Discover more from Brad DeLong's Grasping Reality

Our Current Moderate Inflation Is Just Not a Truly Serious Problem

Compare our current economic situation to any other possible economic situation we might have reached, and it looks very good indeed...

Or, perhaps, rather: those who focus on inflation as the most significant feature of the Biden economy are not serious: rather, they are clowns, or corrupt.

And so I do wish Matt Yglesias would go a little bit farther here:

The policy that produced our current situation, including the inflation, was optimal ex ante because it guarded against very real and deadly risks (which did not eventuate).

The policy that produced our current situation, including the inflation, was optimal ex post because it has produced a very strong and good economy—with our current inflation a very minor and surmountable problem.

Matt:

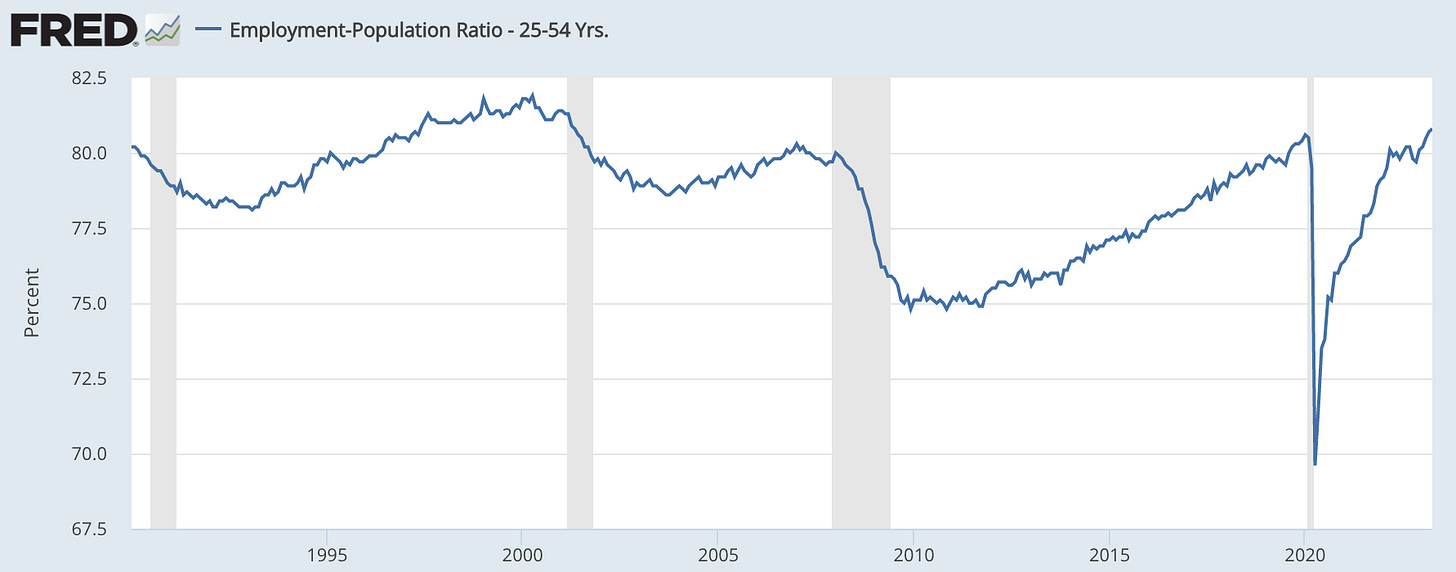

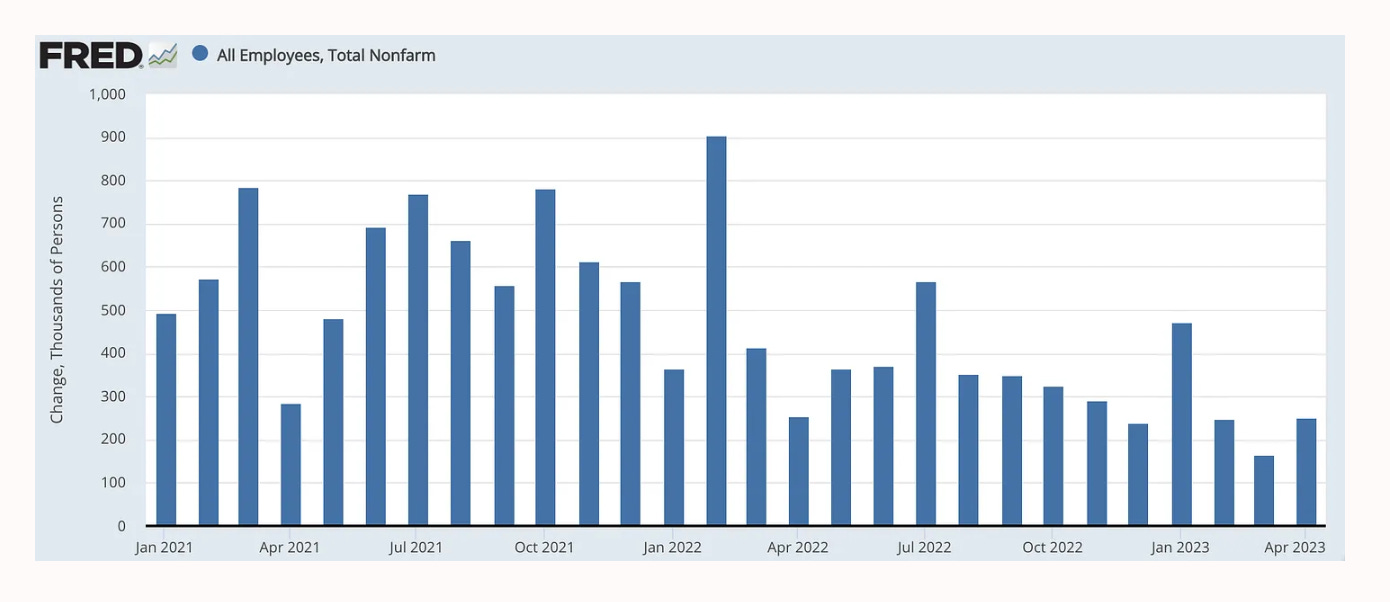

Matthew Yglesias: Greedflation is still fake: ‘Policy [needs to] focus on supply-side reforms that allow for productivity growth and real wage gains. Trying to use price controls to prevent excess demand from transforming into rising profits and prices is only going to generate shortages