HOISTED FROM ÞE ARCHIVES (2015): Albert Hirschman’s Linkages, Economic Growth, & Hopes for Future "Convergence"

Highly relevant to assessing the state of the economies outside the charmed Dover Circle at the end of the Long 20th Century...

Todd Tucker <https://twitter.com/toddntucker> gets me thinking about these issues today...

Brad DeLong (2015): Albert Hirschman’s Linkages, Economic Growth, & Convergence: When you think about it, broadly speaking, the question of why we have seen such huge rises in the real wages of labor–of bare, unskilled labor not boosted by expensive and lengthy investments in upgrading what it can do–is somewhat puzzling.

We can see why overall productivity-per-worker has increased. We have piled up more and more machines to work with per worker, more and more structures to work in per worker, and develop more and more intellectual blueprints for how to do things. But why should any of these accumulated factors of production be strong complements for simple human labor?

Karl Marx thought that they would not: he thought that what more accumulation of capital would do would be to raise average production-per-worker while also putting strong downward pressure on the wages and incomes of labor, enriching only those with property. Yet the long sweep of history since the early-18th century invention of the steam engine sees the most extraordinary rise in the wages of simple, “unskilled” labor.

There are, again broadly speaking, two suggested answers:

The first is that the accumulated intellectual property of humanity since the invention of language is a highly productive resource. Nobody can claim an income from it by virtue of ownership. Therefore that part of productivity due to this key factor of production is shared out among all the other factors. And, via supply and demand, a large chunk of that is shared to labor.

The second is that there is indeed a property of the unskilled human that makes its labor a very strong complement with other factors of production. That property is this: our machines are dumb, while we are smart. Human brain fits in a breadbox, draws 50W of power, and is an essential cybernetic control mechanism for practically everything we wish to have done, to organize, or even to keep track of. The strong and essential complementarity of our dumb machines and our smart brains is the circumstance that has driven a huge increase in labor productivity in manufacturing. And, by supply and demand, that increase has then been distributed to labor at large.

Both have surely been at work together.

But to the extent that the second has carried the load, the rise of the robots—the decline in the share of and indeed the need for human labor in manufacturing—poses grave economic problems for the future of humanity, and poses them most immediately for emerging market economies.

So let me give the mic to smart young whippersnapper Noah Smith <https://twitter.com/Noahpinion>, playing variations on a theme by Dani Rodrik <https://twitter.com/rodrikdani>:

Noah Smith: Will the World Ever Boom Again?: “Let’s step back and take a look at global economic development. Since the Industrial Revolution… Europe, North America and East Asia raced ahead… maintained their lead… confound[ing] the predictions of… converg[ance]. Only since the 1980s has the rest of the world been catching up…. But can it last? The main engine of global growth since 2000 has been the rapid industrialization of China… the most stupendous modernization in history, moving hundreds of millions of farmers from rural areas to cities. That in turn powered the growth of resource-exporting countries such as Brazil, Russia and many developing nations that sold their oil, metals and other resources to the new workshop of the world. The problem is that China’s recent slowdown from 10 percent annual growth to about 7 percent is only the beginning….

But… what if China is the last country to follow the tried-and-true path of industrialization? There is really only one time-tested way for a country to get rich. It moves farmers to factories and import foreign manufacturing technology… the so-called dual-sector model of economic development pioneered by economist W. Arthur Lewis. So far, no country has reached high levels of income by moving farmers to service jobs en masse…. Poor nations are very good at copying manufacturing technologies from rich countries. But [not] in services…. Manufacturing technologies are embodied in the products themselves and in the machines… used to make the products…. Manufacturing is shrinking… all across the globe, even in China… a victim of its own success…. If manufacturing becomes a niche activity, the world’s poor countries could be in trouble…

By “a niche activity” I read “does not employ a lot of workers”–the value added of manufacturing is likely to still be very high and growing, certainly in real terms, just as the value of agricultural production is very high and growing today. But little of that value flows to unskilled labor. Rather, it flows to capital, engineering, design, and branding.

