CONDITION: Hopeful (for Financial Times Best Business Book of the Year, That Is)

Am I reading too much into the appearance of my book as the cover image of the FT’s promotional video? Probably… But at least it tells me that the Basic Book design team did an excellent and eye-catching job!

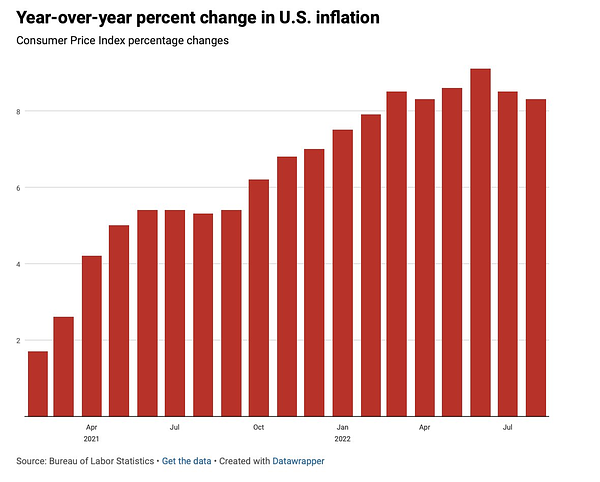

FIRST: The Natural Rate of Inflation

The policy discussion surrounding appropriate monetary policy has been greatly hobbled by a lack of attention on the natural rate of inflation—”the level that would be ground out by the Walrasian system of general equilib- rium equations… [accounting for] structural characteristics… including market imperfections, stochastic variability… cost of gathering information… [and] of mobility, and so on…” <https://www.aeaweb.org/aer/top20/58.1.1-17.pdf>. Chief, among these structural characteristics is downward nominal wage stickiness: the extreme inadvisability for worker-morale and hence effort-elicitation reasons of a business attempting to continue to employee a worker at a lower nominal wage.

The first-order implication of this is that the natural rate of inflation will almost always be positive—that, contrary to Milton, Friedman, the long-run Phillips curve is NOT vertical, but, rather that downward nominal wage stickiness requires that the economy have a positive average rate of inflation, in order to grease the wheels of commerce and achieve anything close to an efficient allocation <https://www.brookings.edu/wp-content/uploads/2000/01/2000a_bpea_akerlof.pdf>.

The second-order implication of this is that the natural rate of inflation will be higher in times when there is a good deal of reallocation to be done—at times when the economy is not in a stable configuration with respect to sectors and industries, but is instead hunting for a new and different cross-sector and cross-industry relative allocation of effort.

At times like now.

So I ran through the qualitative considerations that impact what the natural rate of inflation is likely to be right now for Tristan Bove of Fortune. And he wrote it up as a very nice little article:

TRISTAN BOVE: Why you should be happy about inflation and worried about something else, top economist Brad DeLong says <https://fortune.com/2022/09/17/why-inflation-good-economy-stagflation-recession-brad-delong-larry-summers/>: ‘“The reopening inflation we’ve had has so far been a very good thing,” Brad DeLong, a professor at UC Berkeley, told Fortune…. Inflation in the U.S. is currently serving two functions that could help… helping expand new economic sectors poised for big growth, and uncovering and optimizing supply chain snags…. “When you’re coming out of a big recession, the natural rate of inflation has got to be above the normal 2%”…. As always, there’s a catch…. Expectations that inflation will become entrenched in the economy and stick around might become a self-fulfilling prophecy, which would lead to something even worse for the economy.…

In a blog post last year, when inflation was already becoming a source of concern, DeLong compared the recovering U.S. economy to a driver suddenly accelerating away. The skid marks left on the asphalt represented inflation—a blemish and a nuisance to be sure—but worth it to get the economy back on track…

This argument of mine is a very von Hayekian argument: Prices exist to serve as traffic signals so that we can crowdsource the solution to the problem of efficient production. In order to serve as proper traffic, signals, prices need to move to the values that are needed—and we all need to gold and swallow the distributional consequences, or we will empowerish ourselves, relatively, at least. Moreover, one market failure—downward-sticky nominal wages for psychological reasons—does not interfere with the market’s ability to do its job of guiding the crowdsourcing as long as we do not pile on top of that a second market failure: the worship of a stable price level.

One might, indeed, see this as a strongly right-wing market-fundamentalist argument: people complaining about the inflation that the market has given us need to learneth the lesson: “the market giveth; the market taketh away: blessed be the name of the market”, for the market has its logic that we need to respect.

