DeLongTODAY: Is Today Rhyming with þe History of þe Great Depression? 2021-01-08

Materials for my "DeLongTODAY" talk for the week of 2021-01-08

For: <http://delongtoday.com>

Let’s start with the slides:

<https://delong.typepad.com/files/delongtoday-2021-01-06.pdf><https://www.icloud.com/keynote/0rieK7uV5prCn0aI0ZSs242Pw>

Or if you want to see the slides in a webplayer:

<iframe src="https://www.icloud.com/keynote/0rieK7uV5prCn0aI0ZSs242Pw?embed=true" width="640" height="500" frameborder="0" allowfullscreen="1" referrer="no-referrer"></iframe>Let’s continue with the google drive video file:

<https://drive.google.com/file/d/1GcSJTvo1u9cbWQLKw-hTZ_smXVzsGSpM/view?usp=sharing>

And the Transcript:

DeLongTODAY: Is Today Rhyming with the History of the Great Depression?

Introduction:

I am Brad DeLong, an economics professor at the University of California at Berkeley and a sometime Deputy Assistant Secretary of the U.S. Treasury. This is the weekly DeLongToday briefing. Here I hold forth here on the Leigh Bureau’s vimeo platform on my guesses as to what I think you most need to know about what our economy is doing to us right now.

I promised Wes Neff when he agreed to provide the infrastructure for this that I and my briefings would be: lively, interesting, curious, thoughtful, and relatively brief. **Relatively.**

I promised I would provide briefings on a mix of: forecasting, politics, macroeconomic analysis, history, and political economy.

Today is mostly an economic history briefing, trying to tease out lessons from the past for us today. Let’s remember the past, and make sure that today does not rhyme with it in a bad way…

But first...

Governance & Congressional Procedure:

Some say it is the Internet, especially Facebook. Others say it is Fox News, with its business model of terrifying old people to keep their eyeballs glued to the screens so it can make money by selling them fake diabetes cure is an overpriced cold front. I see it is as Newt Gingrich’s radicalization and nationalization of the Republican Party, and then the ability of Gingrich and his successors, most prominently Mitch McConnell, in prioritizing party loyalty above all else, and turning Republican legislators into potted plants.

Do we now have an opportunity to return to the normal modes of governance? Actually, I think not. It has now been 30 years since there was an informal centrist send it coccus that tried to build societal near consensus on effective technocrat policies. We do not know how to do that anymore. The best we can hope for is for Biden, Schumer, Pelosi and Company to figure out what is best for America, and then to figure out a way to hold the marginal members of their caucuses to the votes. It will not be an easy task.

What are the prospects for legislation? And administrative action? The first hurdle is that Biden has to get the Democratic senators to be willing to let him drive—get them all to understand that their reelection chances as well as the country’s future depend on Biden’s presidency being a success and being perceived as a success. If that is not accomplished, then things get bad. And it was not accomplished by Clinton or by Obama.

If that can be accomplished—if the Democratic senate caucus can focus on maintaining something like the party unity that the Republican senate caucus has had since the election of Clinton—we move on to the next roadblocks.