Noah’s points about economic development are, I think, completely correct.

The point is, however, one of very long standing. The mandarins of 18th-century Augustan-Age Whitehall had a plan for the colony that was to become the United States. They were to focus on their current comparative advantages: produce, in slave plantations and elsewhere, the natural resource-intensive primary products that the first British Empire wanted in exchange for the manufactured goods and transportation services the first British Empire provided that made it so relatively rich for its time.

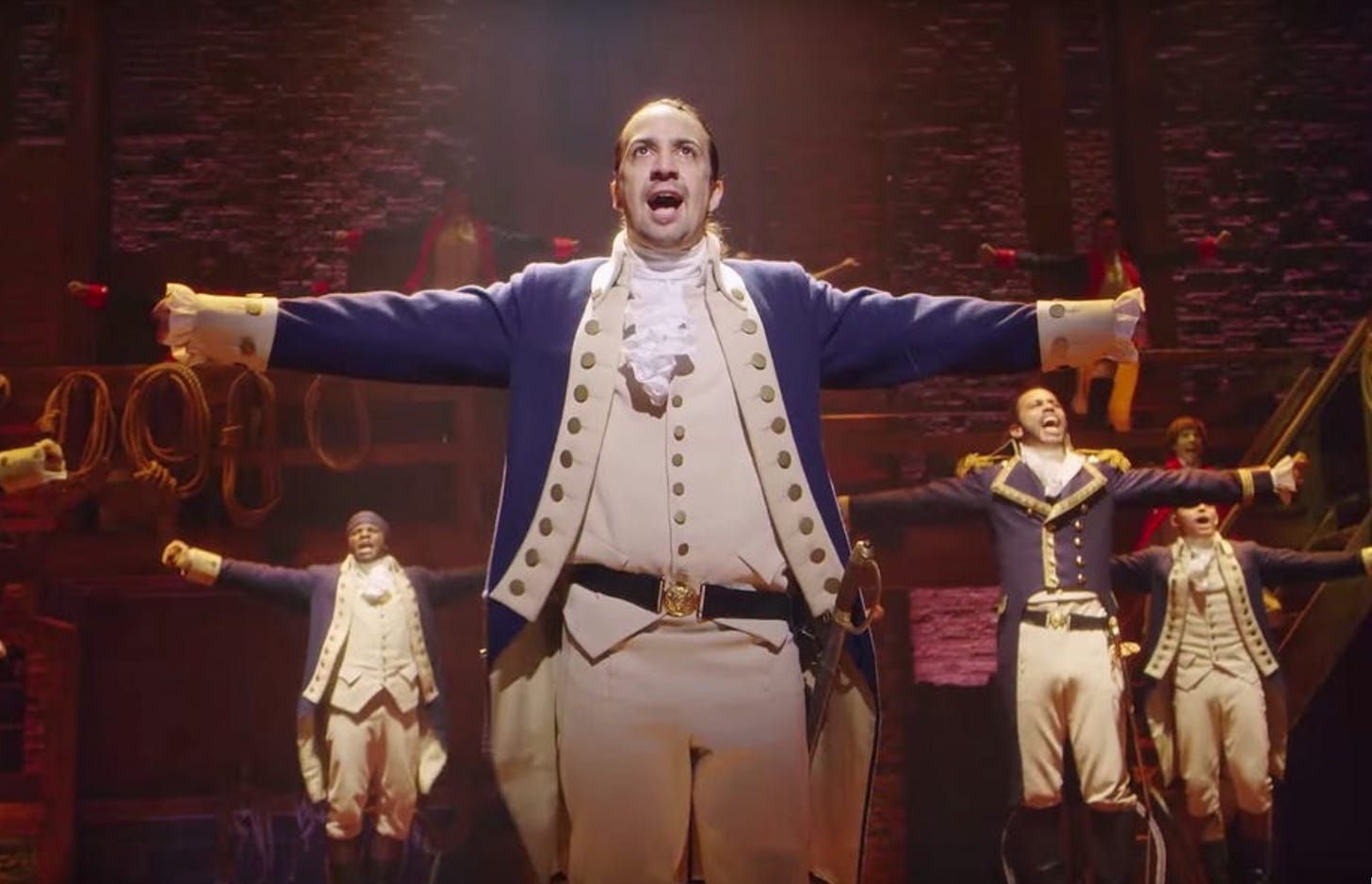

Alexander Hamilton had a very different idea. Hamilton believed very strongly that the US government needed to focus on building up manufacturing, channels through which savings be invested in industry, and exports different from those of America’s resource-based comparative advantage. The consequence would be the creation of engineering communities of technological competence which would then spread knowledge of how to be productive throughout the country. Ever since, every country that has successfully followed the Hamiltonian path—that is kept its manufacturing- and export-subsidization policies focused on boosting those firms that do actually succeed in making products foreigners are willing to buy and not havens for rent-seekers—have succeeded first in escaping poverty and second in escaping the middle-income trap.

The worry is that China will turn out to be the last economy able to take this road–that after China manufacturing will be simply too small and require too little labor as computers substitute for brains as cybernetic control mechanisms to be an engine of economy-wide growth. And the fear is that a country like India that tries to take the services-export route will find that competence in service exports does not more than competence in natural-resource exports to produce the engineering communities of technological competence which generate the economy-wide spillovers needed for modern economic growth that achieves the world technological and productivity frontier.

Very interesting times. Very interesting puzzles…

And, of Course:

References:

Albert Hirschman <https://en.wikipedia.org/wiki/Albert_O._Hirschman>

Concrete Economics <https://www.amazon.com/dp/1422189813>

Dani Rodrik <https://twitter.com/rodrikdani>

Noah Smith <https://twitter.com/Noahpinion>

