FIRST: Marking My View of the Macroeconomic Outlook to Market

What is the incoming flow of data teaching me, as I try to keep my view of the macroeconomic outlook marked to market?

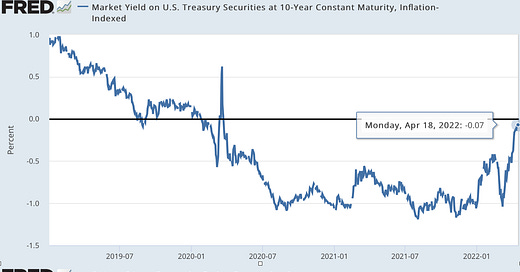

In normal times, the gearing between the Federal Funds rate and the real Treasury 10-year rate is about 1/3: a 3%-point rise in the Federal Funds rate carries with it a 1%-point rise in the real Treasury 10-year rate. Since the start of this year, we have had an 0.25%-point rise in the Federal Funds rate, and aa 1%-point rise in the real Treasury 10-year rate—nine times the standard gearing. Why? Because monetary policy is not just the current level of the Fed Funds rate, but is the current level plus all the forward guidance that gives the anticipated future path of the Fed Funds rate. In the shifts in monetary policy that you should pay attention to are not what the Fed does at its meetings, but rather the unexpected component of Fed actions, and the surrounding word cloud of communications that are the forward guidance.

If you thought at the start of this year that the Fed was behind the curve, and that it needed, through Fed-Funds rate increases and shifts in forward guidance, to do things with effects on long-term real interest rates that would be the equivalent of a 5%-point increase in the Fed Funds rate, then I have news for you: The Fed is 3/5 of the way there. If you thought, like me, that the costs of tightening too soon and being wrong were very high—that the 2010s were a disaster, in which an ænemic secularly-stagnant economy grossly underperformed in employment and productivity growth, substantially because the Fed had let itself get trapped at the zero lower bound in nominal interest rates—then the past four months should lead you to think that the Fed is, if anything, slightly ahead of the curve right now, and should stay its (currently planned) course of Fed-Funds interest-rate increases, rather than accelerate them. Rather than accelerate rate increases further, it should watch what changes in financial conditions over the past four months are about to do to the future of housing investment:

Robert Armstrong & Ethan Wu: The Panglossian Consensus: ‘Here is a case for optimism. Ian Shepherdson of Pantheon… in a note last month…. “It’s very hard to see why the private sector would feel compelled by a fed funds rate of 2 per cent or so by the end of this year to cut back spending to the point where the economy might tip into recession….. We expect a steep drop in housing market activity over the next few months… [but] housing aside, we see few reasons to expect private sector spending to weaken, and plenty of reasons to expect solid growth, notably the potential for catch-up spending on services…. We just don’t buy the idea that the Fed faces a binary choice…. It will be more useful to think in shades of grey.”… The Fed’s trade-off is probably less sharp than many think…. The path is narrow, not… unwalkable. Perhaps the consensus suffers from a bit of optimism bias: a perfectly plausible base case with an unsettlingly wide scope to be wrong…

LINK: <https://www.ft.com/content/9928cdab-9e2f-44e4-86e9-6b1a9c888579>

But one joker has been dealt: The 5/5 forward rate—what those trading in the bond market expect CPI inflation to be not over the next five years but over the five years after that—is now trading at the very top of what has become the normal range. If the 5/5 rate moves higher, it will be a sign that the bond market no longer trusts the Fed to maintain inflation at or below its target over the long run. That would be a sign that the economy’s inflation anchor is not lost, but starting to drag. And that would be a powerful piece of information suggesting that the Fed should accelerate its tightening cycle a notch.

Overall, however, I am still on Team The-Fed-Has-Got-This, and Team This-Is-Not-Like-the–1970s-at-All.

