First: No, the Fed Is Not (Far) Behind the Curve!

Here is a reason I do not think that the Fed is (far) behind the curve:

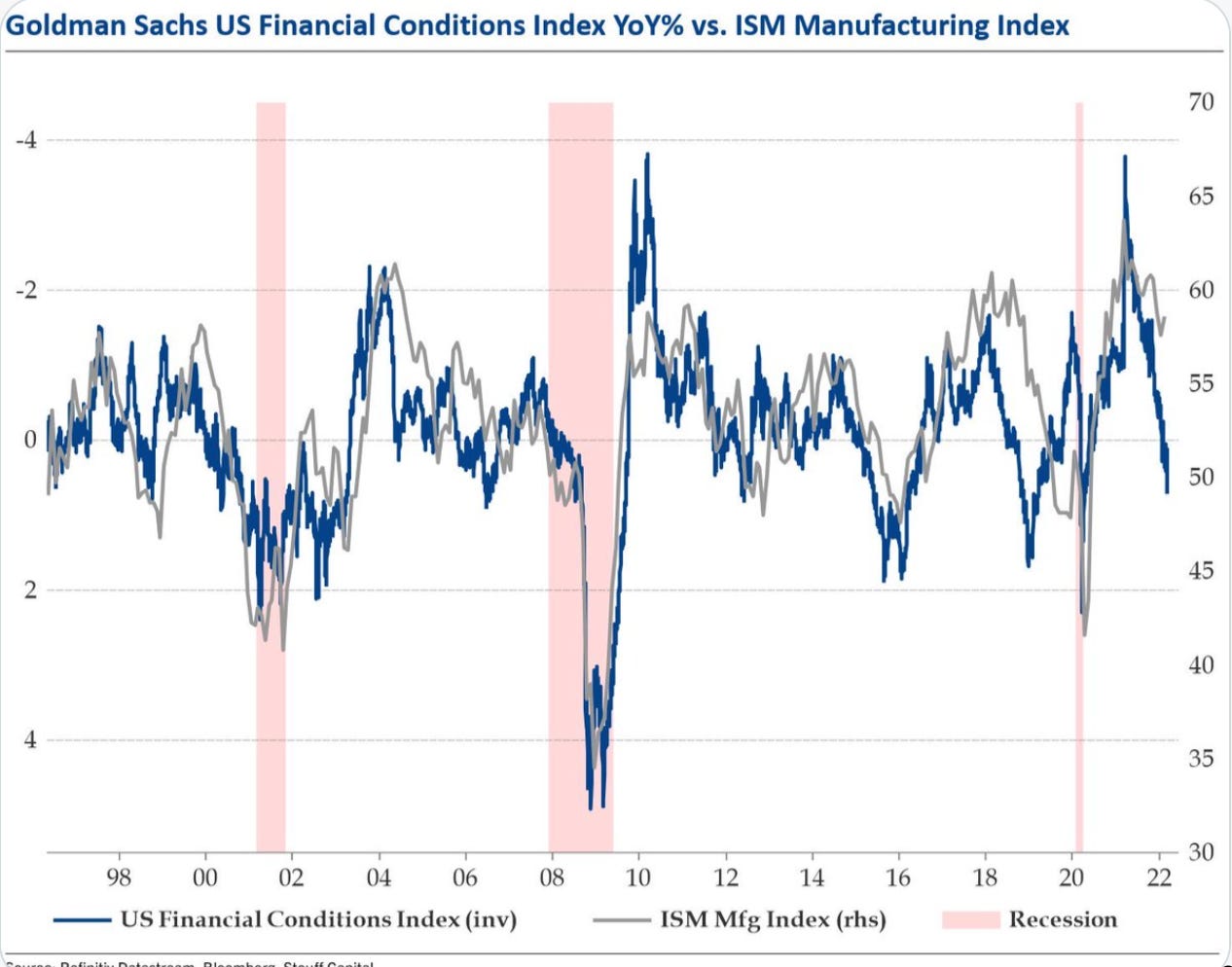

It seems highly likely that at least the manufacturing part of the economy will slow markedly over the next 1 1/2 years, no?

And that is with what the Fed has already done (and is expected to do). Would one want more slowing than the FC index tells us is already baking in the cake? If you think so, why?

Yes, bottlenecks, oil shocks, wheat shocks, and China-lockdowns will do what they will do to inflation in the short run.

