OK, Jay Powell: Precisely Which Inflation Numbers Do You Wish to See "More of"?

Exactly which do you need to see more of because they are not rapidly approaching target right now? What happened to skating to where the puck will be? The only reasons for monetary policy not to...

Exactly which do you need to see more of because they are not rapidly approaching target right now? What happened to skating to where the puck will be? The only reasons for monetary policy not to be near-neutral right now would be (a) seriously asymmetric risks on the inflation side, or (b) a belief that fiscal policy's stimulative effect is strong, and needs to be offset. I do not see how you can argue that either of those things are true…

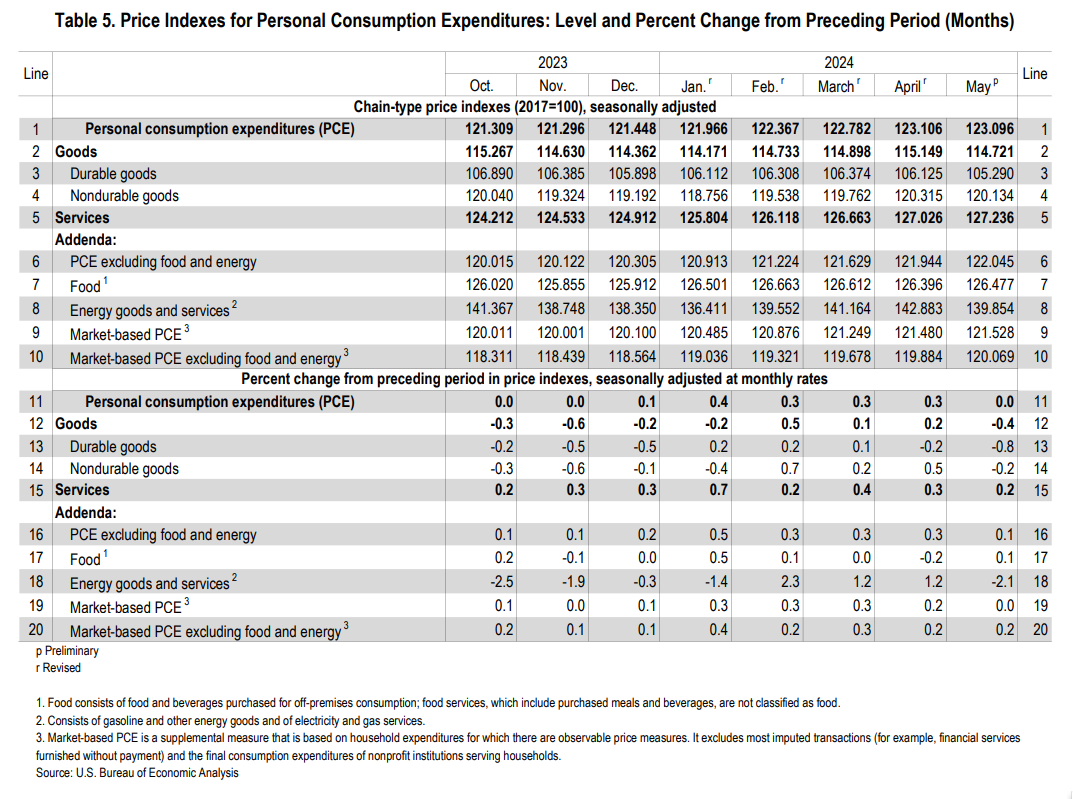

We had, on June 28:

BEA: Personal Income and Outlays, May 2024: ‘The PCE price index decreased less than 0.1 percent [comparing May to April 2024]. Excluding food and energy, the PCE price index increased 0.1 percent (table 5). Real DPI increased 0.5 percent in May and real PCE increased 0.3 percent; goods increased 0.6 percent and services increased 0.1 percent (tables 3 and 4)… <https://www.bea.gov/sites/default/files/2024-06/pi0524.pdf>

And yet, on July 9:

Natasha Solo-Lyons: Powell Looks for ‘More Good’ Inflation Data: ‘US Federal Reserve Chair Jerome Powell said he needs “more good data” to strengthen the case that inflation is moving toward the central bank’s 2% target. Recent readings may point to “modest further progress” on prices, he said, but apparently Powell wants more. Speaking to Senate lawmakers Tuesday, he was careful not to offer a timeline for interest-rate cuts, which investors are now betting will begin in September. But he emphasized mounting signs of a cooling job market after government data published July 5 showed a third straight month of rising unemployment. “Elevated inflation is not the only risk we face,” he said on the first of two days of testimony. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment”… <https://www.bloomberg.com/news/newsletters/2024-07-09/bloomberg-evening-briefing-powell-reveals-what-will-boost-fed-confidence?cmpid=BBD070924_BIZ>

What more does Powell want to see?

