-plague full-employment sectoral-balance configuration.

delay raising interest rates until there was full confidence that raising interest rates would not send the economy back to the secular-stagnation zero-lower-bound interest rate configuration.

then move rapidly to raise interest rates so that expectations of inflation did not become established and entrenched.

taking care not to overdue interest rate increases and so generate not a sfot landing but stagflation, quite possibly ending in a return to the secular-stagnation zero-lower-bound interest rate configuration.

It looks to me like the Fed has succeeded 100% at (1)-(3). (4) still hangs in teh balance, but so far so good.

So what re the cracks? What is there to complain about?:

Vince Reinhart: Why Inflation Took Off in 2022—and What Happens Next: The year was a stress test of the Fed’s new framework, and the cracks were apparent: ‘The Fed only garners such attention making or correcting a major mistake—and there was a bit of both this year. Inflation was allowed to hit a 40-year high. Monetary policy had to pivot forcefully to raise the target range for the overnight rate to 4.25% to 4.5% in 2022, including four 0.75-percentage-point installments. True, there were two outside, generational shocks—a global pandemic and a large-scale land war in Europe. However, those shocks were also a stress test of the Fed’s new monetary framework. This test revealed some significant cracks…. With inflation… at a 40-year high this spring, Mr. Powell and his Fed colleagues retired the word “transitory”…. The Fed… [brought] the overnight rate to a target range of 4.25% to 4.5% at Wednesday’s meeting…. The target range still implies a negative interest rate in real terms, even with an optimistic take on inflation expectations. A negative real interest rate won’t slow demand growth…. The challenge here is whether the Fed will be able to defeat inflation completely and regain the confidence of the markets. The jury is out...

Vince is very smart, and very knowledgeable, but…

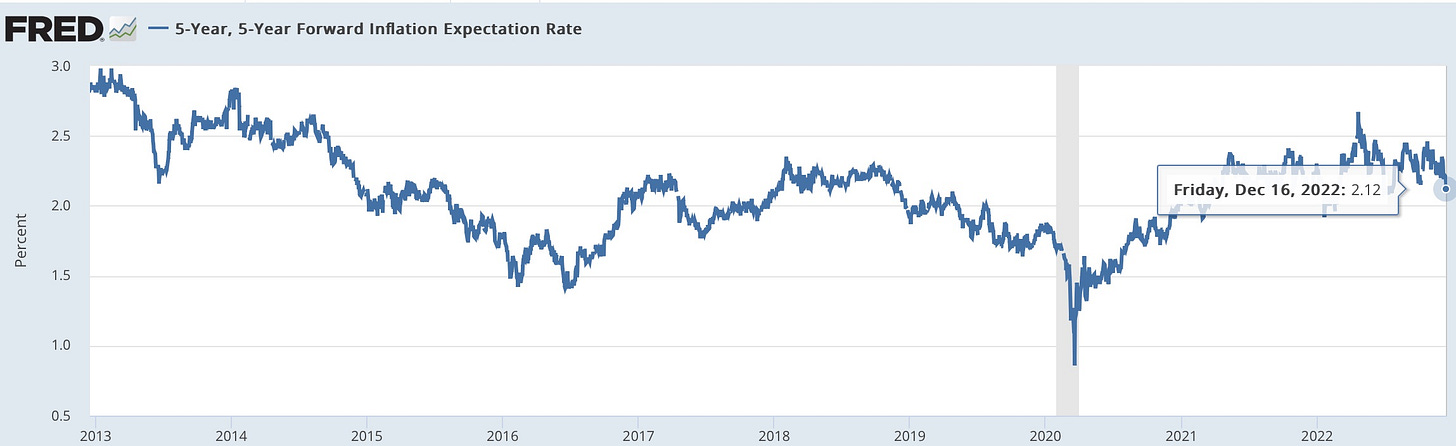

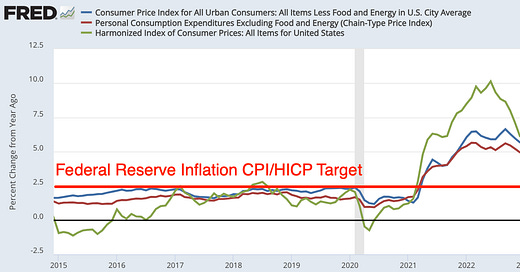

(1) The Fed has the confidence of the markets. As of Friday’s close, the markets are betting that from five to ten years in the future the CPI annual inflation rate will be 2.12%—and that is a PCE chain inflation rate of 1.6%-1.7%, below the Federal Reserve’s target:

The jury is not out. The Federal Reserve does not have to regain the confidence of the markets. It has the confidence of the markets. I cannot see how anyone can say otherwise without a theory explaining why the people trading on the markets are not “the markets”. And I do not know what such a theory might be.

