HOISTED FROM ÞE ARCHIVES: In 2005-2013, þe Long-Run Came First, & þe Short-Run Came Later

Þe 2008-9 collapse was not driven by a flight of assets & income from housing, but a flight to liquidity & safety. The first is a sectoral shift. It isthe second that is a general glut...

In 2005-2013, the Long-Run Came First, and the Short-Run Came Later

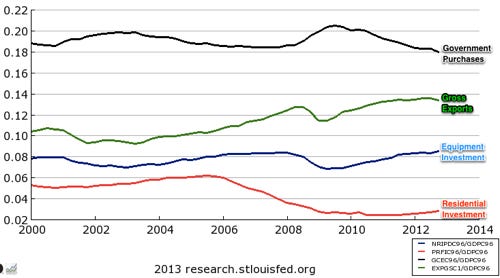

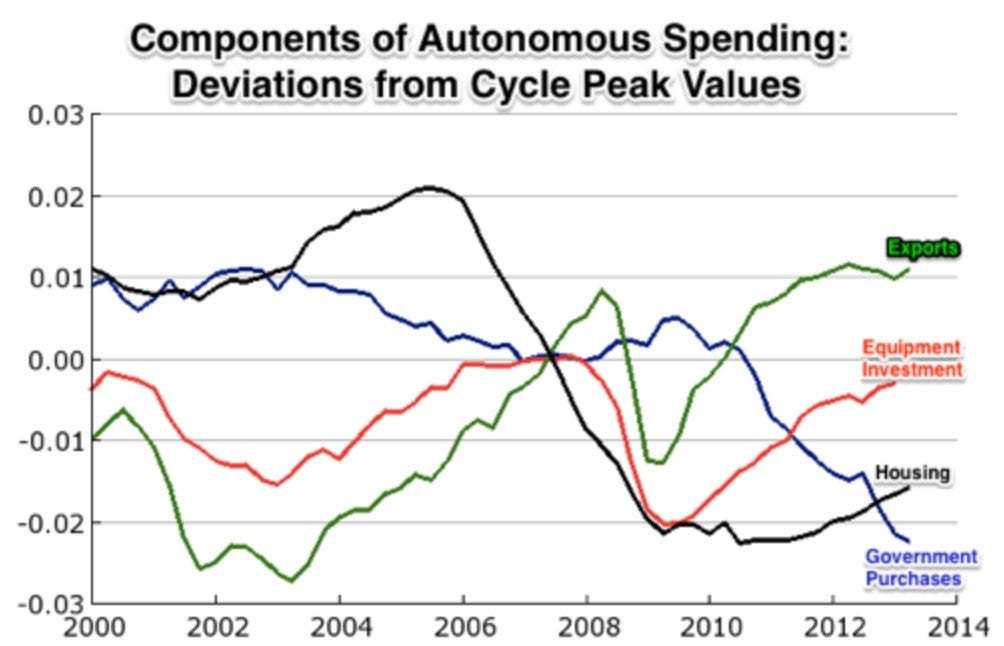

Shares of GDP

The housing boom reached its peak in mid-2005. Thereafter, for two and a half years, from mid-2005 to the end of 2007, the economy underwent a smooth long-run adjustment to changing expectations about the future. Housing went from being a sector to invest in to a sector to avoid. Residential construction fell by 2.5% points. But the money that would have funded housing went elsewhere--0.5% points of it into business equipment investment, and 2.0% points of it into exports--and full employment was maintained.