and make it harder to unwind the underlying pathology…. The architects of ARP deliberately erred on the side of going too big with stimulus and we’re now living with both the upsides and the downsides of that choice. I think the upsides far outweigh the downsides: 1. Prime-age employment is at the highest level of the 21st century. 2. Wages are growing fastest at the bottom of the distribution. 3. Black unemployment is at the lowest level on record. 4. Women’s employment rate is at the highest level on record….

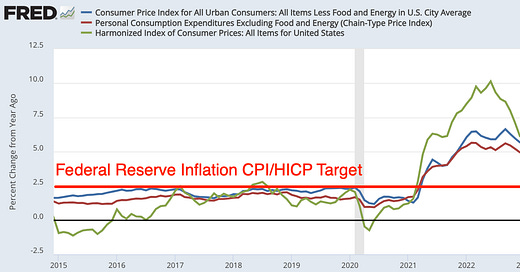

Inflation is bad, but the long-term benefits of a strong labor market are considerable and inflation is a surmountable problem. I believe the choice to go bold on full recovery as soon as possible will work out well in the end. But… we need to make smart, ongoing choices… acknowledging that price increases have been driven by strong demand, and… rationing would make things worse…

Inflation does convince people that the government has messed up: they cannot buy the things they expected to be able to buy with their income at the prices they expected to pay, and it is the business of the government to keep the trains running on time so such disruptions of expectations do not happen.

