Market, Barter, Blat, & Plan, &

BRIEFLY NOTED: For 2022-10-31 Mo

CONDITION: Oþers Report Their Muskker Feeds Have Become Hellscapes:

Mine, on Day 5 of Muskker, remains a garden of unicorns, rainbows, and puppies…

FIRST: Market, Barter, Blat, & Plan

The wise Adam Gurri is posting screenshots from Slouching Towards Utopia <bit.ly/3pP3Krk> as he reads it on his phone:

Adam Gurri: From @delong, Slouching Towards Utopia: ‘On the New Economic Policy, wartime mobilization, and corporate command and control…

Here is the latest, which, I must say, is really damned good!

This is from Chapter 8: Really-Existing Socialism. It has two and a half pages on how World War I, the 1920s, and the Great Depression shattered confidence in the pseudo-classical semi-liberal order inherited from the Belle Époque, the Economic Eldorado of 1870-1913; two pages on Lenin’s version of socialism as one of the competing frameworks bidding for the power to lead humanity into the future and how it did not work “I give little away when I tell you really-existing socialism was… the most murderous of the totalitarian ideologies of the twentieth century…”; two and a half pages on Marx; two and a half pages on what Marx got wrong and yet how he was taken not for an analyst but a prophet; and seven pages on Russia, the Bolsheviks, the October Revolution, and War Communism to bring us to this excerpt:

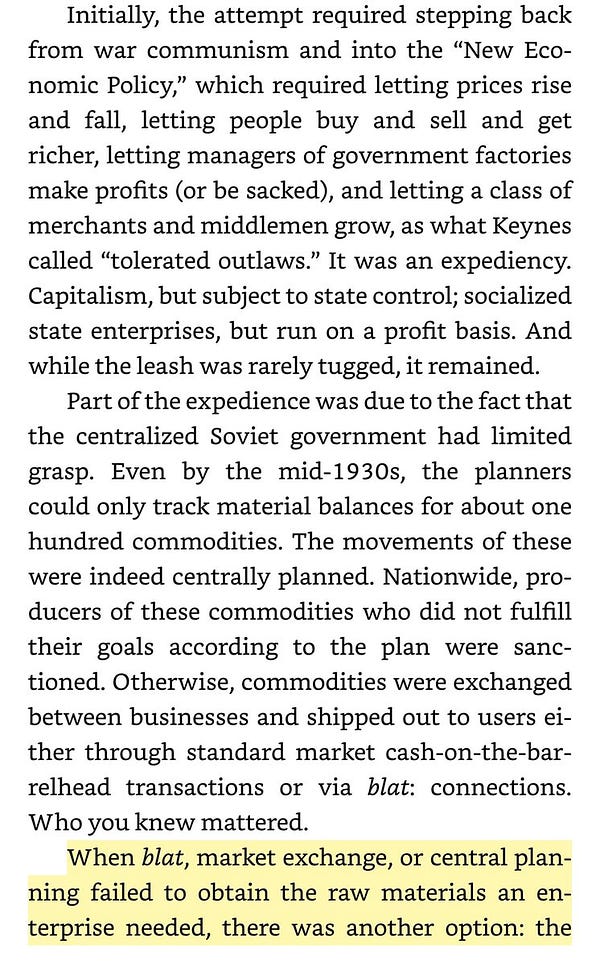

Initially, the attempt [to “build socialism” in one very poor country] required stepping back from war communism and into the “New Economic Policy,” which required letting prices rise and fall, letting people buy and sell and get richer, letting managers of government factories make profits (or be sacked), and letting a class of merchants and middlemen grow, as what Keynes called “tolerated outlaws.” It was an expediency. Capitalism, but subject to state control; socialized state enterprises, but run on a profit basis. And while the leash was rarely tugged, it remained.

Part of the expedience was due to the fact that the centralized Soviet government had limited grasp. Even by the mid-1930s, the planners could only track material balances for about one hundred commodities. The movements of these were indeed centrally planned. Nationwide, producers of these commodities who did not fulfill their goals according to the plan were sanctioned. Otherwise, commodities were exchanged between businesses and shipped out to users either through standard market cash-on-the-barrelhead transactions or via blat: connections. Who you knew mattered.

When blat, market exchange, or central planning failed to obtain the raw materials an enterprise needed, there was another option: the tolkachi, or barter agents. Tolkachi would find out who had the goods you needed, what they were valued, and what goods you might be able to acquire given what you had to barter with.

If this sounds degrees familiar, it should.

One hidden secret of capitalist business is that most companies’ internal organizations are a lot like the crude material balance calculations of the Soviet planners. Inside the firm, commodities and time are not allocated through any kind of market access process. Individuals want to accomplish the mission of the organization, please their bosses so they get promoted, or at least so they don’t get fired, and assist others. They swap favors, formally or informally. They note that particular goals and benchmarks are high priorities, and that the top bosses will be displeased if they are not accomplished. They use social engineering and arm-twisting skills. They ask for permission to outsource, or dig into their own pockets for incidentals. Market, barter, blat, and plan, this last understood as the organization’s primary purposes and people’s allegiance to it, always rule, albeit in different proportions.

