SUBSCRIBERS ONLY: Þis Year's Inflation: Skidmarks, Not Blowouts—DRAFT

A draft of my next column for Project Syndicate...

"U.S. inflation picks up in March, with core prices rising 0.4%, headline rate up 2.3% for year”... “Runaway inflation is the biggest risk facing investors, Leuthold’s Jim Paulsen warns”… "Bitcoin’s time to shine is fast approaching: As fears of inflation rise, people are debating Bitcoin's validity as... a kind of inflation hedge"... "Inflation Is Coming. 5 Stocks to Buy Now"... "5 Experts on How Surging Inflation Will Impact Stocks This Year"... "Inflation Got You Down? Here's Two Pick-Me-Ups: Inflation is an ever-working force, but it works quietly. Today, we look at two ideas to achieve more protection"... "7 ETFs for Inflation: There is a lot of talk about inflation in 2021 as fears of high government spending creep in and the recent rebound in prices…”—those were the headlines that confronted me on Friday morning.

And yet, there was also: "U.S. Treasury yields hold ground even as inflation picks up…”

A 33.4% annualized U.S. GDP growth rate for the third quarter of 2020; a 4.3% growth rate for the fourth quarter; a 6.4% rate for the first quarter of 2021; and we are now ⅓ of the way through the second quarter—which means that ⅔ of the economic transactions that will be aggregated into the second-quarter growth rate have already happened, even though we do not yet have a read on them—in which the growth rate will be at least 8% and perhaps significantly higher. That means that by the third quarter—the fourth quarter at the latest—the U.S. economy will, in aggregate, have fully recovered its production level from the coronavirus plague recession.

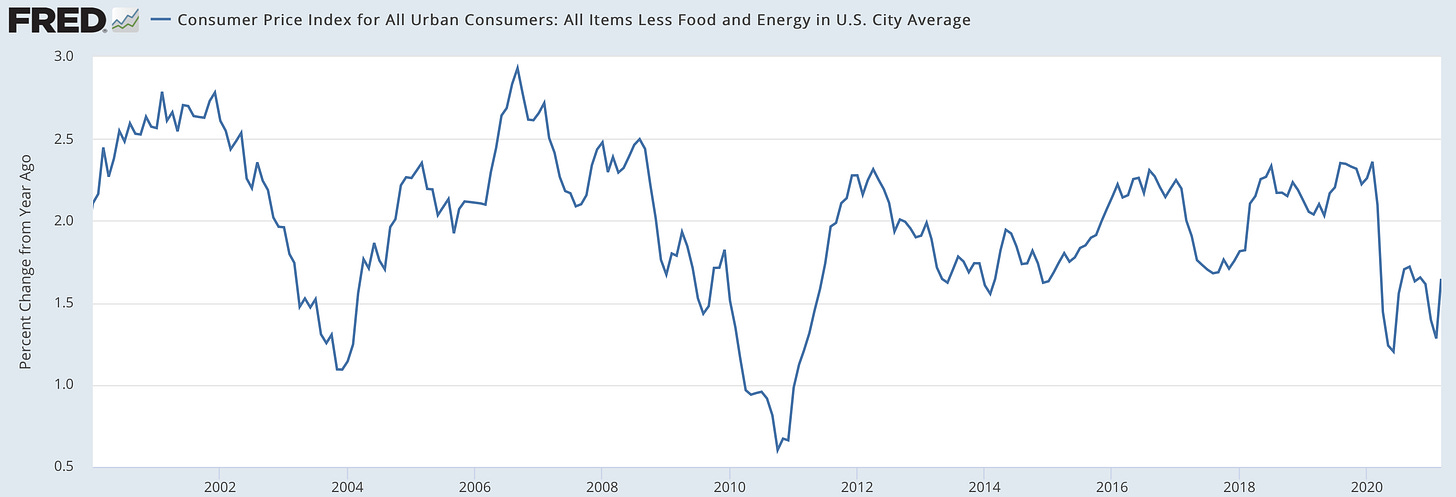

And we already have, this past month in the U.S., core inflation of 0.4%-points: nearly a 5% annual inflation rate if this pace were to continue for the next year. Looking backwards, over the past 12 months core inflation has been 2.3% as measured by the CPI—only a whisker below the Federal Reserve’s 2.0%/2.5% PCE/CPI target.

Yes: We are going to have some inflation this year. Its most important determinant, however, is not “overheating” in the economy as a whole. The amount by which production is going to exceed the level of potential output in the U.S. economy for year 2021 as a whole will be less than zero. And, as the Federal Reserve makes clear with every press conference and statement, it will not allow any wage-price spiral to embed itself in expectations of future inflation. The outlook for 2021 and beyond is that inflation will bounce around—not, as it has for the past thirteen years, average below—the Federal Reserve’s targets.

The U.S. economy is emerging from the coronavirus plague year recession with a very different intersectoral structural balance than it had back in 2019. Durable goods spending right now is running at 1.7%-points of GDP above its 2019 share. Housing construction spending right now is running at 0.5%-points above its 2019 share. On the flip side, business spending on structures and consumer spending on energy are both running at 0.5%-points below their 2019 shares. And services—hospitality, recreation, and transportation—are collectively running at 2.2%-points below their 2019 share.

That is going to be the most important determinant of inflation this year. By the end of this year we will have an economy that will have perhaps 4% of workers not just in different jobs but in different sectors than they were before the coronavirus plague struck. We have an economy in which business very rarely cut nominal wages. That means that to pull workers out of sectors in which demand is relatively slack into those in which demand is intense will require firms to offer wage increases to incentivize workers to move sectors.

How much inflation? We do not know: we have not seen this happen before. We will learn a lot about the short-run intersectoral elasticity of employment supply this year.

Should we be upset at this inflation this year? No. It is an essential part of rebalancing the economy. Real production, real wages, and real asset values will all be higher because of this year’s inflation. And it will still leave the price level far below what it would have been had the Federal Reserve managed to successfully hit its inflation targets since the start of the Great Recession.

Are the 1970s coming again? Highly, highly unlikely. It required a perfect storm of shocks, and a Federal Reserve under Arthur Burns that was greatly conflicted and confused, to generate the 1970s. The Federal Reserve is very different now. And the perfect storm of repeated shocks—from the productivity growth slowdown to the Iranian Revolution and much, much more—is absent.

You cannot rejoin the highway at speed without leaving rubber tracks on the road. But that does not mean you have had a blowout.

810 words

(Remember: You can subscribe to this… weblog-like newsletter… here:

There’s a free email list. There’s a paid-subscription list with (at the moment, only a few) extras too.)

73