But people rarely think about general equilibrium enough to realize that, on average, the component of their incomes that is higher because of inflation offsets the inflation—that lower inflation in what they buy would have brought with it lower inflation in what they sell, and they have not really lost out. They only think they have lost out because they suffered from a temporary illusion that their earnings had risen while the prices of the things they bought had not.

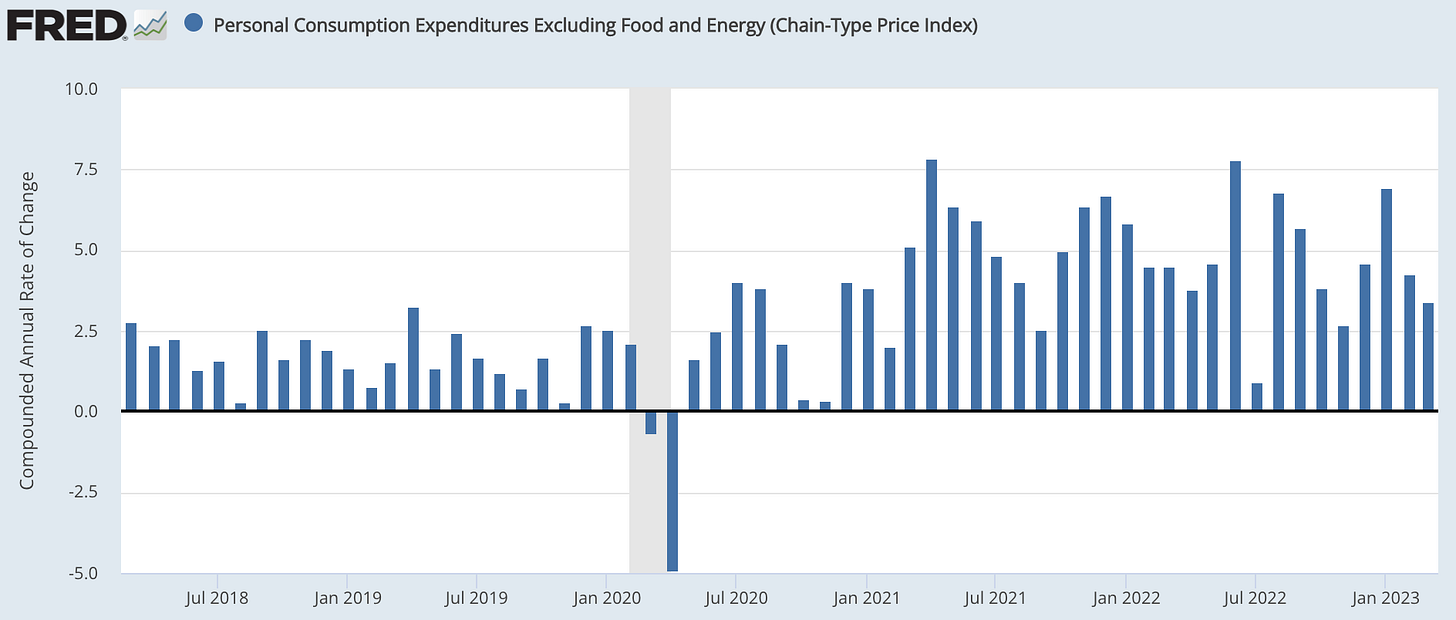

Inflation is, it is true, bad:

because it is annoying,

if it leads people to get confused substantially about what their real options, constraints, and opportunities are, and