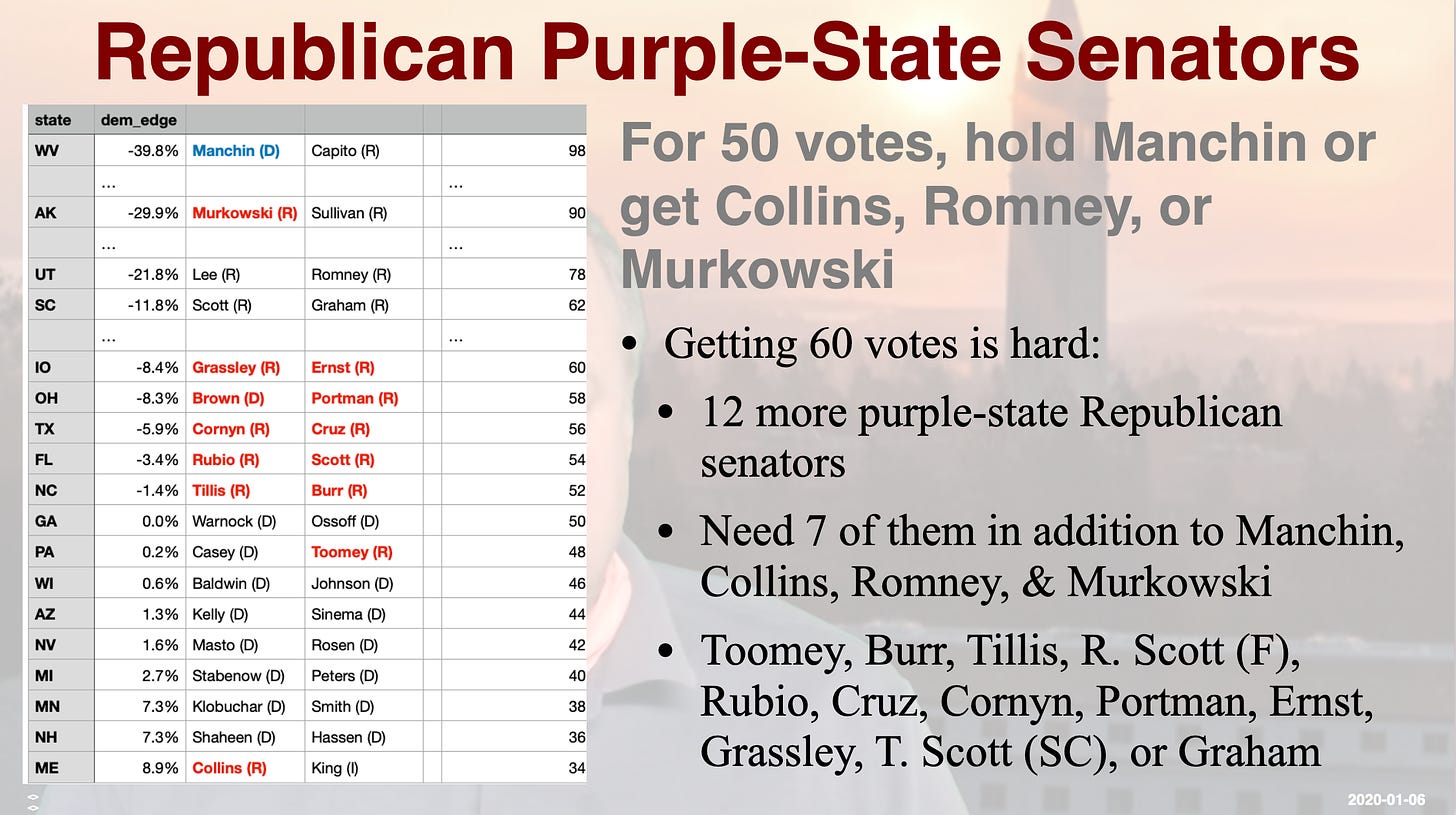

First, rank the Republican senators in order of the purpleness of their states—and add in Romney and Murkowski as virtual purple-state Republican senators. They are red-state senators who are playing a different game than their colleagues in the Republican senate caucus.

To get to 50 senators and pass bills with Kamala Harris, Majority Leader Schumer needs to hold Manchin, or pick off either one of Romney or Murkowski, or pick off one of, in order of ascending redness, the thirteen purple-state Republican senators: Collins, Toomey, Burr, Tillis, R. Scott (F), Rubio, Cruz, Cornyn, Portman, Ernst, Grassley, T. Scott (SC), or Graham

To get to 60 senators and so overcome filibusters or budget points-of-order, the Democrats need to hold Manchin; get Collins, Romney, and Murkowski; and then pick off at least seven of, in order of ascending redness, the thirteen purple-state Republican senators: Collins, Toomey, Burr, Tillis, Rick Scott (F), Rubio, Cruz, Cornyn, Portman, Ernst, Grassley, Tim Scott (SC), and Graham. The question is: how many of those thirteen want to pursue the strategy of “I’m not loyal to the obstructionist party barons; instead I get things done—and the things I get done are the things I want to do, not the things Biden and Schumer and Pelosi want to do” as both a road to reelection and as, you know, a way to hold their heads up and look at themselves in the mirror in the morning.

