HOISTED FROM ÞE ARCHIVES (2015): Þe Monetarist Mistake

The inadequate response to the Great Recession reflected policymakers’ then-acceptance of Friedman’s analysis of the Great Depression which had little to do with evidence...

The inadequate response to the Great Recession reflects policymakers’ acceptance of Milton Friedman’s analysis of the Great Depression. And yet the dominance of Friedman’s monetarism has less to do with the evidence supporting it than with the fact that economics is all too often tainted by politics:

BERKELEY—Ideas matter. That is the lesson of Hall of Mirrors, the American economist Barry Eichengreen’s chronicle of the two biggest economic crises of the past 100 years: the twentieth century’s Great Depression and the ongoing Great Recession, from which we are still struggling ineffectually to recover.

Eichengreen is my friend, teacher, and patron, and his book is to my mind the best explanation to date of why policymakers in Europe and the United States have reacted to the most dramatic economic collapse in almost four generations with half-hearted measures and half-finished interventions.

According to Eichengreen, the Great Depression and the Great Recession are related. The inadequate response to our current troubles can be traced to the triumph of the monetarist disciples of Milton Friedman over their Keynesian and Minskyite peers in describing the history of the Great Depression. In A Monetary History of the United States, published in 1963, Friedman and Anna Jacobson Schwartz famously argued that the Great Depression was due solely and completely to the failure of the US Federal Reserve to expand the country’s monetary base and thereby keep the economy on a path of stable growth. Had there been no decline in the money stock, their argument goes, there would have been no Great Depression.