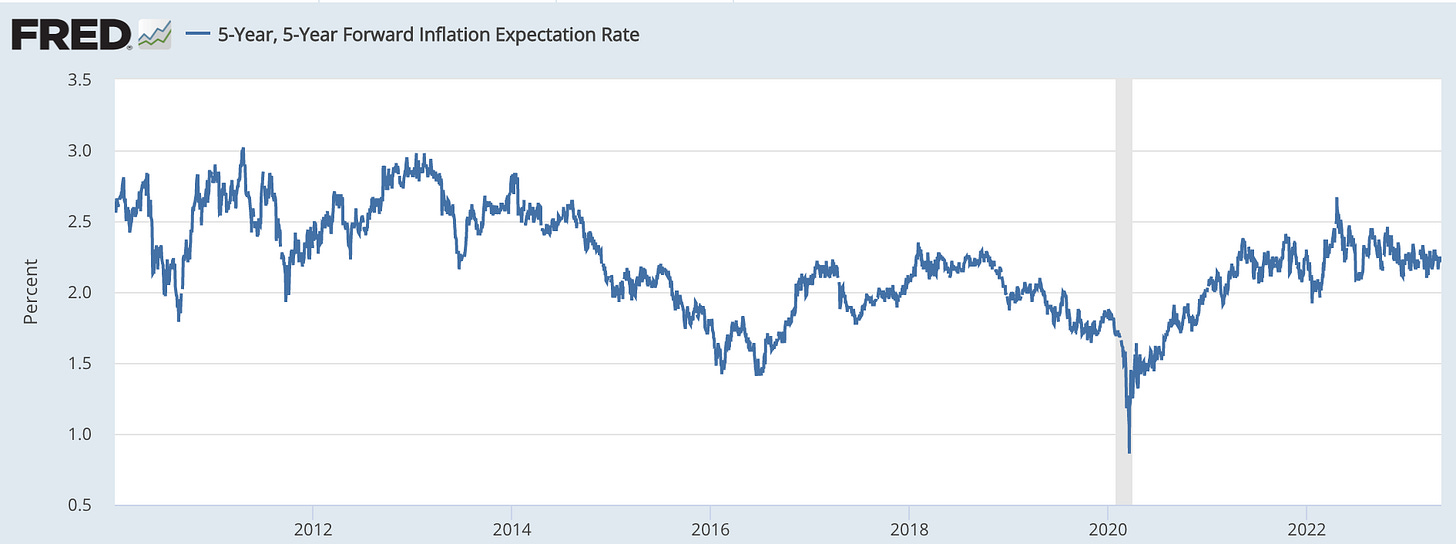

if it becomes embedded in expectations so that higher unemployment is required to keep it rising further.

So far we have only inflation (1). And there is no question that the benefits from aggressive recovery policy—“1. Prime-age employment… the highest level of the 21st century. 2. Wages… growing fastest at the bottom of the distribution. 3. Black unemployment… the lowest level on record. 4. Women’s employment…t the highest level on record”—vastly outweigh that cost.

