I Cannot Believe Þere Are Still Economists Eagerly Riding þe Trump Train

& BRIEFLY NOTED: For 2022-01-06 Th

First: I Cannot Believe There Are Still Economists Eagerly Riding the Trump Train

Duncan Black finds Gray Kimbrough calling some of our fellow economists ghouls:

Duncan Black: Ghouls: ‘I’ve long said that economists aren’t as bad as some people think, but the public face of economics is absolutely horrendous and part of the reason for that is not enough economists, like Gray, call their colleagues (appropriately) ghouls: Gray Kimbrough: “Many economists get very defensive about non-economists seeing us as privileged ghouls, but here we have a senior University of Chicago economist (who was acting chair of the Trump CEA) writing at Christmastime that we shouldn’t be helping children by sending money to parents. Typical Philipson column: after he misapplies average inflation measures, he makes his usual claims (without evidence) that Trump somehow caused an economic boom and that Biden is waging an ”explicit war on capital," presumably at least in part by sending cash to parents:

Many economists get very defensive about non-economists seeing us as privileged ghouls, but here we have a senior University of Chicago economist (who was acting chair of the Trump CEA) writing at Christmastime that we shouldn't be helping children by sending money to parents.From @WSJopinion: You don’t cut poverty by increasing people’s reliance on government. You do it by making them self-reliant, writes Tomas J. Philipson https://t.co/PNxIEZ3ZV2The Wall Street Journal @WSJ

As I have often said, there was something very wrong with economists who signed up for the Trump train. There was worse wrong with economists who stayed on the Trump train once it became clear what he was—“the only thing the Republican Party accomplished in two years with control of Congress was a big tax cut," as Oren Cass, who had hoped for much more put it. And Cass then got off the train.

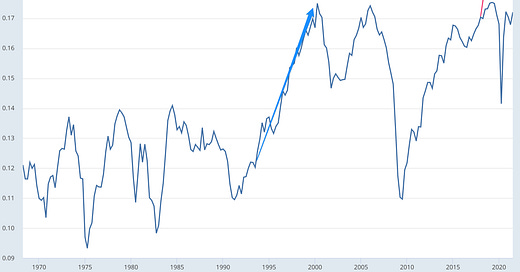

Parenthetically, it was a very badly designed tax cut. It is hard to produce a tax cut for capital that contains such feeble incentives for investment in new capital that it has no effect increasing investment in America. Trump, McConnell, and Ryan managed:

The Trump economists—Tomas Philipson and company inside the White House, plus such luminaries as Mike Boskin and Bob Barro outside—claimed, even after the shape of the tax cut at the micro level had become very clear, that it would be as big a boost to investment in America as the blue line in the graph above that shows what followed the Clinton budget-balancing reconciliation plan of 1993, and they claimed it would have its impact faster: it was implemented immediately, while the Clinton plan took five years to take full effect. But investment in America did not follow the trajectory of the red line: no, no, no, no, no.

In a healthy profession, you would take a reputational hit for continuing to claim that things worked out as planned. Thus if you had gotten on the wrong train, you would have enormous professional incentives to get off of the train, and at least pretend to be rethinking what went wrong with your forecasts.

Yet—as Kimbrough points out—that is not what we are getting from Philipson and company, are we?

Defensive economists I talk to say other disciplines are no better: that “science progresses funeral by funeral” precisely because we are so bad at realizing when we are deep in a hole, and it is time to stop digging. But doesn’t that make it more urgent to develop societal systems that impose very steep reputational penalties on those who refuse to mark their beliefs to market?

One Video:

Thomas E. Ricks: Why Our Generals Were More Successful in World War II than in Korea, Vietnam or Iraq/Afghanistan <https://www. youtube.com/watch?v=AxZWxxZ2JGE>

One Picture:

Very Briefly Noted:

Daniel E. Sichel: The Price of Nails since 1695: A Window into Economic Chang<https://www.nber.org/papers/w29617>

Frank O’Brien: The Most Important Computer You’ve Never Heard of: ‘How SAGE jumpstarted today’s technology and built IBM into a powerhouse… <https://arstechnica.com/science/2022/01/the-most-important-computer-youve-never-heard-of/>

Michael Bader (2016): Bruce Springsteen: Born to Be Honest<https://www.psychologytoday.com/us/blog/what-is-he-thinking/201610/bruce-springsteen-born-be-honest>