Thus which things will pass the Senate this year? The answer is:

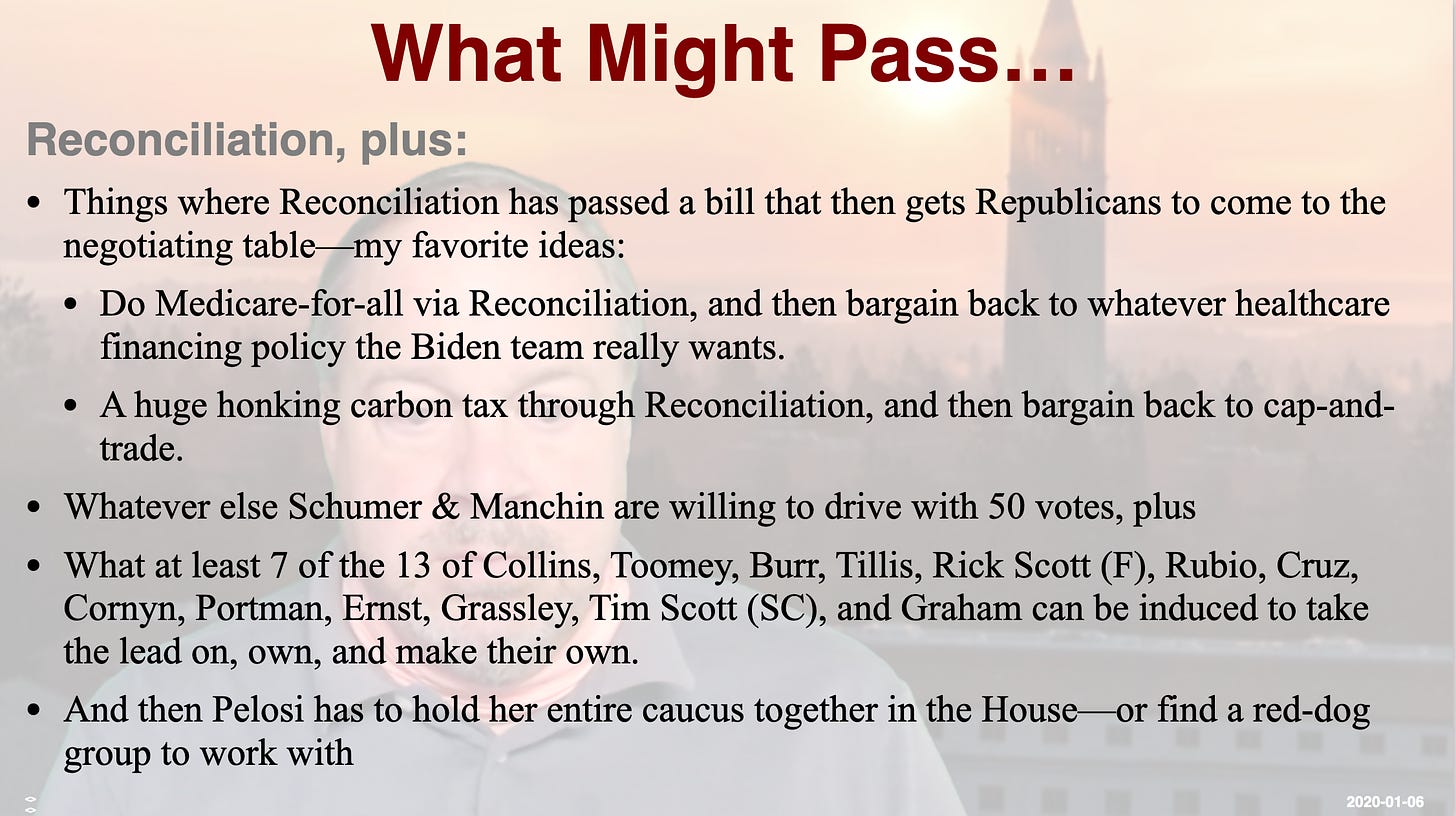

Reconciliation things

Things where Reconciliation has passed a bill that then gets Republicans to come to the negotiating table—my favorite idea is to do Medicare-for-all via Reconciliation, and then bargain back to whatever healthcare financing policy the Biden team really wants. Also, a huge honking carbon tax through Reconciliation, and then bargain back to cap-and-trade

Whatever else Schumer & Manchin’s are willing to drive with 50 votes, plus

What at least 7 of the 13 of Collins, Toomey, Burr, Tillis, Rick Scott (F), Rubio, Cruz, Cornyn, Portman, Ernst, Grassley, Tim Scott (SC), and Graham can be induced to take the lead on, own, and make their own.

And then Pelosi has to hold her entire caucus together in the House—or find a red-dog group to work with.

Much better than the past four years. But it does not strike me as good, or as anything that would lead anyone in any other country to see America as a model for how to run a democratic-with-a-small-d government.

