Elon Musk Today Claims Wealth Equal to 2.5 Million Times Median Household Income; His Predecessor Daniel Ludwig in 1982 Claimed Only 85 Thousand Times

Yes, Virginia: income and wealth inequality has grown in the Neoliberal Age—and by a lot...

Venkatesh Rao writes the Ribbonfarm Studio SubStack:

Today he has a question for me:

The question is about: Auten, Gerald, & David Splinter. Forthcoming. “Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends.” Journal of Political Economy. <https://www.davidsplinter.com/AutenSplinter-Tax_Data_and_Inequality.pdf>. The abstract is:

Concerns about income inequality emphasize the importance of accurate income measures. Estimates of top income shares based only on individual tax returns are biased by tax-base changes, social changes, and missing income sources. This paper addresses these shortcomings and presents new estimates of the distribution of national income since 1960. Our analysis of pre-tax income shows that top income shares are lower and have increased less since 1980 than other studies using tax data. In addition, increasing government transfers and tax progressivity have resulted in rising real incomes for all income groups and little change in after-tax top income shares…

Here is my take:

In the US in 1982, the top of the first Forbes 400 list was Daniel Ludwig with nominal $2 billion. That was 85,000 times the then-median nominal family income of $23,430.

In 2023, the top of the Forbes 400 was Elon Musk with nominal $251 billion. That was 2,500,000 times the now-median nominal family income of $98,705.

Now: ($251B/$99K)/($2B/$23K) = 29.8

How the f*** is the ratio of the top to the median to explode by a factor of 30 while the Auten/Splinter measures show “little change in after-tax top income shares”?

Until someone comes up with an explanation for how this could be—how a 30x multiplication since 1982 of the ratio of the top of the Forbes 400 to median household income is consistent with “top income shares are lower and have increased less since 1980 than other studies… increasing government transfers and tax progressivity have resulted in… little change in after-tax top income shares…”—I am going to presume the chances are 99% that there are big things wrong in the numbers in Auten/Splinter.

Thus I am going to presume that whenever anybody points out something wrong with their calculations and Auten/Splinter disagree, odds are very high that Auten/Splinter are wrong.

(And, no, it is not that the first-order statistic of the wealth distribution is weirdly and massively noisy as an inequality measure: the 400th member of the Forbes 400 in 1982 had a wealth of $75 million; the 400th member of the Forbes 400 in 2023 has a wealth of $2.9 billion—that is a 10-fold rather than a 30-fold relative amplification of the ratio to median family income, but it is a 10-fold amplification.)

Of course, “income”, “wealth”, and “inequality” are extremely fraught as concepts and measures. I think the literature needs improvement, and a division between personal material standard of living on the one hand, and social power to command and direct human effort on the other. And income and wealth are not really the right measures for those concepts—not that I know, mind you, what the right measures are.

And if you do want to get into the measurement and conceptualization weeds, you can start reading through:

Auten, Gerald, & David Splinter. Forthcoming. “Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends.” Journal of Political Economy. <https://www.davidsplinter.com/AutenSplinter-Tax_Data_and_Inequality.pdf>.