CONDITION: J.D. Vance in 2016 on Donald Trump:

Not at all surprising, but still:

J.D. Vance (2016): ‘I'm not surprised by Trump's rise, and I think the entire party has only itself to blame. We are, whether we like it or not, the party of lower-income, lower-education white people, and I have been saying for a long time that we need to offer those people SOMETHING (and hell, maybe even expand our appeal to working class black people in the process) or a demagogue would. We are now at that point. Trump is the fruit of the party's collective neglect….

I go back and forth between thinking Trump is a cynical asshole like Nixon who wouldn't be that bad (and might even prove useful) or that he's America's Hitler. How's that for discouraging?…

We presume that J.D. Vance does not think that Donald Trump is America is Hitler, because if he did his new Trump-loving and Trump-worshiping persona the demonstrate a remarkable degree of pure evil in his soul.

But then we think that if JD Vance were not evil, he would have a plan to offer his “lower-income, lower-education white people” “SOMETHING” other than racist-adjacent culture-war garbage. And he does not.

One Video:

Rene Ritchie: M2 vs. M1—But How Much Faster Really?:

One Picture:

Jesus saith unto her, “Woman, why weepest thou? whom seekest thou?”

She, supposing him to be the gardener, saith unto him, “Sir, if thou have borne him hence, tell me where thou hast laid him, and I will take him away.”

Jesus saith unto her, “Mary””.

She turned herself, and saith unto him, “Rabboni”; which is to say, Master… <https://www.biblegateway.com/passage/?search=John+20%3A11-16&version=KJV>

But why the spade, and why that hat?

Very Briefly Noted:

Craig Fuller: Will the Bullwhip Do the Fed’s Job on Inflation? <https://www.freightwaves.com/news/the-supply-chain-bullwhip-is-doing-the-feds-job-on-inflation>

Nilay Patel: Chris Dixon Thinks Web3 Is the Future of the Internet—Is It?: ‘A lot of why Twitter won is that, opposed to RSS, they had a global namespace. The problem with RSS and with Mastodon is the internet right now has no publicly owned, common database; there is no place to store that follow graph… <https://www.theverge.com/23020727/decoder-chris-dixon-web3-crypto-a16z-vc-silicon-valley-investing-podcast-interview>

Mark Levinson: The Privatization Myth: ‘A deeply reported history of the past four decades of handing public services over to private companies provides a stunning account of how not to govern… <https://prospect.org/culture/books/privatization-myth-cohen-mikaelian-review/>

Guido Menzio: Stubborn Beliefs in Search Equilibrium <https://www.nber.org/papers/w29937>

David Johnson: The Tank Is Dead: Long Live the Javelin, the Switchblade, the…? <https://warontherocks.com/2022/04/the-tank-is-dead-long-live-the-javelin-the-switchblade-the/?__s=vyym9al708ox0czut6oj>

Barry Ritholtz: Is McKinsey & Co. the Root of All Evil?: ‘Rajat Gupta… ran McKinsey & Co. from 1994 to 2003…. [The SEC] brought insider trading charges… shined a long overdue light on a company that has successfully dodged responsibility for some of the worst financial ideas in history…. What is it about McKinsey that allows them to give some very awful, legally questionable advice, and yet escape blame?… <https://ritholtz.com/2011/03/is-mckinsey-co-the-root-of-all-evil/>

Sergei Guriev: Putin’s Dictatorship Is Now Based on Fear Rather than Spin: ‘The origins of the war in Ukraine lie in Russian economic stagnation, corruption and the president’s dwindling popularity… <https://www.ft.com/content/e58832c5-a35a-4bf4-8be7-359b4563c1c9>

Joshua M Brown: How to Succeed: ‘Make yourself useful to smart, successful people… [for] the first ten years of your career. Surround yourself with smart, successful people… [for] the next ten…. It works… <https://thereformedbroker.com/2022/04/13/how-to-succeed/>

Dan Shipper & Kieran O’Hare: The CEO of No: ‘Andrew Wilkinson… Tiny… <https://every.to/superorganizers/the-ceo-of-no-1725658>

