CONDITION: Healthy Payroll Employment Growth

The big question: How does healthy payroll growth—263,000 seasonally-adjusted in September—fit with what appears to be very low, in fact nearly zero, real income and expenditure growth?

I confess I am Team “The Fed Should Pause” right now. Is that simply because I am not updating my beliefs fast enough in response to new data—especially to the news that is the OPEC+ price cut? Or is the Fed being stupid, and following a knee-jerk reaction function in which it raises rates as long as a lagging indicator is not indicating recession—a policy rule that guarantees stop-go overshoot, and almost guarantees a big recession in our future?

FIRST: Lessons from Slouching Towards Utopia for Today?

What seems to me to be a very smart meditation on the relationship between economic history, economic theory, and economic policy:

Zach Carter: On Economic History: ‘Brad DeLong's new book Slouching Towards Utopia <bit.ly/3pP3Krk> offers a corrective to months of madness: I reviewed Brad DeLong's long-awaited Slouching Towards Utopia for the good people at Dissent…. Go read my review, then go read Brad's book…. Brad… knew he was swinging for the fences and he cared about getting it right. There's an intellectual flexibility at work in the book that I find really admirable, even when I don't necessarily agree….

Economic history is… unusual field. Good economists study it closely, but there is nevertheless an allergy to history in some corners…. Economists who love math think stories about the past are unscientific, and they’re right. But numbers without narrative are meaningless…. Understanding economics from an historical perspective helps demystify it—we come to grips with how different economic policy initiatives are supposed to work, and what problems they were developed to solve…. Starting with the financial crisis of 2008, a lot of smart people who had taken the economic orthodoxy of the 1990s for granted started to look more carefully at its intellectual and political roots… discarded the strictest elements of the 1990s orthodoxy for free trade and balanced budgets… acknowledged that budget deficits are not the apocalyptic threat they were once presented to be… monetary policy is not the ideal or only appropriate tool for economic management, that austerity is politically dangerous, and that under-investment and unemployment are the most serious economic problems facing the world….

Over the past few months, however, we've watched central banks in Europe and the United States pivot to what strikes me as an indefensibly bleak view of economic management—the insistence that higher interest rates and higher unemployment are not only an effective way to combat inflation, but also somehow humane and, in any case, unavoidable…. One day Larry Summers says we need sustained, high unemployment to cure inflation, and the next he points out that unemployment is jet fuel for fascism. Jason Furman rails against student debt relief as a 0.2 percent tax on the poor, and then calls to add more than four million names to the unemployment rolls. If you are concerned about the plight of the poor, in my view, it is a bad idea to throw them out of work by the millions, especially if you think doing so will enhance the appeal of authoritarian politics….

In June, Federal Reserve Chairman Jerome Powell was thoughtfully emphasizing the limits of monetary policy…. Gas prices are down dramatically since June, and to the limited extent that inflation expectations can be quantified in financial markets, those expectations have been falling for months. And yet with no apparent revision to his summertime framework, Powell abruptly vowed in September to continue tightening monetary policy until inflation disappears, all consequences for employment, investment and social stability be damned. Nor is this a strictly American problem…. Nobody can really say why we have to throw so many people out of work, but apparently everyone really wants to do it….

And do read the review.

Let me set out a few quick points:

Economic theory can be nothing other than distilled or crystalized economic history—after all, what else can it possibly be?

When applied to policy issues, people relying on economic theory need to realize that it is not only concentrated historical examples and analogies, but also that it has been adulterated with ideology—and they had better hope the adulterant is only oregano, and not something like peyote.

Why is it adulterated with ideology? Because every single generation since 1870 has been trying to figure out how to cobble together, running Econo social code on top of a brand new set of technological forces of production. Since the technological forces of production are brand new, there is no experience to guide us. and since pretending that things are working, even when they are not can get you another year or decade or generation in power, the standard move becomes "my ideas did not fail: they were failed". And thus history gets contaminated with ideology.

How reliable are the underlying historical examples and analogies? Not at all. Every generation, as I just said, face is the problem of building, Econo, social software code for humanity that will run on top of a brand new set of technologically enabled forces of production hardware. Thus claiming that our problem, today is essentially the same as the problem of any past generation is certain to be wrong.

Since 1870 we have been continually in the situation that teams warned us about back in 1924: “We lack more than usual a coherent scheme of progress, a tangible ideal. All the political parties alike have their origins in past ideas and not in new ideas.... No one has a gospel. The next move is with the head…”

With respect to Larry Summers's views of our current inflation problem... Look: There were and are three dangers: (1) insufficient support for a struggling economy that lands us back in secular-stagnation semi-permanent depression, as happened in 2010; (2) insufficient monetary tightening at the appropriate time that lands us in stagflation; (3) a Federal Reserve that does not react early to a strengthening economy and then, when it feels it has fallen behind the curve, panics, and so lands us back into (1) after a short episode of (2).