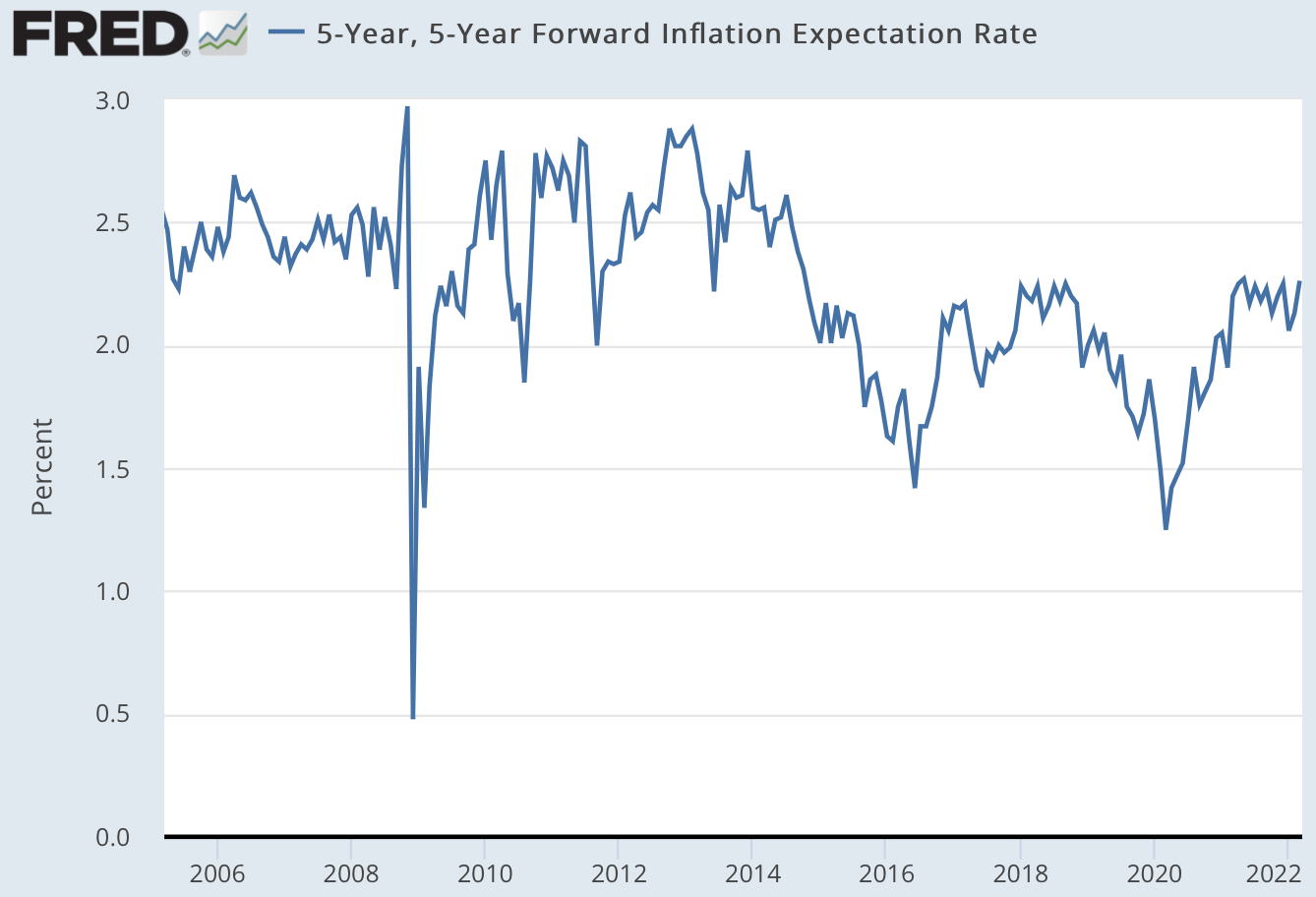

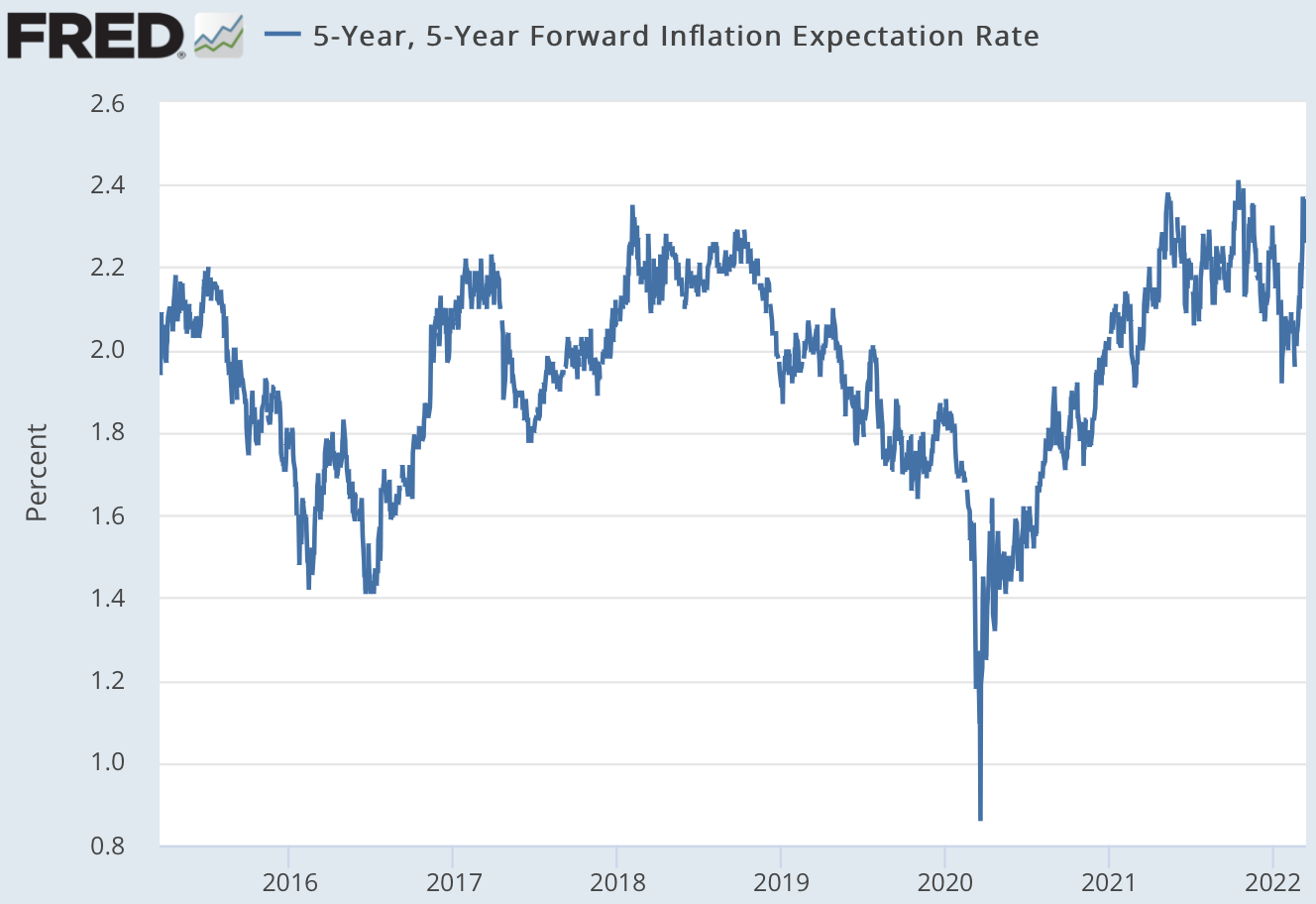

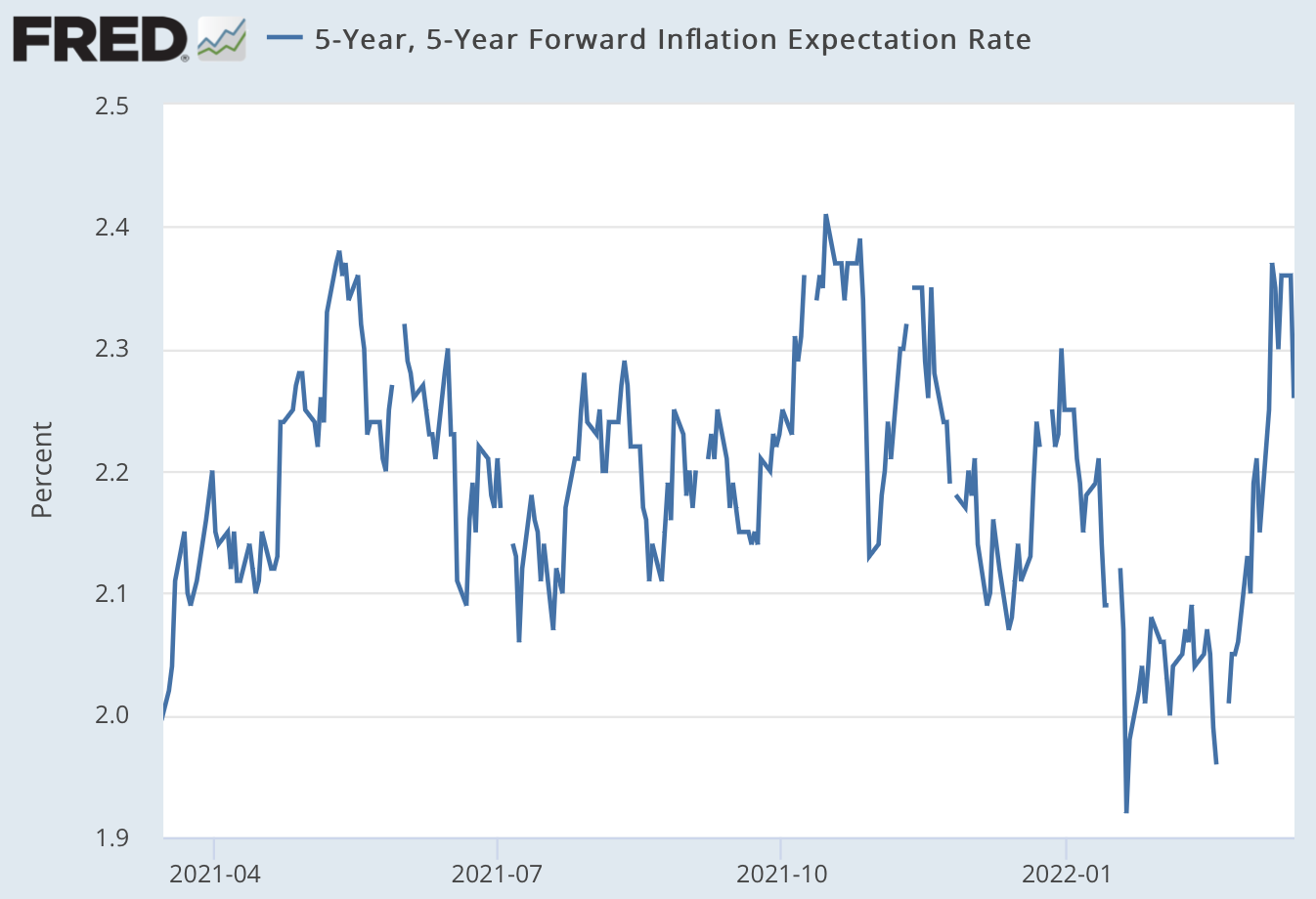

But over the medium and the long run, the bond market is still quite happy with the outlook as far as inflation is concerned, at least if you believe the information in TIPS:

So then why now do we have the extremely sharp Olivier Blanchard, commenting on Reifschneider and Wilcox <https://www.piie.com/publications/policy-briefs/case-cautiously-optimistic-outlook-us-inflation>, writing <https://www.piie.com/blogs/realtime-economic-issues-watch/why-i-worry-about-inflation-interest-rates-and-unemployment>:

?

Moreover, he is far from alone:

Neil Irwin: “When did the Fed start getting behind the curve? I think it was one year ago this week. Between December '20 and March '21 meetings…” <https://twitter.com/Neil_Irwin/status/1503364672686280706>;

