Notes for DeLong, Forbes, & Kohn "Probing for Full Employment" Panel

Federal Reserve Bank of Boston, November 17, 2023...

Rethinking Full Employment

67th Economic Conference

Federal Reserve Bank of Boston

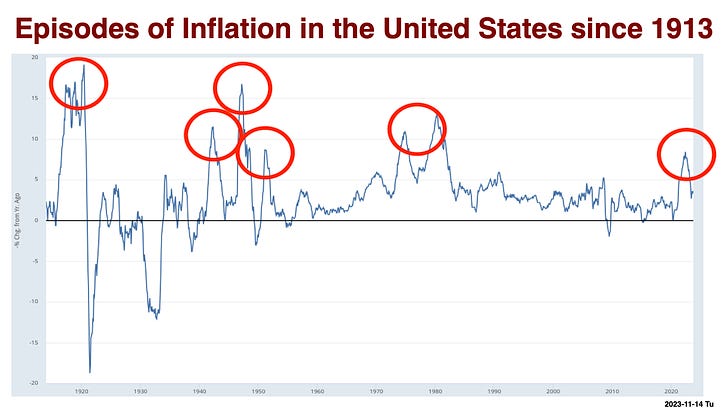

Perhaps nine times since 1940 the U.S. government has, in a sense, decided to “probe” for full employment. They are: 1942 (war), 1947 (post-WWII rebalancing), 1951 (Korean-Cold War rebalancing), 1972 (Nixon), 1978 (Carter), 1988 (post-Black Monday), 1996 (dot-com), 2004 (“conundrum”), 2022 (post-plague).

Six of those times an episode of inflation has resulted. And that has nearly always caused the government to stop the probing, and to start either to try doing something to get rid if the inflation, or at least reduce it to dithering and spinning in circles. For “full employment” in practice seems to mean: employment just short of the point where enough inflation appears to become politically salient in the eyes of the government.

And as a result of one of those six episodes of inflation—after the Carter-Miller attempt to get American prosperity in-gear again in the late 1970s—an extremely painful more-than-recession followed, one that still dominates thinking by the bulk of people in the Federal Reserve system, and outside.

I would classify two of these episodes of probing as individual and exceptional—although very interesting. And so I don’t think that there are general lessons from them, They are: 1942 and WWII, and 1972 and Richard M. Nixon. If I had more time, I would return to them at the end. But I don’t, and I won’t.

The remaining seven episodes fall into three groups:

1978: Carter’s CEA-Chair Charles Schultze used to tell me over lunch war stories of that harrowing year when the Troika’s nominal-GDP forecast was dead-on, but real growth was 2%-points low and inflation was—very surprisingly to them—2%-points high. Add to that the Iranian Revolution, and the stage was set for the required Volcker Disinflation. Cf.: Schultze (2000). This is what we greatly fear and dread.

Alan Greenspan the inflation dove: 1988, 1996, and 2004:

In 1988 Greenspan took a step towards monetary ease and, more important, did not take steps toward tightening in the aftermath of the Black Monday 25% one-day stock market crash of late 1987. This probe was followed by a rapid reversal of course as inflation rose—although Greenspan has always maintained policy was optimal ex ante as a cheap way of buying insurance against devastating consequences from a financial shock that might have turned out to be massive.

In 1996 Greenspan overrode the bulk of his committee—including Governors Blinder, Meyer, and Yellen whom we in the Clinton Administration has put on the Board because we thought it would be fun to have Governors who could analytically go toe-to-toe with Division Directors. The consequence was what Janet Yellen and Alan Blinder once called “the fabulous decade”. Cf: Blinder & Yellen. (2001).

In 2004 interest rates were kept lower for longer in what we then thought was a remarkable and was then an unprecedented degree. The result was the global savings-glut “conundrum”: policy appeared very stimulative, but production and employment did not seem to have reached full-employment levels, and there was a great deal of ex post-justified anxiety about overleverage and financial stability.

In all three of these episodes policy seems to me to have been thoughtful, and appropriate. Why the short-run Phillips Curve appeared steep in 1989, and flat in 1997, and why stimulative policy appeared to lack expected traction in 2004—is that just the luck-of-the-epsilons, or can we make analytical progress in understanding here, and if so how? These are important questions. I do not know the answers.

The economy wheels: 1947, 1951, and 2022: In these three episodes the economy swung from a wartime to a post-war, from a peacetime to a Cold War, and from a plague-time to a post-plague goods production-heavy configuration:

In each case a burst of inflation resulted. Bottlenecks. Shortages. Wage pressures as wages in contracting sectors do not shrink while wages in expanding sectors rise. In the first two the Fed more-or-less stood pat—it was, remember, pre-Accord, and was managing and supporting the Treasury bond market. These wave of inflation passed, and had no enduring effect on expectations or inflation patterns.