And leet me stress this: given that we have downward-sticky nominal wages in the economy, requiring that the Federal Reserve hit its 2% inflation target year-by-year gravely damages the market economies ability to do its proper job in a time of substantial sectoral activity reallocation.

This is, as I say, obvious. Rapidly returning to a different full-employment configuration after the plague is like rejoining the highway at speed. Inflation is thus like leaving skidmarks—rubber on the road. To complain about leaving skidmarks and also demand that we rejoin the highway at speed is simply silly.

And there is, of course, a big danger: that the interaction of the energy and grain price shocks stemming from Muscovy's invasion of Ukraine with the reopening-shock inflation will cause us to lose inflation’s expectational anchor, and leave us with a big problem. When I point out to Larry Summers that the bond market still thinks that the Federal Reserve has got this, Larry replies: “Yeah. But that is because the bond market expects the Federal Reserve to deliver a big recession to our door.” I think that it is 50%-50% whether that is right—the expectational interest rate path implicit in the term structure does not seem to me to be sending that message. But Larry is not dumb, and his “worry about this issue” positions have greatly risen in their market value over the past twenty-one months.

As I said, my argument here is at its base a strongly right-wing market-fundamentalist argument: people complaining about the inflation that the market has given us need to learn that the market has its logic that we need to respect.

And so I am not surprised by amused that this triggered my first right-wing twitter mob, with 1030 almost-invariably hostile replies:

This is, of course, a very low-wattage right-wing twitter mob in all respects: 1000 angry comments is small beer in these matters, so not much power; there is no there there, in that I have not yet run across a reply in this thread (no, I have not and will not read them all) that gives any evidence of having actually read the Fortune article, so not much attention; and a more-or-less complete forgetting that whining about market outcomes is not a right-wing position in America today, so low IQ.

But it does reinforce my beliefs that Twitter needs to be changed fundamentally. If I were running it, I would give real people one free tweet and ‘bots zero free tweets a day—and make them pay to tweet more. Otherwise, we would be better off without it, and it does need to die.