Larry is right to worry about (3), and looks to have wise and prescient with his early warnings about how it would be advisable not to get into a situation in which (3) was a danger.

But we have, and it now is.

Would Larry look prescient but for Vladimir Putin, OPEC+, and Biden's choice of a highly competent Republican Worthy rather than a Democratic macroeconomist to lead the Fed through this?

Perhaps not.

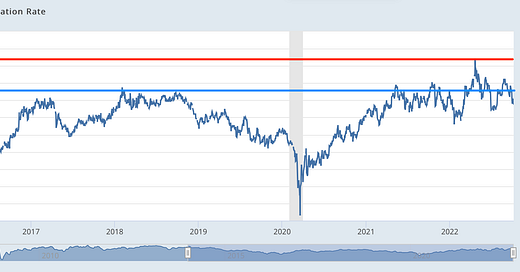

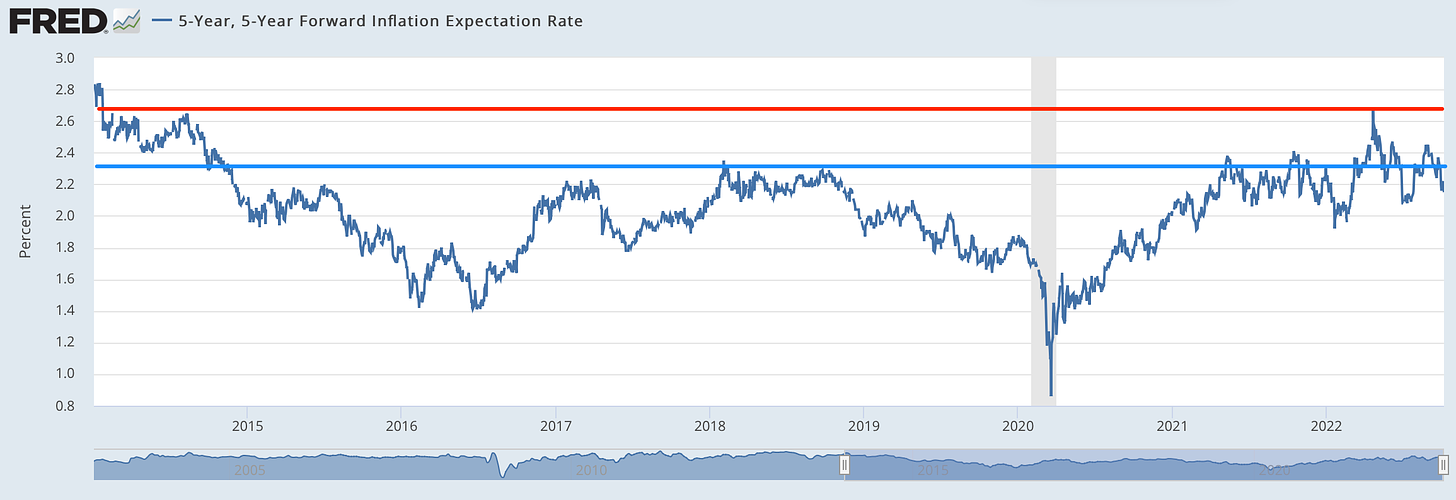

But I will certainly not die on the hill of claiming that he would not.My view? If the bond-market five-year-ahead five-year breakeven inflation rate—what the bond market “expects” inflation to be between 5 and 10 years from now—is above 2.8%, it is a clear sign from the bond market that the Fed’s monetary policy is not restrictive enough, not because the bond market is infallible but because bond market expectations of inflation are a driver of inflation. If bond-market five-year-ahead five-year breakeven inflation rate—what the bond market “expects” inflation to be between 5 and 10 years from now—is below 2.3%, it is a clear sign from the bond market that the Fed’s monetary policy is too tight. This sign is not dispositive. Other things enter into the general expectations that matter than the bond market’s view. Specifically prices at the gas pump have a lot to do with consumer inflation expectations.