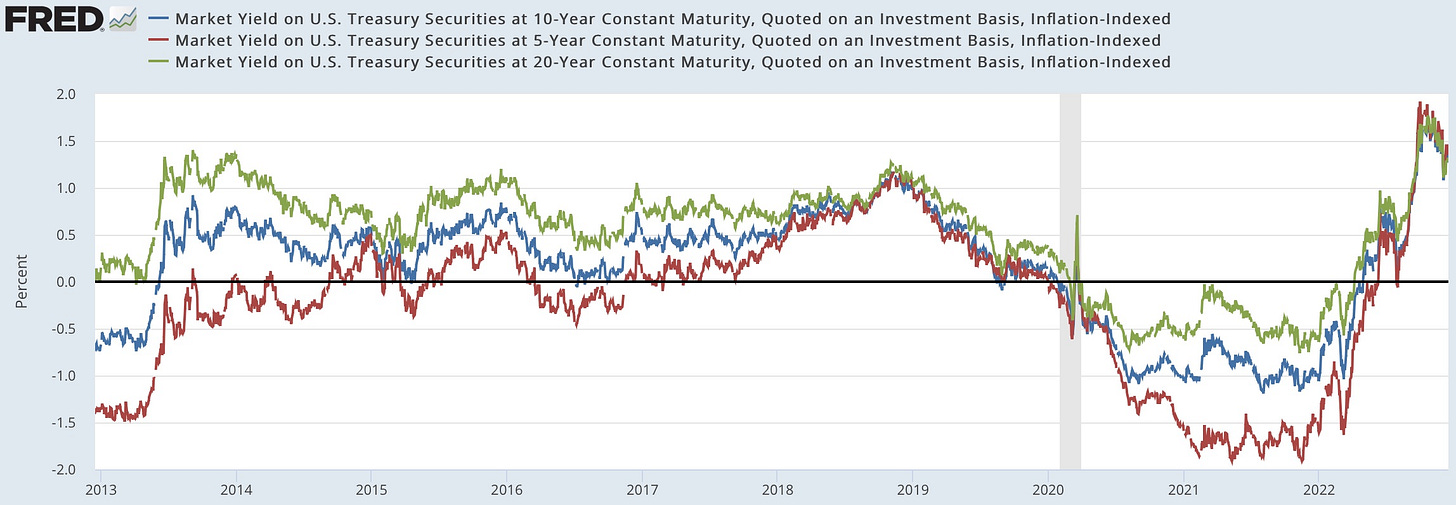

(2) The target annualized rate of 4.25%-4.5% for overnight money does not “imply a negative interest rate in real terms”. The 5-year, 10-year, and 20-year inflation-indexed U.S. Treasury securities are all hanging up there at positive annual real interest rates of 1.1%-1.5%:

Yes, the current overnight rate is less than the current inflation rate. But those sectors of the economy in which demand is sensitive to real interest rates—construction and, via the exchange rate, exports and import-competing products—are governed not by any real overnight rate but by the real longterm interest rate. The claim that “a negative real interest rate won’t slow demand growth” does not apply, because the relevant interest rate is not negative.

(3) In fact, the claim that “a negative real interest rate won’t slow demand growth” does not make any sense: a shift from a more negative to a less negative real interest rate would slow demand growth. (But, as I said, we don’t have a negative real interest rate in any relevant sense.)