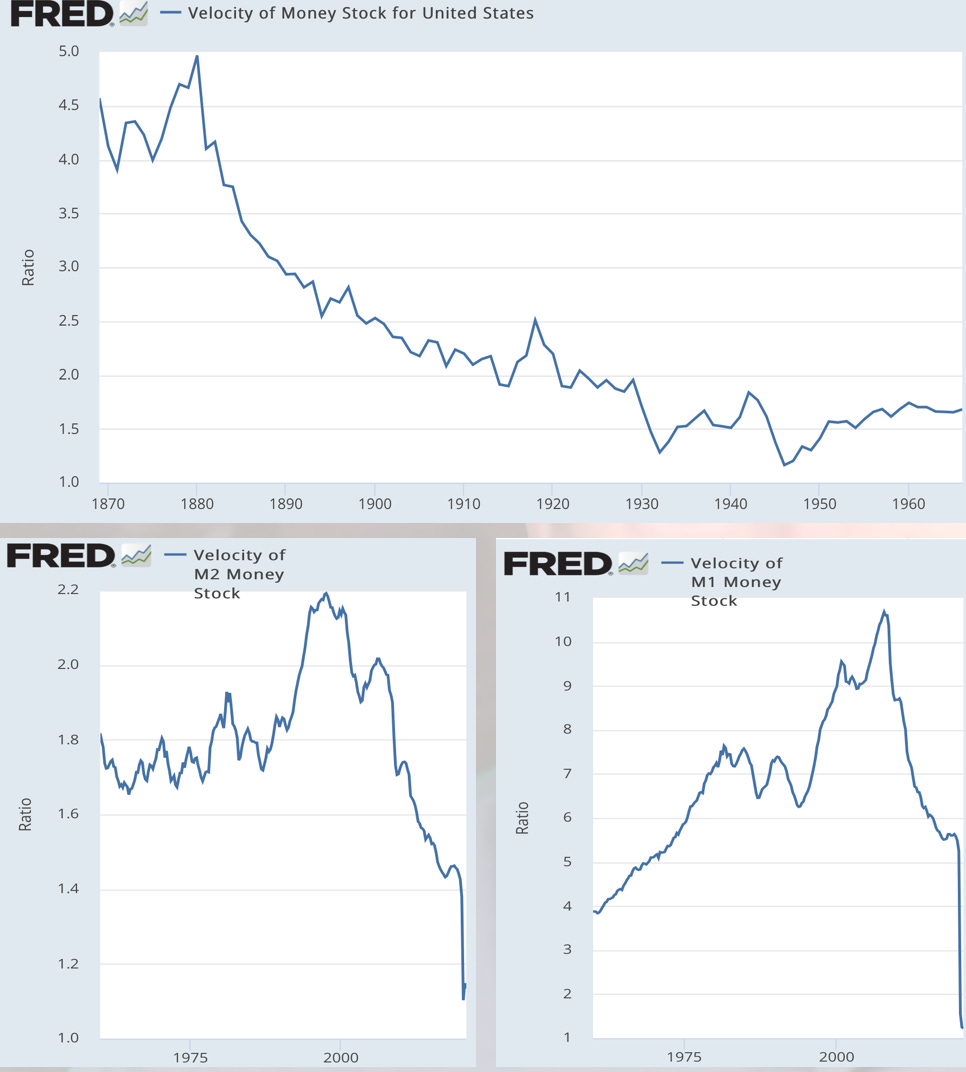

This interpretation makes a certain kind of sense, but it relies on a critical assumption. Friedman and Schwartz’s prescription would have worked only if interest rates and what economists call the “velocity of money”—the rate at which money changes hands—were largely independent of one another. What is more likely, however, is that the drop in interest rates resulting from the interventions needed to expand the country’s supply of money would have put a brake on the velocity of money, undermining the proposed cure. In that case, ending the Great Depression would have also required the fiscal expansion called for by John Maynard Keynes and the supportive credit-market policies prescribed by Hyman Minsky.

The debate over which interventions would be needed to put a halt to something like the Great Depression should have been a simple matter of analyzing the evidence. In economic hard times, did interest rates have little impact on the velocity of money, as Friedman suggested? Was Keynes correct when he described the concept of a liquidity trap, a situation in which easing monetary policy further proves ineffective? Is the stock of money in an economy an adequate predictor of total spending, as Friedman claimed, or is the smooth functioning of credit channels a more important factor, as Minsky argued?

These questions can be debated. But it is fairly clear that even in the 1970s there was not enough empirical evidence in support of Friedman’s ideas to justify their growing dominance. And, indeed, there can be no denying the fact that Friedman’s cure proved to be an inadequate response to the Great Recession—strongly suggesting that it would have fallen similarly short had it been tried during the Great Depression.

The dominance of Friedman’s ideas at the beginning of the Great Recession has less to do with the evidence supporting them than with the fact that the science of economics is all too often tainted by politics. In this case, the contamination was so bad that policymakers were unwilling to go beyond Friedman and apply Keynesian and Minskyite policies on a large enough scale to address the problems that the Great Recession presented.

Admitting that the monetarist cure was inadequate would have required mainstream economists to swim against the neoliberal currents of our age. It would have required acknowledging that the causes of the Great Depression ran much deeper than a technocratic failure to manage the money supply properly. And doing that would have been tantamount to admitting the merits of social democracy and recognizing that the failure of markets can sometimes be a greater danger than the inefficiency of governments. 2 The result was a host of policies based not on evidence, but on inadequately examined ideas. And we are still paying the price for that intellectual failure today.

(Remember: You can subscribe to this… weblog-like newsletter… here:

There’s a free email list. There’s a paid-subscription list with (at the moment, only a few) extras too.)

"The dominance of Friedman’s ideas at the beginning of the Great Recession has less to do with the evidence supporting them than with the fact that the science of economics is all too often tainted by politics."

I think there is very little science practiced by economists, and the recognizable science work is more like scientism than science.

IIRC, the UK experience was that the stagflation of the 1970s ended the belief that Keynesism worked which led to the Tory party adopting Monetarism in teh 1980s under Thatcher. It may have been more about trying any other policy lever in the toolbox, and Friedman's influence in Chile, especially as Pinochet was a friend of Thatcher, to select Monetarism as the preferred tool. How much was also influenced by Reagan's administration IDK, but we know that Reagan and Thatcher were friends. My experience of UK policies as a layperson until I emigrated in the late 1980s was that almost every grand economic policy by the UK chancellor of the exchequer, of whatever political stripe, seemed to fail, especially by the 1960s.

Is there counterfactual evidence that invalidates my perception of this period in the UK?