But here in the U.S. there are no signs of the bond-market vigilantes who showed up in Little England last week:

MUST-LISTEN: Charles Ignatius Sancho: From Slavery to High Society

Dan Snow & Patterson Joseph: ‘Charles Ignatius Sancho was born on a slave ship crossing the Atlantic Ocean, in what was known as the Middle Passage. He was soon orphaned and then brought to England, where he was enslaved in Greenwich, London, by three sisters who opposed any attempt at education. So how did Charles Ignatius Sancho later go on to meet the King, write and play highly acclaimed music, become the first Black person to vote in Britain and lead the fight to end slavery? Paterson Joseph is an actor and writer. Paterson joins Dan on the podcast to share Sancho’s extraordinary story— one that begins on a tempestuous Atlantic Ocean, and ends at the very centre of London life…

<https://overcast.fm/+GH8ICofOw>

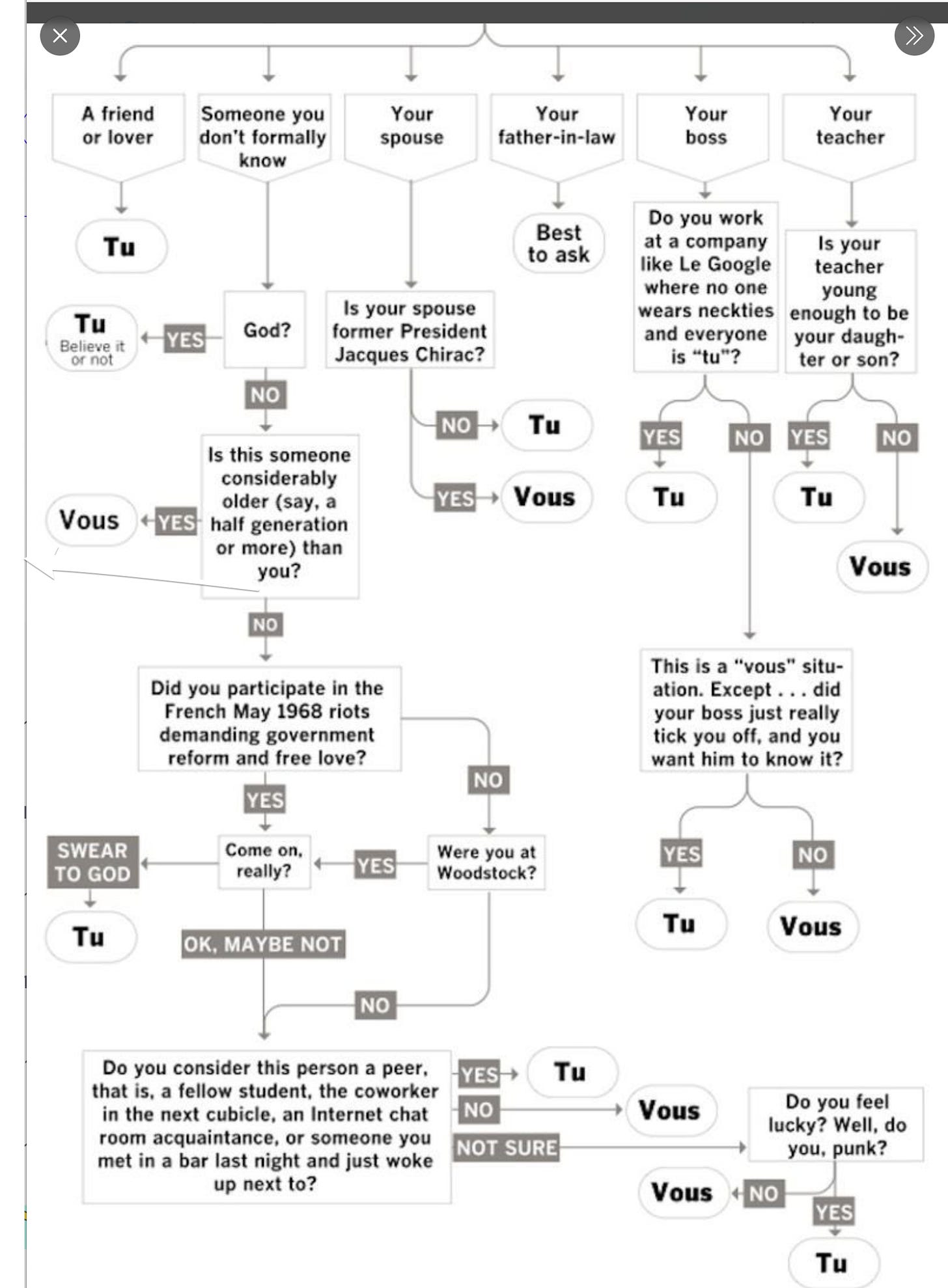

One Image: French Usage

Must-Read: What Is Going on with Muskker?