Irving Swisher: “Consensus is that the Fed has fallen behind the curve…” <https://twitter.com/IrvingSwisher/status/1503774531009363975>;

Squawk Box: “‘We are behind the curve. We have to move’, says Former Dallas Fed President Richard Fisher…” <https://twitter.com/SquawkCNBC/status/1503340706731077641> (never mind that Fisher made precisely zero correct calls his entire time at the Fed);

Mohamed El-Erian: “The US Federal Reserve, the world’s most powerful central bank, is already dealing with self-inflicted damage to its inflation-fighting credibility. With that comes the likelihood of de-anchored inflationary expectations…” <https://www.ft.com/content/db9e3706-84dd-47bc-a943-90d7dfef6abe>;

Eric Rosenbaum: “Fed 'behind the curve' on inflation, says former Obama economist Jason Furman…” <https://www.msn.com/en-us/money/markets/fed-behind-the-curve-on-inflation-says-former-obama-economist-jason-furman/ar-AAQybLT>.

“Self-inflicted damage to [the Fed’s] inflation-fighting credibility…”:

“Self-inflicted damage to [the Fed’s] inflation-fighting credibility…”:

I simply do not see this “self-inflicted damage to [the Fed’s] inflation-fighting credibility…”

Now maybe there is an argument did the people treating in the bond market are weirdos, disconnected from the inflation expectations embedded in the actors in the economy—those whose beliefs and expectations really matter because they drive decisions. Maybe there is an argument that we need to fear not bond-market vigilantes, but rather other actors and agents. Maybe it is their expectations of inflation have become substantially de-anchored already. Maybe they are already taking steps that will produce a persistent inertial inflationary spiral.

