HOISTED FROM 2018: Why Trumpists & Ex-Trumpists Should Just Sit Down & Shut Up

Two Differences Between a Clinton Administration and a Trump Administration... (December 11, 2018)

<https://www.bradford-delong.com/2018/12/clinton-administration-vis-trump-administration.html>

Here is one difference between a Clinton Administration and a Trump Administration. The Clinton administration of 1993-2001 sold its 1993 deficit-reduction reconciliation bill as a phased-in five-year plan to boost American economic growth and American incomes. By raising taxes and by cutting government spending relative to the then-projected baseline—half of the cuts coming from the military, half of the cuts coming from the social insurance programs—Clinton sought to redirect 1%-point of GDP's worth of funds each year for five consecutive years from funding the government debt to funding productive private investment.

Over the five years as the program was being phased in, this boost in investment was projected by the administration—i.e., by me and others—to be a supply-side economic stimulus raising the rate of growth of potential output and boosting the rate of economic growth and thus of American incomes by 0.2%-points per year. Thereafter, once it was fully phased in, the program was projected by the administration—i.e., by me and others—to boost investment relative to the baseline by 4%-points of national product and so boost the rate of potential output growth and thus of American incomes relative to bas3eline by 0.4%-points per year. The program was supposed to make the U.S. 1% richer after 5 years; 3% richer after 10 years; 5% richer after 15 years, and so on.

It worked. Investment grew. Growth accelerated. Income rose relative to the baseline.

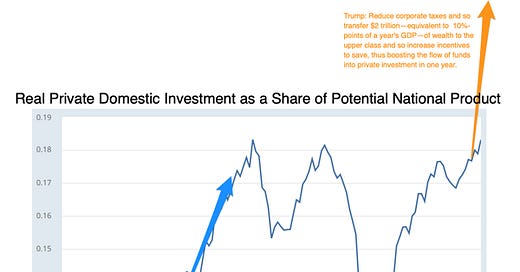

The Trump administration sold its 2017 tax-cut reconciliation bill as a plan to boost American growth and American incomes by reducing, corporate taxes, transferring $2 trillion—equivalent to 10%-points of a year's GDP—of wealth to the upper class, thus increase incentives to save, and boost the flow of funds into private investment in one year. In the year after the tax cut was passed the program was projected to boost investment relative to baseline by 4%-points of national product and so boost the rate of potential output growth and thus of American incomes relative to baseline by 0.4%-points per year not by demand-side stimulus boosting spending and reducing unemployment but by supply-side stimulus boosting investment in America and America's capital stock. The program was supposed to make the U.S. 1% richer after 5 years; 3% richer after 10 years; 5% richer after 15 years, and so on.

Where is this extra 4%-points of investment spending as a share of national income and product? Nowhere. The investmen share did not leap upward. It is not leaping upward. It will not leap upward. Relative to baseline, incomes are not boosted by any supply-side stimulus raising potential output.

Here is another difference between the Clinton administration and the Trump administration—a difference in how their economists behave. Clinton administration economists eagerly watched to see whether the plan was in fact working—whether incomes and growth were increasing, and whether the increases relative to previously-projected baselines were in line with the ex ante modeling predictions made. Trumpists are now watching their ex ante modeling predictions fail, catastrophically. Are they curious? Are they writing about why things are different than they had projected? No.

Do we have anything from Barro, Boskin, Cogan, Holtz-Eakin, Hubbard, Lindsey, Rosen, Shultz, and Taylor <https://tinyurl.com/20181209b-delong> saying why it is turning out not to be the case that the supply-side investment-driven boost relative to baseline from the tax cut would be "3% to 4%... if achieved over a decade, the... increase in... annual... growth would be about 0.4%..."? No. Do we have anything explaining why reality has disagreed from Hubbard, Lindsay, Holtz-Eakin, and a fourth (who is either Lazear or Mankiw) who forecast privately, according to Sen Susan Collins (R-ME) <https://tinyurl.com/20181209c-delong>, that the tax cut would boost growth by enough to raise tax collections enough to keep the deficit from going up by much? No. Do we have anything from Miller, Calomiris, Bhagwati, Luskin, and a hundred-odd others <https://www.bradford-delong.com/2017/11/i-am-embarrassed-to-belong-to-a-profession-that-includes-these-100-clowns.html> who confidently predicted a supply-side growth boost by enough to raise tax collections enough to keep the deficit from going up at all—and boost annual growth by 0.4%—assessing why, so far, they are wrong? No. Do we have anything from Kevin Hassett <https://tinyurl.com/20181209d-delong> and Greg Mankiw <https://tinyurl.com/20181209a-delong>, who told us that these productivity gains would primarily boost wages not profits because the relevant model was one in which foreigners would flood America with savings, lending to and investing in this country on a large scale to finance the bulk of this surge and investment, explaining why we are not, right now, seeing the rise of a mammoth inflow of capital into America? No.

Back when all these economists from Barro through Taylor were setting out their claims, these drew sharp dissents from not just economists associated with former Democratic administrations but from scorekeepers like the Tax Policy Center whose entire model of operations rests on pleasing not politicians and donors but rather making the best forecasts they can. The disagreements, in turn, drew an anguished cry from reporter Binyamin Applebaum:

I am not sure there is a defensible case for the discipline of macroeconomics if they can’t at least agree on the ground rules for evaluating tax policy. What does it mean to produce the signatures of 100 economists in favor of a given proposition when another 100 will sign their names to the opposite statement? How does Harvard, for example, justify granting tenure to people who purport to work in the same discipline and publicly condemn each other as charlatans? How are ordinary people, let alone members of Congress, supposed to figure out which tenured professors are the serious economists?...

I think we can now answer Applebaum's question. The 100-odd economists from Barro through Taylor were not engaged in any intellectual discipline. When you are engaged in an intellectual discipline, it is very interesting when you get something wrong—it is a sign that you have something to learn. And so, in every intellectual discipline, you try to learn it: you study it, analyze it, debate about it, in the hope of making yourself smarter—if, that is, you see yourself as a thinker.

There has been none of that.

There has been silence.

There has been silence because the absence of the promised 800 billion surge in investment in America this year continued through next year and beyond is not something anybody is surprised to see. Overwhelmingy, those writing opeds and releasing studies boosting last year's Trump-McConnell-Ryan corporate tax cut knew that the forecasts they made last year were overwhelmingly likely to be wrong. So they are not surprised when they turn out to be wrong. And they do not even think it worthwhile to go through the motions of pretending to be surprised that the investment share of national income and product in 2012 dollars is 18% and not 22%.

So I say to Binyamin Applebaum, and to other reporters who wrote up—much less critically than they should have—what the administration was saying and what corporate tax cut-boosting economists from Barro to Taylor and company were saying last year: remember: "fool me once, shame on you; fool me twice, shame on me".

LINK: <https://www.bradford-delong.com/2018/12/clinton-administration-vis-trump-administration.html>