Elon Musk gets his three-week stay of his deposition, and the subsequent trial, over the objections of Twitter. But what price did he pay for it?

Chance: The Chancery Daily: ‘Judicial estoppel…. The theory would only apply if the relief was granted, just merely filing the brief doesn't do it…. I go to look up judicial estoppel…. I come to Twin Willows! The last specific performance, prevention doctrine case we covered back in August!…

The thing to do now is to comb back through the letter brief <https://s3.documentcloud.org/documents/23126626/musk-01-motion-to-stay-w-cos.pdf> and figure out what this really sticks them with, and how damning it could be for the bulk of Musk's merits cases, defenses, and counterclaims.

The theory would be that Chancellor McCormick saw Musk’s claim that, never mind all the problems with Twitter’s behavior they had seen, he “agreed to do exactly” consummating the closing, and granted Musk his stay in reliance upon this representation. Thus Chancellor McCormick will then, if the closing does not happen on October 28, rule that Musk has estopped himself from claiming that the problems he had seen are sufficient to release him from his obligation to buy Twitter at $54.20 a share. The idea is that you can make alternative arguments in the hope that the judge buys one of them, but that once a judge has bought one of your arguments, you are stuck with it.

Interesting theory.

MOAR Things That Went Whizzing by…

Very Briefly Noted:

Colby Smith: US employment growth cooled in September: ‘263,000 positions added last month as Federal Reserve rate rises take effect…. The data, released on Friday, come just days after figures showed employers slashed more than 1mn job openings in August—one of the sharpest monthly declines in two decades. That pushed the ratio of job vacancies to unemployed people down from 2 to 1.7…

Lucio Russo: The Forgotten Revolution: How Science Was Born in 300 BC and Why It Had to Be Reborn…

John Culver: How We Would Know When China Is Preparing to Invade Taiwan: ‘If China has actually decided to go to war with Taiwan… how would we know?…. It almost certainly would not be subtle…. China would have already started surging production… tak[ing] visible steps to insulate its economy, military, and key industries from disruptions and sanctions… preparing their people psychologically for the costs of war…

Adrian Kennedy and Alice Truong: Our Best Reads of the Week: ‘It’s bad for one person to wield too much power for too long, Clara Ferreira Marques writes for Bloomberg Opinion. The long tenure of Putin, now 70, helps explain his “crippling paranoia, imperialist obsessions and insulation.…

Jamie Dupree: Democrats After voting against aid, Florida Republicans now want help ASAP: ‘A group of U.S. House Republicans from Florida—who last week all voted against $18.9 billion in disaster relief for FEMA—now want Congress to quickly approve a disaster relief bill to aid Florida victims of Hurricane Ian…. Ten years ago… Florida Republicans voted against Hurricane Sandy relief—because it helped repair federal facilities damaged by Hurricane Sandy. But Republicans said that was pork…

Jonathan Bernstein: Why Republicans Wound Up With Herschel Walker: ‘Walker’s other ugly personal history… pointed a gun at his ex-wife’s head… had multiple secret children…

Janice Eberly: The Value of Intangible Capital: ‘Special properties of intangibles allow firms to essentially expand at will, at least in some dimensions. Jonathan Haskell, Paul Mizen, and I show that this turned out to be especially useful during the COVID-19 pandemic…

Gita Gopinath Managing a Turn in the Global Financial Cycle: ‘When a country’s financial markets are deep and its debt is well below the debt limit, the textbook prescription of relying exclusively on interest rates and flexible exchange rates can work well. But there are other cases when such a policy response does not suffice…

Brad, when you write: "Is that simply because I am not updating my beliefs fast enough in response to new data—especially to the news that is the OPEC+ price cut?" - did you mean OPEC+ -production- cut?

I'm continuing to slowly read the book (into the Cold War now), and that section of the history resonates with this point from the post:

"How reliable are the underlying historical examples and analogies? Not at all. Every generation, as I just said, face is the problem of building, Econo, social software code for humanity that will run on top of a brand new set of technologically enabled forces of production hardware."

You've used that analogy before (and it's a good one) and I've mostly heard it in terms of future shock -- the psychological and social stress of constant change. But reading about the world wars I find myself thinking of the (apocryphal) quote that, "[people] can always be relied upon to do the right thing — having first exhausted all possible alternatives." Humans learn by trial and error, and the section of the book I'm reading emphasizes that, as technology and globalization increase, business and governments wield and increasing amount of power to impact people's lives, and that the trial and error becomes more costly.

At the moment the lesson I am taking from it is a (small-c) conservative one. That we should remember there is rarely a straight line between intentions and outcomes, and that increasing power does not make that path any more direct.