These two waves raise the following question: Have we paid sufficient attention to the natural or the neutral rate of inflation—“the level that would be ground out by the Walrasian system of general equilibrium equations… [accounting for] structural characteristics… including market imperfections, stochastic variability… cost of gathering information… [and] of mobility, and so on…”? I guess that the natural rate of inflation will be higher in times when there is a good deal of reallocation to be done—at times when the economy is not in a stable configuration with respect to sectors and industries, but is instead hunting for a new and different cross-sector and cross-industry relative allocation of effort. Is that how to read 1947 and 1951?

Now on to 2022. Is it analogous to 1947 and 1951? We have had, in the past three years, not just the reopening of the post-plague economy in a new, different sectoral configuration. We have also had Vladimir Putin’s attack on Ukraine, although that did not have the further destructive consequences in terms of frozen Germany and mass famine in Cairo and Lagos that we had initially feared. This third 2022 episode of probing for full employment hangs in the balance yet.

Still, I put forward the thesis that FOMC policy since the start of 2020 has been very close to perfect both ex ante and ex post:

Ex ante, to move to tighten late but fast bought valuable insurance against the real ex ante possibility of a return to secular stagnation. While it did break a couple of banks as deposits thought sticky turned out not to be sticky at all, destructive contagion appears absent—so far.

Ex post, we have rejoined the highway at speed without getting rear-ended. What does it matter in the big picture if we have left a little rubber on the road as we have done so? Prices exist to serve as traffic signals so that we can crowdsource the solution to the problem of efficient production. That means that they need to rise commensurate with rises in their marginal importance in constraining production. With downward stickiness, getting prices right requires inflation.

This is, at its base, a strongly right-wing market-fundamentalist argument: the market has its logic that we need to respect, and for it to work prices need to do what they need to do—and to keep them from doing so by artificially pushing demand down diminishes the market’s power to do its proper job properly.

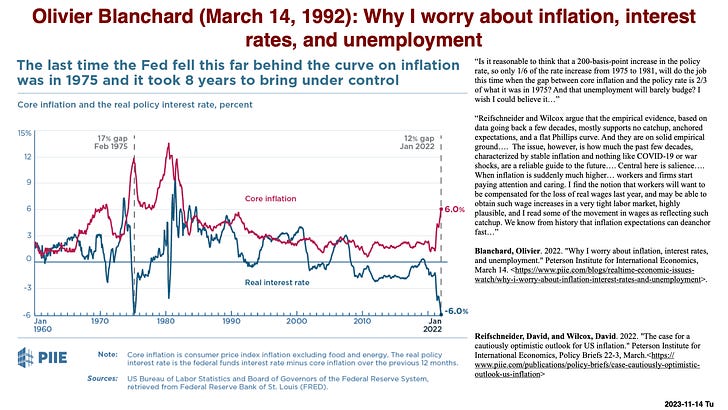

And let me end by emphasizing to you the stunning contrast between where we are today, and where general expectations were that we would be today. Olivier Blanchard is perhaps the finest macroeconomist of his generation. And here is what Olivier was writing 20 months ago:

Appendix:

Let me return to the two individual and exceptional cases:

1942: War: There was a serious war on. Maximizing military production while maintaining civilian confidence in the Roosevelt government’s policies were the highest priorities. Inflation—to the extent that it was contained—was going to be contained by price controls and by rationing. But avoiding it was not a high priority. The big lesson I take from this episode is that price controls can sort-of work briefly, but that rationing and in fact completely suspending production of desired durable goods can be extraordinarily effective at generating a huge flow of savings and thus diminishing aggregate demand pressures. In those places in the U.S. where military production was concentrated, we see not differential inflation during WWII but rather extra-high savings. Cf: Brunet, Gillian. 2017. “Understanding the Effects of Fiscal Policy: Measurement, Mechanisms, and Lessons from History.” PhD diss., University of California, Berkeley. <https://sites.google.com/site/gillianmbrunet/research>.

1972: Nixon: My view of Nixon has always been shaped by two written documents. The first is the passage in Nixon’s memoirs, Six Crises, in which he recounts how he and Arthur Burns went to Eisenhower asking for macroeconomic stimulus in advance of the 1960 election, how Eisenhower referred him to staff, how staff concluded it was not warranted, and how Nixon lost the 1960 election to Kennedy by the narrowest margins. The second is Arthur Burns’s late 1950s AEA Presidential Address, in which he poses a conundrum: (a) Labor unions will not believe that central banks will even try to push interest rates up enough to make unemployment high enough that moderating wage demands would be advisable; (b) even if central banks were to try, legislatures reliant on union votes would not let them; hence (c) controlling inflation is ultimately a political problem of guidelines, jawboning, and the threat and perhaps the reality of price controls rather than a problem of supply and demand. There is a brand-new and very nice paper by Thomas Drechsel concluding that “increasing political pressure 50% as much as Nixon, for six months, raises the [long run] U.S. price level by more than 8%…” But this is too close to being a one data-point regression to have much confidence in it. Cf: Drechsel (2023), Nixon (1960), & Burns (1960).