Dina Smeltz & Lily Wojtowicz: Do Russians Support Putin’s War in Ukraine?: ‘Russians think they’re engaged in a heroic struggle with the West. A new survey finds that the public in Russia believes President Vladimir Putin’s rationale for the ‘military operation’ in Ukraine… <https://www.washingtonpost.com/politics/2022/04/14/russia-public-opinion-putin-ukraine/>

Kristina Stoeckl & Dmitry Uzlaner: Putin & the Russian Orthodox Patriarch See the West as Weak & Russia as Strong. So They Invaded: ‘Russia believed the West was weak and decadent…. Russia sees itself at the global forefront of the culture wars, leading the resistance to gay parades, ‘cancel culture,’ and liberal values more generally… <https://www.washingtonpost.com/politics/2022/04/15/putin-patriarch-ukraine-culture-power-decline/>

Paragraphs:

The problem with Web3 is threefold: First, the good part of it—the trusted, decentralized, community-owned database part to protect against the builders of walled gardens—is inevitably a public good, and a public good that can only exist if the database is properly managed and pruned to protect its ecology from bad actors. Second, the big money in it comes from out-and-out grifts, and from building the infrastructure to support large-scale crime. And, third, the medium money in it comes from degrading the quality of the trusted, decentralized, community-owned database part. The government could do Web3 in an effective way. Apple could do it for the Apple ecosystem. Google could do it were Google to be not evil. But Silicon Valley as a decentralized institution cannot:

Nilay Patel: Chris Dixon Thinks Web3 Is the Future of the Internet—Is It?: ‘Web1… 1990 to 2005…. The platform that you built on was the web or on email… open protocols designed by the government and academia… became the governing protocols of the early internet… a very positive thing…. Web2… 2005 to 2020… social networking…. A big negative thing with Web2: We basically handed over the power of the effective de facto control of the internet to five or so companies. Open protocols still exist, you can still go to websites, but effectively most of the power and most of the money on the web goes to Apple, Facebook, Amazon, Google, and maybe Twitter and a handful of other[s]…. If Web3 works right… it is the best of both worlds of Web1 and Web2… advanced functionality… from Web2… the predictability, reliability, and neutrality of Web1 protocols… creative people, businesses, and startups… reach audiences directly, and to truly have a relationship with those audiences that is not mediated by algorithms and advertising… which is where I think we are today…. A lot of why Twitter won is that, opposed to RSS, they had a global namespace. The problem with RSS and with Mastodon is the internet right now has no publicly owned, common database; there is no place to store that follow graph. That is why companies stepped in and said, “We’ll store it for you.” Then once they stored it, they ended up having monopolistic network effects. One way to look at a blockchain is as a community-owned database…

The idea that one should replace a public bureaucracy with a private monopoly and hope that you had improve the situation was always bonkers. This was especially, especially so because there is no reason to believe that a government that cannot run a public program can run an honest privatization auction and then constrain the winter:

Mark Levinson: The Privatization Myth: ‘A deeply reported history of the past four decades of handing public services over to private companies provides a stunning account of how not to govern…. The Privatization of Everything: How the Plunder of Public Goods Transformed America and How We Can Fight Back. By Donald Cohen and Allen Mikaelian: For 40 years, both Republican and, regrettably, Democratic administrations have been turning over control of health care, public water supplies, infrastructure and transportation, criminal justice, education, prisons, parks, policing, sanitation, libraries, the weather service, and more to private companies. Donald Cohen and Allen Mikaelian’s The Privatization of Everything documents, in far more detail then has ever been done, this dismantling of the public sector. In the privatizer’s worldview, this shift from public to profit-seeking private management will lead to cost-cutting and greater attention to customer satisfaction, reduce taxes, and shrink the size of government. Cohen and Mikaelian simply and completely demolish these arguments…

