DeLongTODAY: Economic Growth from þe Distant Past to þe Medium-Term Future 2021-01-26 Fr

Transcript & Notes for DeLongTODAY on 2021-01-26 Fr

Video: <https://drive.google.com/file/d/1Qr7YbwK-fY4lkWRGupus9f2ChSnPy6Ic/view?usp=sharing>

I am Brad DeLong, an economics professor at the University of California at Berkeley and a sometime Deputy Assistant Secretary of the U.S. Treasury. This is the weekly DeLongToday briefing. Here I hold forth here on the Leigh Bureau’s vimeo platform on my guesses as to what I think you most need to know about what our economy is doing to us right now.

I promised Wes Neff when he agreed to provide the infrastructure for this that I and my briefings would be: lively, interesting, curious, thoughtful, and relatively brief.

Relatively.

I promised I would provide briefings on a mix of: forecasting, politics, macroeconomic analysis, history, and political economy.

Today is mostly an economic analysis situation briefing…

But first:

I want to note that I am extraordinarily pleased by the result of last Wednesday’s inauguration of President Joe Biden. It had much more of an effect on me than I had thought it would have. It was, for me, a real the people who walked in darkness have seen a great light; they that dwelt in the land of the shadow of death, upon them hath the light shined…

To all those of you who were among the helpers here, thank you very much.

And for those who were not, please consider three questions:

How did you turn into such an easily-grifted moron?

Why didn’t you wake up and smell the coffee at any of the obvious moments?

How are you going to change your ways so that you are less of a menace to us in the future?

And I am 75% confident that we barely dodged a very dangerous bullet.

When Attorney General Barr quit, and when Trump replaced the top echelon at the Defense Department, and when past Secretaries of Defense including Richard Cheney wrote a letter stating that the military had no interventionist role to play in the transfer of power, people I respect said: Trump is going to try something…

It looks to me like a 75% chance that they were right: he did try something…

My view is that it is more likely than not that people in the defense and justice departments were told to slow-walk any requests for back up coming from a riot at the Capitol. And the mob was told—in a semi-plausibly-deniable way, of course; that’s how Trump operates—to try to storm the Capitol and put some spine into Mike Pence and the Republican senators by threatening to lynch them.

But then they stormed the Capitol.

And they waited for instructions from Trump for what they should do next.

And those instructions did not come.

And then Pence told the Defense Department to stop the slow-walking.

And there were only 7 senators who were scared or thought it would be to their political advantage to try to overturn the election.

And there were only 120 House members—40 scared, 40 hoping it would be to their political advantage, 40 easily-grifted morons who believed—willing to try to overturn the election.

Now for the main course…

I am here to talk about prospects for medium-term economic growth—although my medium-term may seem like the long run to you. For I am going to do so by looking way back as well as sideways at the current developments in technology.

Let me start from where we are.

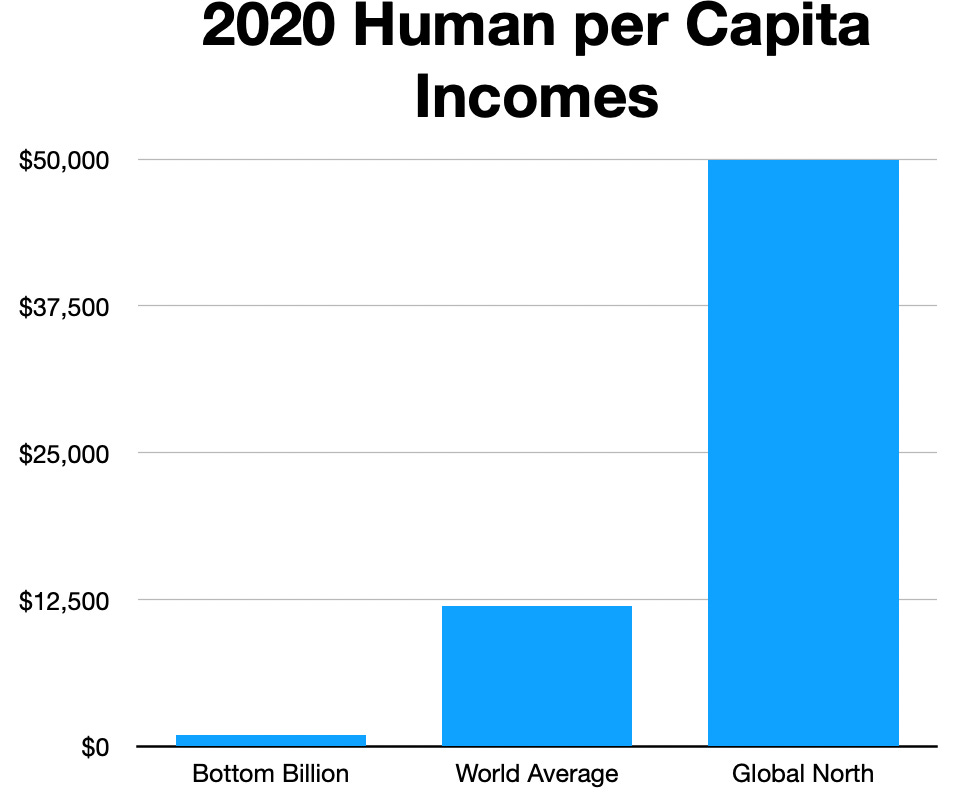

The world today has something like 7.6 billion people on it. The world today has an average level of national income of around $12 thousand per person per year. Part of the globe is much richer than $12 thousand per person per year: the top 10th that is the global north has an average income of national income of about $50,000 per year. Part of the globe is much poorer: the bottom billion—the bottom 1/8th—has an average income of $1000 a year, which supports a style of life not that significantly different from the style of life of our preindustrial peasant and craftworker serf ancestors. There are big differences along only a few of its dimensions—public health and mass communications being the major two.

