KV-Curious Podcast; & BRIEFLY NOTED: For 2023-03-17 Fr

Yet another—this one is very good "Slouching" podcast; Bing & Chat-GPT traffic no longer lost in the underflow; AI is my copilot; SVB & defanging the bank regulators; Livingston & Doctorow & Wolfra...

FOCUS: KV-Curious Podcast:

Key Points:

Neoliberalism has resulted in a growing wealth inequality and a failure to properly utilize resources for the betterment of society.

Universal Basic Income (UBI) is unlikely to work—people want the opportunity to contribute and be rewarded for their work

The idea of a right to a job is likely to be much more effective.

Centralized versus market-driven systems—that is and remains a key issue in policy-making.

But we need, other, different mechanisms as well: command, bureaucracy, and market are not a sufficient menu of alternatives.

Is philanthropy a separate mode? Perhaps.

Is democracy best thought of as a separate mode? Perhaps.

Are “algorithms” a different mode? Perhaps.

A market society simply does not “see” the poor it all.

A market society simply does not “see” the overwhelming importance of research and development.

A market society simply does not “see” the overwhelming importance of nurturing communities of engineering practice

Education is the most productive way to lift individuals out of poverty. But saying that is not doing that.

The left is much better positioned than the right to guide future societal changes because that is its business—and the right’s idea that things should be as they were, in some sense, is never going to work in a world of rapid technological change.

Wealth inequality and the resulting deviation of market prices and rewards from levels consonant with social utility is the major market failure. Indeed, it may be the only significant one.

The first-order effect of globalization today is to create a richer and more equal world—but those were not its effects from 1800 to 1990.

Is the gerontocracy a huge problem? Perhaps.

The resilience of the global economy in the energy and food sectors has surprised me, and has helped reduce the impact of the Russian attack on Ukraine.