Wikipedia: The Silesian Weavers <https://en.wikipedia.org/wiki/The_Silesian_Weavers>

Tian Chen Zeng, Alan J. Aw & Marcus W. Feldman: Cultural Hitchhiking & Competition Between Patrilineal Kin Groups Explain the Post-Neolithic Y-Chromosome Bottleneck<https://www.nature.com/articles/s41467-018-04375-6>

Michael Tomasky: Jamie Raskin, Democracy’s Defender: ‘I asked him for a quote from the Bard that sums up our times. He squinted his eyes and looked downward. “I mean, um… ‘Hell is empty and all the devils are here’?”… <https://newrepublic.com/article/164778/jamie-raskin-democracy-defender-profile>

Monika Karmin & al.: A Recent Bottleneck of Y Chromosome Diversity Coincides with a Global Change in Culture <https://pubmed.ncbi.nlm.nih.gov/25770088/>

Chad Orzel: Not THE Ending, but AN Ending : ‘A TV show is necessarily more external, and one with a big ensemble demands some different narrative choices to make sure that the audience gets more of a feel for more of the cast…

Paragraphs:

Matthew Levine: Slaying the Blood Unicorn: ‘In the early 2010s, Elizabeth Holmes pretended that she had invented a new technology to do blood tests, and used this pretend technology to raise several hundred million dollars from gullible investors for her blood-testing startup, Theranos. Back in the 2010s this was all viewed as pretty noteworthy stuff, and it was huge news when Theranos’s technology turned out to be fake…. Now of course it is 2022 and we are all a bit more jaded. There was the SoftBank boom, we’ve had a couple of years of SPACs, there is so much crypto. Raising hundreds of millions of dollars from gullible investors who don’t do much due diligence is not particularly impressive anymore. If you want to do it by pretending to have a technology, you can (try electric vehicles!), but these days even that is optional…. You can raise lots of money from investors by letting them pretend to own digital pictures of apes, or by just saying “hey here’s a Ponzi”…. Theranos looks a little quaint…

LINK: <https://www.bloomberg.com/opinion/articles/2022-01-04/slaying-the-blood-unicorn>

Noah Smith: China’s Economic Woes: An Opportunity for U.S. Manufacturing?: ‘Reshoring means nearshoring, ally-shoring, and robots…. In the long run, rich countries produce some of everything, but they aren’t heavily weighted toward labor-intensive industries. That’s just the nature of the beast…. Which means that if we want to have American companies be at the center of those supply chains, we should do two things: Nearshoring and ally-shoring. Nearshoring means moving production from Asia to Mexico and other close-by places (especially Mexico)…. Ally-shoring… means relocating suppliers from China to countries allied or de facto allied with the U.S…. Remember, in the age of automation, manufacturing isn’t going to be our source of mass employment…. Instead, it’s most like software, a high-value industry that brings in lots of money that then gets spent locally on things like health care and restaurants and insurance and other things that create the real mass employment. That’s why we want to focus on manufacturing very capital-intensive, high-value-added stuff…

LINK:

Robert Armstrong: What We Know About Markets in 2022: ’Monetary conditions are set to tighten…. Asset prices face a headwind…. Market prices signal investor confidence that inflation will subside soonish…. Supply chains remain knotted up, and we still don’t know when that will normalise…. The market is mighty thin. US stocks, as we have pointed out, have been exceptional in both performance and top-heaviness. So much so that holding the S&P 500 last year would have nearly trebled the average hedge fund return…. Globally, the US accounts for the lion’s share of equity gains. And just a few stocks account for the lion’s share of US gains…. It’s… spooky, if you ask us. Especially so because the main reason the super-duper stocks have gone up is not profit growth but multiple expansion…

