CONDITION: More High Praise from a Smart Person for Slouching Towards Utopia!:

MATT YGLESIAS: ‘Brad DeLong’s book called Slouching Towards Utopia, which is a broad-based history of economic growth over the course of the long 20th century is really, really good…

FIRST: I Had Thought þe Twitter-Merger Drama Was Over?

This was a bizarre thing to wake up to Friday morning:

US Weighs Security Reviews for Musk Deals, Including Twitter Buy

Concerns over Musk's stance on Russia, threat to cut Starlink

Discussions at early stage as officials consider legal options

By Jennifer Jacobs and Saleha Mohsin

(Bloomberg) - Biden administration officials are discussing whether the US should subject some of Elon Musk's ventures to national security reviews, including the deal for Twitter Inc. and Space's Starlink satellite network, according to people familiar with the matter.

US officials have grown uncomfortable over Musk's recent threat to stop supplying the Starlink satellite service to Ukraine—he said it had cost him $80 million so far—and what they see as his increasingly Russia-friendly stance following a series of tweets that outlined peace proposals favorable to President Vladimir Putin. They are also concerned by his plans to buy Twitter with a group of foreign investors.

The discussions are still at an early stage, the people familiar said on condition of anonymity. Officials in the US government and intelligence community are weighing what tools, if any, are available that would allow the federal government to review Musk's ventures.

One possibility is through the law governing the Committee on Foreign Investment in the United States to review Musk's deals and operations for national security risks, they said…

First of all: Musk is paying out of his and his investors’ own pocket for a great deal of Ukraine’s battlefield communications. To call someone doing that “increasingly Russia-friendly” is Orwellian to an overwhelming degree.

Elon also wants peace—as do all non-psychopaths. Elon also does not see a path to peace this or next year that includes a retreat of Muscovite forces to the juridical boundary between Ukraine and Russia—as do nearly everyone not off in some fantasyland. Elon also says what he thinks, immediately, unfiltered, and often what he thinks is based on unreliable information—which has good sides and bad sides (I would not invest in one of his ventures), but it is not a crime, and not cause for a government to attempt to disrupt the operations of his business via transparent and false pretexts.

Elon is not a threat to the national security of the United States.

And while you might say that CFIUS has jurisdiction over whether foreigners can have an ownership interest in Starlink, which might someday be seen as a strategic asset, I know of no colorable theory for CFIUS having any jurisdiction whatsoever over the ownership of Twitter.

Second: “Biden administration officials’“. Not “senior Biden administration officials”. And “people familiar with the matter”. Not “senior officials familiar…” or even “officials familiar…” Do these weasel words have meaning?

My view is that you have nothing if you cannot say “administration sources report that senior administration officials are advocating”. Those who are not administration sources may well not know what is going on. Mere administration officials—who are not senior do not shape policy. And even senior administration officials do all kinds of scenario planning and discuss all kinds of things: no policy is possible without an advocate.

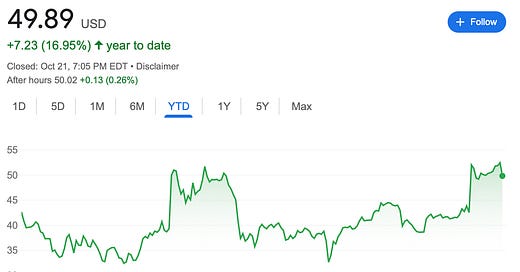

And yet the Twitter stock price… reacted, and reacted substantially, and has since stayed down. While before it had been on track to smoothly converge to $54.20 a share come Friday and the closing of the Musk acquisition, it no longer is:

$4.30 a share on the table: profit if the merger goes through as scheduled, and no big long-term loss in the very small probability event that it does not. There is value in the Twitter network that could be unlocked, and after the past six months a bunch of smart people have been thinking at least idly about how that could happen.

I presume that everyone professional who is in the Twitter-merger-convergence business is at their risk limit, and that… tells us something about how few people interested in betting on fundamentals can shift quickly to raise their risk limits or enlarge their area of focus.

One is very tempted here to go with Lucius Cassius Longinus Ravilla, and ask: “Cui bono?” Who does benefit from this story’s appearance, and how?

One Video: N2PE on “Slouching Towards Utopia”

One Image: Canine Industrial Action

After 3.5 miles of horizontal and 800 uphill and 700 downhill feet of vertical, a sit-down strike.

She has to know that we are almost back at the car, right?

Oþer Things Þt Went Whizzing by…

Very Briefly Noted:

Brendan Scott: Xi and the new members of the Politburo Standing Committee: ‘An emerging powerbroker from today’s lineup is Shanghai party chief Li Qiang, 63, who appears set to become premier after Li Keqiang retires…. Li is a close associate of Xi who sealed off Shanghai for two months this year, following one of the biggest virus outbreaks to breach Covid Zero…

Elaine Moore: The driverless car revolution is stuck in the slow lane: ‘There is still no consensus on how autonomous vehicles should work…

Martin Sandbu: A political backlash against monetary policy is looming: ‘Defenders of independent central banks must think about their democratic legitimacy…

Luciano Canfora: The Fate of Aristotle’s Library

Alfred Twu: ‘Taipei Zoning & City Planning…

Phillip Coggan: Free Market — the boundary between state and the economy: ‘[Jake Soll’s] timely and erudite history traces our ambiguous attitudes towards moneymaking and laissez faire trade…

Ezra Klein: Interviews Matt Yglesias…

¶s:

Noah Smith: The Banking-Finance Nobel Prize: ‘Codifying… things we already knew into mathematical formats… didn’t really add any value…. The mathematical macroeconomists of the 70s and 80s did serious harm to economists’ ability to understand the world…. Charles Kindleberger [on]… Ben Bernanke’s prize-winning papers in 1983: “I think you have provided a most ingenious solution to a non-problem. The necessity to demonstrate that financial crisis can be deleterious to production arises only in the scholastic precincts of the Chicago school with what Reder called in the last JEL its tight priors, or TP. If one believes in rational expectations, a natural rate of unemployment, efficient markets, exchange rates continuously at purchasing power parities, there is not much that can be explained about business cycles or financial crises. For a Chicagoan, you are courageous to depart from the assumption of complete markets…”. Paul Krugman begs to differ…. argues that formal mathematical modeling, of the kind that Bernanke and Diamond-Dybvig did, adds significant value to the lessons of history…. “I actually took… [Kindleberger’s] international finance course in grad school; all of us came out feeling very confused. Diamond-Dybvig-Bernanke… cut through the fog. After DDB economists could read Bagehot very differently and more productively than before…”. I score this debate about even…

Charlie Stross: Strong and Stable!: ‘Russ Jones… enumerates the Conservatives' five factions thuswise: One Nation Conservatives (eg. Ken Clark), the traditional faction of stable national unity government, now reduced to a rump (and arguably more at home with the Liberal Democrats, or even the Labour right wing); Xenophobic English nationalists… Swivel-eyed Libertarians (see: Liz Truss, Kwasi Kwarteng, the 55 Tufton Street mob); Populist bullshitters… (Johnson, Dorries)…. Machine politicians… (Gove and May)…. And each faction has now given the other factions good cause to mistrust them…. And it's all David Cameron's fault…

Have you ever heard of Henry Simons?

That Charlie Stross post is pretty great, thanks for bringing it up.