Inflation-Wise, The U.S. Economy Achieved Its Soft Landing a Year Ago. The Implications for This Week's FOMC Meeting Are Obvious

Looking back on the past year, in which lots of people have been pretending that the U.S. economy had not, in fact, achieved the soft macroeconomic landing that it has…

Looking back on the past year, in which lots of people have been pretending that the U.S. economy had not, in fact, achieved the soft macroeconomic landing that it has…

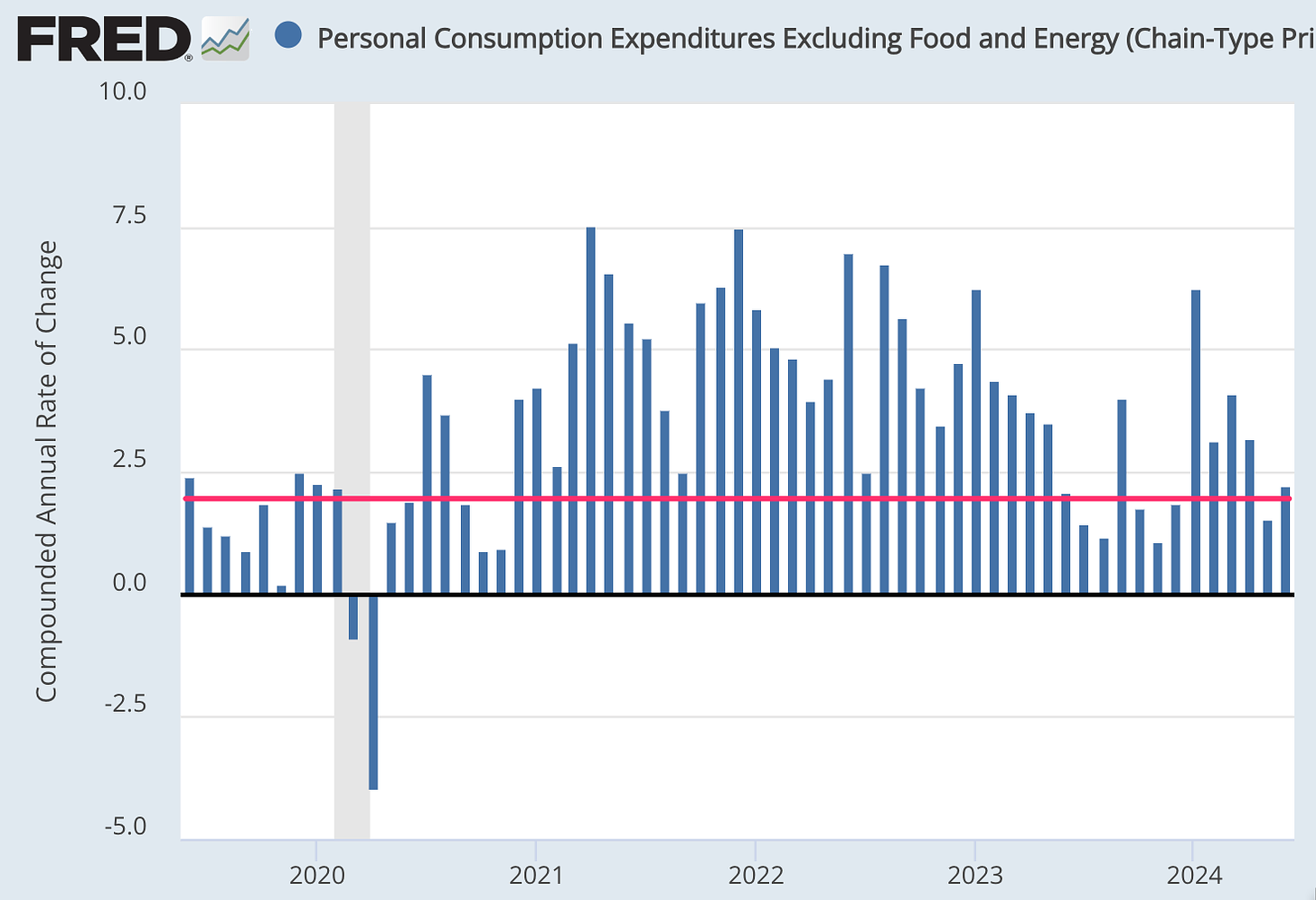

Month-to-month figures are volatile. Trailing-year figures are out of date. So month-to-month is what we are going for. The Federal Reserve’s prime inflation target indicator:

Maybe two months ago you could have worried a bit, after four straight monthly indicators above the Fed’s target, that the seven months of soft landing before that were not sustainable. But to do that you would have had to ignore the action deeper in the fundamentals. And you would have been wrong.