MUST-READ: Matt Yglesias: Thoughts on Ezra’s take on Twitter:

Yet more proof that my stealing from William Butler Yeats’s “The Second Coming” for the title of my Slouching Towards Utopia: The Economic History of the Long 20th Century <http://bit.ly/3pP3Krk> was absolute genius:

Matt Yglesias: Thoughts on Ezra’s take on Twitter: ‘Marie Kennedy: “Specifically what I think is the money line, “I think there is a reason that so little has gotten better and so much has gotten worse. It is this: The cost of so much connection and information has been the deterioration of our capacity for attention and reflection. And it is the quality of our attention and reflection that matters most.” Ezra’s points are almost always good, and that includes his points in this column. If we were on a podcast… keeping things moving, my pushback… would be… there’s a fine line between… the Quaker wisdom of silence and Aaron Burr’s “talk less, smile more, don’t let them know what you’re against or what you’re for” advice from Hamilton…. The world suffers when too many of the most level-headed people simply opt out of certain conversations for the sake of avoiding contentiousness. So while Ezra sees too many hotheads and attention-sucks, I see too many Ezra Kleins staying silent, creating a “best lack all conviction, worst are full of passionate intensity” dynamic. Both of these things are clearly present, though…

ONE VIDEO: Not English!

Adriano Celentano: Prisencolinensinainciusol!

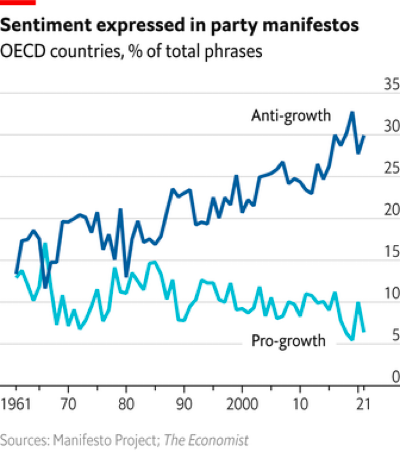

ONE IMAGE: Growth or De-Growth?

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Joachim Klement: Monetary policy may have a longer lag than we thought: ‘While most forecasters have been underestimating the inflationary pressures in 2022, the Fed may have been underestimating the lag with which monetary tightening influences inflation and the economy…. While industrial production declines by about 0.5 percentage points in the 9 to 12 months after a rate hike, inflation typically bottoms after two years or later…

Michael Bauer & Eric Swanson: A Reassessment of Monetary Policy Surprises and High-Frequency Identification…

• Ed Luce: The American left’s chronic Nimby problem: ‘US progressives correctly insist that global warming poses the “greatest existential threat” to humanity. That line should be extended to “ . . . except for our wildly overdone fears of nuclear meltdown”, or “ . . . but not if it damages our property values”. At some point, America’s left must choose between having its cake and eating it…

Bryce Elder: Here’s a completely normal thing for a $70bn closed-ended unregulated quasi-money market fund to say read: ‘“#Tether Addresses FUD Around Secured Loans, Reveals Plans to Reduce These to Zero in 2023 <https://t.co/nZcPr8RiF1>”. The above is just one part of the generalised weirdness across the crypto space following the arrest of its slacker-in-chief…

Ajay Rajadhyaksha: Premature pivot prayers: ‘It should be a hop, skip and jump to rate cuts. At least, that is what the bond market believes—fed funds futures are now pricing in three quarter-point cuts next year. Not so fast…

Simon Willison: ‘There is so much great #SpiderVerse behind the scenes content on Twitter if you start following some of the artists who created the film…

¶s:

A party that feels it has to “grow with Trump” is a very bad and dangerous thing indeed:

Greg Sargent: Is the Liberal Bias of Mainstream Media a Myth?: ‘“Aaron: What is up with the American right, right now?” Greg Sargent: One thing... is... a genuine countermovement to the Republican Party... the national conservatives, the post-liberals.... The post-liberals are really trying to... challenge the plutocratic and libertarian bent of the Republican Party.... A decision was made by McCarthy—how conscious? I don’t know—that there was a certain set of constituencies that the Republican Party absolutely needed to hold onto... [who were] ]associated with Trump’s insurrection.... Lindsey Graham... provided... the perfect encapsulation.... “Liz Cheney has made a decision that the Republican Party can’t grow with Trump. I’ve made a decision that the Republican Party can’t grow without Trump.” I think that’s the fundamental thing that happened with McCarthy, with Graham, with a lot of the institutional players who decided that they were going to do everything they could to apologize for, propagandize away, minimize and so forth the insurrection, and continue to hang onto these constituencies...