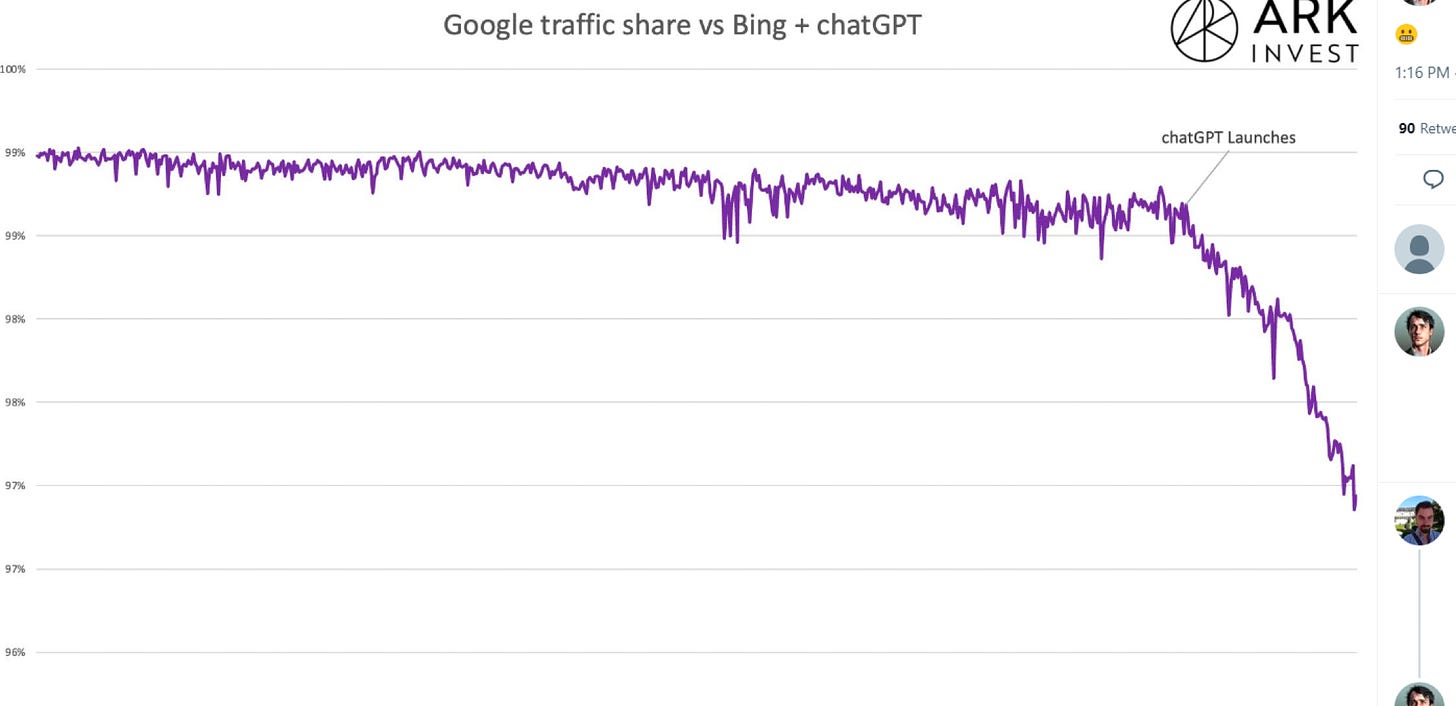

ONE IMAGE: Bing & Chat-GPT Traffic Is No Longer Lost in the Underflow:

So is this Google down or other things up from zero? I bet the second. But the slide deck does not tell us…

MUST-READ: AI Is My Copilot:

Dan Shipper: Where Copilots Work: ‘This is the ideal copilot in my mind: Every time you touch your keyboard it brings to bear your entire archive of notes, and everything you’ve ever read, to help you complete your next sentence. It would help you make connections between ideas, bring up pieces of supporting evidence, and suggest quotes to use. It might also bring up writers you love who disagree with the point you’re making—so you could change your mind, or sharpen your argument in response to theirs. Ideally, it would do this in a fashion that’s seamless, highly accurate, and easily checked. In other words, usually if it completes something it’s making a good point, and it’s easy for you to tell if the point is good or not, without lots of extra effort. This is far from the reality today. If we want to advance these kinds of tools beyond just being interesting demos, we’re going to have to build them ourselves. I hope this post pushes a few of you in that direction. I’ll keep you posted as I keep discovering more…

ONE MORE AUDIO: Alloway & Weisenthal and Menand:

We speak with Columbia Law School professor Lev Menand, who discusses the defanging of bank supervisors in the run-up to this [SVB] fiasco. With proper oversight, someone might have caught and put a stop to the unique set of risks the bank was taking. But without proper oversight, they were encouraged to go for all-out growth, regardless of the ultimate social cost. We also discuss legislative changes over time that led to this buildup of risk….

<https://overcast.fm/+5AWNEiF0U>

Very Briefly Noted:

Brad Setser: The World Bank Stepped Up During the Pandemic: ‘The World Bank (and the IMF) should get credit for increasing their lending to the world's poorest countries during the pandemic. But without additional action, net flows to developing economies will fall off a cliff…

I confess I do not know why gullible centrists ever let Bret Stephens live rent-free in their brains, but they do: Zeynep Tufeckci: Here’s Why the Science Is Clear That Masks Work…

Cory Doctorow: Pluralistic: The AI hype bubble is the new crypto hype bubble: ‘Long Island Ice Tea – known for its undistinguished, barely drinkable sugar-water – changed its name to "Long Blockchain Corp." Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since…

Zyi Mowshowitz: AI #3: ‘Welcome to week three of the AI era…

Duncan Black: Live And Let Live: ‘I always come back to… Schiavo…. Influential DC people… [did not] understand that there was a big difference between "Michael Schiavo should not pull the plug" and "Tom DeLay should be in charge of these decisions”…. A lot of people are assholes, but a lot of people aren't, and even more people are able to understand that "this could be me and my kid"…

Jonathan V. Last: The Three Histories of Conservatism: ‘Was MAGA always the inevitable endpoint of conservatism?… The question is whether or not a healthy conservatism ever truly existed in the first place, or if it was just the intellectuals’ mind palace. My tentative answer was that (a) I could argue this both ways and (b) there was a third option: conservatism as a cargo cult…

Jonathan V. Last: Conservatism Inc. Surrenders (Again): ‘The Always Republican caucus gets ready to swallow hard. 1. Must Protect the Precious…. The Democratic party is on the right side of Ukraine… understand that this war is more than a “territorial dispute.”… Parts of the Republican party—primarily the party’s Senate leadership (and Mike Pence)—also understand this. But the main body of the Republican party is moving the other way

Andreas Kluth: What Motivates Putin and His Followers Is Resentment: ‘The force Nietzsche called ressentiment is now driving the Kremlin to make endless war.