The key difference, perhaps, is that a standard business firm is embedded in a much larger market economy, and so is always facing the make-or-buy decision: Can this resource be acquired most efficiently from elsewhere within the firm, via social engineering or arm-twisting or blat, or is it better to seek budgetary authority to purchase it from outside? That make-or-buy decision is a powerful factor keeping businesses in capitalist market economies on their toes, and more efficient. And in capitalist market economies, factory-owning firms are surrounded by clouds of middlemen. In the Soviet Union, the broad market interfaces of individual factories and the clouds of middlemen were absent. As a consequence, its economy was grossly wasteful.

Though wasteful, material balance control is an expedient that pretty much all societies adopt during wartime. Then hitting a small number of specific targets for production becomes thexf highest priority. In times of total mobilization, command-and-control seems the best we can do. But do we wish a society in which all times are times of total mobilization?

And over on Twitter, Elf Sternberg reminds me that my thoughts on these issues are derivative from:

Francis Spufford: Red Plenty <https://archive.org/details/redplenty0000spuf>

Cosma Shalizi: In Soviet Union, Optimization Problem Solves You! <https://crookedtimber.org/2012/05/30/in-soviet-union-optimization-problem-solves-you/>

That as of 1990 the really-existing socialist economy is round up only 1/5 as well off in material terms as the capitalist market ones is one of the most important facets of the history of the 20th century. It is also a somewhat puzzling aspect. After all, the really existing socialist economies were, to a kremlin, authoritarian: they, theoretically, at least, had no difficulty in suppressing consumption to promote investment. And the world as of 1990 was still a very capital-scarce one, with a high marginal return on investment.—at least in potential. But a gap of 5-to-1 in income and 8-to-1 in deployed-and-diffused technology? Yet that is what it was, in 1990, when the experiment was wound up.

One Video: Quantum Computing:

Ian Cuttress: TechTechPotato: ‘It's easy to consider Quantum Computing very far away, but in reality there are millions upon billions of quantum circuits being run every single day on Quantum Computers readily available in the cloud. You can sign up today to access one. But what really is the goal here? IBM Research invited me to their Quantum research facilities in New York to get a closer look at the Quantum computing roadmap and the systems they're using today…

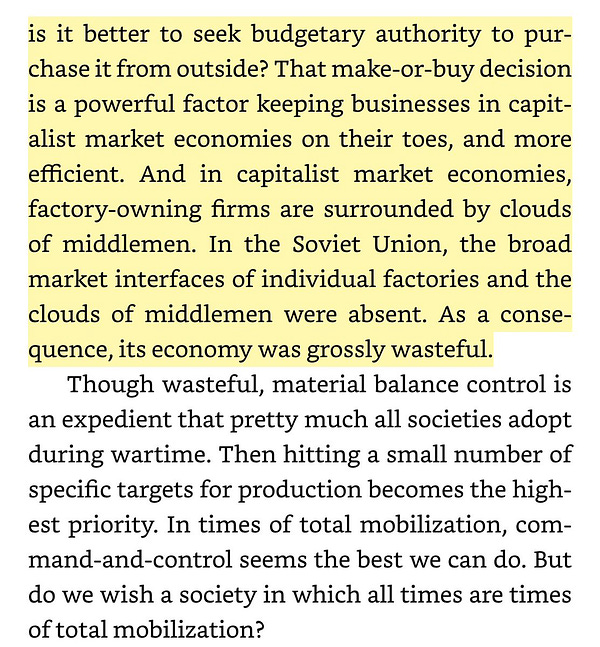

One Image: Going Viking!:

Must-Read: Rogoff on China:

Kenneth Rogoff: China’s Diminishing Returns: ‘The breakneck pace of state-guided investment in real estate and infrastructure… has generated diminishing returns…. China and the global economy appear to be at a turning point. Heightened political tensions, together with deglobalization, look set to slow productivity…. Europe is headed for a deep recession, and… the United States seems to be headed for a slump as well, [so] China cannot count on exporting its way out of its real-estate-driven slowdown…. With the Chinese government even less inclined to adopt market-oriented reforms, a smooth landing seems less likely than ever…

O þer Things Þt Went Whizzing by…

Very Briefly Noted:

Gideon Rachman: Xi Jinping’s China and the rise of the ‘global west’…

Joe Gagnon: To keep unemployment low, central banks should plan to raise inflation target: ‘After high inflation is defeated in the next year or two, the world risks returning to the excessive unemployment of the decades before 2020. Central banks will therefore need to put less faith in estimates of sustainable employment based on simple linear models and adopt a more aggressive policy approach…