But who are they?

What are their expectations?

How are their expectations now being translated into actions?

And how are those actions not easily reversible?

I have not seen any of those arguments made.

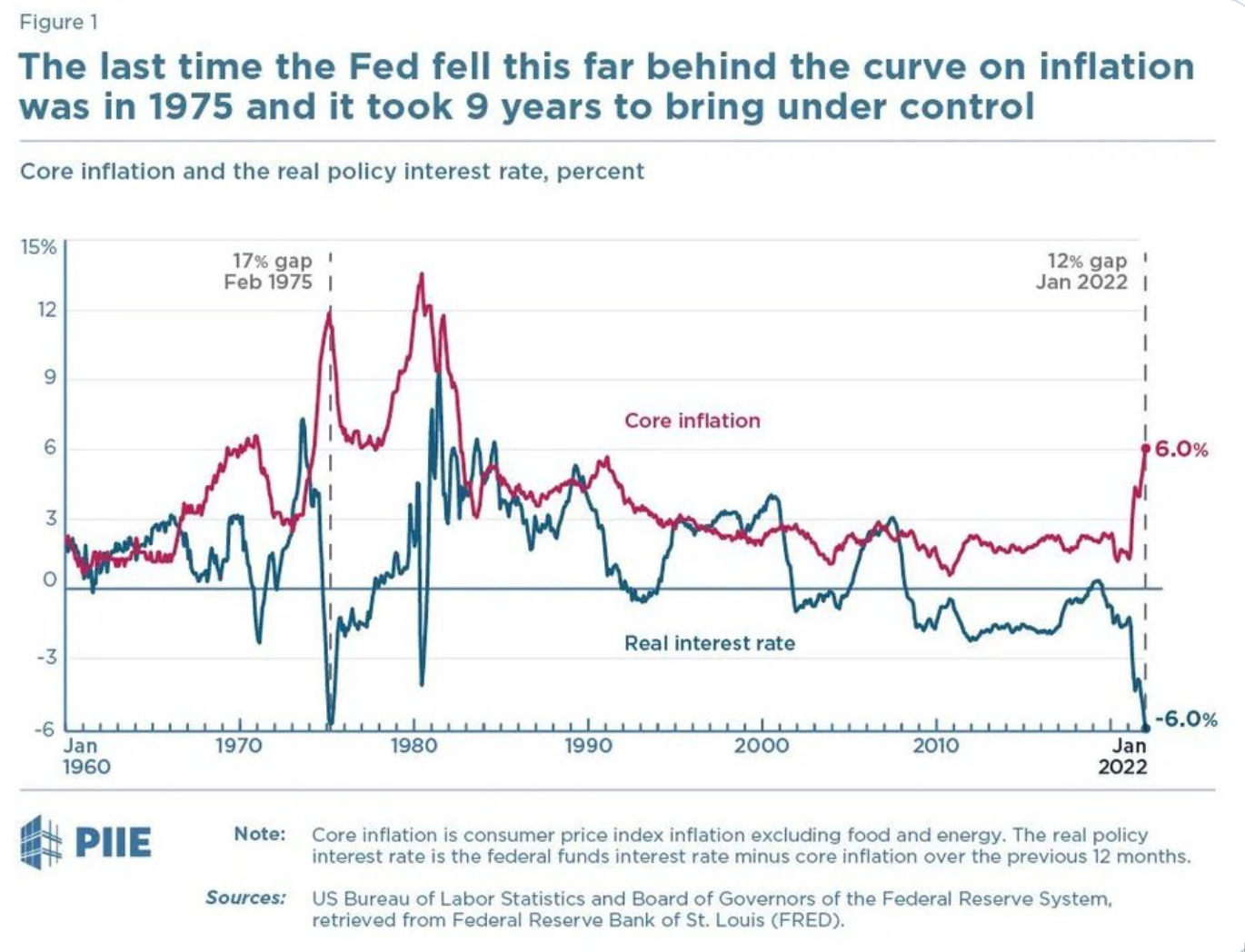

Blanchard writes, apropos of the 200 basis-point increase in the Federal Funds rate we expect to see over the next two years:

Is it reasonable to think that a 200-basis-point increase in the policy rate, so only 1/6 of the rate increase from 1975 to 1981, will do the job this time when the gap between core inflation and the policy rate is 2/3 of what it was in 1975? And that unemployment will barely budge? I wish I could believe it…

But why is the rate increase from 1975-1981 relevant? We have a target: inflation from five to ten years out. We have an instrument: the current level and planned forward path for the Fed Funds rate. We have a reading on whether we are on a glide path to the target—the bond market’s 5-year, 5-year forward expected inflation rate. That reading says we are.

