I Was on "Team Transitory": My Historical Perspective Made Me Smarter

Preliminary thoughts provoked by reading Larry Summers about inflation & soft landings, and talking to Gabriel Mangabeira Unger about changing economic structures & macroeconomic outcomes...

Preliminary thoughts provoked by reading Larry Summers about inflation & soft landings, and talking to Gabriel Mangabeira Unger about changing economic structures & macroeconomic outcomes...

I Was on "Team Transitory". My historical perspective has, I think, made me much smarter than the majority of my peers in analyzing inflation so far this decade. I was not hypnotized into ignoring the reality outside my window by being unable to think of analogies and models other than “we are repeating the inflation of the 1970s”.

However, writing as a card-carrying member of Team Transitory, I must admit that I was substantially alarmed when the Federal Reserve kept raising rates in and after August 2022, after short rates broke above 2.5%/year nominal.

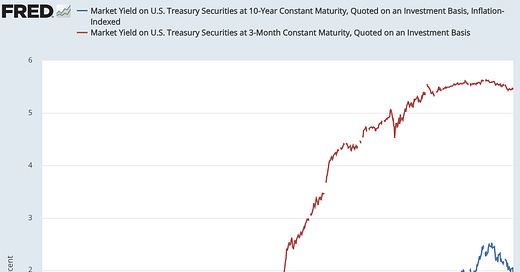

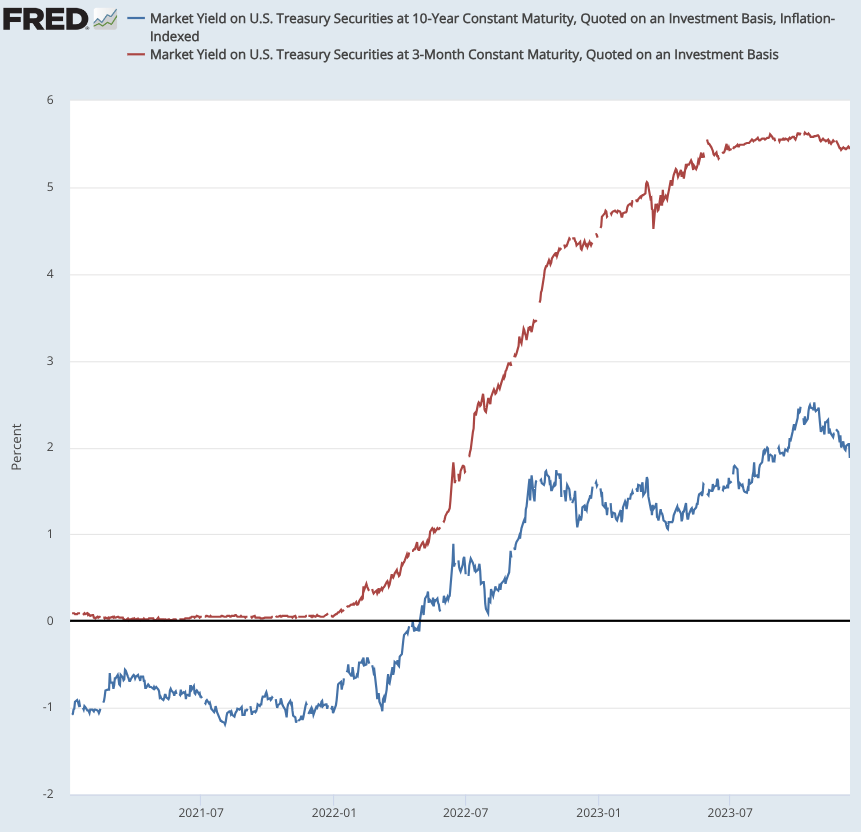

It seemed to me that it was running unwarranted and unnecessary risks of pushing the economy into recession, and possibly back into a depressed low-activity secular-stagnation zero interest-rate trap that it would be impossible to get out of in a timely fashion. Shifting from an inflation-indexed real ten-year rate of -1.0%/year to one of 0.5%/year seemed to me to be substantial monetary contraction. In view of the fiscal contraction already then in play, the prudent move seemed to me to pause, wait, and see what effect the Fed’s policy moves from January through July 2022 would have, and let the “long and variable lags” work out.

Thus a define point to Larry Summers, when he says: “ironically, if team transitory proves to be vindicated, it will only be because their policy advice was not taken…” The underlying expansionary momentum of nominal aggregate demand turned out to be much stronger than I would have imagined, and had the Federal Reserve paused Federal Funds-rate increases starting in August 2022, it would almost surely have seen significantly worse inflation news after that, had to restart the increases in or before the summer of 2023, and we would not now be quibbling about how this-or-that suggests that we are not certainly on a “soft landing” glide path:

Larry Summers: We haven’t nailed the landing yet <https://www.ft.com/content/59fff67e-b136-4435-89e1-2400b90f4b83>: ‘Look at underlying inflation rates… some… are still running well above 2 per cent. If inflation is currently at 2 per cent, it’s not clear that it won’t go back up again. And it isn’t clear that the landing has been soft… declining flows of credit, inverted yield curves, aspects of consumer behaviour… credit strains… raise the possibility that the landing won’t be soft…. The landing may be hard, and we may overfly. That said… hav[ing] inflation above 4 per cent and unemployment below 4 per cent, and you extricate from that situation without a recession… has never happened before in the United States…. And it certainly looks in play as a possibility…. Primary credit should be given to the Fed for having acted relatively rapidly to correct its earlier errors…. The Fed in 2022 raised rates very sharply in a way that did not take place during the Vietnam period. So I think that, ironically, if team transitory proves to be vindicated, it will only be because their policy advice was not taken. It will be because the Fed moved strongly enough that [inflation] expectations never became unanchored…

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.