DRAFT: Inflation Piece, Perhaps for the “Economist”:

The first and most important thing to recognize about the macroeconomic situation in the U.S. is that Jay Powell and his FOMC should be taking victory laps. Two and a half years after the start of the Global Financial Crisis in 2007, the U.S. unemployment rate was kissing 10%, the Federal Reserve had found that it had no traction to speed recovery, and the Obama administration had just thrown away its ability to use fiscal policy to speed recovery by promising to veto spending and tax bills that were insufficiently austere. It would, after that moment, take six years for the U.S. economy to approach full employment. The cumulative pointless and unnecessary economic losses of $7 trillion from deficient employment alone, plus a multiple from investments not made, business models not experimented with, and workers not trained during the decade of ænemic recovery.

We have avoided all that.

Relative to the Bernanke Fed, therefore, the Powell Fed are public benefactors to the residents of the United States to the tune of $20 trillion dollars. We could afford to make each of the 19 voting and alternate members of the Powell FOMC as rich as Elon Musk was at his peak, and that would only eat up 1/10 of the good they have done relative to the Fed, Congress, and President of a decade ago.

But we do now have an inflation problem. So after it finishes taking its victory laps, and after the cheers the Powell Fed deserves—but that somehow I am not hearing right now?—die down, what should the Powell Fed do to deal with the current inflation problem?

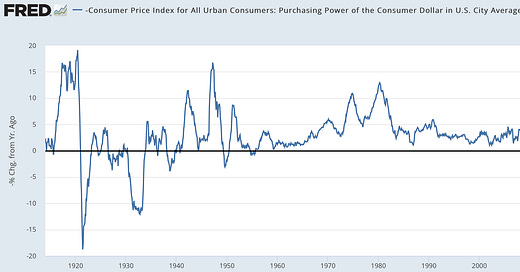

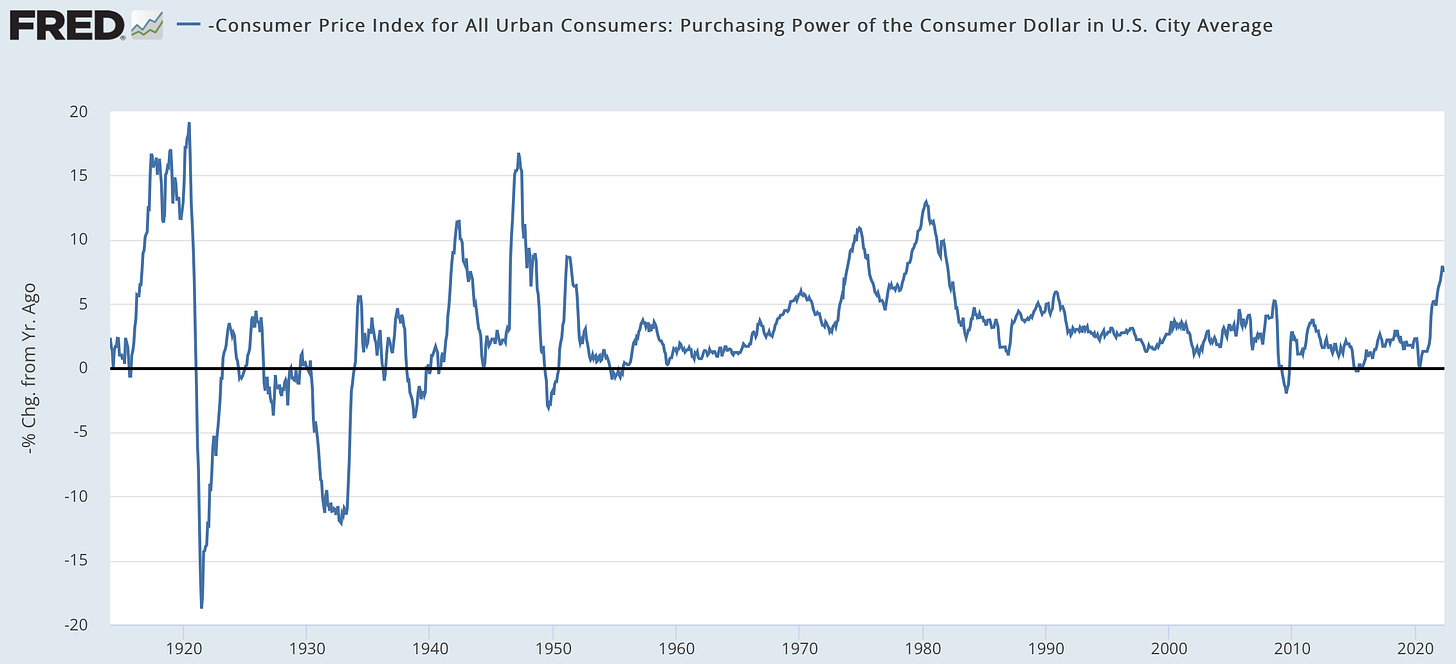

The U.S. has faced five—or maybe six, depending on whether you count the 1970s as one or two episodes—inflation problems in the past century and a bit. One, the WWII inflation brought under control by wartime price controls, is not relevant to our situation. That leaves four (or maybe five) historical parallels.

