Is Þere Someone Who Is a Reliable Narrator & Knows About Chile?: & BRIEFLY NOTED: For 2023-03-16 Th

Marc Cooper writes well, but I fear that he sees only half of what Chile is; the 2022 tightening cycle and Federal Reserve possible loss of transmission-mechanism control; Ryan Cooper, Matt Yglesia...

FOCUS: Left-Wing Journalists Who Cannot See Straight:

Thinking again about this from Marc Cooper:

Marc Cooper: Chile's Utopia Has Been Postponed: ‘Yawning economic and social gaps…. Civilian rule… lifted expectations just enough to produce mass disillusionment and disappointment, scorn for all the traditional parties and a sense of exclusion…. The then-incumbent government led by right-wing billionaire Sebastian Piñera, stocked with the country’s indifferent elite… a “let them eat cake” performance by a government of cartoon plutocrats…. Protesters fought police… downtown Santiago was trashed…. Piñera put together an agreement… for a plebiscite… allow[ing] Chileans to choose and write a new constitution…. Nearly 80 percent of voters approved ….

The constitutional assembly’s 155 delegates were… free of tutelage from the discredited political parties; the political right was virtually excluded from the process….

In December 2021, Gabriel Boric was elected president of Chile with 55 percent of the vote in a runoff with Jorge Antonio Kast, a marginal figure of the extreme right and an open enthusiast of Pinochet and Brazilian strongman Jair Bolsonaro…. Though Boric lacked a majority in a narrowly divided Congress, expectations for change remained high….

Voters overwhelmingly rejected the constitution… 68 percent…. The rejection… hit the government, its supporters and the Chilean left like a Category 5 storm…. Chile appeared fragmented, with an atomized population more interested in building a better bookcase than making sure their neighbors could eat…. Strategists close to Boric project that tax reform and possibly expanded pensions could pass… and be useful political capital for a 2025 election….

These reforms are a long way from utopia, or even the peaceful revolution imagined by many in the streets in 2019. But they would produce meaningful improvements in the quality of life for millions of Chileans and keep the flame of deeper reforms alive…

But… But… But…

How did a “government of cartoon plutocrats” like that of Sebastian Piñera win election in Chile?

Why were “expections for change” “high” when Boric did not have a legislative majority?

And how did a constitutional convention elected to represent the people to write a new constitution to be submitted for referendum so lose complete contact with the fact that they were the people’s servants, not engaged in some grand expressive feel-good project?

The people united can never be defeated, and the people are united against “a government of cartoon plutocrats” and the country’s “indifferent elite”. But the cartoon plutocrats are competitive in, and win, elections. And the candidate of the united people cannot win a legislative majority.

The question I want to ask Marc Cooper is: What are the majority of voters in Chile who voted for Sebastian Piñera, the 45% who voted for Jorge Antonio Kast, the majority who voted against Boric’s candidates for the legislator, and the 68% who voted to ditch the proposed constitution thinking?

And what is “the left” thinking that they are of no account—are not part of the “people”.

Is there any other conclusion I can reach other than that Marc Cooper is a grossly unreliable narrator with respect to what is happening in Chile? Can I conclude other than that he just does not see a large part of what is in front of his nose?

He might say that his job is to "rally the troops", and that is a different job than classifying, broad currents of public opinion, both organic and manufactured, in Chile. But rallid troops should only be sent on attainable missions. And that requires seeing things as they are.

So the next question: where is there a reliable narrator?

ONE IMAGE: The 2022 Tightening Cycle:

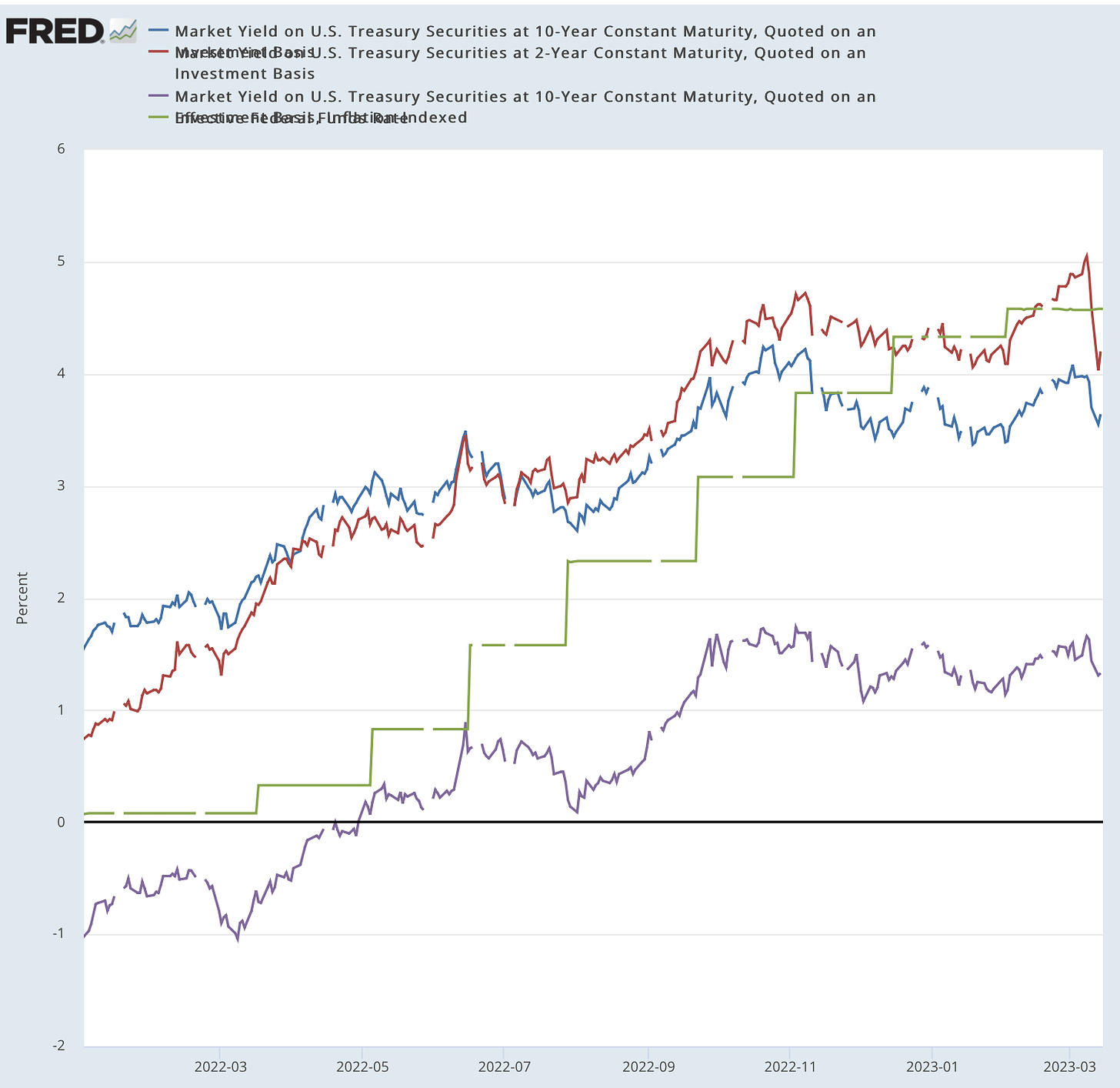

The green line is the Federal Funds rate; the blue is the two-year nominal Treasury; the red is the ten-year nominal Treasury; and the purple is the ten-year inflation-indexed Treasury.

Since October the Federal Reserve has continued raising the Federal Funds rate and saying that that is a signal that they believe that tighter financial conditions are appropriate and that they are trying to make them so. And Ms. Market has absolutely refused to bite.

This is, I think, possibly a substantial problem: if, indeed, Federal Reserve increases in interest rates, and tough talk now lead financial markets to think that they will have to reverse themselves and reverse themselves swiftly and substantially in the near future, the Federal Feserve has possibly lost the power to control financial conditions in any but a most ham-fisted way. And a ham-fisted central bank is not a good central bank.

So if the Federal Reserve still feels the need to cool off the economy in order to fight inflation, as it does, what is it to do? If I were on the Federal Reserve, I would be tempted to conduct an experiment of substantial, quantitative tightening simply to gain information about the shape of the demand curve for US Treasuries.

Very Briefly Noted:

Vincent Palumbo Smith: The Crooked Timber of American Public Opinion

Noah Smith: SVB and the Fed: ‘Are we now living under “financial dominance”?… Is [it] already making the Fed slow down its rate hikes[?]…

Phillips O'Brien: Why is Ukraine being made to try and win the war the hard way?: ‘Forcing Ukraine to take the Russian Army head-on makes no sense.... US aid could be much more effective in what it provides to Ukraine… range and accuracy… weakening of an enemy before battle...

Edward Luce: Putin holds a trump card in the 2024 US election: ‘The Russian leader’s best hope of winning the war in Ukraine lies in American politics…

• Patrick McKenzie: Banking in very uncertain times - Bits about Money

• about a quarter of all equity in the banking sector has been vaporized by one line item. I was surprised to learn this.