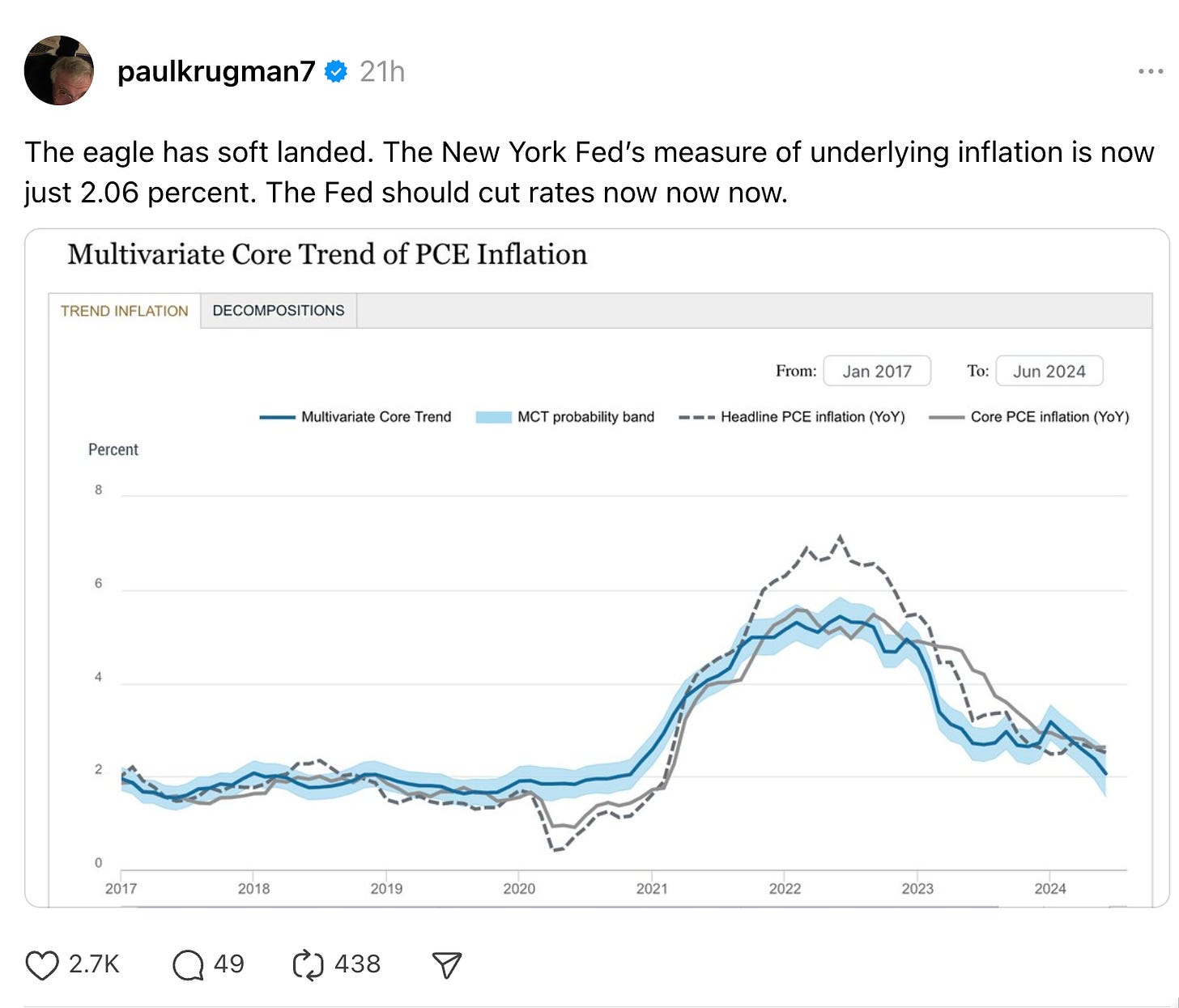

Plus:

:

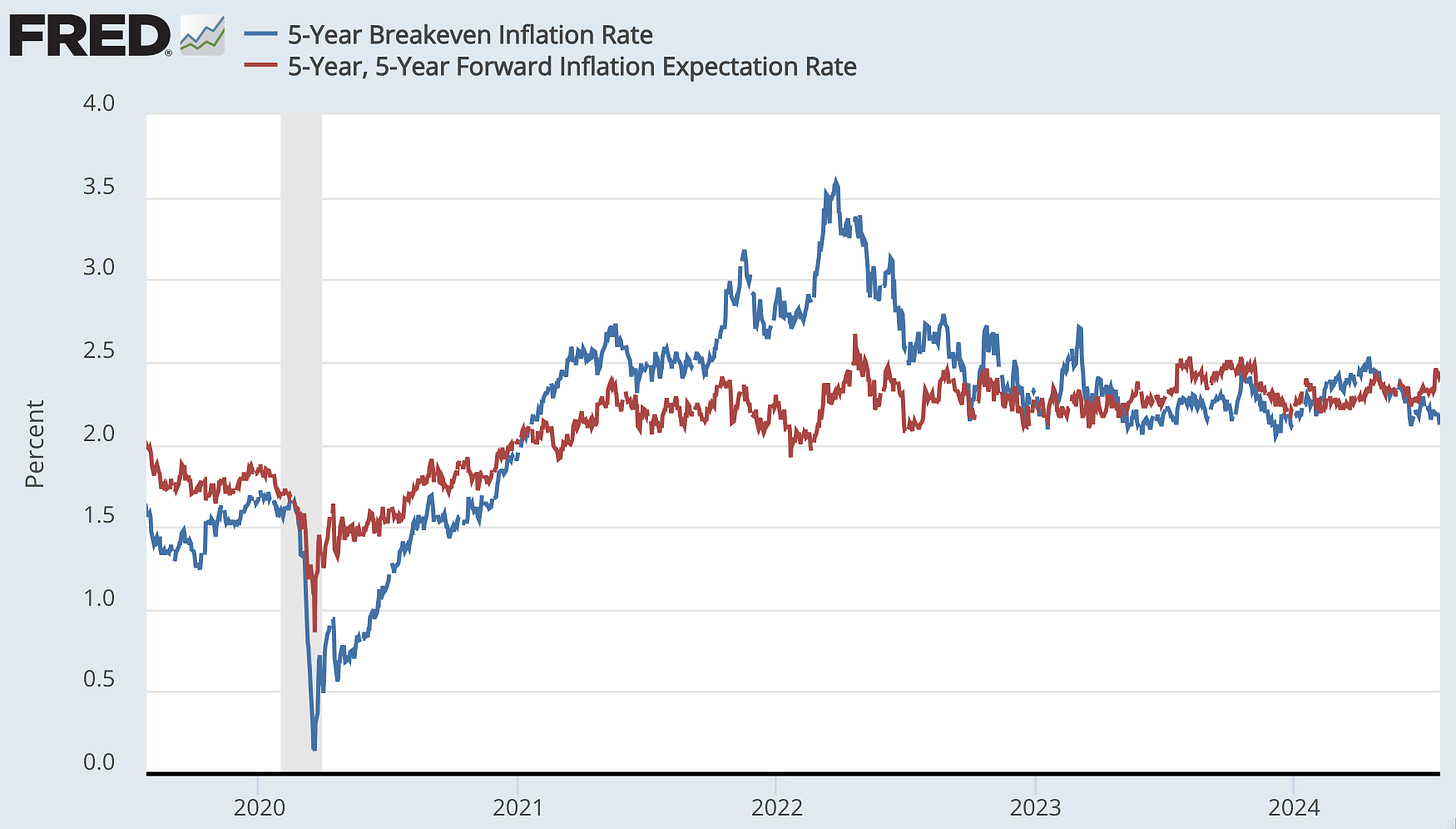

Moreover, the market always—always—thought we would achieve a landing before five years had elapsed. The market did worry in early 2022 that it would take a while—that there would be an extra excess 5%-points of inflation above target over the next five years. But the market was confident by late 2022 that the soft landing was fait accompli:

