Masters of Blancmange Baking at the "New York Times"

Delaying until ¶27 the bottom line: on inflation "There’s not a lot of upside risk left"...

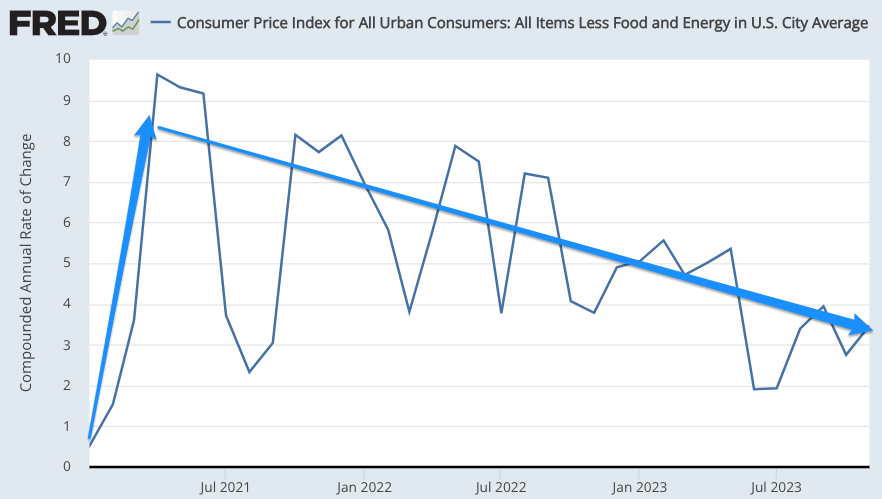

Inflation month-by-month since the start of 2021:

A headline “Inflation Is Fading. Will It Last?” <https://www.nytimes.com/2024/01/03/business/economy/inflation-prices.html> asks a question. A few hints are dropped along the way. But the question is not answered until the last three paragraphs of the story, paragraphs twenty-five through twenty-seven, in which Jeanine Smialek gives the mic is given to Omair Sharif who concludes: “There’s not a lot of upside risk left”.

The overall impression? Let us ask ChatGPT4 to summarize:

The article "Will America’s Good News on Inflation Last?" by Jeanna Smialek, dated January 3, 2024, discusses the unexpected decline in U.S. inflation in late 2023, after a period of high inflation rates in 2021 and 2022. The piece explores factors contributing to this decrease, including falling prices in goods like apparel and used cars, and moderating service costs, especially in travel. However, rent increases are still significant. It raises questions about the sustainability of this trend into 2024, considering various economic indicators and potential risks like fluctuating fuel prices and geopolitical tensions. The article concludes with a cautious optimism about continued moderation of inflation.

That’s what people will take away from the article, plus that inflation is a problem for President Biden and his approval rating, that it strains household budgets, and that it has “stoked hopes of a gentle economic landing”.

Yet if you poke your head into the financial world, the case for a “gentle economic landing” has led to great joy and much champagne. The stock market over the past year:

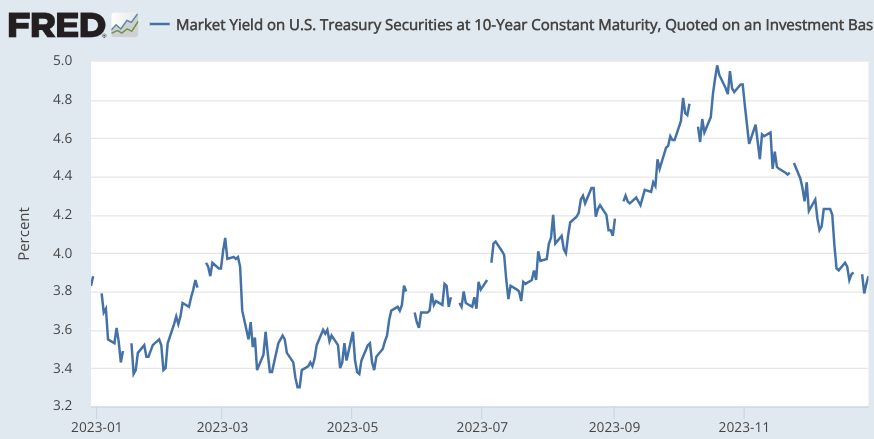

And the long-term 10-Year Treasury Bond:

More champagne! The question the bond market is now asking is not: “Will the fading of inflation last?” The question is: “When will the Fed stop buying inflation insurance and start cutting interest rates?”