Failures of American Governance in Historical Perspective:

History does not repeat. But it does rhyme. I have been thinking about the failure of the American government to do the Right Thing with respect to the COVID-19 plague, and to the failure of the American government to do the Right Thing with respect to prioritizing swift and full recovery from the Great Recession, and then looking back at the Hoover administration—and its failure to do any of the Right Things from 1929 to 1933.

So let me tell you the Great Depression story of the Hoover administration, as I understand it right now.

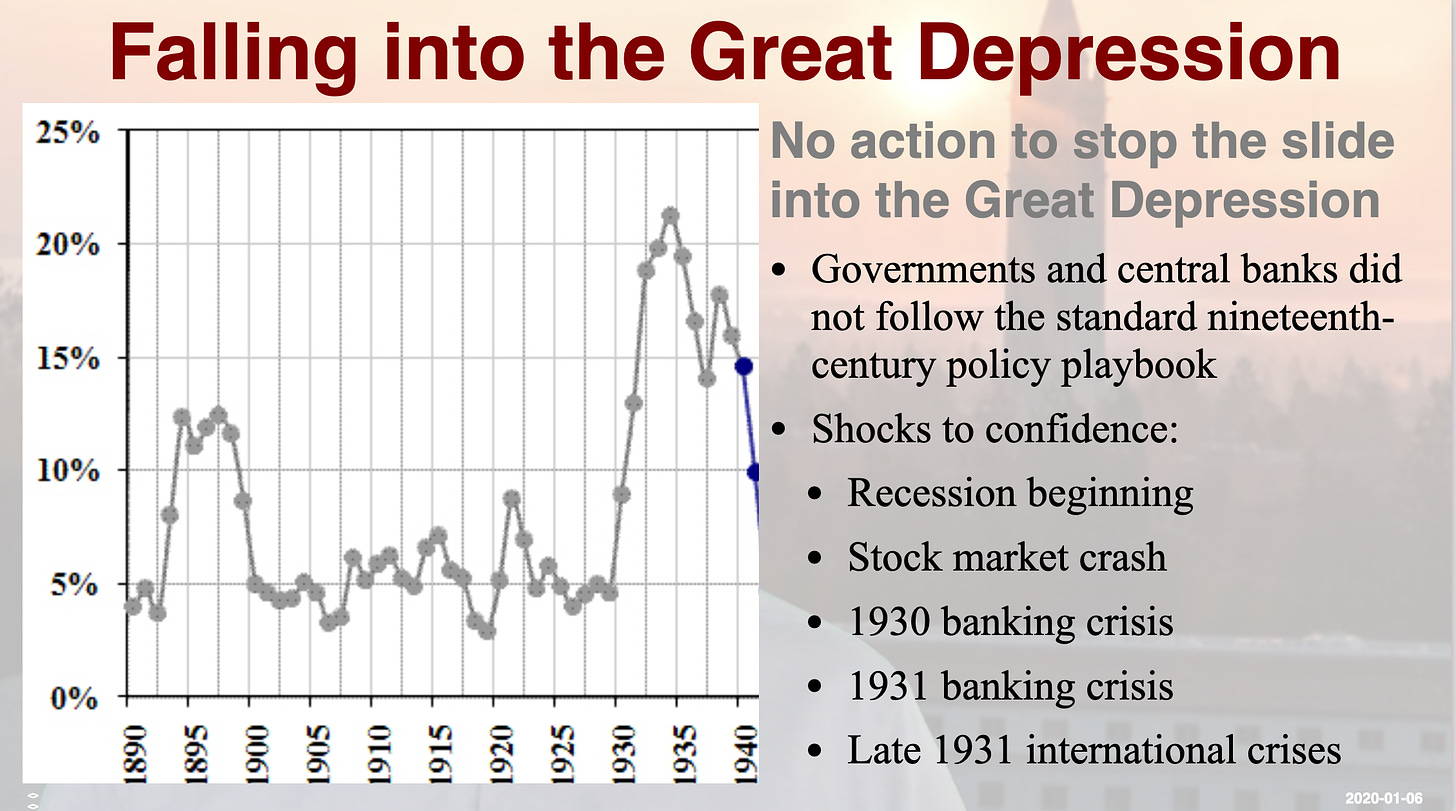

As the world slid into the Great Depression from 1929-1933, central banks did not take large-scale emergency steps to boost cash in the hands of the public. It is straightforward to narrate the slide. It is not straightforward to understand why central banks—and governments that could have upped their direct spending and employment—sat on their hands.