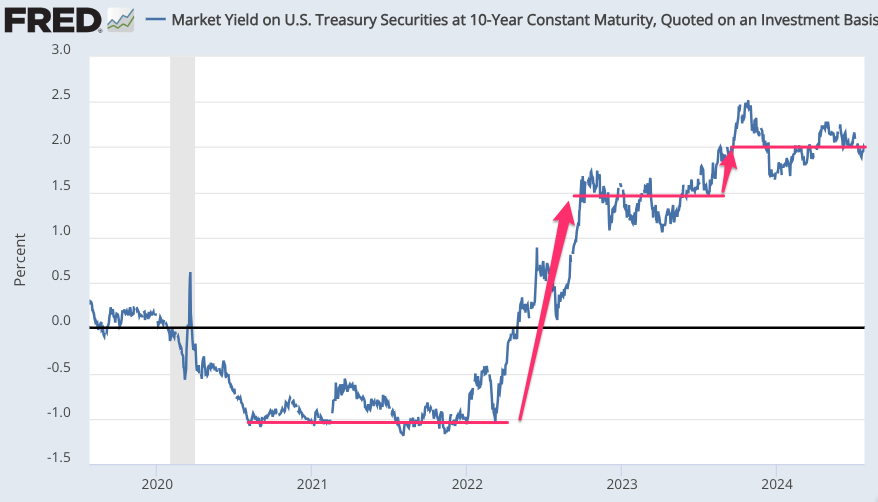

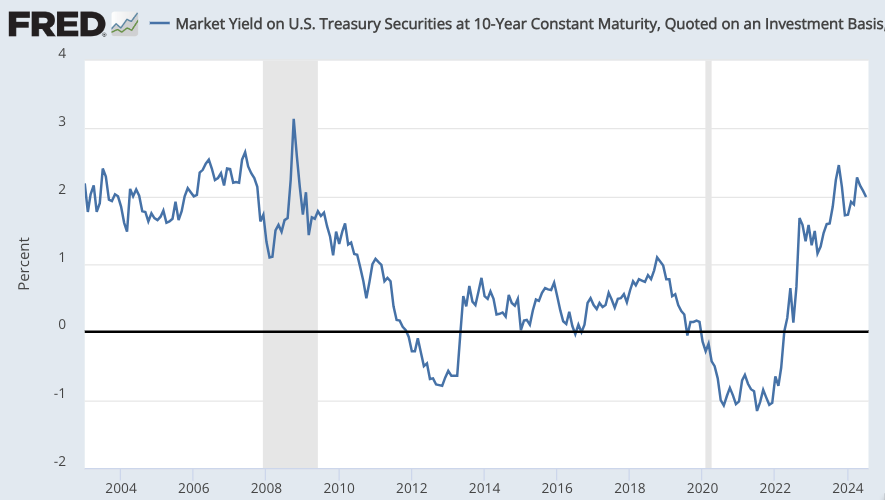

And yet in late 2023—after the soft landing—the market revised upwards its expectations of how tight monetary policy was going to be over the next decade. And with the exception of the brief start-of-year enthusiasm (or was it recession-fear?) that substantial rate cuts were on the way in 2023, that upward revision has stuck, with long-term real interest rates 0.5%-points above where they had settled as the soft landing had taken place:

Why are long-term rates so high? They are in fact as high as they were back before the Great Recession, in spite of all the factors—demography, slowing growth, safe-asset shortage, safe-harbor demands, capital-light economies—that ought to have pushed and kept fundamental r* down below its pre-Great Recession levels:

Well, there still are lots of people claiming that we are not a year into the soft landing. Item: Michael Strain of the American Enterprise Institute. I could pile up more quotes. I could pile up more people. But these should more than suffice:

2024-07-19: “The case against the Fed cutting rates in September is straightforward…. The Fed should not cut rates until there is solid evidence that inflation is moving sustainably toward 2 percent…. Such evidence does not exist…. While the labor market is certainly weakening, it is not weak…. The combination of cooling inflation and a softening job market does suggest that a less restrictive policy stance is advisable. But what matters for monetary policy are overall financial conditions…” <https://www.aei.org/op-eds/the-fed-should-not-cut-in-september/>

2024-07-17: “Since the Fed’s pivot last November, rising equity prices and falling long-term interest rates and credit spreads have eased financial conditions considerably. Much of the financial tightening caused by the relatively high Fed policy rate has been undone. Markets are doing the Fed’s job for it. Fed Chair Jerome Powell said as much in congressional testimony last week, noting: ‘It feels like policy is restrictive, but not intensely restrictive…’. The risk that inflation gets stuck above 2.5% is too great for policymakers to lower rates now. The Fed has entered the last mile of its fight against inflation. With its credibility at stake, it must not flinch before it reaches the finish line…” <https://www.marketwatch.com/story/the-fed-would-be-making-a-big-mistake-cutting-rates-in-september-or-anytime-soon-72c4f97e>

2024-03-14: ““If you look at the labor market, if you look at overall economic output, if you look at the inflation data that we had prior to the release of the February CPI data, I think it was clear that the economy had not achieved a soft landing, despite all the celebrating by many economists and commentators and others…. The absence of a soft landing to Americans is borne out in higher prices. That's what's bothering them. That's what's not soft about the current economy…. By [“]soft landing[”]… we mean basically three things…. The economy's underlying rate of inflation is roughly where the Fed wants it to be for a relatively significant period of time…. The labor market is hot enough to be adding jobs… relatively low unemployment, but not so hot and not so tight that it is contributing to inflationary pressure…. The economy is growing, but not so fast that economic growth is adding materially to inflationary pressure…. We love low unemployment rates. But there is such a thing as too low…” <https://www.aei.org/podcast/bonus-michael-strain-on-recent-inflation-report-and-the-us-economy/>

2024-02-26: “Inflation has come down quite a bit, but some measures are still pretty high, at least high enough to be concerned about it, high enough to give the Federal Reserve some pause before cutting interest rates in the first half of this year…. [Recent developments] suggest that the economy is in for a no landing scenario, rather than a soft landing scenario…. A a soft landing… is one possible scenario. A second possible scenario is that the economy enters a recession…. A third scenario is that the economy just stays hot and inflation stays above the Fed's target…. There's a question about whether the Fed should raise interest rates. Certainly, the Fed's not going to cut interest rates as many times as investors think. Probably not going to cut interest rates as many times as the Fed itself thinks…. The jobs report really suggests that it's that last scenario that may be the most likely, the scenario where the economy reaccelerates or at least doesn't slow down. And that creates a scenario where the Fed may need to raise interest rates some more…” <https://www.aei.org/podcast/michael-r-strain-on-the-state-of-the-us-economy/>

2023-11-28: “When the soft-landing arguments began to be made, I was more optimistic…. Labor market tightness looked to me to be driven more by excessive labor demand than by excessive employment. Labor demand is normalizing. The job-worker gap is shrinking, and we still have inflation that is well above the Fed’s target, and there’s still the risk of inflation kind of getting stuck well above the Fed’s target. And that normalization of labor demand without an accompanying clear path back down to 2 percent for price inflation has increased my level of pessimism regarding the soft landing possibility…” <https://www.aei.org/wp-content/uploads/2023/11/231128-The-Federal-Reserve-and-the-Economic-Outlook-A-Conversation-with-Christopher-J.-Waller-transcript.pdf?x85095>

Let me, especially, pick on the second of these:

There is no argument that r* has risen. There is no argument that adverse supply shocks are on the way. There is just a word-salad of confused and misleading metaphors.

