Discover more from Brad DeLong's Grasping Reality

FIRST: Alan Blinder’s Monetary & Fiscal History:

Let me start this week off by recommending the very, very nice: Alan Blinder: A Monetary and Fiscal History of the United States, 1961-2021 <https://www.google.com/books/edition/A_Monetary_and_Fiscal_History_of_the_Uni/vM5qEAAAQBAJ>. It is all about how the U.S. government has tried to manage the country’s macroeconomy in attempting to achieve price stability, full employment, financial robustness, and healthy investment. The big lesson is that there is no big lesson. There is no linear development. There is no (or not much) “progress” in figuring out how to manage economies for macroeconomic stability. Rather, as Blinder writes:

wheels within wheels, spinning endlessly in time and space… [with] certain themes… waxing and waning… monetary versus fiscal… the intellectual realm… the world of practical policy making… the repeated ascendance and descendance of Keynesianism…

The book is a worthy successor to Herb Stein’s The Fiscal Revolution in America: Policy in Pursuit of Reality <https://www.amazon.com/Fiscal-Revolution-America-Pursuit-Reality/dp/0844739375>, broader in scope and later in time, but also more political-intellectual and less administrative-technocratic. Anyone wanting to know the history of fiscal and monetary policy in the United States needs to read them both.

A few passages especially struck my eye:

I entered graduate school in the fall of 1967…. The view… was that while Friedman and Phelps had made convincing theoretical cases that α should be equal to 1, the empirical evidence virtually screamed out that α < 1. It was one of those stark cases in which theory and empirics clashed sharply. As Groucho Marx memorably asked, “Who are ya gonna believe, me or your own eyes?” The view at MIT, as I recall, was go with your own eyes. Meanwhile… Thomas Sargen… was demonstrating—in a beautiful five-page paper that was underappreciated at the time—that the debate over the estimated parameter α was beside the point…

And:

Late in November 1965, [Fed Chair] Martin warned… Johnson’s treasury secretary, that the Fed might vote to raise the discount rate…. Johnson replied ominously that he was “prepared to be Jackson if he [Martin] wants to be Biddle.”… But Martin, though warning his Fed colleagues of the potential threat to their independence, did not hold back. The December discount rate hike passed by a 4–3 vote, which meant that Martin had cast the deciding vote. A livid President Johnson, who was recuperating from surgery at his Texas ranch at the time, summoned the Fed chair down to banks of the Pedernales…. The Fed chair was apparently unmoved, telling Johnson that the president and the central bank had different jobs to do…. No fiscal dominance there. The president… nominated him for yet another term a year later…

And:

[Monetarism] rose to prominence on a combination of some hotly disputed scholarly work, Milton Friedman’s singular brilliance and skill in debate, and perhaps most important the rise of inflation in the late 1960s (due to excess demand) and the early 1970s (due mostly to the supply shocks discussed in chapter 5). Keynesianism was unjustly tagged as inherently “inflationary,” and monetarism stepped forward as the replacement…. [It] died… only after monetarism had registered substantial influence on policy formulation in the United States, the United Kingdom, Germany, and elsewhere. The policy debate was not, as Friedman and others sometimes claimed, over whether monetary policy mattered. It was about whether fiscal policy not accommodated by monetary policy mattered. As it turns out, it did…

And:

New classical economics, with this “policy ineffectiveness” result, conquered vast swaths of academia in the 1970s and 1980s, but it never developed much of a following among central bankers… [who] saw that both inflation and real economies were crushed by Margaret Thatcher’s excruciatingly tight money in the United Kingdom and by Volcker’s excruciatingly tight money in the United States. No real effects?…

And:

Clinton understood very well that whether his deficit reduction gamble would succeed or fail hung on the behavior of the Federal Reserve under its very Republican chair, Alan Greenspan. Perhaps even more frightening, it hung on the reactions of a bunch of bond traders in New York, London, and Tokyo. Both delivered…. The U.S. economy performed splendidly…. What most surprised mainstream economists was that the sizable fiscal contraction (without any monetary easing) seemed not to slow the economy at all. Rather, it precipitated a strong bond market rally that overwhelmed the fiscal contraction. Now, that was something new…

And:

By about 1972 the strong consensus among macroeconomists was that neither monetary nor conventional forms of fiscal policy had permanent effects on employment or output. There was a short-run… no long-run trade-off…. Expansionary monetary or fiscal policies could put the economy on a short-term “sugar high.” But the sugar would dissolve, leaving inflation somewhat higher in its wake. That quickly became the canonical view in [élite high-status] academia, and it still is…

And:

It’s an overused and sometimes abused adjective, my macroeconomic framework is decidedly Keynesian. How could it be otherwise if you want to make sense of history? Rival doctrines to Keynesianism have come and gone…. Competitors… either fell of their own weight… or saw their most useful aspects incorporated…. Keynesian economics circa 2021 differs in many ways from the theory… in 1936, but… as Mark Twain might have said, it rhymes…

And:

Friedman and David Meiselman’s (1963) lengthy… “The Relative Stability of Monetary Velocity and the Investment Multiplier in the United States, 1897–1958”…. They asked which was the better predictor of consumer spending (C): what we now call M2 or what they classified as “autonomous expenditure” (A), conveniently eliding the facts that M had clearly not been the Fed’s policy instrument…. Their basic methodology was to run statistical horse races between M and A via univariate regressions… evidence… simplistic… not very convincing—unless you were already convinced…

And:

The old-fashioned Phillips curve did indeed fall apart later in the 1970s. Why?… Not for Lucas-Sargent reasons… [but] because [of] severe adverse supply shocks…

And:

Greenspan saw that inflation was not rising. Why not? He hypothesized that rapid productivity growth from New Economy innovations was pushing potential GDP up faster than people realized. It was a hunch at first, but the data subsequently vindicated his iconoclastic view. Due largely to this “great call,” the Fed let the good times roll into the late 1990s…

If Blinder does have a single bottom line, it is that:

Fiscal policy decisions will continue to be made largely on political grounds while monetary policy decisions will continue to turn on technocratic, economic considerations. The twain will not soon meet…

I would add three things:

(1) Monetary policymakers permanently tarnish their reputations for all time when they make their decisions on political grounds. Arthur Burns’s reputation did not survive his excessive concern for Nixon’s reelection in 1972. And, as for Alan Greenspan:

During the congressional debate in 2001, Greenspan tarnished his gold-plated reputation by seeming to endorse the Bush tax cuts. His thinly disguised advocacy not only crossed the line between monetary and fiscal policy but also struck many people as way too political for the Federal Reserve. Democrats were naturally displeased. But Greenspan’s endorsement of the Bush tax cuts probably didn’t hurt his chances for reappointment by Bush in 2004…

(2) Proper demand-management-and-growth fiscal policy is incredibly complex. The appropriate rules-of-thumb shift from decade to decade in ways that it is impossible for the political system to comprehend in anything like real time. And this is a huge problem.

(3) Macroeconomic theories and doctrines turn out to be of appallingly little effective use, at least if we focus on the role played by the élite academic macroeconomics community.

At the best of times, those policymakers who took academic élite macroeconomists seriously and attempted to rely on cutting-edge macroeconomic theory to guide policy found themselves skating not to where the puck was going to be, not even to where the puck was, but to where the puck had been in the past. Cutting-edge élite theories were crystalized historical analogies from the past generation adulterated by ideologies—and you had better hope that the ideological adulteration was like oregano, rather than peyote. Such theories were of little use in a world in which changing technology-driven forces-of-production underpinnings had profoundly changed how the economy worked.

At the worst of times—when RBC theorists or those who demanded that everything be hammered into the form of a forward-looking “microfounded” DSGE model—those who attempted to rely on cutting-edge macroeconomic theory found that it told them to take off their skates entirely and exit the rink.

Highly, highly recommended.

One Image: Of þe Rings of Power & þe Second Age:

On Amazon Prime…

Must-Watch: Alan Blinder & Michael Shermer:

Other Things Þt Went Whizzing by…

Very Briefly Noted:

The takeover of the Republican Party by election result-deniers is the most important of the many crises facing America today: Steve Schmidt: The country is edging towards an abyss: ‘Kari Lake… [if] elected… will become a central player in an ongoing conspiracy to topple American democracy…. She has all but pledged to assault the integrity of the next presidential election…

As I said, the takeover of the Republican Party by election result-deniers is the most important of the many crises facing America today: Heather Cox Richardson: October 16, 2022: ‘Arizona Republican nominee for governor Kari Lake refused to say that she would accept the results of the upcoming election—unless she wins… an astonishing rejection of the whole premise on which this nation was founded: that voters have the right to choose their leaders…

The difference between the Trumpists and fascists on the one hand and garden-variety “Caesarians” on the other is the glorification of irrationality and will—Louis Bonaparte, Andrew Jackson, Theodore Roosevelt, indeed, C. Julius Caesar understood means, ends, and rationality: Damon Linker: The Ever-More Incoherent GOP: ‘Intellectuals are especially ill-suited to grasping the character of what’s going on in politics… because intellectuals aspire to coherence…