“Say’s Law”

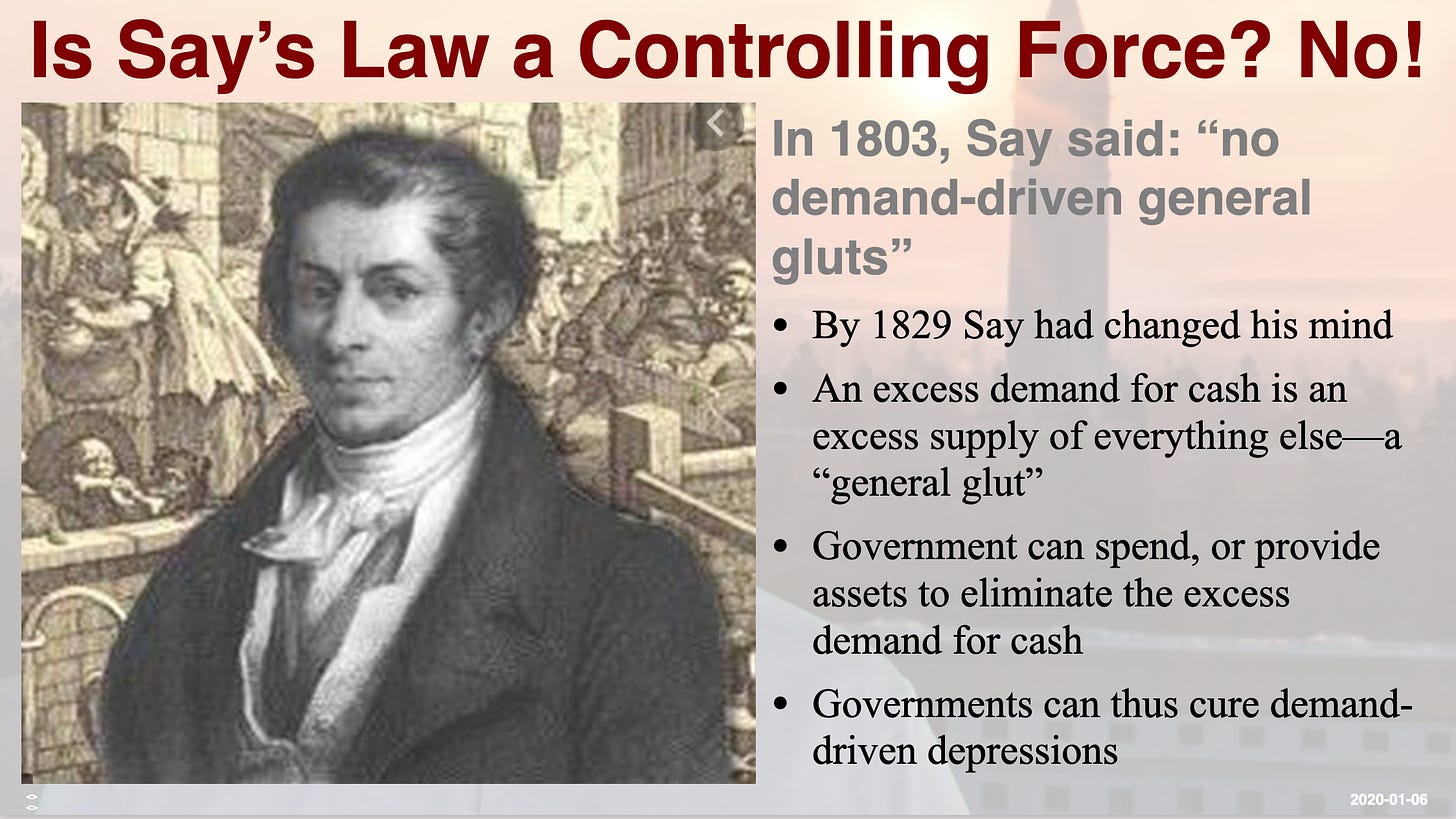

Back in 1803 there was a French economist, Jean-Baptiste Say, who argued that there was no such thing as a depression that was caused by a shortage of aggregate demand and that could be cured by the government spending more, or by the government giving or loaning people money to induce them to spend. more. Back in 1803 Say argued that if there was a shortage of spending on one commodity it meant that there was excess demand for another one—and if there was unemployment, it was only because bad regulations or a lack of information was keeping workers and entrepreneurs from shifting from the sector where there was excess supply to the sector where there was excess demand. The solution, Say’s followers have said ever since, was not to stimulate the economy but rather to unleash the free market—to remove whatever regulations or subsidies, especially things like unemployment insurance, were impeding the process of reallocation.