References:

Akerlof, George A., William T. Dickens, & George L. Perry. 2000. “Near-Rational Wage and Price Setting and the Long-Run Phillips Curve.” Brookings Papers on Economic Activity 2000 (1): 1-60. https://www.brookings.edu/wp-content/uploads/2000/01/2000a_bpea_akerlof.pdf.

Blinder, Alan S., & Janet L. Yellen. 2001. The Fabulous Decade: Macroeconomic Lessons from the 1990s. New York: Century Foundation Press. <https://archive.org/details/fabulousdecadema0000blin>

Burns, Arthur F. 1960. “Progress Towards Economic Stability.” American Economic Review. March, 50, pp. 1–19. <https://www.nber.org/books-and-chapters/business-cycle-changing-world/progress-towards-economic-stability>

DeLong, J. Bradford. 2022. “Why you should be happy about inflation and worried about something else, top economist Brad DeLong says.” Interview by Tristan Bove. Fortune. Accessed November 17, 2023. <https://fortune.com/2022/09/17/why-inflation-good-economy-stagflation-recession-brad-delong-larry-summers/>.

Drechsel, Thomas. 2023. “Estimating the Effects of Political Pressure on the Fed: A Narrative Approach with New Data.” CEPR Discussion Paper No. 18612. CEPR Press, Paris & London <https://cepr.org/publications/dp18612>.

Friedman, Milton. 1968. “The Role of Monetary Policy.” American Economic Review 58 (1): 1-17. <https://www.aeaweb.org/aer/top20/58.1.1-17.pdf>.

Nixon, Richard M. 1962. Six Crises. New York: Simon & Schuster. <https://archive.org/details/sixcrises0000nixo>

Schultze, Charles L. 1982. “Charles Schultze Oral History, Economic Adviser.” Interview by Stephen G. Knott and Martha J. Kumar. Miller Center.<https://millercenter.org/the-presidency/presidential-oral-histories/charles-schultze-oral-history>

“Have we paid sufficient attention to the natural or the neutral rate of inflation—“the level that would be ground out by the Walrasian system of general equilibrium equations… [accounting for] structural characteristics… including market imperfections, stochastic variability… cost of gathering information… [and] of mobility, and so on…”? I guess that the natural rate of inflation will be higher in times when there is a good deal of reallocation to be done—at times when the economy is not in a stable configuration with respect to sectors and industries, but is instead hunting for a new and different cross-sector and cross-industry relative allocation of effort. Is that how to read 1947 and 1951?”

By “natural” do you mean maximally market-clearing/real income maximizing inflation? Since there is always reallocation to be done, isn’t a sensible way to model this to have an average target rate for normal amounts of reallocations to be done [relative price changed to be made] and a temporarily higher, "flexible" over-target rate when there is more re-allocation to be done [relative price changes to be made] -- financial crisis/OPEC/COVID down shock/COVID up shock.

FAIT QED

But why would this schema be valuable only for 1947 and 1951? A significant change in the budget deficit would be just one more kind of shock that could call for an over-target rate.

“Still, I put forward the thesis that FOMC policy since the start of 2020 has been very close to perfect both ex ante and ex post.”

I fully agree, but even a “little” rubber on the road is an IMperfection. At least with hindsight [but TIPS signaled it] starting to tighten in September 2021 might have prevented having to raise ST rates as high and for as long as it has and the risk of rescission to be as high as it still is. Also, I guess the Fed was as surprised as anyone else at how MUCH the public hates rubber on its roads and blames Biden not Powell for the "dammed spot."

“This is, at its base, a strongly right-wing market-fundamentalist argument: the market has its logic that we need to respect, and for it to work prices need to do what they need to do—and to keep them from doing so by artificially pushing demand down diminishes the market’s power to do its proper job properly.”

Right wing? The Right-winger respects the market "logic" only when it transfers income and power up the SE scale. The neoliberal respects the “logic” of the market but not its resource allocations (externalities, information asymmetries, public goods) nor its distributional consequences.

I like "luck-of-the-epsilons". But, not being an economist, I usually work in continuous time. My version would have to be something like "that's the way the Wiener process wiggles".