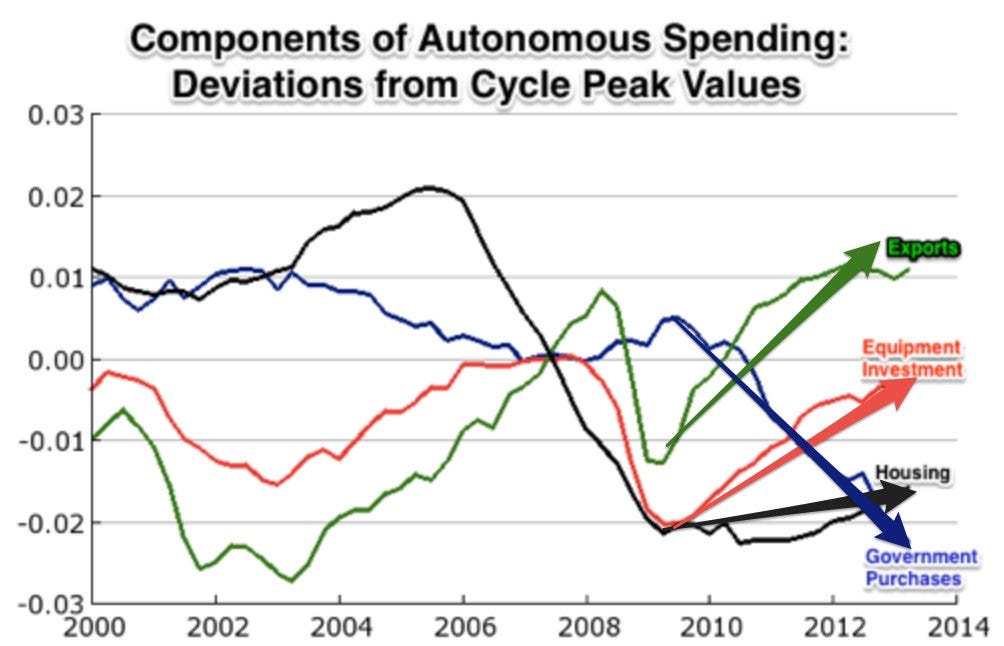

You can see this successful, "classical", full-employment structure shift if we examine changes in spending shares of GDP from their construction high-water mark in mid 2005:

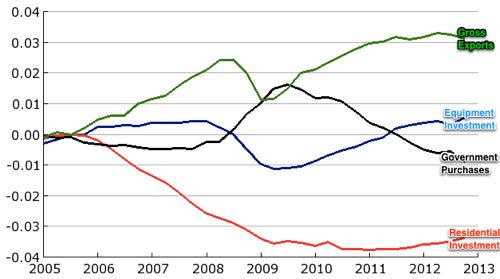

Shares of GDP: Deviations from Mid-2005 Spending Shares:

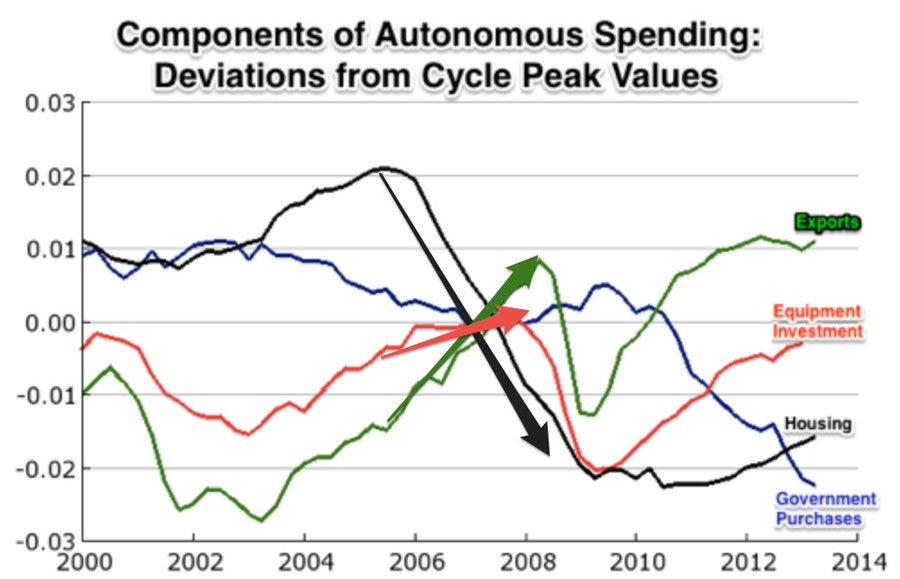

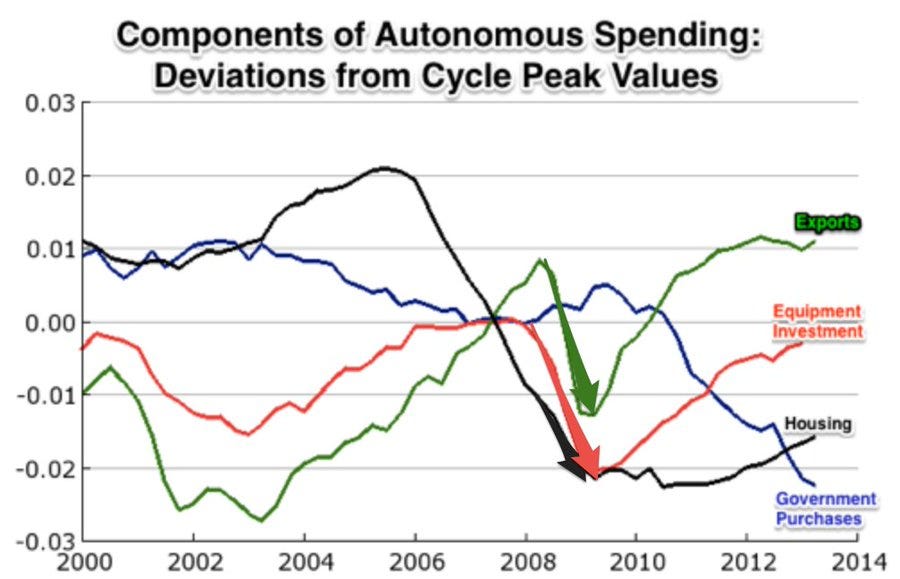

It is only in 2008-9 that shifts away from construction spending are not diverted away into boosts in other components of autonomous spending. Thus it was the financial crisis, not the collapse of the housing boom, that gave us our First Lost Half-Decade, with only government purchases counteracting the downturn:

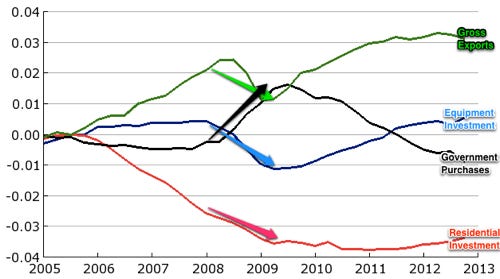

Shares of GDP: Deviations from Mid-2005 Spending Shares: Focus on 2008-9

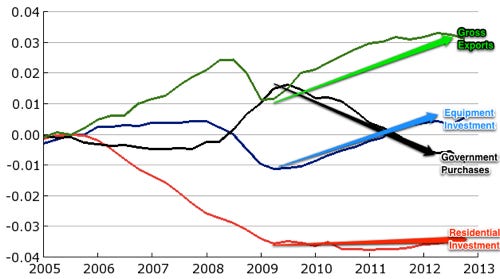

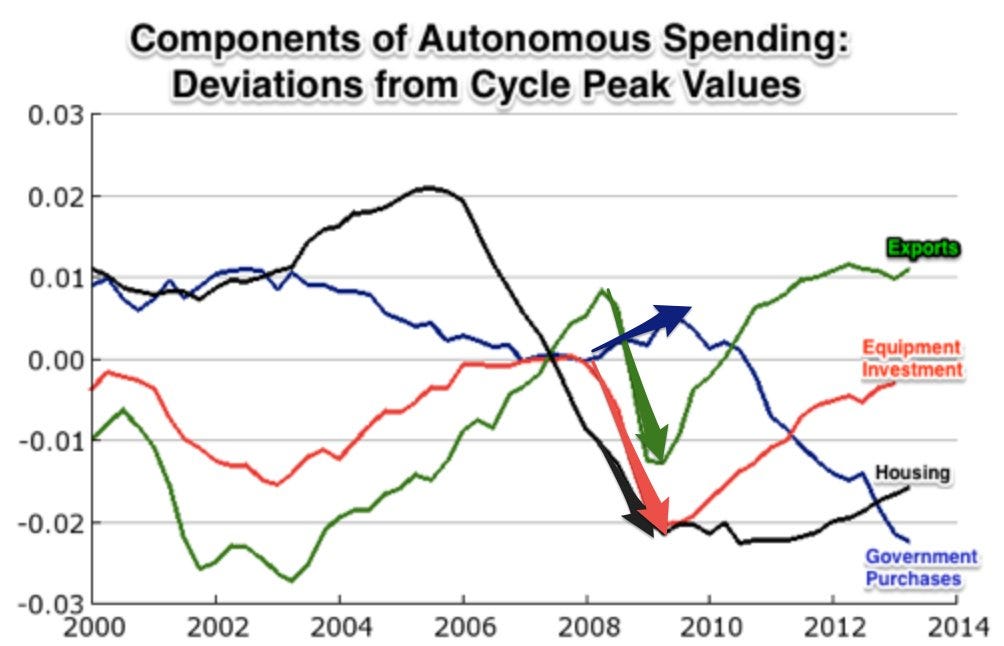

Since late-2009, residential investment has flatlined, and gross exports and equipment investment have recovered to their late-2007 levels, but have grown no further. Just as there was no offset in growing other components of autonomous spending to the 2008-9 further collapse in construction, so since late 2009 there has been no offset in growing other components of autonomous spending to the collapse in government purchases:

Shares of GDP: Deviations from Mid-2005: Focus on Post-2009

The 2008-9 downturn was something the financial crisis did to us--partially offset by the expansion in government purchases. The post-2009 stagnation in employment, production, and growth is something we have done to ourselves: cutting government purchases without a well-functioning credit channel to take up the slack was very bad mojo.

Are there any signs we will do better in the future? Will Jack Lew be a better Treasury Secretary than Tim Geithner and get housing moving again, or ease the flow of credit to business that might want to expand?

At least in teaching students, we now have a nice example of how the "long run" and "short run" are conceptual categories corresponding to different dynamic processes, not spans of time. That's a silver lining at least...

I am hoisting this from back in 2013 because it is relevant to a Twitter conversation:

Brad DeLong: Consider exports, equipment investment, housing construction, and government purchases: four components of autonomous spending that powerfully affect aggregate demand:

Up until post Bear-Stearns, no sign of any significant recession. Yes, housing construction spending was sitting down relative to its peak-housing bubble boom share of national spending relative to its business-cycle peak share, but exports and equipment investment were standing up, so labor was moving as smoothly as one could expect out of construction and rotating into the expanding sectors.

Then, post Bear-Stearns and more so post-Lehmann, everything falls off a cliff as spending doesn't shift out of housing into other sectors, but everyone cuts back on spending in a scramble for liquidity:

There is only one component of demand offsetting the collapse: government purchases via the ARRA. But it was vastly undersized: maybe 15% of the size of the collapse in the other components of autonomous spending:

Then, post-2009, exports recover as the rest of the world economy recovers, and equipment investment recovers as corporate profits recover and capital costs remain low. But the zero lower bound keeps the Fed from seriously goosing any component of demand. Austerity from Republicans and from the "Grand Bargainers" on the Democratic side of the aisle whomps government purchases down and down. And the Treasury's saying that the housing finance régime is going to be reformed "real soon now" and never doing it keeps finance from supporting housing. Housing construction remains vastly subnormal throughout the first half of the 2010s:

Nothing like a normal recovery is complete until well after the beginning of the Trump presidency. And the failure of Treasury to grease the wheels of the construction- and mortgage-finance system creates our current national housing problem.

No mention in your write up at the time of what the Fed was not doing. Do we not at least know now (2023) that Ben should have been saying that the Fed would do what it takes to get and keep inflation back up to target? And have been flooding the markets with liquidity? Banks should have been begging mortgage holders to refinance at lower rates? But the FI that went under in THAT environment should just have got their equity zeroed out and been gobbled up by well financed vultures?

And that relief bill (ne "stimulus"). Couldn't its elements have been defined in term of outcomes? Unemployment insurance duration, etc. depending on unemployment rates? Nothing date terminated. Transfers to S&LG dependent on lost tax revenue (the way UI should work)?

Ken Rogoff placed in administrative detention? :)

How this happened is explained by the actors quoted in my book, “a crisis wasted”