My view: shaking things up will either kill Twitter or improve it, and so transferring it to a chaos monkey is the best way to get us out of what is a bad local equilibrium: Kurt Wagner: Twitter Faces Only Bad Outcomes If the $44 Billion Musk Deal Closes: ‘The company has been damaged by the drama over the deal, and things look bumpy if it goes through…

We cannot have nice things unless we power their production and utilization, hopefully in a green way: Brian Katulis: Energy security is central to an abundance agenda…

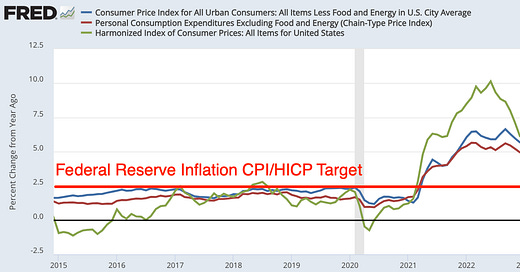

Another Federal Reserve official who evades the opportunity to say “nothing we have done yet has affected production, employment, or prices”: Kristine Aquino: Five Things You Need to Know to Start Your Day: ‘Jumbo hike? St. Louis Fed President James Bullard left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings in November and December, while saying it was too soon to make that call…

No, YIMBYism is not just a boon to developers: Addison Del Mastro: A D Who?: ‘When you let homeowners be small developers, they do it: As a test case of the YIMBY agenda, California's 2016 legalization of ADUs is almost too perfect—besides the fact that the homes are in literal backyards, it has been a runaway success, permitting ~60,000 new homes in five years…

How is this feasible given the likely continued evolution of variants?: Linda Lew: China President Xi Jinping Doubles Down on Covid Zero…

I confess this was not something I had on my Biden-administration bingo card: Noah Millman: The China Syndrome: ‘The Biden Administration’s dramatic moves to try to hobble the development of China’s advanced semiconductor industry…. A rubicon has been crossed that cannot easily be crossed back. This is not just a decoupling, but virtually a declaration of economic war…

As Dan Wang stresses, things like this do align the Chinese tech community 100% with the government: Irene Zhang: China Responds to Chip Export Controls: ‘“We cannot return to the old ways”…. Official statements are focused on rebuking… Biden…. [The] wolf-warrior stream… sound[s] almost tepid…. In this moment its in no-one’s interest in China to highlight a setback for a core Party goal…

¶s:

Not a Trump—not even the force of personality of an Andrew Jackson or a C. Julius Cæsar—but, rather, a Louis Bonaparte with modern propaganda tools at the head of not a 19th but rather a 21st century administrative machine. The tides of history were, however, flowing in Louis Bonaparte’s way from 1848 to 1870. It is unclear that Xi Jinping will be as lucky:

Noah Smith: Xi Jinping, forever: ‘In each case—Zero Covid, aggressive diplomacy, tech crackdowns, the crushing of Hong Kong—a failure of outcome is presented as a triumph of will. As long as a unified China stood strong and acted tough, success has been achieved, despite any negative economic and diplomatic consequences. Beyond obvious screw-ups, Xi has simply changed the character of Chinese society. Acquaintances who lived in China during the fast-growth Hu Jintao years, or even during the early years of Xi’s rule, recall a China full of hope and energy—one that seemed like it was opening up economically and culturally, even if it not politically…. That China is gone now. Chinese people realize this, and I think Americans are just starting to realize it. Xi Jinping crushed that China—not with tanks, but with tech-industry crackdowns, with restrictions on TV idols and video games, with campaigns against Western, Japanese, and Korean influence, with crackdowns on the VPN services that Chinese people had used to access the global internet, with steadily increasing levels of mass surveillance and social credit systems, with increased communist party presence at every level of life, and now with Zero Covid.

Some are saying that Xi’s ascendance represents a return to China’s old imperial system, or a reprise of Mao. But I see something a bit different—a nostalgic Baby Boomer kicking against modernity and yearning for a semi-imagined past greatness. This reminds me a lot of Donald Trump—and like Xi, Trump is a guy who’s proven adept at bullying a political party to obey and worship him. In fact, my ability to see through Xi’s veneer of competence was really just pattern-matching—I recognized a certain type of strutting, nostalgic, domineering old guy. The big difference, of course, is that the GOP isn’t a pervasive bureaucratic oligarchy that has given itself quasi-absolute power over business and society. A Trump-type figure in China thus commands much more power than in America…

This I question: America accepted a role as Britain's junior partner from 1865 on up until 1943, and benefited anonymously from it. Why would not wise Chinese leaders seek to do the same? The answer, I think, is that, from Deng Xiaoping on they did—until Xi Jinping and the coming of the wolf warriors. The question is why Xi Jinping’s China became Wilhelmine—is attempting to emulate the geopolitical and economic strategies of Imperial Germany after the fall of Bismarck. Is it just so that the Communist Party of China can, like the Prussian cabbage-squire bureaucrat-officer aristocracy, demonstrate that it does have a viable social role?