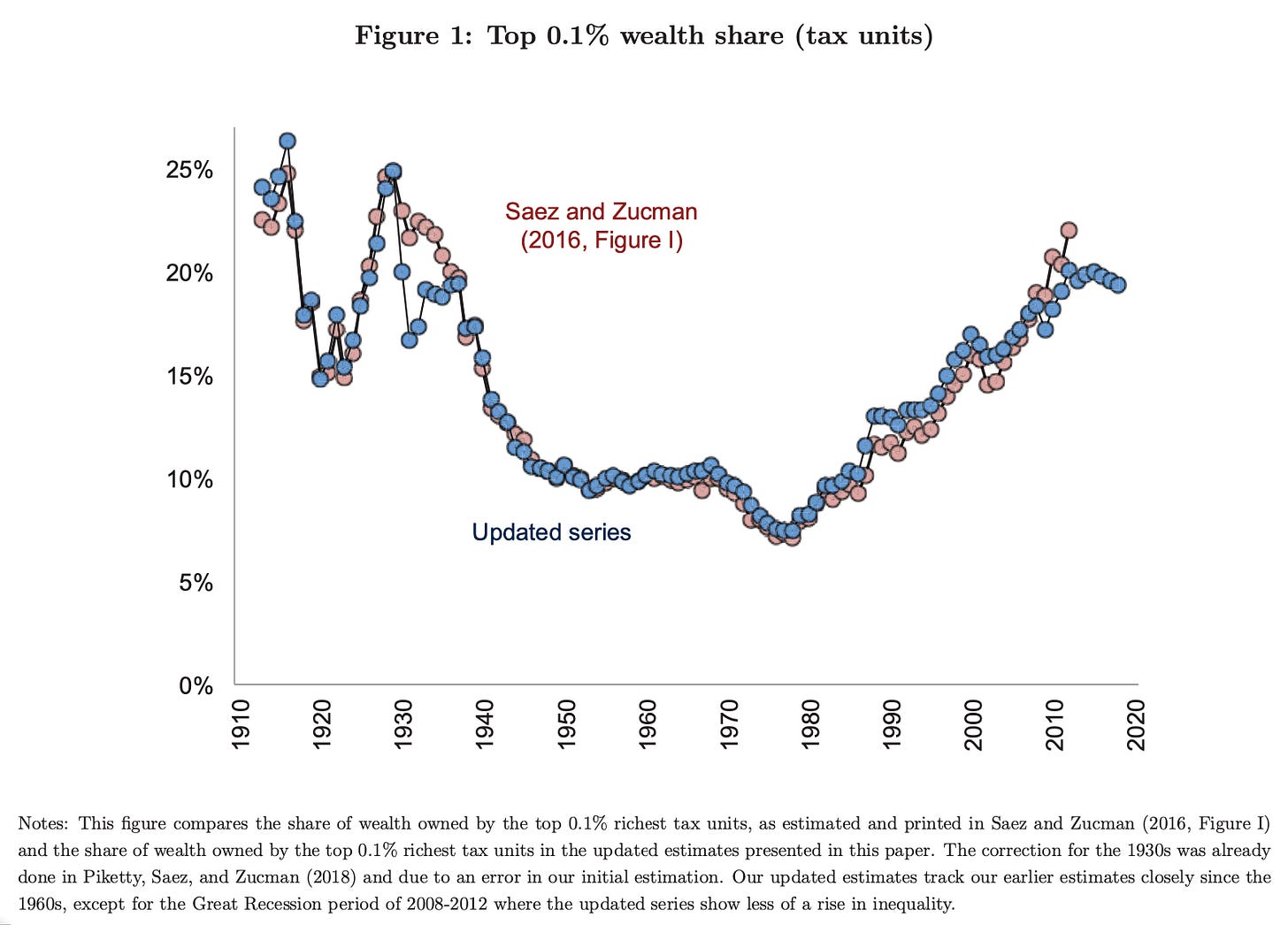

Saez, Emmanuel, & Gabriel Zucman. 2020. "Trends In US Income & Wealth Inequality: Revising After The Revisionists”. National Bureau of Economic Research. [Accessed November 29, 2023]. <https://data.nber.org/data-appendix/w27921/Splinter2020-SaezZucmanReply3.pdf>.

Saez, Emmanuel, & Gabriel Zucman. 2020. “The Rise of Income and Wealth Inequality in America: Evidence from Distributional Macroeconomic Accounts.” Journal of Economic Perspectives 34, no. 4 (Fall 2020): 3-26.<https://www.aeaweb.org/articles?id=10.1257/jep.34.4.3>.

Smith, Matthew, Danny Yagan, Owen Zidar, & Eric Zwick. 2019. “Capitalists in the Twenty-first Century.” Quarterly Journal of Economics 134, no. 4: 1675-1745. <https://academic.oup.com/qje/article-abstract/134/4/1675/5542244>.

Smith, Matthew, Owen Zidar, & Eric Zwick. 2020. “Top Wealth in America: New Estimates and Implications for Taxing the Rich.” Working Paper, April 24, 2020 revision. <https://www.nber.org/papers/w29374>.

Splinter, David. 2020. "Reply to Saez and Zucman's Comment on 'Billionaires' Wealth, Inequality, and Taxes'." National Bureau of Economic Research. [Accessed November 29, 2023]. <https://data.nber.org/data-appendix/w27921/Splinter2020-SaezZucmanReply3.pdf>.

I know Saez and Zucman: they are focused on getting the right numbers, first because it is what you do, and second because if they report numbers that people conclude are “too high” they greatly undermine their entire research project and reputation. I do not know Auten and Splinter, but I do not get the same “let’s get this right” vibe from their work. It seems more “let’s throw this thing that minimizes inequality against the wall and see if it sticks”. But my judgment could be wrong.

I can't find the argument about the present value of pension payments that Tom Barson is referring to. I'm not going to spend any more time on it, because anyway, the Auten & Splinter paper is about income, not wealth.

Saez and Zucman have converged to a degree to Auten and Splinter on income distribution, but there remains a significant disparity and an argument about the reasons for that disparity. As nearly as I can make out, about half the difference comes from different assumptions about how unreported business income is distributed. Saez and Zucman assume that unreported business income is distributed across income groups in the same way as reported business income. Auten and Splinter assume that poor business owners hide more business income, and that therefore unreported business income accrues disproportionately to lower income groups. I have to say that I find that assumption implausible, but I don't know the reasoning behind it.

I need better numbers for my economist stand up :

"GDP is 10 times what is was 20 years ago, so is your family 10 times richer? DID ANYONE IN THIS ROOM GET A TRICKLE DOWN CHECK?