Noah Smith: Will the World Ever Boom Again? <http://www.bloombergview.com/articles/2015-07-20/will-the-world-ever-have-fast-economic-growth-again->

This rimes well with Tabarrock's, "There is no such thing as 'development economics'"

I think there never was (although that was my specialization in Graduate School and I think I first heard that from U Mich. Richard Porter). For any one country "getting the prices right," (this included budgeting that invests in activities with positive NPV's) especially reducing the Learner tax on exports represented by import restrictions, was about all that was needed.

That does seem like an important question -- and one that applies _within_ wealthy countries as well.

Take WA state, for example, in which the Seattle regions is the clear economic hub of the state. How should we expect the economic success of Seattle to affect the rest of the state?

Traditionally you have a lot of agriculture and timber in the state, but that's likely to fall further behind. Looking it up now, the wikipedia page for the economy of Spokane (the largest city in Eastern WA) is surprisingly informative: https://en.wikipedia.org/wiki/Economy_of_Spokane,_Washington

When I read this summary, it seems directly connected to the discussion in this post:

-------------------------------------------------

The growth witnessed in the late 1970s and early 1980s was interrupted by another U.S. recession in 1981, in which silver, timber, and farm prices dropped. The period of decline for the city lasted into the 1990s and was also marked by a loss of many steady family-wage jobs in the manufacturing sector. Although this was a tough period, Spokane's economy had started to benefit from some measure of economic diversification; growing companies such as Key Tronic and other research, marketing, and assembly plants for technology companies helped lessen Spokane's dependence on natural resources.

Mining, forestry, and agribusiness continue to be important to the local and regional economy, but Spokane's economy has diversified to include other industries, including the high-tech and biotech sectors. Spokane is still trying to make the transition to a more service-oriented economy in the face of a less prominent manufacturing sector. Developing the city's strength in the medical and health sciences fields has seen some success, resulting in the expansion of the University District with University of Washington (first class in 2008) and Washington State University medical school (established 2015) branches.