Why would you need more than this to invoke the optimal-control principle that when the system is near equilibrium, control levers should be near-neutral?

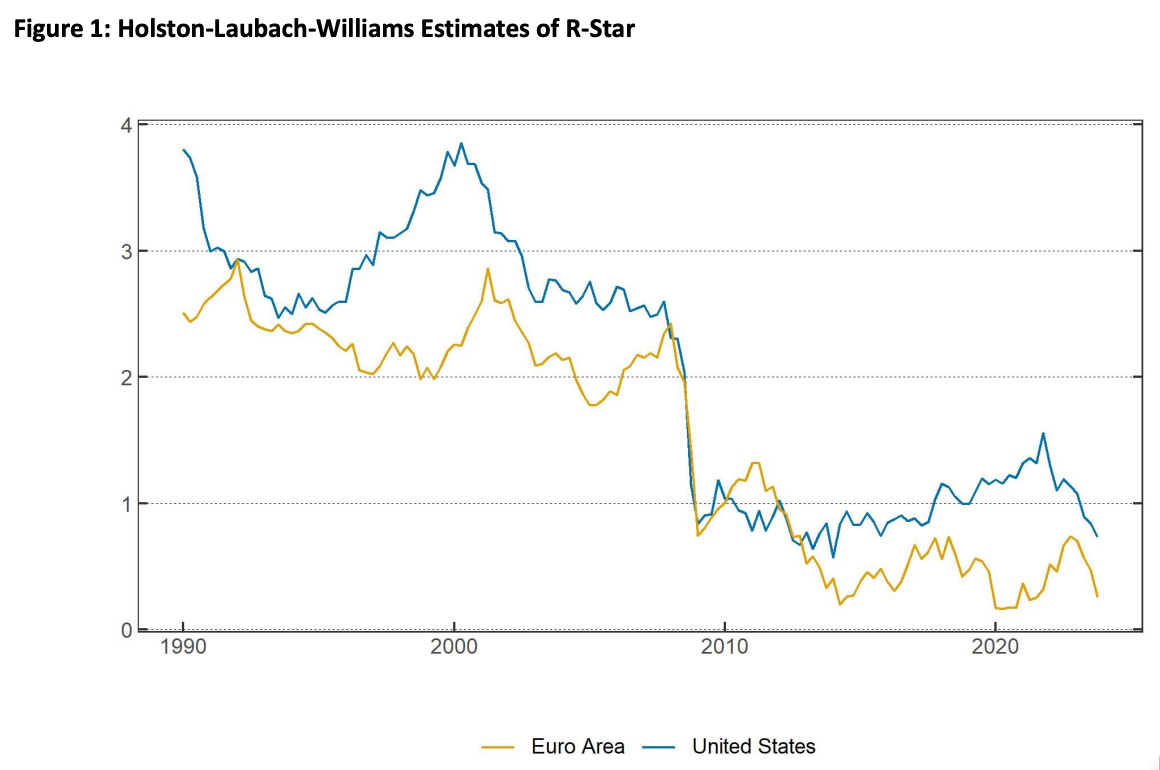

To the response that we do not know what “near-neutral” is—what the neutral rate r* is—the answer is: but we have guesses that are quite good. And whatever monetary policy we adopt cannot but rest on a view of r*. As New York Fed President John C. Williams said:

John C. Williams: R-star - a global perspective: ‘R-star is either explicitly or implicitly at the core of any macroeconomic model or framework one can imagine. Pretending it doesn’t exist or wishing it away does not change that… <https://www.bis.org/review/r240703f.htm>

And, as he also said, we have good reason to think that r* has not risen much since the 2010s:

John C. Williams: R-star - a global perspective: ‘The case for a sizable increase in r-star has yet to meet two important tests. First… plausible factors pushing up r-star… are likely to be global… tension between the evidence from Europe that r-star is still very low and arguments in the United States…. Second, any increase in r-star must overcome the forces that have been pushing r-star down for decades… trends in global demographics and productivity growth…. HLW estimates of... trend potential GDP growth in 2023 are nearly unchanged from… 2019… <https://www.bis.org/review/r240703f.htm>

You cannot argue that fiscal stimulus is making temporary r* higher than long-run r*—fiscal policy right now is a zero if not a drag on growth.

So can you argue that r* has jumped a lot, for other reasons? If not, why is the Fed making policy based on the financial-commentator panic of last winter rather than on the distribution of likely situations looking forward to a year from now? I really do not see it.

Keep reading with a 7-day free trial

Subscribe to Brad DeLong's Grasping Reality to keep reading this post and get 7 days of free access to the full post archives.