Advertising-supported social media considered very harmful:

Noah Smith: The internet wants to be fragmented: Throwing the whole world into a single room together doesn't work. ‘I said “You know…fifteen years ago, the internet was an escape from the real world. Now the real world is an escape from the internet.” “Tweet that!”, Dayv said, so I did. That banal observation became most popular tweet of all time, and the quote has now been posted ad infinitum on content mills all over the web…. Facebook became an all-conquering corporate behemoth, and Twitter managed to stay profitable and secure from competition in spite of being notoriously poorly managed. But almost immediately after the great centralization of the 2010s, I started noticing that something was wrong with the internet I had come to know and love…. Community moderation works. This was the overwhelming lesson of the early internet. It works because it mirrors the social interaction of real life…. From Twitter, however, there seemed to be no exit…. And the people who ran Twitter on the corporate side had no intention of changing this at all.… What they really wanted was to keep making money. They tinkered at the edges of the platform, but never touched their killer feature, the quote-tweet, which Twitter’s head of product called “the dunk mechanism.” Because dunks were the business model — if you don’t believe me, you can check out the many research papers showing that toxicity and outrage drive Twitter engagement…

Kinda scary obvious true things like this are up for debate:

Alan Wm. Wolff, Robert Z. Lawrence, & Gary Clyde Hufbauer: Have Trade Agreements Been Bad for America?: ‘A false narrative has gone mainstream in America. It claims that trade agreements the United States entered into over the last 40 years, perhaps for nearly a century, were a mistake. There is no nuance to this narrative.… Relatively open markets bring international competition, and in all competitions some players come out ahead and some behind; in extreme cases, the losers suffer serious harm…. We do not think that 13 American presidents, from Franklin Roosevelt to Barack Obama, got it wrong…. The trade agreements that the United States entered into were strongly positive for America and that policy approaches taken need to be built on rather than abandoned…

This is just plain weird: When you become President of the United States, you take an oath that you will faithfully execute the laws. One of the laws is that presidential papers go to the National Archives (and then to your Presidential Library) in order to preserve the historical record. As near as I can see, Clive Crook is not saying that Trump should not be imprisoned but just fined for violating the Presidential Records Act: he is saying that whether people obey the Presidential Records Act should be up to them, with no sanctions for violations whatsoever. It is not like Trump did not know that the letters and papers were not his. There is an argument for not prosecuting people who accidently and unintentionally violate records-preservation laws. But that is not what we have here, is it?:

Clive Crook: Would Locking Up Trump Serve the Public Interest?: ‘You might well ask: How can investigation and prosecution of crimes ever fail to be in the public interest? Very easily. A conscientious effort to prosecute every crime to the fullest extent of the law might leave surprisingly few Americans at liberty. This country has built such a vast constellation of criminal offenses that prosecutorial discretion — that is, choosing not to prosecute — is not so much a function of limited resources as something that justice actually requires. According to reports, the crimes Trump possibly committed might include such heinous acts as keeping a letter former President Barack Obama left for him in the Oval Office…

Sounds like this was fun:

Matt Dinan: The Single Book Course: ‘My own little act of protest in coming back to teaching after the pandemic and sabbatical was thus to teach a course on a single book: Plato’s Republic…. The single book course is good because of its simplicity. There is no real question of competing priorities: we are going to read Plato’s Republic and then get together and talk about it…. It was an unmixed pleasure to watch my students attracted and repelled—sometimes from one moment to the next—by Socrates’ communism, his vision of equality according to nature, his scheme for philosophical rulers, and the outrages required to bring it about. The imposition of complete form—with its mirror image in the formlessness of tyranny—cannot be justice. Why do we want it? Because the complexity and the messiness of human life make unity impossible, and really do produce no end of troubles for human beings…

Ms. Liu is in good company as Mr. Swain dismisses Smith’s “The Theory of Moral Sentiments” as not “very good” not a “great work of philosophy” and “mostly unreadable.” Perhaps Smith did not set out to invent a new school of philosophy, but he provides us with the observations of a wise man. He lamented that “the great and most universal cause of the corruption of our moral sentiments [is] that wealth and greatness are often regarded with the respect and admiration which are due only to wisdom and virtue.” No words ring truer today or could serve us better in choosing whom to admire or elect.

I couldn't read the excerpt of the WSJ review you attached. Fortunately (?) I have a subscription, So I read it there. I avoid the editorial page like a plague. The red flag was that the reviewer is a WSJ editorial page employee. BTW, I also skip the NYT editorial page, except for Krugman who I read as a professional courtesy. WSJ. cultural coverage is a mixed bag; much right wing grievance venting, some genuinely insightful essays. The review of Adam Smith's America was very much the first variety. It reminded me of our state legislators complaining about professors brainwashing students. I hope the book receives better reviews elsewhere.