Is there a better reading available as to whether we are on the glide path?

If so, what is it?

I believe that there is not. So why is the conclusion not: “Policy is appropriate. The Fed is not behind the curve”? This is, to me, a very genuine mystery.

Blanchard writes:

There are good reasons, however, to think that the Phillips curve will, as it has done many times in the past, shift, and that the landing will be harder than Reifschneider and Wilcox conclude. Part of the inflation will indeed go away on its own, but the Fed may have to increase interest rates by more than 200 basis points to get back to its target…

Indeed. The Fed may have to raise interest rates by more than 200 basis points. The Phillips Curve may well shift. And when there is evidence that the Fed is indeed behind the curve and not on an appropriate glide path, it will be time for the Fed to use forward guidance that it has changed its policy plans to shape expectations.

But why is today that day?

Especially since errors in not raising interest rates quickly enough are errors from which we can recover, but at and near the zero lower bound—which we are—errors in raising rates too quickly are errors from which we cannot reasonably recover.

CONDITION: Tankies Gotta Tank:

There was a certain… Mephistophelean… grandeur—doing evil that good may come—in shilling for Stalin back in The Day, especially if you genuinely thought that British and French power structures would reach an accomodation with or surrender to Hitler, that the U.S. would wash its hands of Europe, and thus that Hitler and Stalin were your only choices.

There is nothing good about shilling for Putin—asserting equivalence between the “brinksmanship” of a U.S. saying “we won’t fight for Ukraine, but please don’t…” and a Putin rolling the tanks:

Wolfgang Streeck: Fog of War: ‘Accounting for the descent of the European state system into the barbarism of war—for the first time since NATO’s 1999 bombing of Belgrade—needs more than lay psychiatry…. Nobody knows at the time of writing how the war over Ukraine will end, and after what amount of bloodshed. What we can try to speculate about at this point is what the reasons may have been—and human actors have reasons, however crankish they may seem to others—for the uncompromising brinkmanship on the part of both the US and Russia…

Plus bonus Milosevic whitewashing as well. But what can you expect from the thugs of the New Left Review?

One Audio:

Kai Wright & Corey Robin: Why the ‘Reagan Regime’ Endures: ’Presidencies are rarely transformational, and neither Biden nor Trump have lived up to their supporters’ dreams. So what does it take to really change our politics? Host to confront that question, and take your calls about Biden’s first year in office: <https://www.wnycstudios.org/podcasts/anxiety/episodes/reagan-regime>