LINK: <https://www.ft.com/content/314325ec-822a-4ba4-ae65-3c86213c4c81>

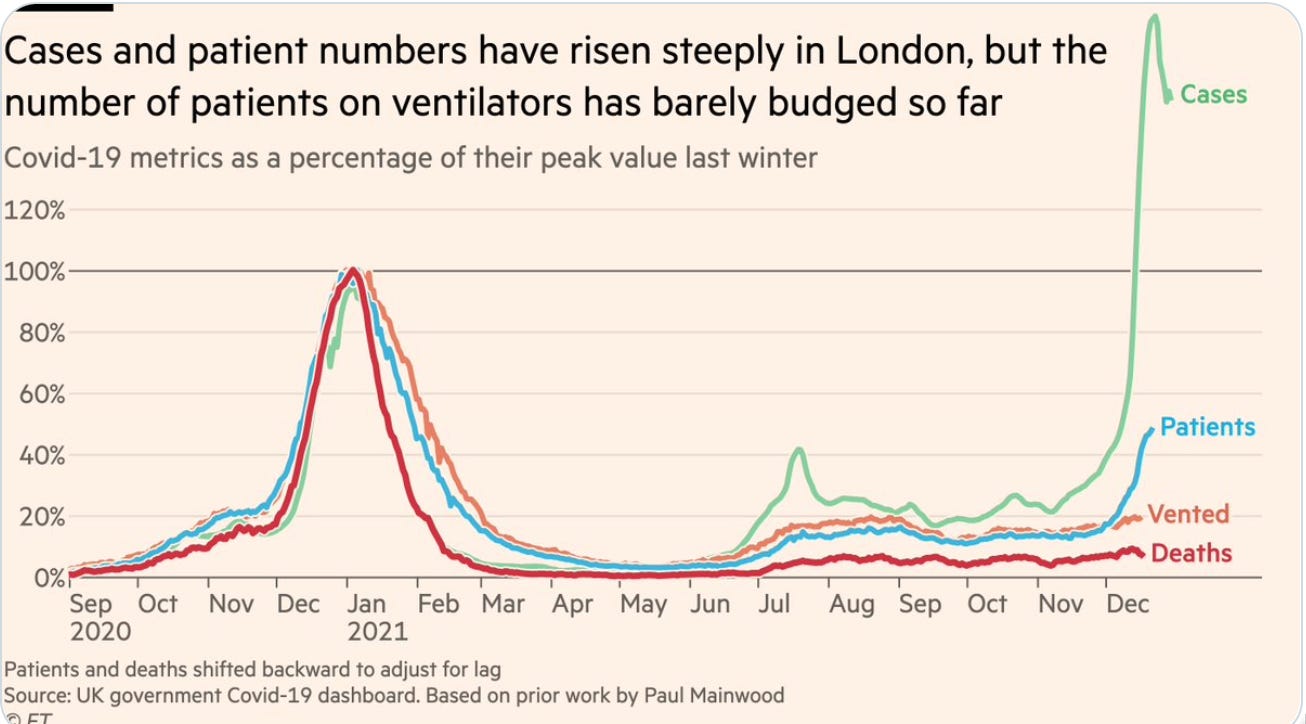

Bill Gardner: Cancer Journal: The COVID Pandemic on New Year’s Day, 2022: ‘Perhaps I’m oversensitive. I am 68 and a cancer patient, so I am at high risk from COVID…. If I got COVID-related pneumonia, I’d have to stop the immunotherapy, unleashing my tumour…. For the entire epidemic, America has a rate of 2,494 COVID deaths per million compared to 805 Canadian deaths…

Matthew Yglesias: How I Learned to Stop Worrying & Love the Washington/Baltimore/Arlington Combined Statistical Area: ‘The main reason the pandemic should increase the salience of CSAs is that it’s clear at this point that remote work is going to be somewhat sticky…. There’s going to be an increase in the number of people who want to live within a day-tripping range of where their industry is located, but not necessarily commute to the office every day. That means probably a flattening of the gradient so there’s not as much differentiation between inner-ring suburbs and further-flung ones…. What we really need to do is to improve the transit connections throughout the region…. The goal is to serve what TransitCenter calls “all-purpose” transit ridership, not just 9–5 commuters. In other words, people who live in the suburbs should find the train to be an appealing option for an occasional trip to a museum or cultural attraction in central D.C. or Baltimore…. The Savage MARC station between D.C. and Baltimore has an awesome name, but it’s surrounded by a park-and-ride lot and some generic strip mall stuff. You should be able to build tall apartments and townhouse clusters near these stations—not with the expectation that people will be living car-free but thinking that it might work for a lot of one-car households who do many day-to-day errands on foot in the manner of the 15-minute city and can also ride trains to lots of regional destinations…. Larry Hogan has so far given the state two terms of the kind of “do nothing” moderate-Republican-in-a-blue-state governance that voters seem to like. But there’s plenty of fruit here to be picked by a leader with a bit more vision…

