Interviewed by Smart-Thinking Books; & BRIEFLY NOTED: For 2023-03-11 Sa

smart-thinking books: "Meditations", "Thinking Fast & Slow", "Sword at Sunset"; Raghu Rajan's old-time religion; advice on using Bing-AI; McCormick on the origins of the European economy; Marc Coop...

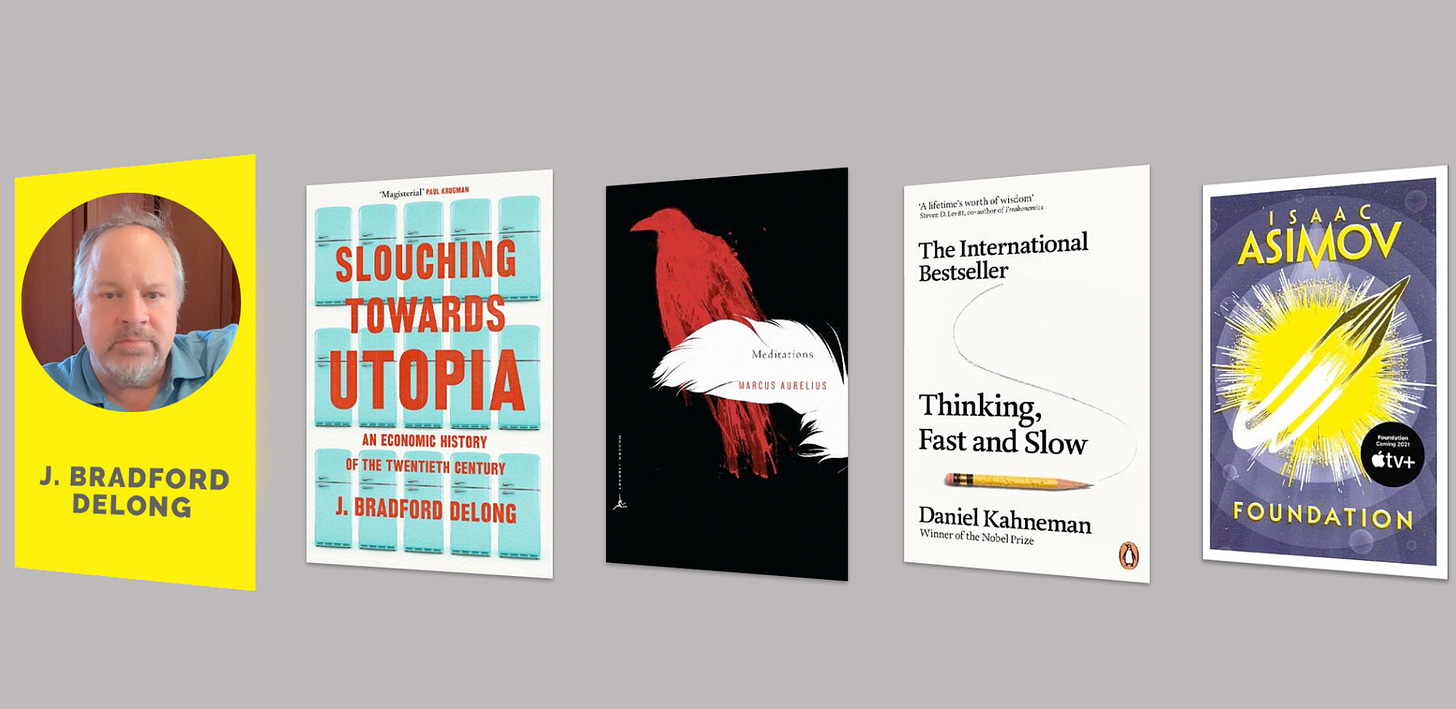

FOCUS: Interviewed by Smart-Thinking Books:

Brad DeLong & Daryl Feehely: J. Bradford DeLong Interview - Smart Thinking Books - Books To Fuel Your Mind!

Q. DO YOU HAVE A FAVOURITE SMART THINKING BOOK (AND WHY THAT BOOK)?

I confess that I have always liked Marcus Aurelius's Meditations, and I find myself liking it much, much more as I age. Feeling things in the world, and then recentering yourself and focusing on "Well! That happened! But what would be a better state of the world to get to given where we are, what is important, and what should I do next?"—that is, I think, a very important skill and attitude to take toward the world. And a Roman emperor was perhaps ideally positioned to model and practice it.