The first is the WWI-era inflation, brought under control when the newly-installed Fed raised its discount rate from 3.75% to 7%, and triggered a short but very deep recession accompanied by substantial deflation. Milton Friedman judged that the Fed had moved too late—should have started raising interest rates a year or more before it did—but moved too far when it did move.

The second is the post-WWII inflation. Inflation peaked at 16.7% on a trailing annual basis in May of 1947 as the U.S. economy reoriented itself from its wartime to its post-war structural configuration. The Federal Reserve did nothing. It was focused on propping up the value of all the U.S. Treasury bonds that had been issued to fight World War II. Inflation then declined over the next two years to 8%, and then went negative in 1949, when a minor recession came.

The third is the 1951 inflation. Inflation peaked at 8.6% on a trailing annual basis in May 1951 as the U.S. geared up to fight the Korean War and, perhaps more important, to build up the full Cold War military prepared to instantly project power anywhere on the globe. Again, the Fed did nothing. And the inflation wave passed. By May 1952 it was below 2%. And recession was avoided until a minor one in late 1953.

The fourth, or the fourth and fifth, are the 1965-1984 experience, when inflation rose from 2% at the start of 1966 to 4.4% on Richard Nixon's inauguration in January 1969, reached a trough of 2.8% in August 1972, roared to 10.9% in November 1974 with the Oil Crisis, declined to 4.5% in December 1976, and then came roaring back to a peak of 12.8% in March 1980. The Federal Reserve wished and washed. Arthur Burns, Fed Chair from 1970 to 1978, was too interested in having a strong economy while his friend and patron Richard Nixon ran for reelection in 1972, and did not believe that Congress would let him keep interest rates high enough for long enough to cure inflation by monetary policy. G. William Miller, Fed Chair over 1978-9, was out of his depth. And Paul Volcker raised interest rates to a peak of 16.9% in December of 1980, and did not lower them below 10% until August of 1982.

Which of these is our current situation most like? What does macroeconomic theory tell us?

Well, macroeconomic theory tells us nothing. Macroeconomic theory is a historical analogy dressed up in a leotard, a tutu, and pointe shoes. There are some macroeconomists—Paul Krugman comes to mind—who are able to successfully use macroeconomic theories as intuition pumps. But for the rest of us they are, basically, nothing but boxes into which we can file historical analogies.

The thing that gives us hope that the second and third episodes, 1947 and 1951, are relevant is that long-term inflation expectations implicit in the bond market are still trading at their normal "in the long run bet that inflation will be about 2.5% range". One thing to fear is that this is like 1920—that the inflation rate would have passed on its own, but the Federal Reserve is in the process of tightening too much right now. The second thing to fear is that this is indeed like the 1970s, and that the important thing is to scotch any expectations of an inflationary spiral before they are even formed.

It is the call of Jay Powell and his committee. Most of the time I think it would be great fun to be on the FOMC. But not today.

¶s:

Plutarch, at least, thought that Sparta exercised remarkable reach with what seemed to him—and to me—to be much more the appearance than the reality of overwhelming force:

Plutarch: Life of Lycurgus of Sparta: "So, one might say, with no more than a single skytale and a thin cloak, Sparta ruled Greece with the willing consent of its inhabitants, dissolving unjust power blocks and overthrowing tyrannies in various states, mediating in wars, putting an end to civil strife—and managing to do all of this often without any military intervention at all, but by sending a solitary envoy…

LINK: <https://www.google.com/books/edition/Greek_Lives/TCFLl6fJDI8C>

The writer of the story—Elizabeth Weil—and all of the editors of New York magazine, and of Vox Media, appear to have a major we-are-HUGE-patriarchy-loving-assholes problem:

Scott Lemieux: “Cancel Culture” & Patriarchal Entitlement: ‘Why was the primary subject of the story “cancelled”? Well: “Then, in the middle of last summer, Diego went to a party. He got drunk and — Diego really fucked up here: Everybody, including Diego, agrees on that, so please consider setting aside judgment for a moment — showed a nude of his beautiful girlfriend to a few kids there.”… Particularly in a context in which girls are implicitly and directly pressured to supply them, strong norms against nonconsensually sharing private nudes are a superb idea. One of the best reasons for someone to suffer a hit to their social status, in fact. And that’s all that happens here…. My takeaway would be “it’s encouraging that the nonconsensual sharing of nudes led to the ostracism of the guy who shared them rather than the young woman whose privacy was violated” rather than the umpteenth CANCEL CULTURE thumb-sucker. But as cancel culture, again, I have no idea what the story is supposed to be here…

LINK: <https://www.lawyersgunsmoneyblog.com/2022/06/cancel-culture-and-patriarchal-entitlement>

I cannot stress the last of these enough: your article’s life does only begin at publication!

