It Appears We Are Almost at the End of the Glidepath to an Inflation Soft Landing...

& yet there does seem to be a very curious disjunction between chatter and current-data reality. A great deal of this is clickbait noise-and-fluff, & yet it would seem that there are other, more...

& yet there does seem to be a very curious disjunction between chatter and current-data reality. A great deal of this is clickbait noise-and-fluff, & yet it would seem that there are other, more evidence-based narratives that those who live by clickbait are hyping. So why is it still inflation?…

There is no longer any inflation going on. If we were going to have a soft landing, this is exactly how it would look like. That is the current-data reality.

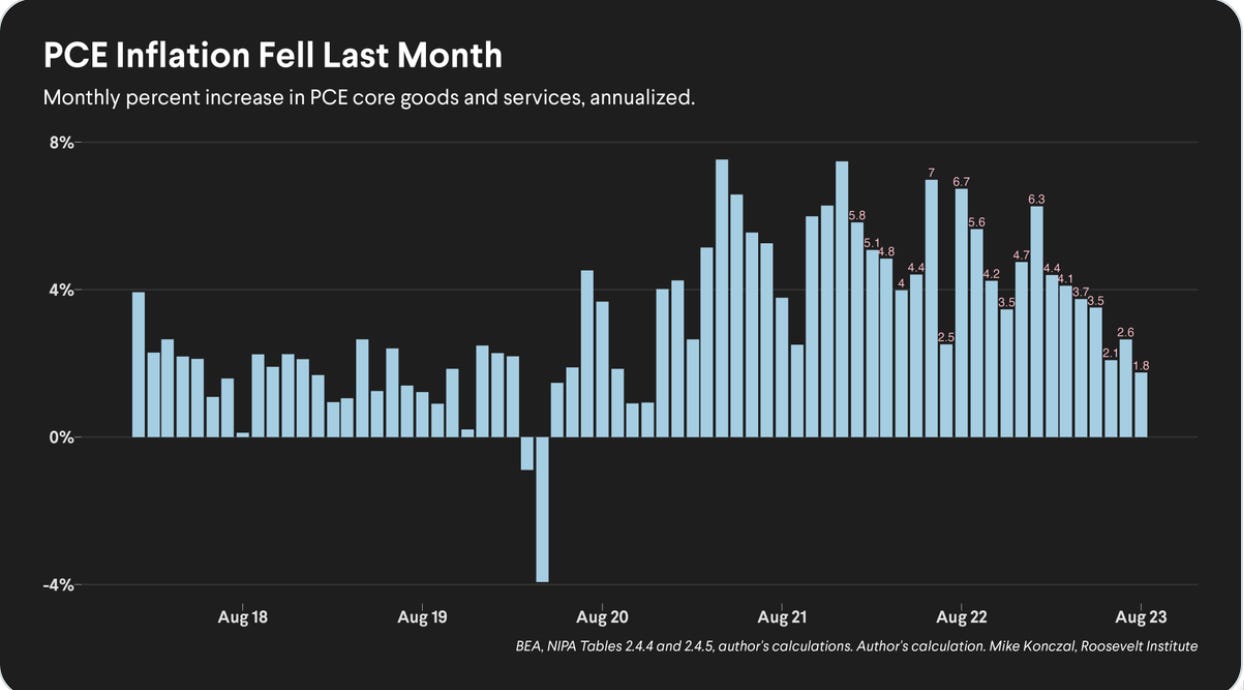

And so, this morning, we have Mike Konczal:

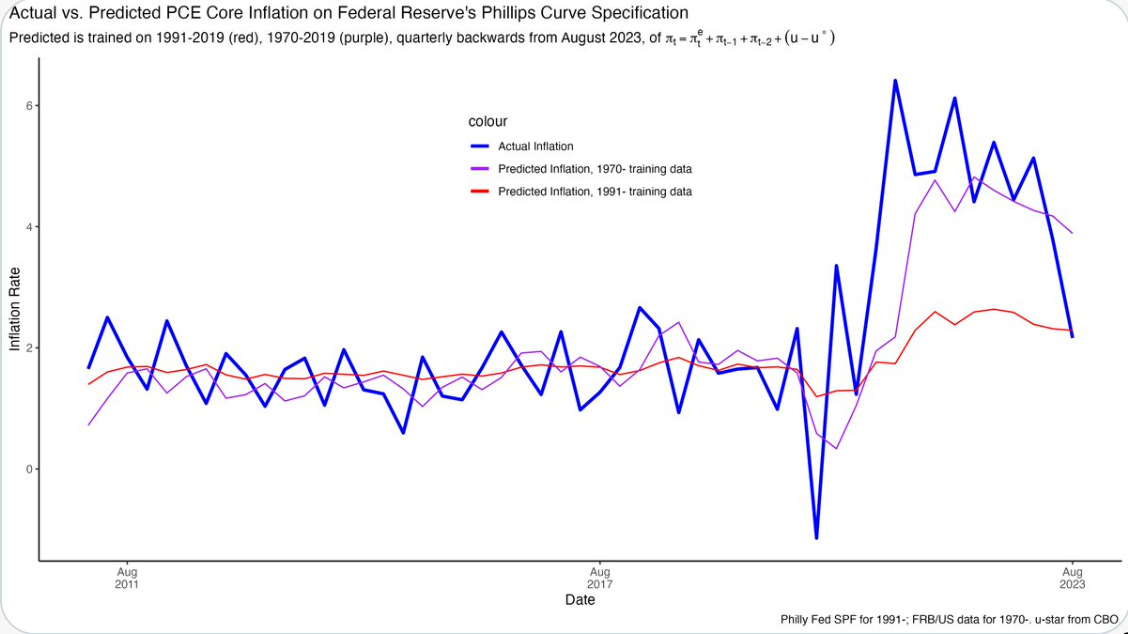

Mike Konczal: ‘Well that's about the best inflation print ever. Core PCE has a monthly value below 2 percent annualized (the Fed's target) for the first time since the lockdowns. But under the hood it's even better - it's all in the right directions. Let's dive in. This month had zero inflation in core goods and further slowing in services, especially non-housing services. This is exactly the scenario we want to see…. What is the Fed seeing? Well here's their favored Phillips Curve specification, trained on data from 1970- (stagflation model) and 1991- (Great Moderation model). Folks, we're back. It's right on the moderation line….

The harsh 'unemployment is necessary for any disinflation' world is the purple line; it's behind us. If you are reading this far you probably have strong opinions about whether imputed services are driving the decline in non-housing services and/or you just really don't want to start work today. Either way, they are not. The decline is genuine rather than weird accounting…. Next month might be worse (if we get the data next month) as much as this one is good. But all the longer trends are pointing in the right direction, too. This is as the labor market and growth continue to remain strong. An achievement…

And yet, Larry Fink—not a dumb man at all:

Question: You have Jamie Dimon, for example, saying rates in the U.S. could go to 7%. Is he right?

Fink: Look, we all have opinions. I have been saying for over a year that…

Question: I want to know your opinion.

Fink: My opinion is that we are going to have 10 year rates at at least 5% or higher because of this embedded inflation. This structural inflation is unlike anything. And I think business leaders and politicians are not providing the foundation to help explain this. We have not seen inflation like this in over thirty years. I was a young bond trader in the late 1970s when we had hyperinflation. I do not think we are going to have anything close to the inflation of the 1970s, but we have so much deeper structural inflation and we are underestimating what this change in geopolitics is so structurally inflationary. When I was in Davos earlier this year, I heard the phrase “national security” uttered everywhere. I had never heard that phrase uttered so often before for chips or food or energy—obviously energy, and all these issues. And the question is: at what cost? Nobody answers that question “at what cost?”

Hyperinflation? A hyperinflation is typically defined as more than 50% per month. The highest monthly inflation rate we got during the 1970s was 1.02% per month.

But I shouldn’t make fun of Larry Fink. He is not a forecaster. He has forecasters working for him to try to give BlackRock an analytical edge via better senses of directional moves than the consensus. But he pays little attention to them, because the business is much more to hedge macro risks than to exploit macro opportunities.

And there is some sense underlying Larry Finks worries. He hears “derisking”. and he fears that derisking will turn into decoupling will turn into protectionism will turn into deglobalization, and that will be a mighty adverse supply shock that will cause central banks to lose control of the situation. And he is worried that markets are not fearing this possibility enough and so governments are about to do things that are really stupid. I cannot say that this is an invalid fear for him to have.