There is a great deal of economic growth for humanity as a whole that is, in a sense, already completely baked into the cake. It is at hand and can be grasped by simply deploying and diffusing the technologies already deployed in the global north. Bringing the world average up to today’s global north average would quadruple humanity’s wealth. It would open the door to the prospect of a truly human world. (Or it would if humanity could also be made to undergo a psychological and sociological-organizational sea-change, for all evidence today is that, while poverty and material resource stringency greatly aid us in making trouble for ourselves, we are driven to make bad trouble for ourselves even under conditions of wealth and abundance.)

Would resource scarcity—of which the most important aspect right now appears to be the limited capacity of our biosphere to serve as a carbon sink without deranging our climate—keep us from accomplishing this to-hand quadrupling of human wealth? Almost surely not. Our physicists and technologists I have turned out to be more ingenious and creative than I would have thought at all likely a generation ago, The transition to non-carbon energy systems is now held back not by humanity’s poverty in any sense, but by the pure short-sighted greed of many of humanity’s powerful, who are taking advantage of their strong positions to block action. This is just one of the many reasons that America’s Republican Party needs to clean house. (It is not the most important such reason: the Republican Party in America needs to clean house unless it wants to go down in history as the keystone of the early 21st century fascist revival; but cleaning house with respect to environmental policy is a close second.)

How much more in economic growth can we expect from our future, in addition to this global quadrupling?

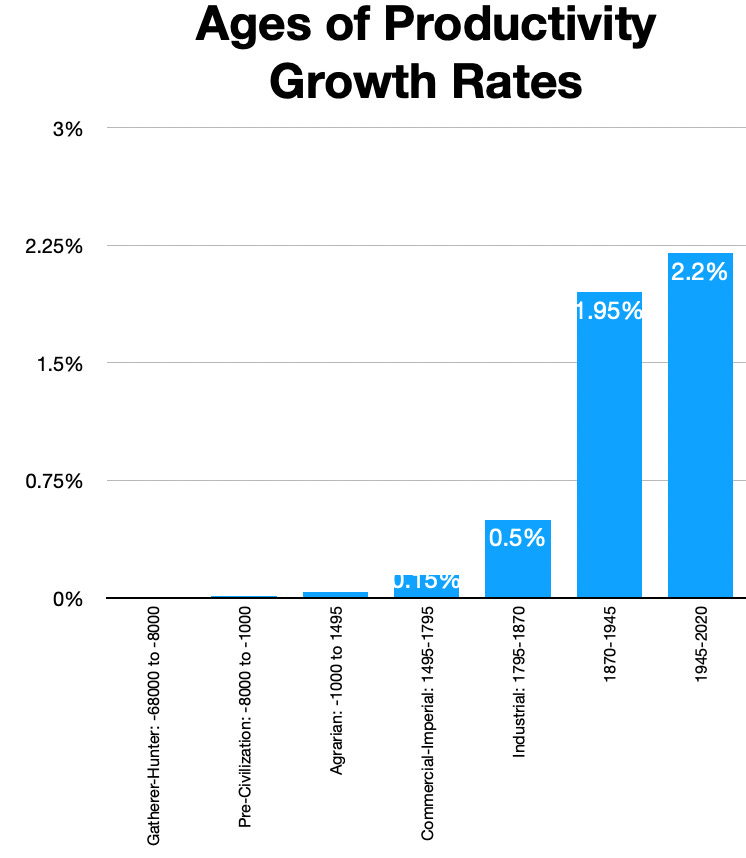

Since the end of World War II in 1945, the world has roared ahead, with the value of the stock of useful human ideas that underpins the efficiency of our labor growing at an average rate of 2.2%/year—that is doubling every 32 years. Not all of that has gone to support higher productivity and incomes. Those have grown at 1.6%/year, and the rest of the potential for income growth has gone to compensating for greater resource scarcity as humanity’s numbers have grown from 2.3 billion in 1945 to 7.6 billion today. But that needed to compensate for increasing relative resource scarcity is coming to an end.

Right now it looks as though the completion of the demographic transition will stabilize human populations at 9 billion in the middle of the 2000s. Thereafter improvements in technologies for manipulating nature and organizing humans will all flow through to higher incomes.