Roy Edroso: The word torturers: ‘Conservatives get stressed when their culture-war provender goes bad: The progress from “n****r-lover” to “woke” as the favored pejorative of bigots could make for a book-length study…

Aaron Rupar, Noah Berlatsky, & Sarah Hurst: Republicans attack "woke banks" to remind you they’re a party of hate: ‘It's white identity politics…

¶s:

James Livingston: The Sense of an Ending: ‘Three recent books combine theoretical sophistication and historical method in ways that enable us to rethink majority rule and thus re-imagine the future of democracy. And the most searching of the three calls into question whether that future is compatible with capitalism as we have come to know it:

Martin Wolf, The Crisis of Democratic Capitalism (Penguin Press, 2023). Francis Fukuyama, Liberalism and Its Discontents (Farrar, Straus and Giroux, 2022). Pranab Bardhan, A World of Insecurity: Democratic Disenchantment in Rich and Poor Countries (Harvard University Press, 2022)…. Fukuyama, who identifies as a right-wing Marxist in the tradition of the Russian-born French philosopher Alexandre Kojève, has written the least ambitious of the manifestos. He aims merely to restate and clarify the claims of “classical” liberalism, then test them against recent criticisms from the left and the right. The result is a “fair and balanced” treatment of the doctrinal triangulation, but one which leaves the reader wondering for most of the book where the author stands. Indeed, it is only in the book’s last two chapters that the “need to restore liberalism’s normative framework, including its approach to rationality and cognition” is announced as the real agenda. The key word here is “restore.” Fukuyama seems to think that, when compared as theories of governance, the alternatives residing in the various critiques of liberalism just don’t measure up: they’re intellectually inferior as well as practically unworkable….

Bardhan… is also much more attuned than Fukuyama to the possibility that the centrifugal social logic of classical liberalism fueled the nihilism common to neoliberalism and authoritarian populism… more interested than Fukuyama the political theorist in the politics of the impending transition from capitalism to social democracy, and more cognizant than Wolf the economic journalist of how inequality registers in populist revolts as cultural resentmen….

The Crisis of Democratic Capitalism is the most searching of the three books…. Wolf… charts… relentlessly and meticulously, from climate change to the con game we know as the banking system…. But he cloaks his radical ideas in the persona and language of a centrist, buttoned-down journalist out to save capitalism from its excesses, not to promote revolutionary change. No one should be fooled…

Cory Doctorow: Pluralistic: The AI hype bubble is the new crypto hype bubble: ‘As Bender says, we've made "machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it." One potential tonic against this fallacy is to follow an Italian MP's suggestion and replace "AI" with "SALAMI" ("Systematic Approaches to Learning Algorithms and Machine Inferences"). It's a lot easier to keep a clear head when someone asks you, "Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?"…

Human language as stochastic parroting plus a dash of secret cognition and reality-testing sauce?

Steve Wolfram: What Is ChatGPT Doing … and Why Does It Work?: ‘How is it, then, that something like ChatGPT can get as far as it does with language? The basic answer, I think, is that language is at a fundamental level somehow simpler than it seems. And this means that ChatGPT—even with its ultimately straightforward neural net structure—is successfully able to “capture the essence”…. If we could somehow make the laws explicit, there’s the potential to do the kinds of things ChatGPT does in vastly more direct, efficient—and transparent—ways…

Duncan Black: Data Guy All Vibes Now: ‘Nate's nonspecific, but we know what he means (specifically he means people supportive of trans rights, but it's all part of the WOKE blender): NateSilver538 Nate Silver: “People #OnHere would benefit from understanding which ideas are popular and which aren't .’There's a backlash against changing cultural norms!’ is obviously true on some level, but some of the norms never gained broad acceptance outside of rather narrow media-adjacent circles.” Time to adjust your priors!!!!!!!: “Republican presidential hopefuls are vowing to wage a war on "woke," but a new USA TODAY/Ipsos Poll finds a majority of Americans are inclined to see the word as a positive attribute, not a negative one. Fifty-six percent of those surveyed say the term means "to be informed, educated on, and aware of social injustices." That includes not only three-fourths of Democrats but also more than a third of Republicans.” The supposed poll guys just gave up on polls when they stopped supporting their own positions on things, now they just act as Bubba whisperers. Issue polling is always a very limited way to approach politics, but at least it's an ethos, man. Now they just make things up entirely. At least the Abolish Ice guy went quiet. "Stop tweeting" was probably the first bit of advice from his attorney…