LINK:

Claire Berlinski: ’Shadi, this makes zero sense. Liberals made masks, expertise, and science a “cultural identity marker” because it is stark raving insane in a pandemic to adopt any other culture. You seem to be assuming it’s normal, somehow, that half our country has entered a mass psychosis—such that the afflicted reject lifesaving modern medicine in preference for voodoo formulas made of ivermectin and Vitamin D. They’re at the level of shaking rattles at the ill, whereas the rest of the country lives in the 21st century…. They went back to the Middle Ages all on their lonesome. No one pushed them there…

LINK:

PAID SUBSCRIBER ONLY Content Below:

A parenthesis: when you listen to a discussion of inequality, you may hear lots of references to something called the "Gini Coefficient". A great deal of economists and sociologists studies of inequality presents its results in the form of “Gini coefficients”.

I do not know why.

What is this Gini Coefficient? Here is my attempt to make it comprehensible:

Understanding the Gini Coefficient:

The Gini coefficient is not an intuitive measure. In fact, very few people have a sense of what it means. It is a number describing and summarizing a society's inequality—a number that I find I have a very hard time grasping, a hard time understanding what saying "this society's Gini is X" really means. It is not intuitive to me. So let me try to anchor it in a way to make it more familiar:

If the bottom three quarters of the population were to get one quarter of the income, the top quarter to get the rest, and were income to be evenly distributed within the top quarter and the bottom three quarters, then the Gini coefficient would be 0.5.

If the bottom two-thirds of the population were to get one-third of the income and the top third the rest, once again evenly distributed within the top third and the rest, then the Gini coefficient would be 0.33.

Suppose that we decide to be bad philosophers: suppose that we decide to think like early 19th century British utilitarian Jeremy Bentham. Bentham believed that the obvious point of society was to maximize utility: to attain the greatest good of the greatest number. And he saw no reason why utility, or happiness, or well-being, should not with sufficient progress of a society be susceptible to objective quantitative measurement just as natural philosophers had figured out how to quantitatively measure something as subjective as heat and cold. Bentham further thought the people were pretty good judges of their own utility and were highly motivated to make choices that increased it. End it seemed much more than reasonable to Bentham to believe in diminishing marginal utility: that each doubling of the resources you could command to devote to increasing your utility would add the same amount to your well-being.

If all that were to be the case, then a move of society from a Gini of 0.5 to 0.33 would have the same effect on total societal well-being—provide the same increment to the social welfare function—as a 30% boost to everyone’s income. By such a yardstick, a reduction in the Gini from 0.5 to 0.33 would be an advance in societal well-being, and an increase from 0.33 to 0.5 a retardation, equivalent to what we get in an average 15 years of economic growth, at the pace economic growth has proceeded since 1870.

That means that shifts in inequality of the type we have seen recently are substantial. They are big deals in this particular assessment of how well our society is doing. Shifts in inequality are, however, a much smaller deal than the extraordinary rising tide of economic growth over the past 150 years which has given us 10 successive such increments. But they are not something that you want to ignore—even if you put to one side the consequences of the distribution of wealth for politics and sociology.

A few cautions: The Gini is income, not status or power: the 4 million slaves in the United States in 1860 would have objected most strongly to claims that the United States was then no more unequal than Britain. Yet that is what the Gini coefficient calculated from the income distribution shows.

Really? In 1930, Henry Simons and Frank Knight offered a plan for ecomonic recovery basically used to raise prices and give money directly to people who neeeded it. Essentially, the plan was followed. Among the people who said it worked were Paul Samuelson, Milton Friedman, Hyman Minsky, James Buchanan, Herb Stein, Dan Patinkin, all students of these men. In 1936 or so, Simons convinced Hayek that deflation was always bad. Schumpeter also admitted as much in the 1930s, pointing out that he advised in giving money to people even if there were some down sides. BTW , the same applies to charity. Charity is a disincentive in the same way as Government money. Hilariously, I've had people tell me charity is okay since it's such a small amount, and then argue it's the answer for helping people. In other words, people could always give more as long as it's up to them . Unreal.

I know nothing about Shadi Hamid, but he sounds like a Republican: make up a trope that actually reflects what your side does[1], and pretend that it applies, instead, to Democrats and the hated libruls. [1] i.e. the trope that a given side makes mask, vaccination, etc. status a cultural marker.