It is peculiar that Say has had followers—and he has had followers to this day. He still has them. For Say, after the British Canal Panic of 1825, recognized that he had been wrong back in 1803. In late 1825 the banks and merchants of England decided ithat they had made too many loans to too many counterparties whose investments were not turning out well. They ceased to advance cash in return for being given title to promises to pay that merchants had received from customers. Thus, Say wrote: “commerce found itself deprived at a stroke of the advances on which it had counted…” The consequence, Say wrote, was financial and economic collapse: a true “general glut”, and the first industrial-era business cycle and depression.

Money and credit are, in the last analysis, liquid trust. And if there is not trust that your counterparty is solvent, the money and credit will not be there. And if there is a large excess demand for money, all other commodities will be in excess supply: mass unemployment and shuttered factories.

Now there is one organization that is almost always trusted to be good for the money. The government accepts the money that it itself issues as payment for taxes, and so everybody who owes taxes will be willing to sell what they have in return for the money the government has printed up. Whenever the economy freezes up due to a shortage of demand and of income, the government can fix it—as long as its own finances are trusted over the long term—by boosting the amount of government-issued cash in the public’s hands. People then will be able to buy. Their purchases then become extra income for others. Those others will then be able to scale up their purchases. And so the economy will unwedge itself.

There are a number of ways the government can get extra purchasing power into the hands of the public to cure a depression:

1. It can have its functionaries throw bundles of cash out of helicopters—an arresting image coined originally by Milton Friedman (a reference to which earned former U.S. Federal Reserve Chair Ben Bernanke his nickname of “Helicopter Ben”).

2. The government can hire people, set them to work, and pay them.

3. The government can simply buy useful stuff, and so provide the extra demand to make it profitable for employers to hire more people, set them to work, and pay them.

4. The government can have an arm—a central bank—that trades financial assets for cash.

As the world slid into the Great Depression from 1929-1933, central banks did not take large-scale emergency steps to boost cash in the hands of the public. It is straightforward to narrate the slide. It is not straightforward to understand why central banks—and governments that could have upped their direct spending and employment—sat on their hands.

Shocks to Confidence & Excess Demand for Cash:

The start of the recession in mid-1929 was the first shock to confidence. The stock market crash of late 1929 was consequence of that shock and of overleverage, and was itself a second, major confidence shock that quickly transmitted itself around the entire world. Then, a year later, came a banking crisis in the United States. The thought that your money in banks might get locked away and be inaccessible—or vanish completely—gave a further substantial boost to the excess supply of money. March 1931 saw a second banking crisis. The summer and fall of 1931 saw panics in other countries, which made the Great Depression great worldwide—and greatest in Germany.

Up until late 1930, the excess demand for cash was on the demand side: with the Roaring Twenties over and the stock market in a pronounced bear market, demand for cash is elevated. But starting in late 1930 banks began to get scared and to restrict the amount of cash in the form of bank deposits they were willing to provide to their customers. They called in loans, and cancelled lines of credit, as they sought to raise the ratio of their own reserves they held to the deposits that they owed to their customers. And households began to want to raise their currency-to-deposits ratio: to hold more cash under the mattress for each dollar of deposits they left in the bank. From late 1930 on up into 1933, month by month these reserves-to-deposits and currency-to-deposits ratios grew as confidence became lower and lower, and so month by month the money supply shrank. 1931 had been a year of banking and International financial crises. 1932 saw no large extra crises, but it also saw no recovery, as the situation was now so dire and so unprecedented that there was no recovery of “confidence”.

