PODCAST: Keen On: Tom Keen & Brad DeLong Talk SVB Bank Collapse; & BRIEFLY NOTED: For 2023-03-19 Su

Talking SVB bankruptcy with Tom Keen; Microsoft gives a very impressive AI demo; real people get ground into dust in "culture wars"; pseudo-classical semi-liberalism, more energy, "policy ineffecti...

Keen On: Tom Keen & Brad DeLong Talk SVB Bank Collapse

EPISODE 1373: In this KEEN ON show, Andrew talks to the UC Berkeley economist and author of SLOUCHING TOWARD UTOPIA author Brad Delong about today's banking crisis, Chat-GPT4 and the new economic laws of our social media age.

Brad DeLong is a professor of economics at the University of California at Berkeley, where he teaches economic history, political economy, macroeconomies, and occasional other topics. He was a deputy assistant secretary for economic policy at the U.S. Treasury during the Clinton Administration. He is a New York Times instant bestselling author for Slouching Towards Utopia: An Economic History of the Twentieth Century

<https://overcast.fm/+QK6UF93nQ>

Highlights:

Slouching Towards Utopia: The Economic History of the 20th Century <bit.ly/3pP3Krk> now at 35,000 copies so far worldwide in all formats, based on extrapolation from daily Amazon sales rank and occasional publisher data.

A week ago Thursday, we kind of learned something that we really should have recognized two years ago: If Elon Musk tweeting one word, "Gamestonk", can quintuple a stock’s price because Elon's fanboys like being part of a community in it for the LULZ, then viral meme contagion from Silicon Valley venture capitalists can close a bank—can bankrupt a bank that looked otherwise as if it was likely to skate through.

A shock like Lehman Brothers took a month to propagate. Something similar today would likely take only three days.

Janet Yellen, Jay Powell, and Jamie Dimon believed that transferring another $30 billion of bank deposits into First Republic would calm everyone down and allow things to settle. But…

The FDIC doesn't have the power to declare all bank deposits covered. A systemic risk exception needs to be declared—there needs to be a genuine fear that failing to guarantee a bank's deposits would cause significant systemic trouble.

It would be helpful to see a letter from McConnell, Schumer, McCarthy, and Jeffries stating that the United States Congress believes the government should not let bank depositors lose their money or have their funds tied up in bankruptcy proceedings, and intend to swiftly move legislation through Congress to revise the deposit insurance ceiling.

The Trump-McConnell-Ryan 2018 bill took a piece of regulation that was useful and removed it.

Silicon Valley Bank fails, and not only does Silicon Valley begin screaming at the idea of having their cash tied up for the next two or three months in a bankruptcy process, but people elsewhere get very nervous about whether their bank might fail, especially since such a huge share of bank deposits are now uninsured

Biden will be judged depending on whether people have jobs, whether inflation is tolerable, and whether people feel that their money is secure and risks are manageable.

When I was 21, writing my undergraduate thesis, it took a full week to type up the thing—too make two high-quality copiies. The coming of the personal computer kind of quadrupled white collar workers' productivity in terms of assembling and then moving and printing out words, and doing spreadsheet calculations, and looking up things in databases.

The internet had similar effects: a quadrupling of your ability to communicate and research.

Now I think we're about to see a furtrher quadrupling in your ability towrite down what you really mean: Chat-GPT and its cousins are page-level autocomplete for everything controlled by a natural-language interface, and that is a really valuable thing to have.

Chat-GPT takes a page, looks out for the “closest neighbors” to that page in its training data, looks at what the next pages, the response pages, to those neighbor pages are, averages those response pages in some sense, and sends that average back to you. Just what autocomplete does, but on the level of the page rather than of the phrase.

Incredible advancements in technology in infotech like “AI” and in biotech like the mRNA vaccines restore some of my optimism about the pace and value of technology-driven economic growth—optimism that had been severely eroded by Web2 social media and Web3 cryptocurrencies.