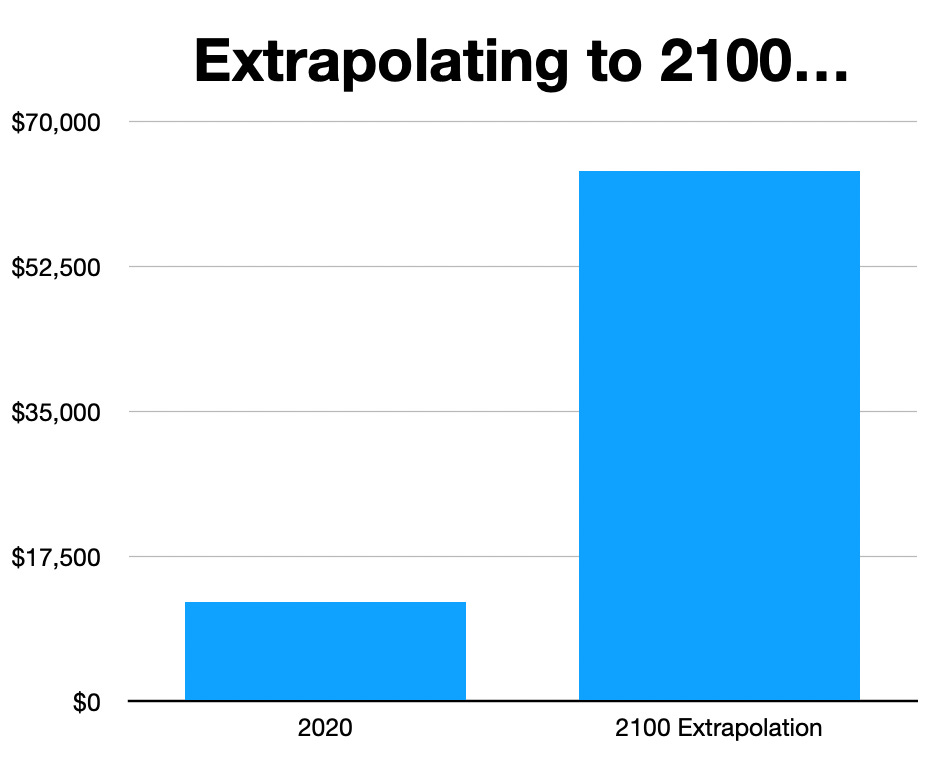

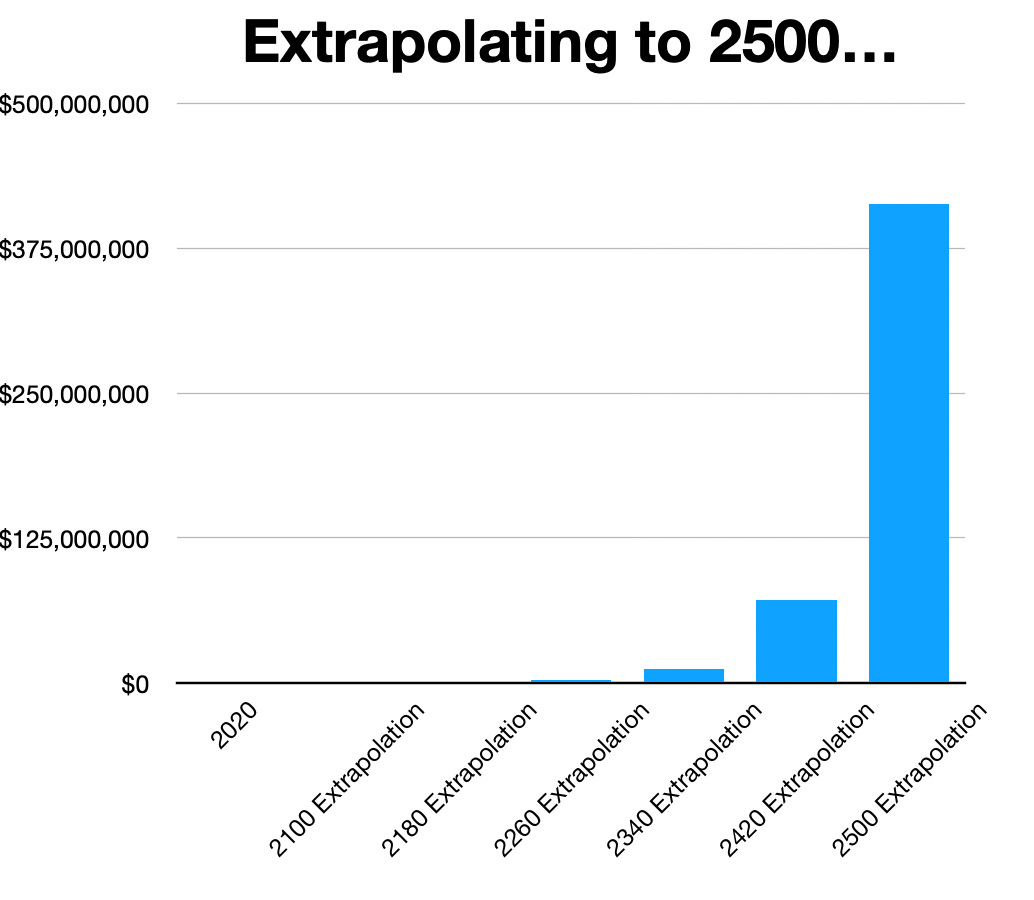

If we extrapolate the 2.2%/year 1945-2020 number for the invention and deployment of ideas, we get a more-than-quintupling to an average human annual income of $64 thousand in 2100: a world with an average a hair above that of the global north today.

A further 80 years and another more-than-quintupling would get us to $370 thousand in 2180. And if we look forward to the mid-millennium, extrapolating at the same pace, we see an average human annual income of $400 million per year in 2500. The average one of us then would have the income-based social power to every single dayˆ, acquire goods and use services that would, in aggregate and on average, cost a million dollars—and something like $10 million on a peak-consumption day.