Chris Blattman: ’Economics has a hidden curriculum for how to succeed (plus how to help others succeed). Marc F. Bellemare’s new book pulls back the curtain. A thread on some of my favorite advice and insights from the book. Every opportunity to write is an opportunities to practice writing well…. One of the best things you can do for your career, service-wise, is to help organize your institution’s seminar series…. Some of the best service is to the profession…. Advising students is never a burden…. Your article’s life begins at publication! Once your article is published, publicize it online, through op-eds, or media. That’s how you shape the world, and also how you get citations. Sit on everything you write for a day, at least…

LINK:

Yes, much of the time our conscious wetware module that could actually pass the Turing Test is simply alone for the ride in a body it is doing different things for its own reasons. Yes, often the pattern-matching answer is the one we want—if the pattern-matching algorithm is sufficiently sophisticated. But I think the hyper pragmatist turn that Matt takes here is ultimately going to be more confusing than helpful. Yes, there is a sense in which we are all simply Chinese-room look-up tables. But, as somebody-or-other once said, if we are Chinese rooms, then our rooms are each the size of the planet earth and operated by 100,000 robots moving at light speed. Sufficient differences in the quantity of information processed has a quality—or is that a qualia?—all its own.

Matt Yglesias: We’re Asking the Wrong Question About AI Sentience: ‘I think the real question isn’t whether LaMDA is sentient (clearly no) but whether you have any firm basis for the belief that you are sentient and not just a really good pattern-matching machine…. For a layperson, adopting an intentional stance vis-a-vis computers is often pretty productive, even when the system in question is relatively unsophisticated…. The more sophisticated the computer system, the wider the range of users who may find it helpful to adopt an intentional stance at least some of the time…. On the flip side, as we learn more about neurology and biochemistry, we have a wider range of circumstances in which it can be helpful to analyze human beings as physical systems, adopting a non-intentional stance and attributing behavior to hormonal fluctuations, caffeine consumption, serotonin levels or what have you…

LINK:

I am sorry, but if there is one thing that crypto tokens—supposed to “align network participants to work together toward a common goal—the growth of the network and the appreciation of the token. This fixes the core problem of centralized networks, where the value is accumulated by one company, and the company ends up fighting its own users and partners”—do not do is “align (past, present, and future) network participants to work together”. Instead, we see all of the defects of multi-level marketing scheme raised to an exponential power, and none of the useful food-storage or skin-care products:

Chris Dixon: Why Web3 Matters: ‘Web3… combines the decentralized, community-governed ethos of web1 with the advanced, modern functionality of web2… the internet owned by the builders and users, orchestrated with tokens…. Centralized platforms… when they hit the top of the S-curve, their relationships with network participants change from positive-sum to zero-sum…. The transition from cooperation to competition feels like a bait-and-switch…. In web3, ownership and control is decentralized. Users and builders can own pieces of internet services by owning tokens, both non-fungible (NFTs) and fungible…. Blockchains are special computers that anyone can access but no one owns…. Tokens align network participants to work together toward a common goal—the growth of the network and the appreciation of the token. This fixes the core problem of centralized networks, where the value is accumulated by one company, and the company ends up fighting its own users and partners. Before web3, users and builders had to choose between the limited functionality of web1 or the corporate, centralized model of web2. Web3 offers a new way that combines the best aspects of the previous eras. It’s very early in this movement and a great time to get involved…

Last time you wrote about inflation I was at an extremely packed Disneyworld. This morning I’m in an extremely packed London where inflation is 11 percent. And just like the House of the Mouse, every hotel is booked (we tried to add an extra night), every tour is full, even the National Gallery was packed, and walking around last night in the suburbs, every restaurant was full. There’s a lot of money chasing goods everywhere.

1. No victory lap. The Bernanke-Yellin recession was just dereliction of duty. You do not get the the Medal of Honor for not deserting under fire.

2. Although the Fed acted very quickly to the Feb 2020 panic, it could have done better. The TIPS should never have been allowed to fall as much as it did. The Fed should have been flooding the market with so much liquidity in early 2020 that something like the PPP monstrosity would not have been thunk up and the eviction moratoria would have been unnecessary. [Congress should have installed the proper generous, automatic, Federally funded UI system that they failed to install in 2009, but that is not the Fed's fault.]

3. The early explanations about inflation being "temporary" [and people in the Biden Administration should have kept their mouths shut except to have confidence that the Fed would do its job] should have been more explicit that a) above target inflation when the economy is hit by supply shocks is salutary and b) that the salutary inflation WILL be temporary becasue we will make dammed sure that it IS temporary.

4. And then in at least September they should have started visibly making it temporary. That would have permitted a mini-reversal in February to allow for the additional shock of the disruption to Ukraine grain exports.

5. Ain't 20/20 hindsight great! :)