Conventional anti-Keynesian economic thinking is that any depression will be cured faster if wages and prices are encouraged—or forced—to fall in nominal terms. The same amount of spending in dollars will then buy more stuff and provide demand for more people to work. The problem is that when wages and prices fall, debts contracted in fixed nominal terms do not fall as well. Thus falls in prices—deflation—during the Depression set in motion bankruptcies which set in motion further contractions in production, which triggered additional falls in prices. With prices falling at ten percent per year, investors could calculate that they would earn less profit investing now than delaying investment until next year when their dollars would stretch ten percent further. Demand for cash went up and the excess supply of goods and services grew. Banking panics and the collapse of the world monetary system cast doubt on everyone's credit and reinforced the belief that now was a time to watch and wait. The slide into the Depression, with increasing unemployment, falling production, and falling prices, continued throughout then newly-elected Herbert Hoover’s Presidential term.

At its nadir, the Depression was collective insanity. Workers were idle because firms would not hire them to work their machines; firms would not hire workers to work machines because they saw no market for goods; and there was no market for goods because workers had no incomes to spend. Orwell’s account of the Great Depression in Britain, The Road to Wigan Pier, speaks of “...several hundred men risk[ing] their lives and several hundred women scrabbl[ing] in the mud for hours... searching eagerly for tiny chips of coal” in slagheaps so they could heat their homes. For them, this arduously-gained “free” coal was “more important almost than food.” While they risked and scrabbled, all around them the machinery they had previously used to mine in five minutes more than they could gather in a day stood idle.

Austerity

In the slide into the Great Depression elites doubled down on the austerity that they had committed themselves to in the 1920s. Faced with the gathering depression, the first instinct of governments and central banks was to do nothing.

Businessmen, economists, and politicians (memorably Secretary of the Treasury Mellon) expected the recession of 1929-1930 to be self-limiting. They expected workers with idle hands and capitalists with idle machines to try to undersell their still at-work peers. Prices would fall. When prices fell enough, entrepreneurs would gamble that even with slack demand production would be profitable at the new, lower wages. Production would then resume. This is how earlier recessions had come to an end.

Throughout the decline—which carried production per worker down to a level 40 percent below that which it had attained in 1929, and which saw unemployment rise to take in almost a quarter of the American labor force—the U.S. government did not try to prop up aggregate demand. The Federal Reserve did not use open market operations to keep the money supply from falling. Instead the only significant systematic use of open market operations was in the other direction. To discourage gold outflows after the United Kingdom abandoned the gold standard in the fall of 1931, interest rates went up.

The Federal Reserve thought it knew what it was doing: it was letting the private sector handle the Depression in its own fashion. And it feared that expansionary monetary policy or fiscal spending and the resulting deficits would impede the necessary private-sector process of readjustment. The do-little-to-nothing approach, the unwillingness to use policy to prop up the economy during the slide into the Depression, was backed by a large chorus, which included some of the most eminent economists around. For example, from Harvard Joseph Schumpeter argued that “depressions are not simply evils, which we might attempt to suppress, but forms of something which has to be done, namely, adjustment to change.” Or, as Friedrich von Hayek wrote, “The only way permanently to mobilize all available resources is, therefore to leave it to time to effect a permanent cure by the slow process of adapting the structure of production…” As Schumpeter put it, in his view: “Any revival which is merely due to artificial stimulus leaves part of the work of depressions undone and adds, to an undigested remnant of maladjustment, new maladjustment of its own which has to be liquidated in turn, thus threatening business with another [worse] crisis ahead…”

The market giveth, the market taketh away, but—in this case—not blessed but cursed be the name of the market.

From the 1950s and contemplating the wreck of his country’s economy and his own political career, Herbert Hoover cursed those in his administration who had advised inaction during the downslide:

>The “leave-it-alone liquidationists” headed by Secretary of the Treasury Mellon felt that government must keep its hands off and let the slump liquidate itself. Mr. Mellon had only one formula: “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate”. He held that even panic was not altogether a bad thing. He said: “It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people”…

This ruling doctrine—that in the long run the Great Depression would turn out to have been good medicine for the economy, and that proponents of stimulative policies were shortsighted enemies of the public welfare—was, to put it bluntly, complete bats—-. John Stuart Mill had nailed the analytical point back in 1829: an excess demand for money was what produced a “general glut”, and if the economy’s money supply were matched to money demand, there would be no depression. Practical central bankers had developed a playbook for what to do. Yet it was not followed.

Why? Perhaps it was because in previous downturns the excess demand for money had triggered a scramble for liquidity: people desperate to have more cash they could spend immediately dumped other assets, including the government bonds they held. As government bonds fell in price the interest rates they paid rose. Central bankers saw such sharp spikes in government bond interest rates as a signal that the economy needed more cash. But the Great Depression was not like previous downturns.