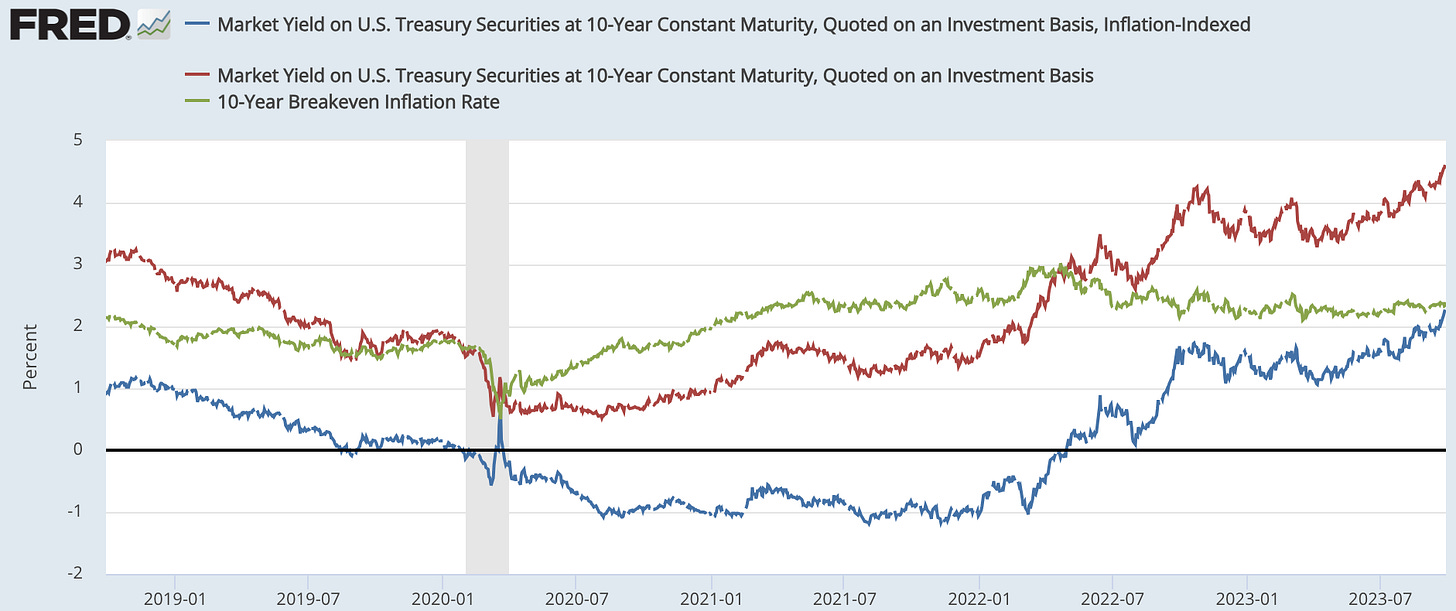

But that is really not the way that the news has been trending over the past six months. We have not been seeing nominal costs coming in higher and production coming in weaker than we had expected—which is what we would be seeing if the derisking-to-deglobalization train were barreling down the track. We have been seeing costs coming in lower and production coming in stronger than we had expected. That has been pushing up interest rates because the chances of “Fed overdoes it and then starts frantically cutting” have been going down substantially, as it becomes clearer that (a) the Fed’s moves so far have not overdone it as far as policy restriction is concerned and (b) there is little rationale for the Fed to take further austere steps that might overdo it in the future. But that is, I think, a different mental channel pushing up interest rates than what Larry Fink is worrying about.

And, truth be told, the “Jamie Dimon… [is] saying rates in the U.S. could go to 7%” is way overhyped as clickbait. Dimon:

Question: What are the risks of a hard landing for the U.S. economy?

Dimon: No one knows. There is a range of outcomes…. I hope and pray there is a soft landing.

Question: When rates go up sharply, there is stress in debt repayments. How are businesses living with such high rates?

Dimon: First of all, interest rates went to zero. Going from zero to 2% was almost no increase. Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility. I am not sure if the world is prepared for 7%. I ask people in business, 'are you prepared for something like 7%?' The worst case is 7% with stagflation. If they are going to have lower volumes and higher rates, there will be stress in the system. We urge our clients to be prepared for that kind of stress. Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out. These 200bps will be more painful than the 3% to 5%…

Dimon is right that interest rates could go to 7%—the world is a surprising and risky place. Dimon is right that people should be thinking about how they would pay their bills in a 7% interest rate world, and JP Morgan Chase is very eager to tell you how to handle that scenario, for a fee. But if either BlackRock or JPMC actually thought that 10-Year Treasuries were going to 7% with any confidence, they would have and would have told customers and clients to take positions and the 10-Year Treasury would already be at 7%. It isn’t:

There may well be more inflationary shocks in our future. But it really looks like the shocks in our past—the reopening-bottleneck shock, the fiscal insurance against a return to secular stagnation shock, and the Putin attack on Ukraine shock—are now in our past. And, right now, the ocean looks remarkably calm again.

Let's hope that the increasing profit margins of corporations has peaked and will stay steady or decline. Escalating prices are very obvious to shoppers - so one should not just look at core inflation to avoid the volatile food and energy inflation that is of more immediate concern to everyday consumers. https://www.yardeni.com/pub/sp500margin.pdf

Long Live Immaculate Disinflation!