Consider all of the technological and organizational change from the year -68000 to the year 1500. That seems, roughly, to be of the same proportional magnitude of all the technological and organizational change from the year 1500 to 2020. The year 2500 of our extrapolation tells us that we will take another such leap of the magnitude of -68000 to 1500 or of 1500 to 2020, and then a second such leap, and then 3/4 of a third such leap, and that will be our world in 2500.

It is really hard for me to imagine what that might mean.

I suspect that we will not get there. That might be because my imagination fails me. But it is, more probably, because there is no sense in which the 2.2%/year proportional growth rate of the collective useful-ideas stock that humanity has seen since 1945 is in any way guaranteed. Let us look further back, and see what we see:

Before 1945 the ideas-stock proportional growth rate was almost as large back to 1870: 1.95%/year rather than 2.2% per year, taking us to a world in 1870 of 1.3 billion people with an extremely poor average annual human per capita income of $1.3 thousand.

But before then growth was much slower—something like only 0.5%/year back from 1870 to 1795, and then something like 0.15%/year from 1795 back to 1570, and something like 0.1% back to 1495, when a world of 500 million people had an average annual per capita income of the not just extreme- but the dire-poverty level of $900. The pace of growth had been gathering speed since 1500 up to and through the Industrial Revolution era. But the biggest upward acceleration by far was the one that took place around 1870.

And before then? As I said, as much of a proportional leap from 1500 to today as from -68000 to 1500. Back in the year -68000, there were perhaps 100 thousand of us East African plains apes in our habitat of evolutionary adaptation, in ecological balance where if we were to become any poorer malnourishment would cause our numbers to drop and resources become more relatively abundant. And perhaps we had just learned to really talk.

Between 1500 and the end of the Bronze Age in -1000, the rate of growth of our ideas stock was something like 0.04%/year. Between -1000 and the discovery of agriculture in -8000, something like 0.015%/year. And before then? Perhaps 0.003%/year.

2.2%—0.5%—0.15%—0.04%—0.015%—0.003%. That’s too many numbers. To grab hold of them, think of them as modern-growth, industrial, commercial and imperial, agrarian, pre-civilization, and gather-hunter ages, each with its characteristic underlying economic growth rate. And think of each of them in terms of the time it takes the value of the human ideas stock to double: 32 years for the modern-growth post-1870 age, 140 years for the 1800-1870 industrial age, 500 years for the 1500-1800 commercial-imperial age, 1750 years for the -1000 to 1500 agrarian age, 4500 years for the -8000 to -1000 pre-civilization age, and 25000 for the gatherer-hunter age.

You might think that this broad pattern should make us very optimistic about the future of economic growth. We see, age after age, acceleration in the pace of growth. The difficulty of achieving technological breakthroughs because the low-hanging fruit has been harvested has been more than offset by the fact that there are so many more of us investigating ideas and our tools for thought are now much much better. And that may well be true.

But there has been no significant acceleration in the pace of global growth since the 1870 or so breakthrough to the modern growth era. And there have been disquieting signs in the slowing pace of global north growth over the past couple of generations.