Q. WHAT'S THE MOST RECENT SMART THINKING BOOK YOU'VE READ (AND HOW WOULD YOU RATE IT)?

It would be Danny Kahnemann's Thinking, Fast and Slow. An awful lot of wisdom in it, and wisdom that is especially relevant to our clickbait world where there are lots of people trying to take your money by triggering your fast-thinking modes where they are really inappropriate. Five stars.

Q. DO YOU HAVE A FAVOURITE CHILDHOOD BOOK?

Isaac Asimov's science-column books. And, I suppose, his Foundation series. Plus Rosemary Sutcliff's King Arthur book, Sword at Sunset.

Q. DO YOU PREFER READING ON PAPER, KINDLE OR LISTENING TO AN AUDIOBOOK?

On paper. But ebooks have been steadily gaining mindshare over the past 15 years. And audiobooks have been rapidly gaining mindshare over the past two years.

Q. DO YOU HAVE A FAVOURITE BOOKSHOP (AND WHY THAT SHOP)?

My neighborhood bookstore, Mrs. Dalloway's on College Ave. in Berkeley, CA. But I have always had a soft spot for Barnes and Noble.

MUST-READ: Þat Old-Time Religion:

Raghu Rajan preaches that old-time religion: the market giveth; the market taketh away: blessed be the name of the market:

Raghu Rajan: Hard landing or harder one? The Fed may need to choose: ‘Beliefs in an immaculate disinflation with only mild job losses could soon be put to the test…. Beliefs in a painless “immaculate disinflation” and soft landing lead to a self-reinforcing equilibrium, in which few believe the Fed will have to do much more. As a result workers are not being laid off, financial asset prices and housing are holding up, and households have the jobs and wealth to keep spending…. To get the job done… the Fed has to force markets to abandon their belief that disinflation will involve only mild job losses….

[But] there are dangers…. The markets could have their Wile E. Coyote moment. Lay-offs may spur more lay-offs…. Laid-off employees may be forced to sell their houses, depressing property prices and reducing household wealth. Unemployment and lower wealth may hurt household spending, which will in turn depress corporate profits. That will lead to more lay-offs…. We may end up with a deeper recession than currently anticipated because it is hard to get just a little unemployment…. The temptation… is for the Fed to be more ambiguous, keep a soft landing on the menu and pray for an immaculate disinflation. If so… the eventual unemployment… could be much higher. The Fed’s only realistic options may be a hard landing and a harder landing. It may be time for it to choose…

Whenever Jay Powell says he is going to raise interest rates more, Ms. Market thinks that he is then going to have to lower them more in the short-medium term in order to (probably unsucessfully) avoid a return to secular stagnation. So the ten-year bond rate stays constant, or drops. And since it is the ten-year bond rate that matters for aggregate demand, Jay Powell right now has next to no levers with which to curb aggregate demand.

Thus it is not clear how Raghu thinks Jay Powell can “force markets to abandon their belief that disinflation will involve only mild job losses…”, short of raising short-term interest rates so high that that directly breaks some things and bankrupts some people—i.e., a bunch more SVBs. And that does not seem to be to be a good idea.

MUST-READ II: Using Bing-AI:

Another solid-useful piece of information from the thoughtful Ethan Mollick:

Ethan Mollick: Power and Weirdness: How to Use Bing AI: ‘Don’t think of Bing as a search engine. It is only okay at search. But it is an amazing Analytic Engine. Indeed, Bing is at its most powerful, and most different from ChatGPT, when it is looking up data and connecting diverse sets of information together. It is often a startling good data analyst, marketer, and general business companion. One trick for using its power is to ask it for charts that pull together lots of information. Analyze the market for alternative milk products. provide a chart with each product, how it is made, its cost per liter, and its market size. The results are pretty impressive. You should check any important data (the links at the bottom usually, but not always, will help you understand where the data is from), and be careful not to push Bing into lying, but results quality has tended to be very good. That doesn’t mean that Bing doesn’t hallucinate wrong answers, it very much will, but it is better than ChatGPT. Still, verify numbers to make sure they are accurate, and don’t expect it to do math correctly…

MUST-WATCH: Origins of the European Economy

Michael McCormick: Origins of the European Economy: Communications and Commerce AD 300-900:

Very Briefly Noted:

Noah Smith: Why was there a run on Silicon Valley Bank?: ‘And how will this affect startups and the financial system?… The government occasionally lets banks collapse in a disorderly, disruptive way, out of a sense of wanting to ensure financial probity…. But… recent experience… suggests that the government has learned… prevent[ing] panic and contagion is a lot more important than the need to make a bunch of startups lose 5% or 20% of their cash

Dan Davies: Silicon Valley Bank is a very American mess: ‘The rules work! They just weren’t applied to SVB Financial…. The fact that a risk isn’t covered by a regulatory ratio doesn’t mean it doesn’t exist…. That large domestic banks in the US are apparently allowed to run such sizable funding mismatches… is likely to be a source of embarrassment…

Michael Hiltzik: Contrary to latest claims, there's still not a speck of evidence that COVID escaped from a Chinese lab: ‘There is no evidence — not a smidgen, particle, speck or iota — that COVID leaked from a lab. There never has been...