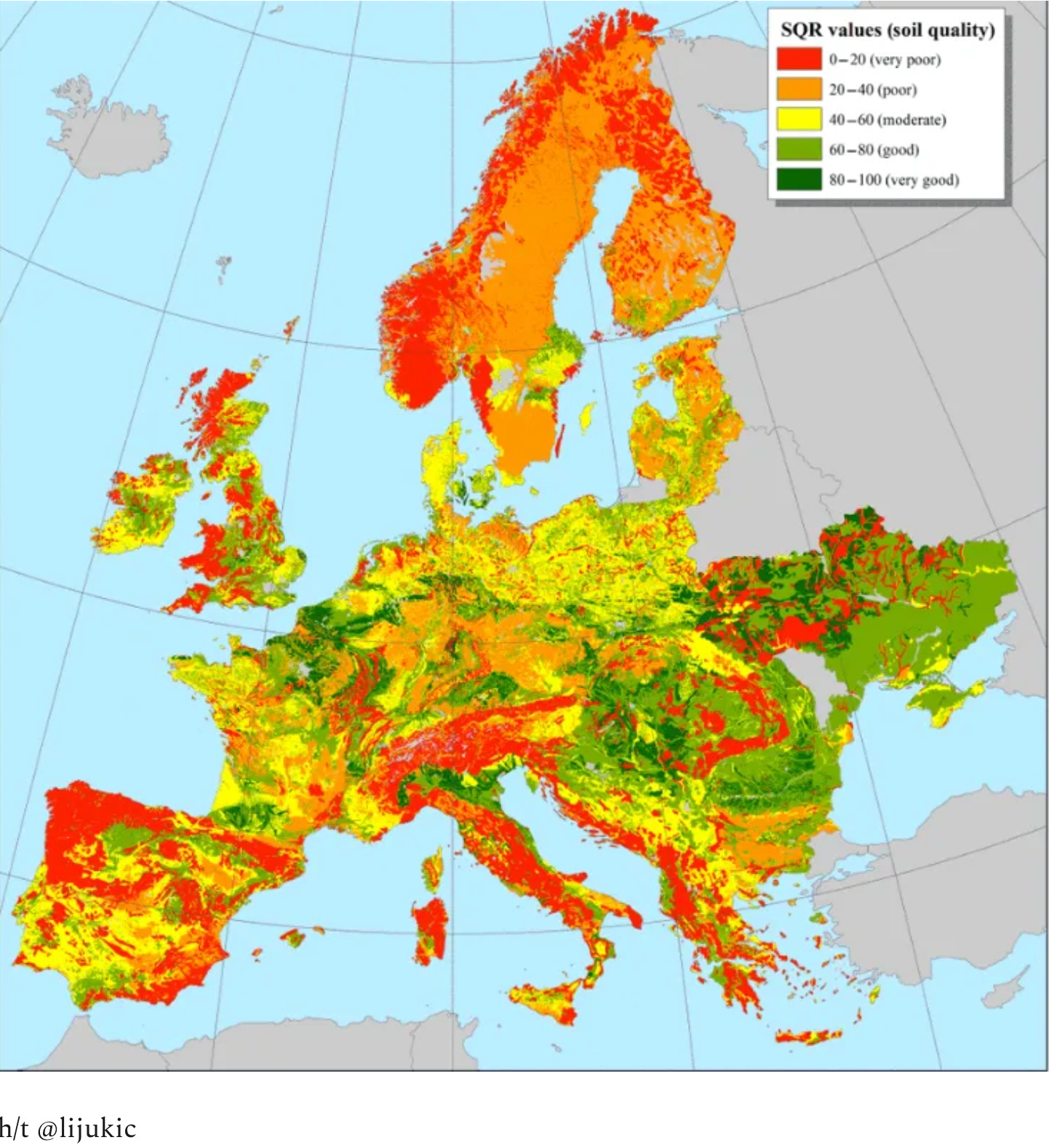

One Image: Agricultural Soil Quality:

Must Read:

Alexandria Symonds: The Gamification of Humanity: ‘YOU’VE BEEN PLAYED: How Corporations, Governments, and Schools Use Games to Control Us All, by Adrian Hon: Adrian Hon traces how and why gamification… has come to suffuse nearly every aspect of human existence in the digital era…. Hon slips easily between the perspectives of expert, enthusiast and critic…. Some of the book’s most insightful moments come when Hon discusses how his team considers ethics and user experience when deciding how much to use gamification tricks in their own work…. The breadth of sources Hon marshals is evidence, too, of his grounding in the subject. Some are to be expected: books released by M.I.T. Press, work by well-known commentators like Neil Postman and Ian Bogost, news articles from mainstream and gaming publications, plus a handful of loftier references like Aristotle’s “Nicomachean Ethics” and Foucault’s “Discipline and Punish.” But throughout, the book also quotes liberally from ordinary users’ posts on social networks and internet forums…. Tension between incisive, specific ideas about technology design and mushier ones about society persists into the conclusion, where Hon lays out some possible solutions to the problems gamification has wrought. Alongside excellent advice for designers hoping to use these techniques ethically are some pretty unsatisfying prescriptions for how the gamification of real life might be averted…. Still, the book is charming and accessible enough to overcome these moments of overreach…. It’s worth keeping up your reading streak to finish…

Other Things I Am Reading:

Very Briefly Noted:

Milton Friedman (1968): The Role of Monetary Policy <https://www.aeaweb.org/aer/top20/58.1.1-17.pdf >

George Akerlof, William Dickens, & George Perry (2000)): Near-Rational Wage and Price Setting and the Long-Run Phillips Curve <https://www.brookings.edu/wp-content/uploads/2000/01/2000a_bpea_akerlof.pdf >

Andreas Kluth: A Decision Tree for Biden If Putin Goes Nuclear

Brendan Murray: Factories’ Supply Pressures Linger as US Economy Downshifts

Twitter & ‘Stack:

Branko Milanovic: A Century Ago: ‘Ideology however was a powerful force. It spread Bolsheviks’ influence far and wide…. Carr was criticized for coming close to adulation of Lenin There is no doubt that he admired Lenin’s clear-eyed realism and Machiavellianism…

Matthew Yglesias: Russia's military and economic strategy is failing: ‘I don’t know what’s going to happen on the battlefield in Ukraine…. A broader point… everything Russia has been doing has been incredibly counterproductive from the standpoint of Russian interests…

Damon Linker: Philosophy and the Far Right

Dan Pfeiffer: Why GOP Voters Choose A#@holes: ‘Cruelty is strength and compassion is weaknesses for many Republican voters. It’s very clear that being the biggest, meanest cruelest person on the block is the path to success in the Republican Party…

Aaron Rupar and Noah Berlatsky: MAGA Vice Signaling: ‘They're desperate to demonstrate that everyone is as immoral as they are…

¶s:

Jared Rubin: ‘It is the *interaction* between factors that matter for long run growth, and these interactions manifest themselves differently in different contexts. For Britain it seems likely the interaction b/t political institutions and culture mattered, although there were other features too (large internal market, access to coal, loads of skilled workers) Many places had some of these features. Only Britain had all at the same time. What matters for catch-up growth is different. Some combinations of the elements we identify can work, although some work better in different contexts The point is: the is *no silver bullet*. If that’s what you’re looking for, read another book (which IMO will be wrong). But just because there is no magical combination of things that will always lead to economic growth does not mean that there is nothing to learn from economic history!…

Joseph Kahn: Representative Government Faces Its Most Serious Threats in Decades <https://messaging-custom-newsletters.nytimes.com/template/oakv2?productCode=NN&te=1&nl=the-morning&emc=edit_nn_20220919&uri=nyt://newsletter/a0abe3e8-a4d9-55a3-b8e8-e2d9f41461f7>: ‘While we may continue to witness robust political competition in this midterm election cycle in ways that appear in keeping with American history, threats to that electoral system have grown relentlessly at the same time. Our coverage must examine both. So while we have a large staff dedicated to reporting on politics, a special team of some of our best journalists, nationally and internationally, has produced dozens of explanatory and investigative stories on the causes of our democratic decline…. David Leonhardt covers the two biggest threats to American democracy: first, a movement within the Republican Party that refuses to accept election defeat; and, second, a growing disconnect between public opinion and government power. Below, we summarize the main points: The Jan. 6 attack on Congress…. Many Republicans who do not repeat the election lies have chosen to support and campaign for those who do…. American democracy also faces a chronic threat: The power to set government policy is becoming increasingly disconnected from public opinion. Two of the past four presidents have taken office despite losing the popular vote. Senators representing a majority of Americans are often unable to pass bills, partly because of the increasing use of the filibuster. And the Supreme Court is dominated by an ambitious Republican-appointed bloc even though Democrats have won the popular vote in seven of the past eight presidential elections…. The growing disconnect from federal power and public opinion generally springs from enduring features of American government…

Robert P. Brenner: The Low Countries in the Transition to Capitalism: ‘In the most recent phase of the discussion on the historical conditions for economic development, or the transition from feudalism to capitalism, the town-dominated Low Countries have been neglected, because the focus has been to such a large extent on agrarian conditions and agrarian transforma- tions. This article seeks to make use of the cases of the medieval and early modern Northern and Southern Netherlands, the most highly urbanized and commercialized regions in Europe, to show that the rise of towns and the expansion of exchange cannot in themselves bring about economic develop- ment, because they cannot bring about the requisite transformation of agrarian social-property relations. In the non-maritime Southern Netherlands, a peasant-based economy led to economic involution. In the maritime Northern Netherlands, the transformation of peasants into market-dependent farmers created the basis for economic development…

Robert Brenner: The Low Countries in the Transition to Capitalism <https://web.archive.org/web/20160910131149/http://www.unsa.edu.ar/histocat/haeconomica07/lecturas/lawcountries.pdf#>: ‘What makes for modern economic growth… is the presence throughout the economy of a systematic, continuous and quasi-universal drive on the part of the individual direct producers to cut costs in aid of maximizing profitability via increasing efficiency and the movement of means of production from line to line in response to price signals. This phenomenon comes into existence… only when the individual direct producers are not only free and have the opportunity, but also are compelled in their own interest, to maximize the gains from trade through specialization, accumulation and innovation, as well as the reallocation…. This positive correspondence between what is required for… modern growth… and what economic actions individuals find it in their own self-interest to choose will prevail only with the emergence of capitalist social-property relations…. Only under such a structure of social-property relations are the economic actors not only left free to act as they deem best, but also—and most fundamental—rendered dependent upon the market for their inputs, thus subject to competition in production to survive, and therefore compelled on pain of extinction to seek systematically to maximize exchange value through specialization, accumulation and innovation, and moving from line to line to meet changing demand, meanwhile subordinating all other goals to exchange value maximization...

This is a very Econ 101 argument, but like most of Econ 101 not well understood by journalists and so called "economic" pundits.

All the factors mentioned under "natural" rate of inflation seem like the ones that a "perfect central bank would use perfectly in setting monetary policy. I can see the usefulness of "natural" in that policy is completely constrained by exogenous variables, but it seems more "natural" to me to discuss what optimal monetary policy ought to be and examine how the sub-optima change as different constraints are imposed on central bank decision making.