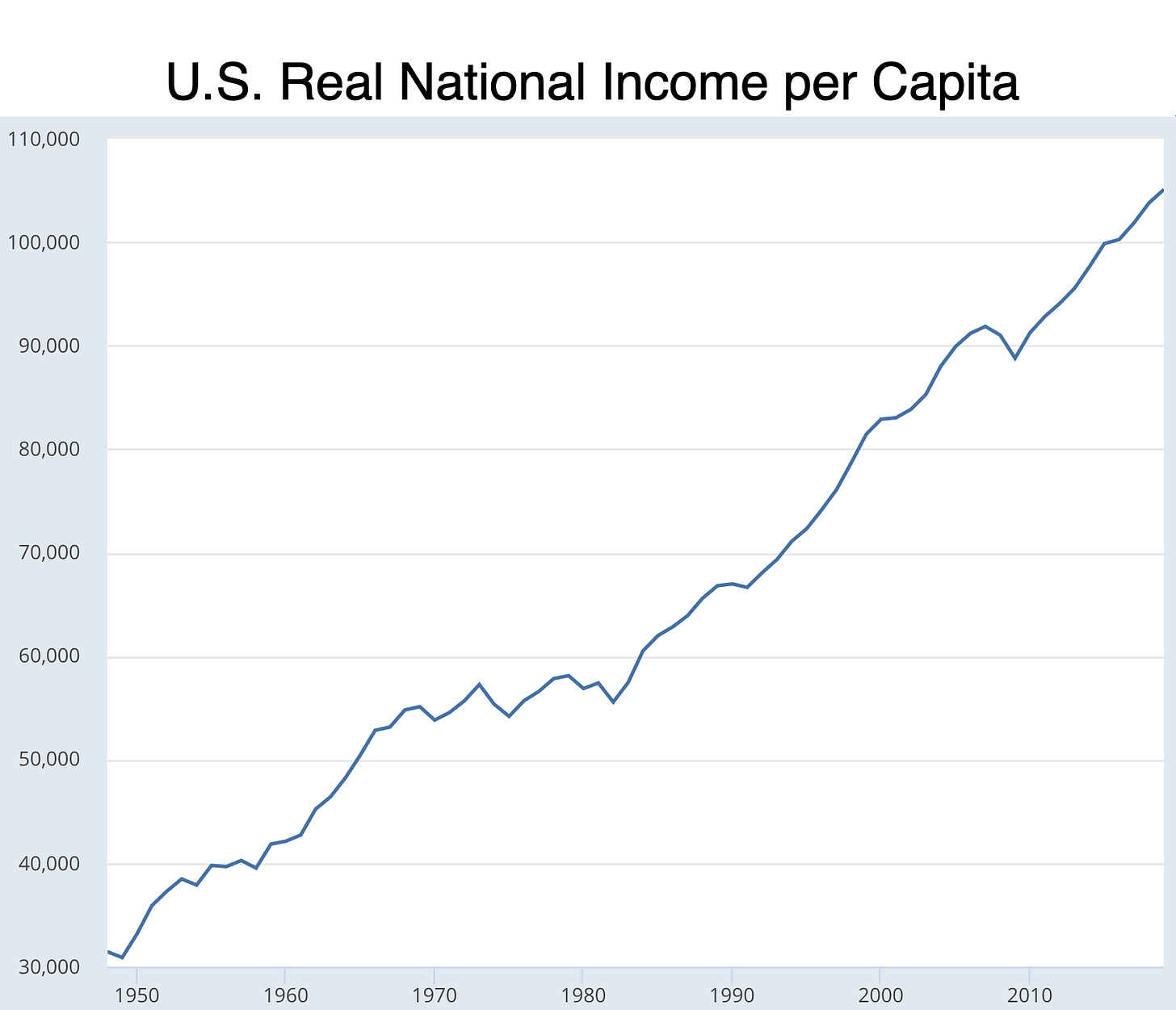

Measured in dollars of 2012’s value, American real national income per capita was $31 thousand in 1948 and $53 thousand eighteen years later, in 1966. But 1984—another 18 years—saw it at only $60 thousand, and that was after the first two very rapid years of growth of the Reagan recovery. And the last of the Reagan-Bush years, 1992, saw it at only $68 thousand. The growth rate thus went from 3.0 to 0.7 to 1.6%/year. The run from 1992 to 2006 saw growth recover to 2.2%/year. But since 2006 it has been anemic at 1.0%/year, and that was before 2020’s COVID-19 plague. Worldwide growth has been faster than American over the past twenty years as other countries have been catching-up. But economic history warns us that this catching up is not necessarily durable, or reliable.

And this slowdown has been called the Great Stagnation <LINK> by the intelligent and reliable Tyler Cowen, and by many, many others <LINK>. The past two generations are the first time when the pace of global productivity growth has materially slowed. Perhaps we might find analogies with the Dark Age at the very start of the Iron Age—when in a half-century it appears as though every large city on or near the arc of the Mediterranean coast between Gaza and the Peloponnese was violently destroyed. Perhaps we might find analogies with the post-Antonine Dynasty repeated crises of and long-term decline of the Roman Empire. But we know too little about them for us to even claim that history rhymes here.

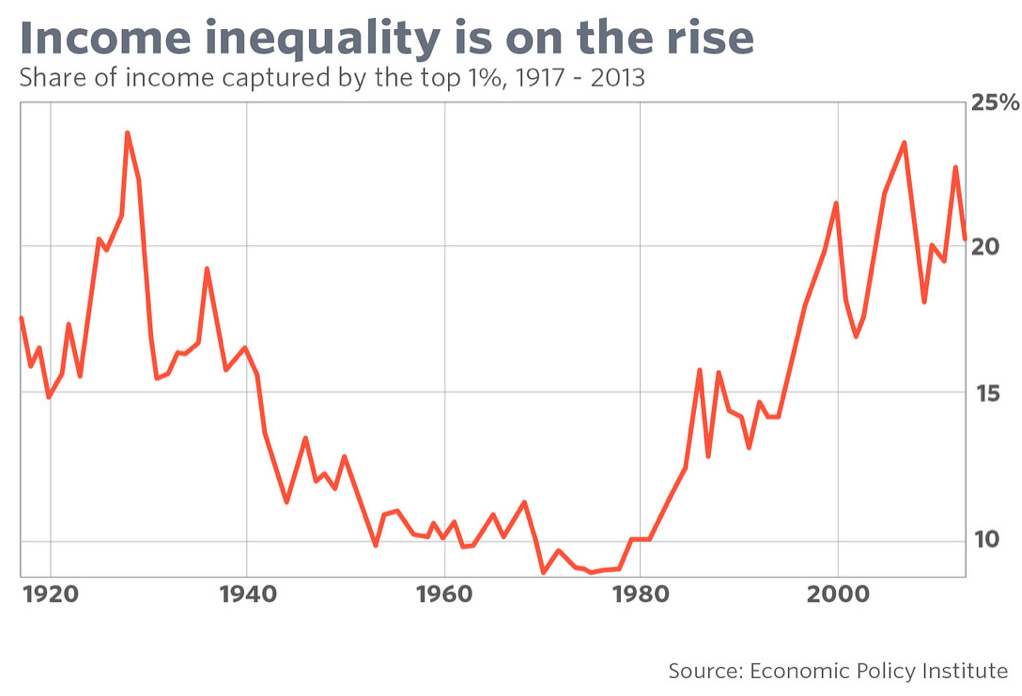

This age of the Great Stagnation has been marked by an extraordinary rise in wealth inequality. And that, in turn, triggered an extraordinary rise in demand for safe assets as the super-rich fear losing what they have much more than they wish to take advantage of opportunities for growth. And that, in turn, has triggered our cycles of high unemployment and disruptive financial speculation. And that, in turn, has triggered large scale belief that our government is no longer securing the rights of the people who count. And that, in turn, has led to the otherwise mysterious attractiveness of neo-fascism. The slowdown in growth from a faster earlier pace has itself been destabilizing to generations who feel like they have been cheated.