LINK: <https://prospect.org/culture/books/privatization-myth-cohen-mikaelian-review/>

A paper I need to unpack, for it is not at all obvious to me where this asymmetry in response could come from, given that in the search-equilibrium model the standard assumption is symmetry, in the sense that a firm with a vacancy has math exactly the same but inverse to a worker without a job:

Guido Menzio: Stubborn Beliefs in Search Equilibrium: ‘Workers… stubborn beliefs…. The response of labor market tightness, job-finding probability, unemployment and vacancies to aggregate fluctuations is amplified…. The response of the labor market to negative shocks is the same even if only a small fraction of workers has stubborn beliefs. In contrast, if the fraction of workers with stubborn beliefs is small, the response of the labor market to positive shocks is approximately the same as under rational expectations…

We humans are smart only when we are engaged as parts of an anthology intelligence. That’s the start of pretty much every successful career is to figure out good anthology intelligence of humans to join. The middle is contributing to that anthology intelligence. We can none of us do it alone:

Joshua M Brown: How to Succeed: ‘Make yourself useful to smart, successful people. That’s how you should spend the first ten years of your career. Surround yourself with smart, successful people and then bet on them. That’s how you should spend the next ten years. And then you’re done, if you want to be done. Imagine someone had given you that advice at 22 and you followed it. Where would you be now? Imagine if that advice were common knowledge rather than the kind of thing most people are forced to figure out for themselves? There’d be a lot more semi-retired 50 year olds walking around with enough money to do (or not do) whatever they want, seven days a week. Most of them would still be working on stuff, because it’s a mentality thing, a personality type. Well, it’s not common knowledge. I gave it to you now, you can do with it as you choose. It works…

LINK: <https://thereformedbroker.com/2022/04/13/how-to-succeed/>

Perhaps it is that ever since 1500 the key to understanding the battlefield is some version of rock-paper-scissors: originally, musket beats pike, pike beats cavalry, and cavalry beats musket—with artillery a joker to break up successful combined arms combinations if the battlefield is properly prepared. Through the ages, changes have been rung on this pattern, with the current question being what form this rock paper scissors will take over the next generation:

David Johnson: The Tank Is Dead: Long Live the Javelin, the Switchblade, the…?: ‘The German General Staff…. What caused the failures of the initial offensive in 1914… the absence of operational mobility…. An army cannot walk to Paris fast enough to keep the enemy off balance. The solution to this mobility-at-distance problem was… tank… lethal and protected mobility that would give the German army longer reach… [and] fire support… [from] the airplane. To connect the two weapons… radio…. The blitzkrieg was an institutional response to solving the… problems encountered during World War I. Only Germany took this approach of combining the tank and the airplane into a combined arms force…. Others (the U.S. and French armies) continued to view the tank largely as an infantry support weapon or alienated their militaries with demands for ascendancy (British Army)…. World War II and the 1967 Arab-Israeli War were the glory days of the tank…

"If you thought at the start of this year that the Fed was behind the curve, and that it needed, through Fed-Funds rate increases and shifts in forward guidance, to do things with effects on long-term real interest rates that would be the equivalent of a 5%-point increase in the Fed Funds rate,"

At the START of the year I was pretty sanguine. They had started tightening in November rather than September but the 10 year (CPI) TIPS was only a bit above 2.3% (my guess at the equivalence to 2% CPE). This still looked like the Fed managing a bit of surprise COVID/supply chain shock. What I mainly wanted them to do was reiterate their average inflation target.

I only began to get worried in March when the 10 year TIPS rose to around 3%. I'm still relatively confident that the can get inflation back down without a real recession, but I really DO wish that they had started a couple of months sooner.

In principle I never have opinions about which instrument the Fed should move by how much. THAT is what it has a staff for.

hey I am not being a smart ass- I am really that bad at math.. but isnt this a 12 times normal gearing not 9? I took 3/.025 =12.. I really am that bad at this stuff.. Help?