In this downturn the excess demand for money was so broad and fear was so great that it triggered a scramble for safety. Yes, people were desperate for more cash, but they were also desperate for assets that they could easily turn into cash in the future, The troubles looked as if they would last for quite a while, so they dumped other assets on the market—speculative stocks, industrial stocks, utility stocks, bonds of all kinds, even secure railroad stocks whose dividends turned out not to be inviolable, plus things like their ancestors’ furniture and their summer homes—and scrambled for both cash and government bonds. With no government-bond interest-rate spike, central bankers were not sure what was going on.

For their part, governments strained their every nerve and muscle to balance their budgets—thus further depressing demand—and to reduce wages and prices—in order to restore competitiveness and balance to their economies. In Germany the Chancellor—the Prime Minister—Heinrich Brüning decreed a ten percent cut in prices, and a ten to fifteen percent cut in wages. But every step taken in pursuit of fiscal orthodoxy made matters worse, especially as expected future deflation further depressed investment. Why invest now if you expect deflation, so that everything you might buy this year would be ten percent cheaper next year?

Cassandras, Croaking:

During the Great Depression a few economists understood this process. None of them walked the corridors of power. So it was that the ruling “liquidationist” doctrine—that in the long run the Great Depression would turn out to have been good medicine for the economy, and that proponents of stimulative policies were shortsighted enemies of the public welfare—over road the anguished cries of dissent from those less hindered by their theoretical blinders (as well as the anguished cries of the unemployed, hungry, and uncertainly housed if housed at all). British economist Ralph Hawtrey scorned those who, like Robbins and von Hayek, wrote at the nadir of the Great Depression that the greatest danger the economy faced was inflation. It was, Hawtrey said, the equivalent of “Crying, ‘Fire! Fire!’ in Noah's flood.” John Maynard Keynes also tried to bury the liquidationists in ridicule.

Even governments that had unrestricted international freedom of action—like France and the United States with their massive gold reserves—tended not to pursue expansionary monetary and fiscal policies on the grounds that such would reduce investor “confidence” and hinder the process of liquidation, reallocation, and the resumption of private investment. Was there nothing to be done? The “liquidationists” believed that there was something. To restore confidence, governments must balance their budgets. Immediately—or at least as rapidly as possible.

The Great Depression was the greatest case of self-inflicted economic catastrophe in the twentieth century. As Keynes wrote at its very start, in 1930, the world was:

as capable as before of affording for every one a high standard of life.... But today we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand…

Keynes feared that “the slump” he saw in 1930 “may pass over into a depression, accompanied by a sagging price level, which might last for years with untold damage to the material wealth and to the social stability of every country alike.” He called for resolute, coordinated monetary expansion by the major industrial economies to “restore confidence in the international long-term bond market... restore [raise] prices and profits, so that in due course the wheels of the world’s commerce would go round again.” His was the croaking of a Cassandra.

History, Rhyming:

When the history of the global north since 2000 is written, I think that it will read much the same as the history of 1929-1933 reads, with one significant difference. Things never got as bad as they did in 1933, hence there never was the revolution against “austerity” and all its works and all its evil promises and the embrace of reflation that was carried out in the Great Depression years by statesmen like Takehishi Korekiyu in Japan, Neville Chamberlain in Britain, Franklin Roosevelt in the United States, and… Adolf Hitler in Germany. Never forget that Hitler’s economic policies did what the previous Weimar Republic’s had not and restored prosperity to Germany, so making him very popular indeed. We still have lots and lots of people saying that we cannot prioritize restoring full employment—suppressing the COVID-19 plague—accelerating the pace of vaccination—accomplishing societal goals like fighting global warming or reducing the excessive cost of health care—because it would interfere with the workings of the neoliberal market system we have constructed. But it is not wise to say “the market giveth, the market taketh away: blessed be the name of the market!”

That was, I think, the root cause of what went wrong over 1929-1933. So let’s not make their mistakes. Let the mistakes we make be new and different ones.

So, instead, we must say “the market was made for man; not man for the market”. As John Maynard Keynes said on the floor of the House of Lords during World War II: “What we can **do**, we can **afford**”. Our first task is to figure out what we need to do and to start doing it. Figuring out how to adjust the financial scaffolding to support that doing is a second-order problem, and one that we are clever enough to solve.

I’m Brad DeLong. This is my DeLong Today briefing.

4015 words