But now it is really looking as though this Great Stagnation is over.

Exceeding the 1%/year productivity growth rate of the past would be wonderful. Is hoping we can do so reasonable?

I believe that it is.

I was most impressed by Caleb Whitney’s piece on Cracks in the Great Stagnation <LINK>. rapid growth requires not just revolutionary technologies but revolutionary technologies that help in producing things in high demand so that they get widely deployed as well. He sees a future in which, perhaps:

VR/AR… become[s] the next consumer electronic platform with a whole suite of specialized productivity-enhancing features, similar to… computers and mobile phones… future vaccines… using… mRNA technique[s]… specialized AI manages to find 20 to 40% improvements to basically every informationally complex task… driverless cars/trains/trucks fulfill[ing] their promise and reshap[ing]… cities… geothermal or nuclear energy… clean energy… abundant… too cheap to meter, with all the economic applications downstream…

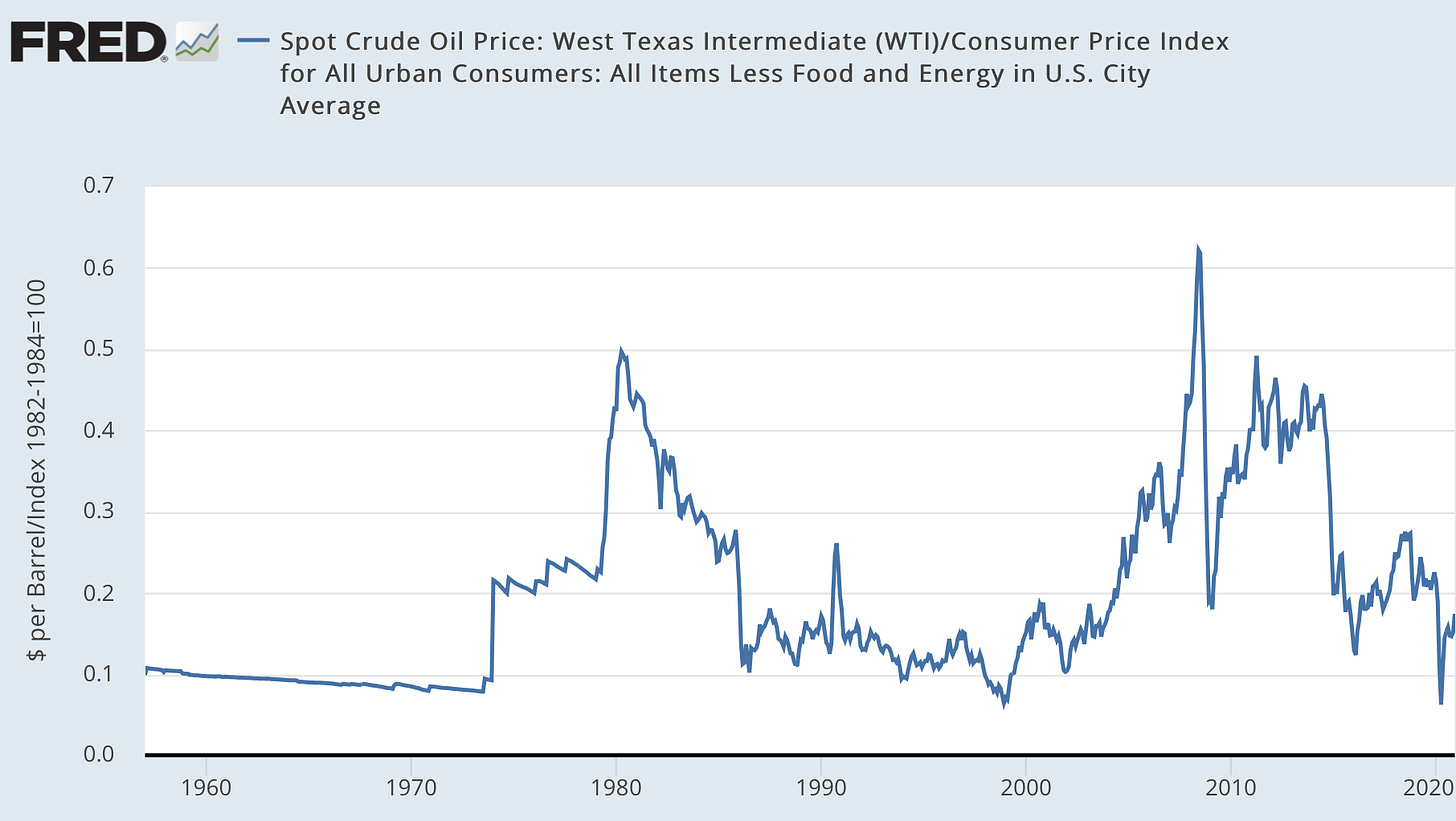

And I have been impressed by Noah Smith’s argument that our shift from 2% to 1% growth was mostly driven by our entering an age of energy-technology stagnation and energy-market disruption. As Smith quotes Bill Nordhaus <LINK>:

The productivity slowdown of the 1970s has survived three decades of scrutiny, conceptual refinements, and data revisions. The slowdown was primarily centered in those sectors that were most energy-intensive, were hardest hit by the energy shocks of the 1970s, and therefore had large output declines. In a sense, the energy shocks were the earthquake, and the industries with the largest slowdown were near the epicenter of the tectonic shifts in the economy…

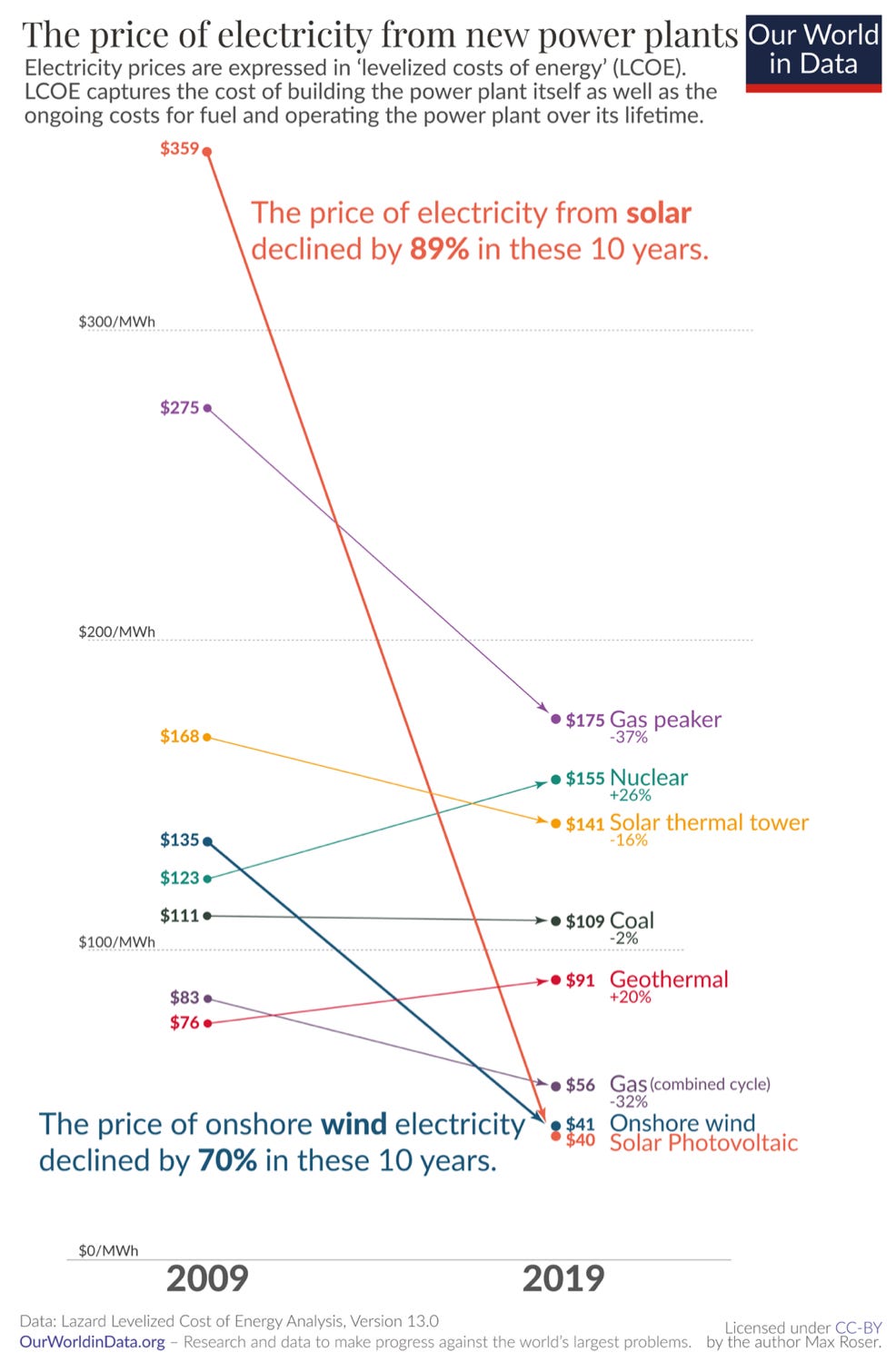

But with the loss of the salience of oil, Middle Eastern war and politics no longer have the power to generate global energy-market disruptions. And our era of energy-technology stagnation is now over. This from Max Roser’s Our World in Data <LINK>, may be the most important graph of the decade:

And another straw in the wind is the highly reliable and intelligent Tyler Cowen: What Might an End to the Great Stagnation Consist of? <LINK>. He sees:

Apple’s M1, GPT-3, DeepMind’s application of AI to protein folding, phase III for a credible malaria vaccine, a CRISPR/sickle cell cure, the possibility of a universal flu vaccine, mRNA vaccines, ongoing solar power progress, wonderful new batteries for electric vehicles, a possibly new method for Chinese fusion (?), Chinese photon quantum computing, and ongoing advances in space exploration…. Distanced work…. The Great Stagnation is over in the biomedical sciences. It is less obvious that the great stagnation is over more generally…