So why the hide-the-ball story? Why the very different tone than what you see if you look over at the Wall Street Journal’s news pages? There you find:

For Much of the World, Inflation Will Be Normal in 2024—Finally

Inflation could be back in central banks’ comfort zones by the end of 2024 after multidecade highs in North America, Europe

<https://www.wsj.com/economy/central-banking/inflation-2024-outlook-economy-98defce9>

Gwynn Guilford

Why not, as the Wall Street Journal does, put in the headline the bottom line the New York Times gets to in paragraph twenty-seven? It is not like you are going to get many more readers by writing the story as a balanced on-the-one-side-on-the-other, only pulling back the curtain at the end.

Are you?

Let us roll the tape. The New York Times:

Inflation Is Fading. Will It Last?

One of the Biggest Economic Surprises of 2023 was how quickly inflation faded in the U.S. A dig into the details offers hints on whether it will last.

<https://www.nytimes.com/2024/01/03/business/economy/inflation-prices.html>

Jeanna Smialek

Prices climbed rapidly in 2021 and 2022, straining American household budgets and chipping away at President Biden’s approval rating. But inflation cooled in late 2023, a spurt of progress that happened more quickly than economists had expected and that stoked hopes of a gentle economic landing. Now, the question is whether the good news can persist into 2024…

In the fourth paragraph, Jeanna Smialek tips her hand a bit: The risks are “few” and “lingering”. But, on the other hand, they do “loom”.

Paragraph seventeen says: “one source of long-awaited disinflation has yet to show up fully: a slowdown in rental inflation… but the process is taking time…”

Paragraph nineteen says: “economists expect overall consumer price inflation to fall… by the end of 2024. There is even a risk that it could slip below 2 percent…”

Paragraph twenty-three says: “the most immediate risk is that the big inflation slowdown toward the end of 2023 could have been overstated. In recent years, end-of-year price figures have been revised up and January inflation data have come in on the warm side…”

Here I gotta pause and note something: How large do you think recent end-of-year revisions have been? Do you think they have been 2%-points? 1%-points? No: think 0.2%-points. Of the fall in six-month inflation from a year ago rate of 5.6% per year to a most recent rate of 2.9% per year, how much of that fall might be undone in retrospect by restrospective seasonal-factor revisions? Less than one-tenth.

It is only in paragraphs twenty-five through twenty-seven, the final three paragraphs, that Jeanna Smialek shows the hole cards. And they are wired aces in the hand of Team Transitory:

But Mr. Sharif said the overall takeaway was that inflation looked poised to continue its moderation.

That could help to pave the path for lower interest rates from the Fed, which has projected that it could lower borrowing costs several times in 2024 after raising them to the highest level in more than 22 years in a bid to cool the economy and wrestle inflation under control.

“There’s not a lot of upside risk left, in my mind,” Mr. Sharif said.

Another example of why I stopped reading the NYT years ago. Looking at Freddie's repeat sales HPI, house prices have been accelerating for past few months, up ~15% annualized in most markets. And that was before mortgage rates fell. Not sure what that means, but it seems important.

Inflation Doomsday is Taiwan. Xi reiterated to Biden that he expected reunification, and Xi recently fired a dozen generals (officially for corruption, but they're all corrupt). Let's say in two years China takes military action. Invasion looks suicidal given modern intelligence, so perhaps gradual increase from harassment of shipping to naval blockade. TSMC chips can still fly out, but inputs constrained. Price and availability of high-end chips tightens. Democracies don't formally halt trade but, supply chains rapidly moved in anticipation. Price of global trade soars. Which is why we better use Ukraine to set an example to autocrats of the West's resolve, not its fatigue. Meanwhile, Trump said, "If they invade, there isn’t a f***king thing we can do about it.” So if Trump is President by then, Xi will assume that he has a free hand.

NY Times is good on cultural stuff and science reporting. The Washington Post is much better overall and really deserves to be the newspaper of record.