Susan Page: A GOP war on 'woke'? Most Americans view the term as a positive: ‘By 56%-39%, Americans say 'woke' means being aware of social injustice, not being overly politically correct...

¶s:

Noah Smith: Which industries will China dominate?: ‘Factors at play… Export controls, Government-directed reshoring efforts and other industrial policies, Massive R&D into emerging technologies, Rising Chinese costs and other pre-existing economic trends…. The flip side of “Which industries will China dominate?” is “Which industries will the U.S. and its allies fail to dominate?”.... China’s two key advantages are disruption and scale; this will allow it to dominate many new industries where existing stores of knowledge aren’t a big advantage, and older technologies where producing large amounts cheaply is key...

Marc Cooper: Chile's Utopia Has Been Postponed: ‘Thirty years of civilian government after the end of the Pinochet dictatorship in 1991 had brought a fair share of democracy, and until 2016, rapid economic growth…. Yawning economic and social gaps continued to grow…. Three decades of civilian rule have lifted expectations just enough to produce mass disillusionment and disappointment, scorn for all the traditional parties and a sense of exclusion…. Adding to Chile’s tinderbox was the then-incumbent government led by right-wing billionaire Sebastian Piñera, stocked with the country’s indifferent elite. Piñera’s administration provoked the ire of millions by announcing that while food had gotten expensive, flowers were still cheap; that if a schoolhouse needed a new roof, maybe it was time for a bingo fundraiser; and if workers didn’t like recent subway fare increases, they should get up two hours earlier to beat the peak-rate fare. It was a “let them eat cake” performance by a government of cartoon plutocrats…. As protesters fought police, much of downtown Santiago was trashed…. Piñera put together an agreement with congress and opposition figures such as Boric for a plebiscite… allow[ing] Chileans to choose and write a new constitution…. In October 2020… nearly 80 percent of voters approved the rewriting of the national charter…. The constitutional assembly’s 155 delegates were… free of tutelage from the discredited political parties; the political right was virtually excluded from the process…. In December 2021, Gabriel Boric was elected president of Chile with 55 percent of the vote in a runoff with Jorge Antonio Kast, a marginal figure of the extreme right and an open enthusiast of Pinochet and Brazilian strongman Jair Bolsonaro…. Though Boric lacked a majority in a narrowly divided Congress, expectations for change remained high…. Voters overwhelmingly rejected the constitution, with a whopping 68 percent of Chilean voters turning it down…. The rejection – El Rechazo – hit the government, its supporters and the Chilean left like a Category 5 storm…. Chile appeared fragmented, with an atomized population more interested in building a better bookcase than making sure their neighbors could eat…. Strategists close to Boric project that tax reform and possibly expanded pensions could pass this year, take effect in 2024, and be useful political capital for a 2025 election that promises a titanic fight with the right. These reforms are a long way from utopia, or even the peaceful revolution imagined by many in the streets in 2019. But they would produce meaningful improvements in the quality of life for millions of Chileans and keep the flame of deeper reforms alive…

Bingo! to your response to Raghu Rajan's thesis. It also astonishes me how many chatter heads (not Rajan) also believe/say that the Fed will likely be pleased if the unemployment rate were to grow. Well, like the labor market report this last Friday, that can happen with higher participation rates as well. That is a different economy from the one in which unemployment grows due to job losses alone.

Small banks (not SVB) on aggregate increased their bond portfolios by 70% during Covid. Those portfolios are worth a lot less today. It is too easy for short sellers to find banks who have lost a lot of book value (hold to maturity be damned) due to interest rate increases, plus maybe a large CRE mortgage portfolio, short them, publicize it, analyst scrutiny, and trigger a deposit run. First Republic is next, and I doubt it is the last. Plus, small banks now have to start competing for deposits - an inverted yield curve isn't just a signal.

The Fed now has a more urgent problem than inflation, and one that will get worse every time they raise rates. In fact, they will probably have to end QT soon as relief for banks. Powell's job just got a lot harder.