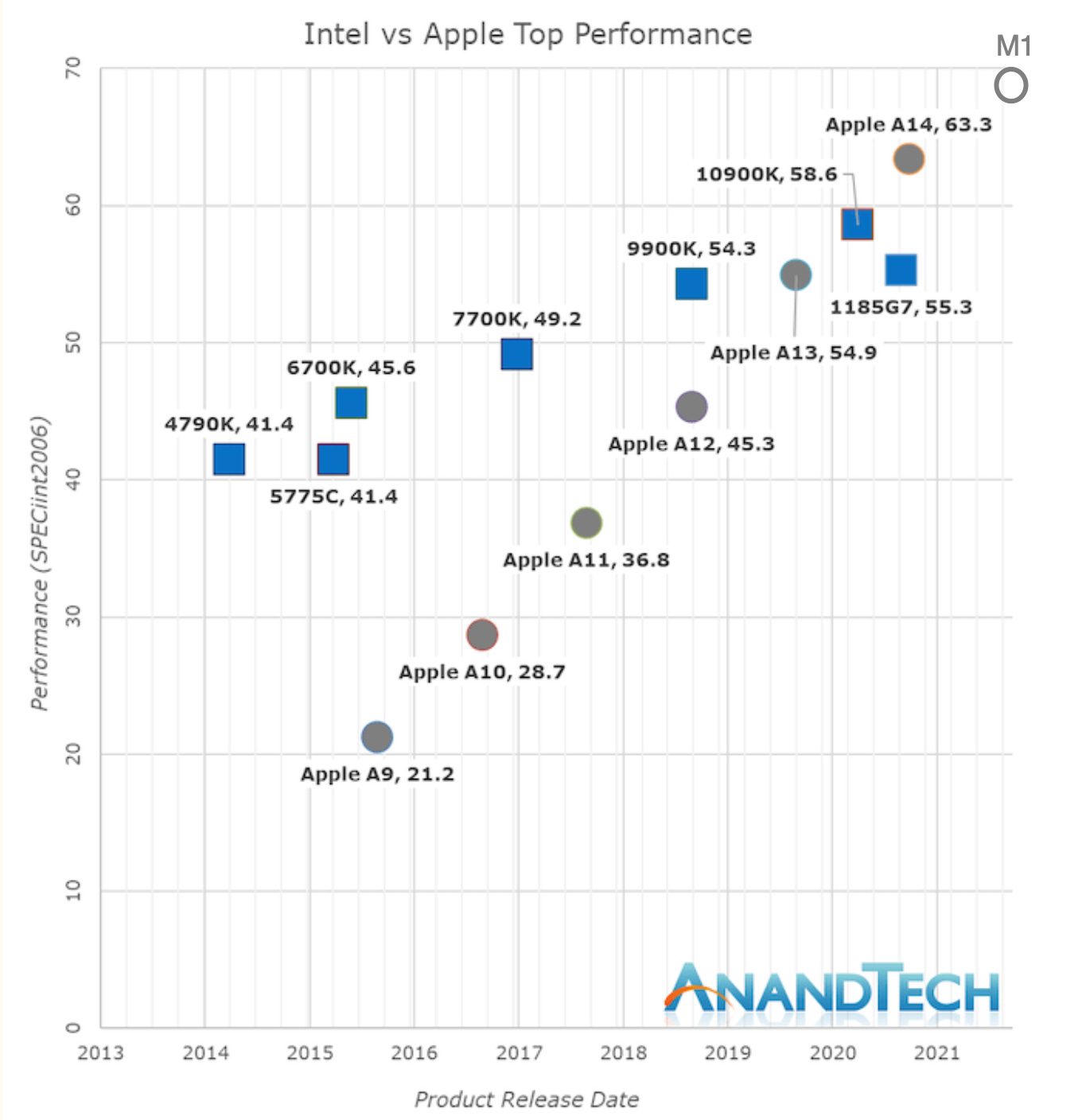

Note that the Apple M1 is here because it may mark a return to Moore’s Law-scale improvements in microprocessors. Apple has managed to quadruple the performance of its low-power CPUs in seven years, in a time in which Intel has barely managed 30% improvement:

And here is the kicker.

1.0%/year growth has been the “Great Stagnation” of the past decades. It is the pessimistic scenario. Yet 1%/year growth is wonderful in the sweep of historical perspective, even if it is small beer compared to the 2.2%/year growth of the post-1945 era. 1.0% is twice the pace of the industrial age and 25 times the pace of the agrarian age. 1.0% per year growth would not carry us to a world of $63 thousand average annual incomes come 2100 and $400 million in 2500; but it would carry us to a world of $26 thousand average global incomes from 2100—a bit more than half of today’s global north. And it would carry us to one of $145 thousand average global incomes in 2270, a world as much proportionately richer than ours as ours is richer than that of our pre-industrial ancestors.

$145 thousand annual incomes are not the absurd mind-blowing singularity levels of $400 million. We can imagine how all of humanity would manage to usefully spend such incomes because they are the incomes that some of us already do manage to spend, and that all of us see, as such incomes are pretty much those that support the reference lifestyle of modern American TV. Such a universal American upper-middle-class world would look to us like a society of abundance, and it would be, in the same way that the globe today would look like a society of abundance to a time traveler from our ancestors’ pre-industrial past. And 2270, 250 years from now, is not that far in the future. They are as far separated from us in time as we are from John and Abigail Smith Adams, and from Thomas and Sally Hemings Jefferson.

The future, indeed, is bright for humanity—if we can maintain the 1%/year average underlying rate of growth that seems to be our post-1970 new normal. And doing that is surely within our grasp, if we can organize ourselves to grasp it. And doing much better may well be very possible.

I’m Brad DeLong. This is the DeLongTODAY Briefing.