• The sacred duty of equity is to protect depositors from losses. After it is zeroed, the losses must come from somewhere. We do not celebrate equity getting vaporized, except insofar that sacrifice of oneself in satisfaction of a duty to others is generally praiseworthy, but we certainly want to be aware that it happened.

• The world is, belatedly, realizing that this did actually happen. Past tense.

• This realization creeped in around the edges with e.g. Byrne Hobart on February 23rd noting that one of the U.S.’s largest banks was recently technically insolvent but almost certainly in a survivable way. And, to be fair, a few short funds and the Financial Times had come to this realization a bit before Byrne. Then, a few weeks later, the entire financial system almost simultaneously discovered how much they doubted precisely one half of his thesis.

• I submit to you that the regulators probably did not understand a few weeks ago that this situation was factually as concerning as it is.

• FT Editorial Board: Subscribe to read | Financial Times

• A looming game of chicken on US debt

• Chasm grows between Republicans’ cliff stance and Biden’s budget pitch....

• Biden’s document ought to be an opener for talks. Unfortunately, Republicans are opting for a game of chicken. Their demands include a near-freeze on discretionary spending for a decade, scrapping new funds for the Internal Revenue Service and the clean energy transition and an end to Biden’s plan to forgive student debts. The latter may well be struck down by the Supreme Court. The other demands are extreme. The IRS budget has declined steeply in real terms to the point where it has scant ability to audit wealthy taxpayers.

• The US is thus losing revenue on taxes it is owed. It makes no sense to make it a condition of paying America’s bills that the US disable its ability to collect revenues it is owed. The real goal is to paralyse the federal government, not to make it more efficient.

• It is also politically suicidal. Playing with America’s creditworthiness will make it far easier for Biden to run for re-election in 2024 against a reckless Republican Congress. The Republicans dictating this stance would not just be cutting off America’s nose to spite its face but doing the same to their own party as well.

Jamele Bouie: The Boys Who Cried ‘Woke!’: ‘Bad actors and interested parties try to obscure serious questions about the structure of our society with claims that serve only to muddy the waters. You don’t have to look hard to find others. Put simply, you show me a scene from the so-called culture wars, and I’ll show you what’s behind it: a real issue with real stakes for real people…

David Frum: Most governors running for president would have relished such an opportunity to flex on national security. DeSantis flinched, because he was scared Tucker Carlson might not like it. Message: Tough on drag queens. Weak on national security.

Most governors running for president would have relished such an opportunity to flex on national security. DeSantis flinched, because he was scared Tucker Carlson might not like it. Message: Tough on drag queens. Weak on national security.In February 2022, 165 Florida National Guard were serving on a training mission inside Ukraine. They were evacuated to a neighboring country, then returned home in August. DeSantis did not publicly greet them, thank them, or even acknowledge their service https://t.co/aEqtOZOVVw

Most governors running for president would have relished such an opportunity to flex on national security. DeSantis flinched, because he was scared Tucker Carlson might not like it. Message: Tough on drag queens. Weak on national security.In February 2022, 165 Florida National Guard were serving on a training mission inside Ukraine. They were evacuated to a neighboring country, then returned home in August. DeSantis did not publicly greet them, thank them, or even acknowledge their service https://t.co/aEqtOZOVVw David Frum @davidfrum

David Frum @davidfrum

¶s:

This has long been the obvious thing to do: a free bank-holding company charter and Federal Reserve system membership with every Social Security card!:

Ryan Cooper: The Case for a Banking Public Option: ‘Every individual and business should get the same Federal Reserve account benefits that banks enjoy.... A FedAccount would work like a plain-vanilla checking account, where you can deposit money and make payments with a debit card or check. There would be no account fees or transaction fees and no minimum balance requirement, but no overdraft coverage. All citizens, residents, and domestic businesses would be able to get one. A FedAccount program would solve multiple chronic problems simultaneously… the unbanked… vastly easier for the government to make payments to citizens…

I don’t think the moderate Democrats who voted for this—55 in the House and 17 in the Senate—did this to “burnish bipartisan cred”. It was just banker-donor service:

Matt Yglesias: How We Came to This Point: ‘After a major legislative debate about how to avoid exactly this… the answer turns out to be pretty straightforward: in 2018, the GOP-controlled House of Representatives wrote and passed a bill substantially curtailing the regulation of banks that are roughly the size of Silicon Valley Bank on the theory that banks of this size are not systemically important and could be resolved through the ordinary FDIC process. Moderate Senate Democrats who felt the need to burnish bipartisan cred chose this bill as their big bipartisan gesture, calculating that of all the possible issues they could defect on, this was the one that progressive groups were least invested in. Trump administration appointees at the Federal Reserve, the FDIC, and elsewhere implemented this legislation very much in the spirit in which it was written…. Objections were raised by Democrats on these boards, including Lael Brainard, who now runs the National Economic Council, and Martin Gruenberg, who now runs the FDIC, but they were overruled.… Five years later, it turns out that Brainard, Gruenberg, and Barr were right all along — putting SVB through the normal regulatory process would risk the stability of a number of perfectly solvent banks, and therefore the government needs to step in and improvise. These improvisational bailouts make a lot of people angry, and I share that anger…. The executives and shareholders of other SVB-sized banks also got bailed out as a result of this, even though those executives were the ones who lobbied against Dodd-Frank on the theory that the regulation was unnecessary. And I’m secondarily angry that a lot of other angry people are going to take out their anger on government officials (like Barr, Gruenberg, and Brainard) who warned against this course of action, while the people who set it on us escape blame entirely…

I think this gets it 100% right. It’s not at all about kneecapping Democrats (with the partial exception of Biden) for the future:

Josh Marshall: Dispatch No. 61: Why Are the GOP Investigations Such a Dud?: ‘[It’s not] because they don’t have the goods… the same could be said about the previous times we did this…. The “lab leak theory”... like The Laptop and Weaponization, the energy… is... the dubious claim that for a period of months almost three years ago this still entirely unproven (though possible) theory wasn’t taken as seriously as its proponents claim it should have been…. Claims of unfairness and double standards in the past, mostly about Donald Trump…. Backward looking… grievance-driven special pleading that only really matters to a minority of the electorate. And at core they’re mostly about Donald Trump…

Ken White is one of the few still completely sane people in America today:

Ken White: Hating Everyone Everywhere All At Once At Stanford: ‘Judge Kyle Duncan is… known for… monologuing in self-congratulatory fashion about why he won't address an incarcerated litigant by their preferred pronouns. This, plus the odd attempt to overthrow the government, is what passes for courage and principle in the 21st-century Federalist Society and for judicial restraint on the Fifth Circuit. Oh, bravely done, Judge Duncan, no doubt: you put that woke trans prisoner in her place. For the Republic. This led the Stanford Federalist Society to invite Judge Duncan to speak to them…. His invitation was a statement by FedSoc members to fellow students and America…. If you’re feeling… realistic… the message was “lol, fuck you.” The FedSoc members didn’t think “Judge Duncan explains Colorado River abstention better than anyone and we need to hear from him.” The FedSoc members thought “Judge Duncan put that pronoun freak in its place and inviting him will own the libs.”… Stanford, institutionally, made it much worse, sending an associate dean to do a grown-up’s job. Tirien Steinbach, Associate Dean for Diversity, Equity & Inclusion, indulged in a colloquy that more or less challenged the entire concept of universities tolerating speech that some people don't like…. Law students are reliably useful idiots, and played their role in the conservative pantomime perfectly. It was as if they arrived with a giant gift basket and magnum of champagne to wish Judge Duncan a bon voyage on his cruise of right-wing grifty victimhood…. Students think that they should be able to dictate which speakers their peers invite, who can speak, what they can say, and who can listen. They’re not satisfied with the most free-speech-exceptionalist system in the world that lets them respond to speech by assembling, protesting, and reviling people of authority like Judge Duncan. They demand the right not just to speak, but to control the speech of others. That’s straight-up thuggish, an aspiration born of a fascist soul. These are law students. They are training to express themselves for a living. If their view is “we can’t respond to awful speech, we can only stop it from happening,” then they’re going to be terrible lawyers...

White. Stanford Libs let themselves be owned far too cheaply

The Fed can easily misinterpret market feedback. Examples:

1) The Fed raises short rates, then long market yields fall. The Fed thinks the market doesn't believe their policy, and dislikes financial condition easing. In reality, long yields fell because the market absolutely believes the Fed will get inflation down ... probably through a recession.

2) Bank stress causes a sell off in bank securities and a flight to safety, so bond yields fall and the gov't creates bank liquidity facilities. Lower bond yields and more liquidity cause bank security prices to rise. The Fed believes this is a signal that the banks are stable, and so raises rates again.

3) The Fed believes its solved bank stress, but most financial firms also borrow short and lend long. So what ails banks also stresses non-bank financials. The problem of falling bond prices and negative NIM will be uncovered someday in a non-bank financial sector, and it will be much harder for the government to manage.

4) Banks will bid up the price of deposits (shrinking NIM) and lend less as they hoard T-bills for liquidity. Bank lending and money supply will now shrink regardless of near-term Fed policy. Rising rates are contractionary, but there was a particularly long lag this time because the banking system had been flooded with deposits and liquidity from QE.