Robert Hubbell: A "normal" news day: ‘ It was a busy news day. The good news is that, because of the steady leadership of Joe Biden on the international and national stages, events unfolded in a way that could broadly be described as “normal.” The NATO alliance resisted Russian aggression, the Treasury Department arranged for the voluntary infusion of capital into a faltering bank, and prosecutors proceeded apace with grand jury proceedings. That description is a far cry from the daily fire drills and never-before-seen-absurdities that characterized the former administration.

Ian Cuttress: Baidu's ERNIE Bot: True Competition?: ‘For those of us that live in the technology space, you can’t swing a cat without someone mentioning machine learning, artificial intelligence, natural language processing, and tools like ChatGPT. If anything, I’m a big culprit of this, as I almost exclusively talk about the semiconductor hardware underlying all of these new innovations. I’m also a user - I’ve put ChatGPT to use in my research, as it often provides a friendlier interface into a rough topic than wikipedia ever could. It’s provided entry paragraphs for upcoming presentations I’m doing. But I also use it to spitball ideas for video titles on my YouTube channel, or iterate feedback. For example, last week I actually spent most of a train journey from Stuttgart to Zurich trying to get it to suggest a title regarding an upcoming video on quantum-safe cryptography I’m working on. I wanted a title simple enough, but expressive enough, to be exciting to new subscribers. I’ve described using ChatGPT in this way as cutting down what could be 6+ hours of thinking of a title to a good 30 minutes prompt engineering to generate a thousand ideas, one of which might be good, rather than spend hours to come up with ten ideas myself…

Timothy Burke: Academia: Institutionality is the Thief of Joy: ‘I will never fully resolve my own ambivalence about the call to reimagine the university as nothing more than a workplace…. Reminding us that these are just workplaces is… a caution that doing a ton of uncompensated labor out of duty and responsibility will never be remembered or loved by the institution itself. The older I get, the more I can verify that truth both from experience and from observation...

The Odd Lots interview of Dan Davies, was fantastic, just pitch-perfect.

The interview with Lev Menand was ... fine, I guess? The observation that Americans prefer "rule-based" regulation in contrast to the "principles-based" regulation in the rest of the anglosphere is hardly original, and while I personally think it is obvious that principles-based regulation has worked out better, there are people of good will who are smarter than me that think the opposite - Matt Levine, for instance. I think Menand would have done a favour to himself to be less tendentious.

I also agree with Menand about "process-focused" regulation, except that on this occasion it seems that it would have worked? Had it been followed through? Here is a Bloomberg quotation from Levine's newsletter yesterday:

"Just over a year before Silicon Valley Bank’s collapse threatened a generation of technology startups and their backers, the Federal Reserve Bank of San Francisco appointed a more senior team of examiners to assess the firm. They started calling out problem after problem.

As the upgraded crew took over, it fired off a series of formal warnings to the bank’s leaders, pressing them to fix serious weaknesses in operations and technology, according to people with knowledge of the matter.

Then late last year they flagged a critical problem: The bank needed to improve how it tracked interest-rate risks, one of the people said, an issue at the heart of its abrupt downfall this month."

Finally, what the everliving heck was Weisenthal thinking when he suggested that a "sophisticated" corporate treasurer would have invested directly in laddered Treasurys ?!?!? No no no no no! The first responsibility of a corporate treasurer is risk management - specifically, matching the risks of assets and liabilities. And also the 2nd, 3rd, 4th and 5th responsibilities. I personally know treasury traders who have been fired after making too much money; for good cause, in my opinion. Weisenthal is telling SVB's customers that they should have taken on the same risks that SVB took directly, in a podcast dedicated to criticizing the risk management of SVB. Absurd.

Masks: Since, like most of the other recommendations, messages were never clear about whether one was being advised to take self protective actions or admonished to take actions to protect others (and that the benefits of doing so were constantly changing with infection rates and vaccination status), it's not surprising that the results of an ambiguous message was in the aggregate, inconclusive.