Berkeley Registrar: Econ 135: The History of Economic Growth: ‘Etcheverry 3106 :: Instruction Mode:In-Person Instruction :: 42 Seats Reserved for Economics Majors :: This course examines the idea and reality of economic growth in historical perspective, beginning with the divergence between human ancestors and other primates and continuing through with forecasts for the 21st century and beyond. Topics covered include human speciation, language, and sociability; the discovery of agriculture and the domestication of animals…

Mauro Boianovsky: Lucas’ expectational equilibrium, price rigidity, and descriptive realism: ‘Lucas rejected disequilibrium price dynamics, as expressed by the Walrasian tâtonnement and auctioneer mechanisms. Lucas’ new treatment of equilibrium as an expectational concept…. Lucas’ effort[s]…led him to stress the notion of descriptive realism of the models’ main assumptions, which played an important role in his original discussion of model robustness…

Kev Quirk: How Does Mastodon Work?…

John Styles: ‘These are loyalty tests, not engineering challenges. The goal is not to retain the strongest talent. They're looking for the yes men who will fall in line and do what they're told. You might be able to think of other leaders in recent history who operated this way…

Rana Faroohar: We must prepare for the reality of the Chip Wars: ‘The question of how far decoupling will go depends on China’s next move as well as the extent of new US rules: There has been widespread portrayal of President Joe Biden’s recent semiconductor export bans on China as America’s declaration of economic war with the country. But, in fact, Washington is merely reacting to Beijing, and it is a late reaction at that…

¶s:

Economist Free Exchange: How to escape scientific stagnation: ‘A number of billion-dollar experiments suggest a path: In 2008 Ben Jones of Northwestern University formalised a simple yet powerful observation. The more knowledge humans have, the longer it takes a budding researcher to get to the frontier, and thus to push things forward. In a paper provocatively titled, “The burden of knowledge and the death of the Renaissance man”, Mr Jones argued humanity’s growing knowledge would slow scientific progress and thus economic growth. More recent research has solidified this view…. The slowdown has spurred academics and policymakers looking to bolster scientific enterprise…. Breaking bad funding habits should make a difference. The DARPA model, which has more in common with venture capital than traditional funding structures, is an attempt to do just that…

Harriet Agnew: Could ‘something break’ in 2023?: ‘“Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world”…. Leverage in the overall financial system, says Mortier, “is in multiple places that are difficult to track”. Increased capital requirements imposed on banks to make them safer following the financial crisis. That made sense. The problem is, a lot of risk appears to have shifted to less regulated parts of the financial system, namely asset managers, insurance companies and pension funds. Investors have fuelled the shift by pouring money into alternative strategies such as private credit as they searched for yield in a low interest rate environment…

John Ganz: March on Rome, One Century Later: ‘Clara Mattei, The Capital Order: How Economists Invented Austerity and Paved the Way to Fascism, is mostly a look at the role liberalism played in early fascism. Italian liberals were both political collaborators and also the architects of a state policy that favored austerity and “stability.” But abroad, liberal and conservative elites also had high hopes for fascism as a constructive force in world affairs. This was “technocratic-fascism”… understood, especially, in the 1920s as a force of order, offering a new set of solutions to the problem of capitalist governance and one which forward-thinking liberals and conservatives associated themselves…. Those who saw from the very beginning in fascism the utter disaster and crime that it actually represented were often either faithful devotees of older traditions or people of unusually perspicacious judgment. Today, we don’t have the same excuses…

Rana Foroohar: Maximum Xi: ‘If we had any doubt about US-China tech decoupling, the past few days have cleared it up…. Richer Chinese are scared about the more authoritarian, top-down nature of President Xi Jinping’s regime…. A credit bubble of unprecedented proportions built on the real estate sector is unravelling, and challenging the finances of provincial governments.… Edward Luce: Rana, I don’t have a strong instinct on whether China’s growth is derailing or going through a period of managed slowdown. Whichever turns out to be the case, this is India’s chance to take the lead as the world’s fastest growing economy…. India has already taken a piece of the rejigged tech supply chains that are moving out of China…

"After all, the really existing socialist economies were, to a kremlin, authoritarian: they, theoretically, at least, had no difficulty in suppressing consumption to promote investment. And the world as of 1990 was still a very capital-scarce one, with a high marginal return on investment.—at least in potential."

I would like to note here that the US has been in a universe of high-capital availability and a decade+ of reduced consumption (aggregate demand falling short) and that this has NOT resulted in massive economic growth in the United States. If the schema (lots of investment, drastically reduced demand) doesn't work well in a capitalist economy, why in God's name would it work in a economy with nothing but state-controlled companies?

elm

efficiency paradox

Rana Faroohar's piece from the FT is paywalled, so I can't see the argument. But I do wonder what the US is "reacting" to in this view, and if that (whatever it is) is not itself a reaction to the actions of the US over the last several years (such as the previous blocking of advanced tech sales to China).