Noah Millman: Why China Didn’t Liberalize: ‘The CCP has successfully embedded itself in Chinese private enterprise, to the point that upward social mobility continues to depend on support from the party. The internet and other modern communications technologies that many hoped would democratize information and thereby limit state power have massively increased the party’s capacity for surveillance…. I suspect that an underrated factor has to do with America’s execution of the “security component” of its engagement strategy. The expansion of NATO into Eastern Europe, the NATO military operation during the Kosovo War, and America’s wars in Iraq and Libya were undoubtedly alarming…. The mere fact that the United States was championing democracy and liberalism meant that those political ideals came to be identified with American leadership…. The sheer scale of China’s potential power, moreover, made it especially unrealistic that the country would accept a spot as America’s junior partner…. Why would such a powerful country ever be satisfied with an American-led global order? And if they would not, why would we assume they would willingly bring their political system into line with our own?…

Yes. U.S. democracy as we know it may well die over the next four years. Each recurrence of the Gingrich Disease is worse and worse:

Aaron Rupar: ‘Kari Lake went on CNN on Sunday and acknowledged an ugly truth about Trumpism — it only accepts elections insofar as Trumpers win them. And when one of the major parties in a two party system turns against democracy, every election cycle is an existential threat. Lake is anything but a fringe character. The TV news anchor-turned-Arizona Republican governor hopeful is probably the closest thing MAGA has to a rising star. Seeing her on TV, you can understand why Trump loves her—she’s clearly a skilled and polished communicator. But just below the hazy filters she uses for her cable hits is deep adherence to the lie that Trump had the 2020 election stolen from him. She’s even said that had she been governor in 2020, she would’ve refused to certify Biden’s victory…

“Techno-serfdom” does not capture it. But an economic world in which the sources of value are primarily intellectual property plus the channels through which people’s attention focuses are accustomed to move is not one in which economists’ market-optimality theorems hold:

John Quiggin: Capitalism without capital doesn’t work: The future of the information (non) economy: ‘In an information economy, the relationship between investment, production and profit, central to capitalism, no longer works…. To the extent that innovation and productive growth arise from

activities that are pursued primarily on the basis non-economic motives, the link between incentives and outcomes is weakened. This in turn undermines the rationale for policies aimed at sharpening incentives…. Haskel and… Westlake… presented a relatively optimistic view of a market economy in which “intangible capital” plays a central role. But… the real intangible here is likely to be monopoly power, generated either by intellectual property laws or control over platforms…

The next AI frontier is clearly going to be your own personal read-and-summarize system:

John Quiggin: AI is coming for bullsh-t jobs: ‘Jasper… has the… goal of producing advertising copy, blog posts and so on. Jasper clearly won’t pass a Turing test if you ask for anything complex, but it is very good for its intended purpose: turning out text that looks as if a human wrote it. This has big implications for a large category of jobs…. That’s not likely to create mass unemployment any time soon. But it will mean that… routine copywriting will be done much faster, by writers who have the skills to give programs like Jasper the right prompts, and then to touch up the final output…. Lots of middle management jobs, for example, involve writing memos and reports justifying one corporate decision or another…. AI can distil the essence well enough to mimic the style. After that, it’s just a matter of fitting the verbiage around the desired conclusion…

The China Syndrome link is confusing ("you must remember this"). Better is

https://gideons.substack.com/i/78837592/the-china-syndrome

Katulllis:

A strange embrace of “drill, baby, drill” on the left.”

Hope springs eternal that leftists (and rightists) will embrace that restrictions on the demand for fossil fuels, not the production and transport of fossil fuels as the way to deal with the accumulation of CO2 in the atmosphere

"The not-so-savvy foreign interference in America’s politics/energy security"

Precisely because the US is a net fossil fuel exporter the Saudi move is only political. There are many more users of gasoline than shareholders of fossil fuel producing firms although the gains of the latter in the aggregates should exceed costs to the former. [We are not donating the LNG shipped to Europe.] But as for being anti-Saudi, guilty as charged and was even before they chopped up one of our journalists and he Wahabis formed the consciences of Osama ben Laden and the 9/11 murderers.

“America needs to take steps to facilitate the energy transition in order to respond to the increasing threats posed by climate change for sure, but if it does so in a way that hurts working Americans, it could end up stalling the transition.”

In other words, a rebated tax on net CO2 and methane emissions even as we give gas frackers the Medal of Freedom for making solar and wind power cheaper and mitigating the discomfort of Europeans this winter.