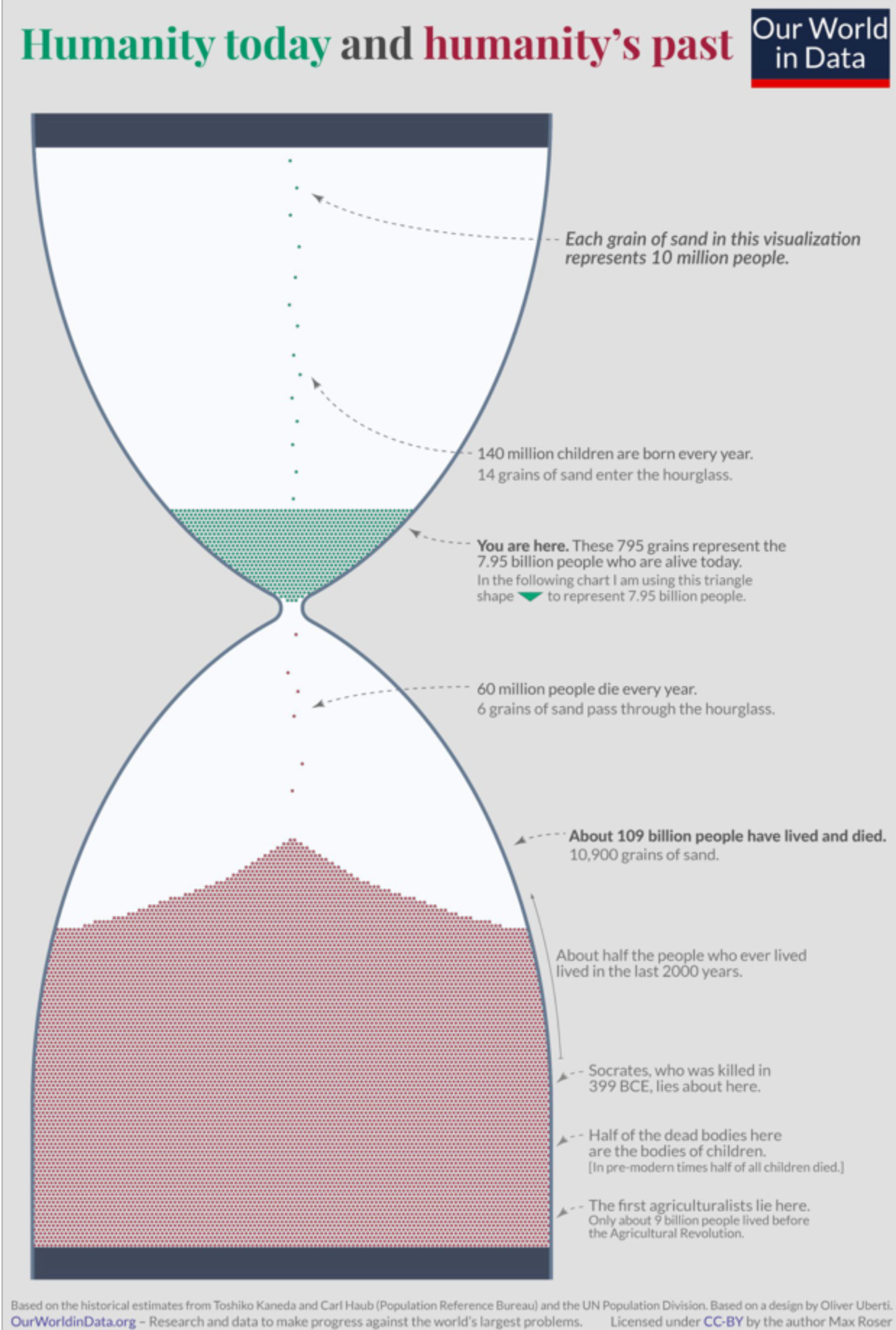

One Picture:

Very Briefly Noted:

Jean Pisani-Ferry: Europe’s Economic Response to the Russia-Ukraine War Will Redefine Its Priorities & Future <https://www.piie.com/blogs/realtime-economic-issues-watch/europes-economic-response-russia-ukraine-war-will-redefine-its>

Laura Curti: Supply Chains Latest: China Lockdowns Have U.S. Ports Bracing for Effects: ‘ust as America’s busiest ports are beginning to process some of the pandemic backlog… <https://www.bloomberg.com/news/newsletters/2022-03-15/supply-chains-latest-china-lockdowns-have-u-s-ports-bracing-for-effects?cmpid=BBD031522_TRADE>

Chad P. Bown: Russia’s War on Ukraine: A Sanctions Timeline<https://www.piie.com/blogs/realtime-economic-issues-watch/russias-war-ukraine-sanctions-timeline>

Julie Legrand: ’It’s not just student housing the NIMBYs resist. The effort it took for a small parish to tear down an crumbling, little used building and replace it with affordable, senior housing was a nightmare… <https://twitter.com/Off_The_Ground/status/1503496761846878208>

Sam Anderson: It Starts with Homer: Writing a Classics Curriculum<https://antigonejournal.com/2022/03/writing-classics-curriculum/>

Bret Devereaux: ’Eyes have shifted from whether Putin will lose to if Ukraine can win. These are, in fact, different questions…

Paragraphs:

Ben Thompson: Substack Launches App, Substack & the Four Bens, In-App Purchase and the Substack Bundle: ‘Substack, needless to say, is no longer a Faceless Publisher, but that’s not a surprise; that die was cast when Substack raised their Series A. In other words, a lot of the angst about this announcement was better felt in 2019; still, it’s worth diving into the specific implications of this announcement, and I like how Substack distinguished between different categories of stakeholders in announcing their new app…. The Substack app is a big win for Reader Ben: I was never reading these posts via email…. Writer and Publisher Ben…. If I were just starting out, I would be a bit nervous… being in my readers’ email inbox is really valuable, and I would be worried about being forgotten in yet another app that my readers need to remember to check…. My content… commoditized to just another item in a Substack-branded feed…. [But] Stratechery as an independent publication which can be added to the Substack app by adding the RSS feed… pretty happy… [because] readers who make the deliberate choice to add Stratechery to the Substack app won’t forget about me…. Analyst Ben…. There is no RSS feed for individual Substacks…. Apple is a great friend to Aggregators and an obstacle for would-be platforms; the App Store and App Tracking Transparency accentuate the advantages that flow to companies that command consumer attention and make things much more difficult for companies that seek to operate in the background; faceless publishers face just as many if not more obstacles than faceless e-commerce operators. Substack making itself a consumer brand is a natural response both to its VC incentives as well as Apple’s preferences…