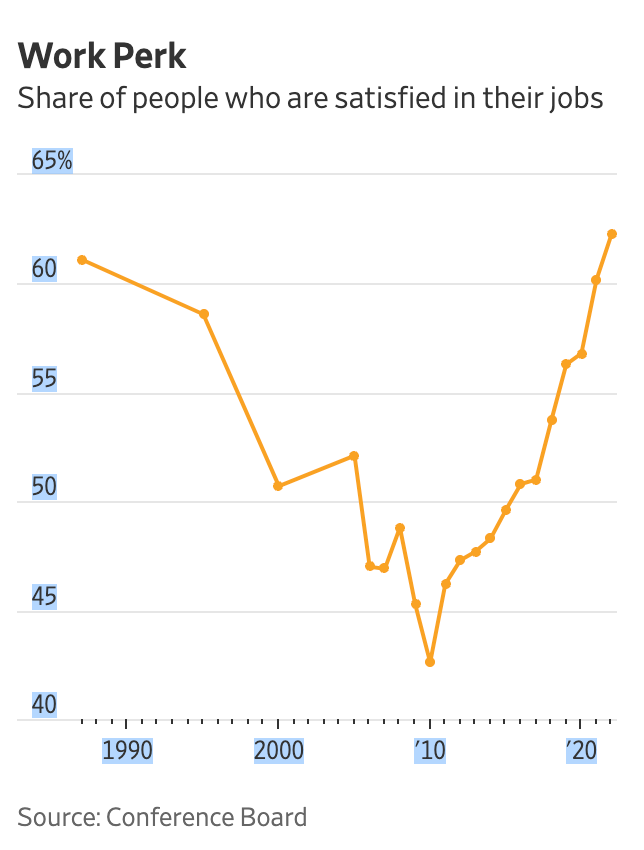

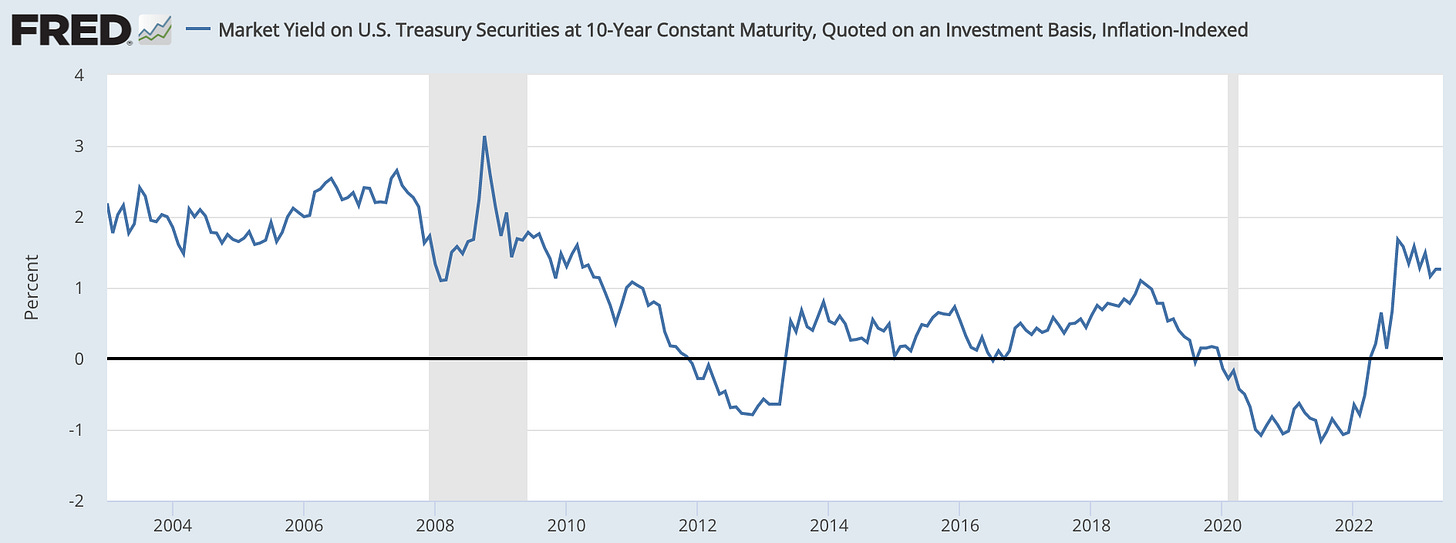

So I would hold the line: inflation is bad in the sense that leaving rubber on the road when you rejoin the highway at speed is “bad”. But rejoining the highway at speed so you do not get rear-ended is good. A forty-year record-high share of people satisfied with their jobs is good. Near-record prime-age employment-to-population is good. Strong confidence that the Federal Reserve has inflation under control for the medium term and beyond is good. Next to no inflation risk premium in long-term real interest rates—so that the intertemporal price system encourages investments in growth and the future—is good. We have all of those things. And we would not have them had we been unwilling to leave a little rubber on the road:

As we said in the 80s, the real problem with inflation is that eventually someone will do something stupid to ends it.

4% CPI is only ~ 1.7 percentage points higher than the Fed's PCR target and merits cautious praise for a pretty skillful recovery from its late 2021 delay. Cautious because it may have already gone too fast, too far with FF increases. TIPS traders, at least think so.