You cannot say “markets are doing the Fed’s job for it”, and thus that the Fed should not cut interest rates this summer and fall, when the following is true: the reason that credit spreads have fallen and long-term interest rates are falling, and one reason equity prices have risen, is that markets are anticipating summer and fall rate cuts. You simply can’t. That makes no sense.

And to claim that interest-rates must not be cut until inflation falls below its target—that the Federal Reserve “must not flinch before it reaches the finish line” guarantees that monetary policy will not be a damper of but an accelerator of business cycles. It is not something that any competent economist should say. Maximum effort until you cross the finish line makes sense when you are trying to cross the the tape in a race as a runner. Maximum speed until you hit the dock is simply stupid if you are trying to dock a boat. And an optimal-control problem like macroeconomic management by monetary means is like docking a boat, not sprinting past a tape.

I very much want to see a rate cut this Wednesday, and to see the real long bond rate below where it was from late-2022 to late-2023. My thinking is that since inflation was above target in late-2022 and has been close to target since mid-2023, policy ought to have been substantially restrictive in late-2022 and should be slightly restrictive today. Yet the long bond says different. And this creates unbalanced risks. And people like Bill Dudley agree:

Bill Dudley: I Changed My Mind. The Fed Needs to Cut Rates Now: ‘Waiting until September unnecessarily increases the risk of a recession…. The persistent strength of the US economy [had] suggested that the Fed wasn’t doing enough to slow things down…. Now, the Fed’s efforts to cool the economy are having a visible effect…. Housing construction has faltered…. The momentum generated by Biden’s investment initiatives appears to be fading…. Inflation pressures have abated significantly… 2.6% in May from a year earlier, not far above the central bank’s 2% objective…. Average hourly earnings were up 3.9% in June from a year earlier, compared with a peak of nearly 6% in March 2022…. Historically, deteriorating labor markets generate a self-reinforcing feedback loop… <bloomberg.com/opinion/articles/2024-07-…>

But we are not going to get it. Tim Duy in his (paywalled) Fed Watch for SGH Macro Advisors:

Tim Duy: ‘This is the “we need to cut rates before inflation reaches 2%” story that Federal Reserve Chair Jerome Powell began selling as early as July of last year…. The economy has lost momentum, and the longer the Fed delays cuts, the more potential weakness builds into the economy, and the more likely that weakness will transform into the coordinated pessimism that brings about a recession…. [But] there is no smoking gun indicating the economy needs a rapid pace of rate cuts…. The FOMC meeting will open the door for a September rate cut but will not guarantee a rate cut. We think the intention of the meeting will be to leave the impression that September is “live” conditional upon “more” good inflation numbers…

Risks seem definitely unbalanced. There are many plausible scenarios in which the Fed will wish after the fact that interest rates had been substantially lower so far in 2024 2023. There are almost no plausible scenarios in which the Fed will wish after the fact that interest rates had been higher so far in 2024 2023.

Yet we have had the Michael Strains and many others talking about how most likely is “the scenario where the economy reaccelerates or at least doesn't slow down. And that creates a scenario where the Fed may need to raise interest rates some more…” These people with their various megaphones have had what seems to me to be a much more powerful impact on the mentalité of the Federal Reserve than I think they deserve.

Why? I do not fully understand it. But one thing that I think is going on is this: The Fed has gotten itself into a box in which markets believe and it believes that “the first rate cut/increase needs to be ‘consequential’’. But that guarantees that they will be late to start cutting/raising, and then have to play catchup because they are behind the curve.

What would wrong with saying: “The Fed Funds rate is a control variable, and basic optimal-control tells us that information arrives we move the Fed Funds rate so that the odds are about 50-50 with respect to whether the next move will be up or down’?

The fact that the Fed trapped itself in the first means that for this entire year it has kept rates higher than it really wanted because it could not figure out a way to get them lower without overshooting substantially and making them lower than it really wanted.

It really should avoid doing this in the future, and the best time for it to get out of this box was last spring. The second best time is now.

If Powell pushes for a rate cut now, will Michelle Bowman go full Trumpian, bat-shit crazy in the FOMC? Because I'm guessing she's been lobbied hard to do so.

In other words, the Fed lacks, ahem, testicular fortitude?