Timothy B. Lee: There’s a Serious Risk of a Recession in 2022: ‘Surging oil prices have economists worried…. “Prior to the Ukraine war, it was already going to be difficult to execute a soft landing,” said David Beckworth, an economist at the Mercatus Center. The war in Ukraine “complicates matters a lot.”… The US actually became a net petroleum exporter back in 2020—arguably achieving “energy independence.”… But this hasn’t insulated consumers from rising energy prices. Producers—including US oil companies—can put oil on a tanker and ship it anywhere on the planet…. American consumers are competing with consumers in Japan and Brazil for gas. If they’re paying higher prices, we will be too…

LINK: <https://fullstackeconomics.com/theres-a-serious-risk-of-a-recession-in-2022/>

Richard Russo: ’We’re jolted but not surprised. It’s from my wife’s sister… Fox News and social media. They’ve believed from the beginning that the coronavirus has been overblown by mainstream media, and that doctors are in on it because they somehow get paid more when they record the death of somebody who died in, say, a car accident as having been caused by COVID‑19…. Vaccines are not about public health so much as personal freedom…. And now, the reckoning…. My sister-in-law can’t stop coughing, though she says her own case is relatively mild. Her husband, however, is being put on a ventilator; his chances of survival, according to his doctors, are roughly 50–50…. The question she wants my wife to help her with isn’t “How could we have been so stupid?” but rather “Why is this happening?,” and she asks this in all sincerity. The obvious answer is one she can’t or won’t accept—in part, I suspect, because it naturally leads to another question that, even in this excruciating moment, she refuses to entertain: “What else have we been wrong about?”… I ought to be able to summon a more sympathetic response than “What on earth did you expect?” but often I just can’t…. When my wife finally hangs up in the next room, I hear her let out a cry of pure exasperation…. One of the problems with screaming “How could you be so stupid?” at people who behave stupidly is that we too often think of the question as rhetorical when it isn’t…

LINK:

Jeet Heer: Civil War Games: ‘Michael Anton has the Confederate delusion of victory in an unwinnable conflict…. The civil strife America has to worry about is persistent terrorism from so-called “lone wolves” radicalized by the extremist ideology that the Antons of the world promote. The return of conflicts modeled on the massed armies of the 19th century is virtually impossible. But even more absurd is the presumption that Texas with its “more robust embrace of the old virtues” is likely to trounce California with its “long experiment with postmodern deracination and anti-masculinity.” The term “deracination” should set off alarm bells, and they should stay ringing at the idea that Texans are tougher, more manly and thus likely to win a war…. That’s the very illusion southerners had on the eve of the Civil War…. James McPherson delineated this thinking… “Southerners invented a genealogy that portrayed Yankees as descendants of the medieval Anglo-Saxons and southerners as descendants of their Norman conquerors. These divergent bloodlines had coursed through the veins of the Puritans who settled New England and the Cavaliers who colonized Virginia…. If matters came to a fight, therefore, one Norman southerner could doubtless lick ten of those menial Saxon Yankees.” These ideas were tested on the killing fields of the Civil War…. Anton should consider himself lucky. The Civil War he dreams of will never happen, so he’ll be spared the ignominy experienced by his precursors…

LINK:

Brad, I've followed and admired you for a long time, so I hope you won't mind a little constructive criticism. Your piece on why the Fed is not behind the curve on fighting inflation has a small problem. I completely agree with your analysis. In fact, this ought to be the position of all members of Team Transitory. However, there were a number of typos in the essay. These slowed me down and might be an absolute impediment to those not familiar with DeLong speak. I know proof-reading your own writing is difficult. However, it would repay the effort. Respectfully yours.

PS. I've just spent five minutes correcting the autocorrect errors in this comment. The struggle is real.

I do not recognize the far right sides of the TIPS graphs shown. Since at least late January, the 5 year tips has been at or above 2.7% (where the CPI equivalent of the 2% PCE target is about 2.3%) and since late February above 3%. The Fed is right to allow enough (how much is enough?) inflation for prices in shocked sectors to rise w/o forcing prices in other sectors to fall, but it definitely should not be allowing anyone to doubt it's commitment to the 2% PCE target over the long run. I think such doubts are arising.

[As a former Treasury guy, why doesn't Treasury have more intermediate term TIPS: 1,2,3, 7.5 years that would be good information for the Fed and maybe 20 and 30 year to for people who want to hedge their mortgages and the public sector for investments in long-lived projects?]