MUST-READ: Fear the Microsoft!:

Was this vaporware? Or is this real? It is possible it was cobble together over the past six months. It is possible that this is something that Microsoft was close to being ready to announce six months ago when chat GPT appeared. The problem is Microsoft is good enough at pulling together things for presentations, that, unlike Google, the sems do not show if it was in fact the first possibility:

Ben Thompson: Microsoft Office AI, Copilot and Tech’s Two Philosophies, Business Chat and Appropriate Fear: ‘All of the demos throughout the presentation reinforced this point: the copilots were there to help, not to do — even if they were in fact doing a whole bunch of the work. Still, I think the framing was effective: it made it very clear why these copilots would be beneficial, demonstrated that Microsoft’s implementation would be additive not distracting, and, critically, gave Microsoft an opening to emphasize the necessity of reviewing and editing. In fact, one of the most clever demos was Microsoft showing the AI making a mistake and the person doing the demo catching and fixing the mistake while reviewing the work. Still, were Office apps worth the grandiosity of the introduction? I think yes; in fact, I would go further and argue that this was the most impressive AI demo to-date precisely because the application space was so obvious…

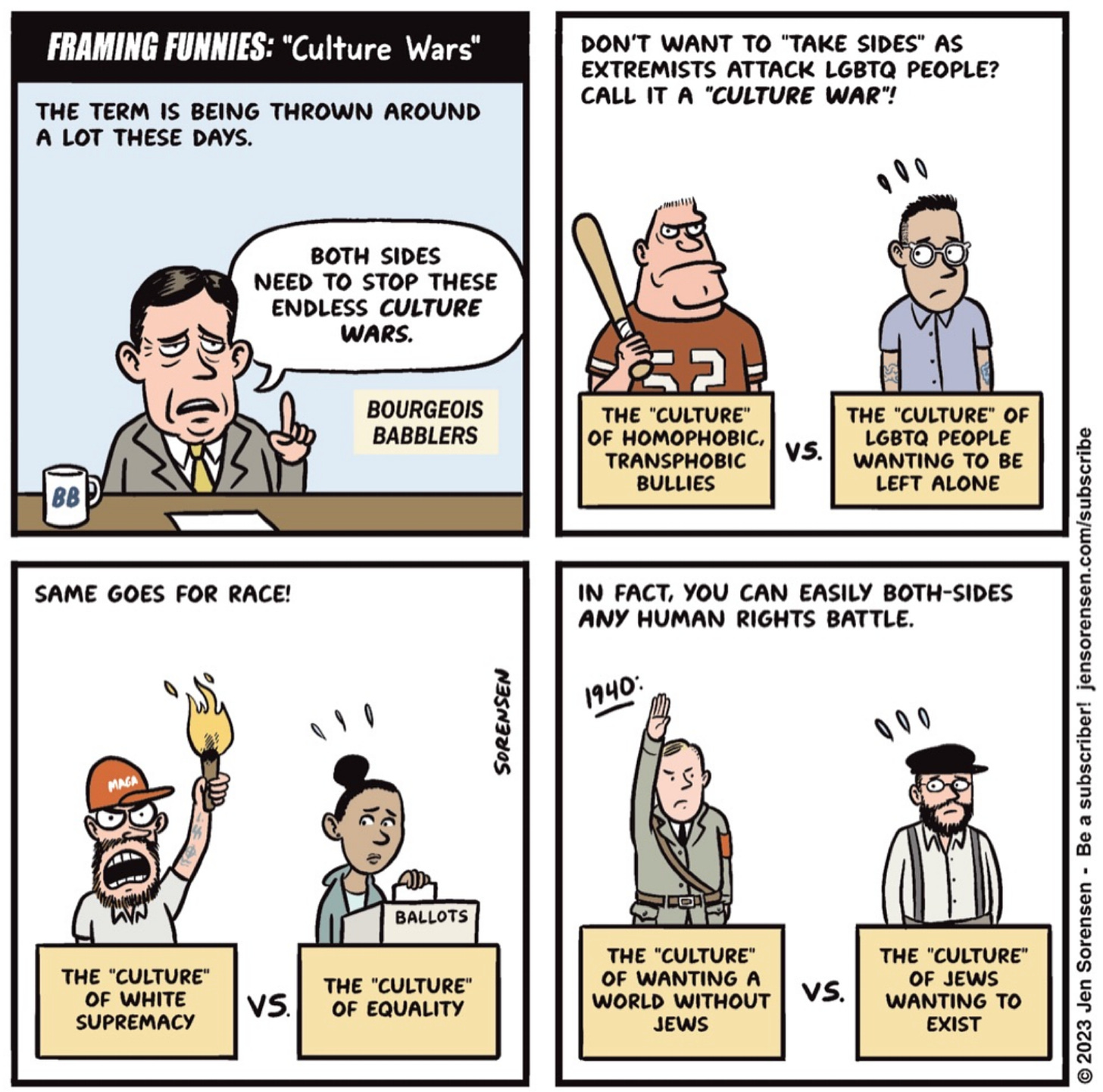

ONE IMAGE: “Culture Wars”:

ONE VIDEO: Microsoft Copilot AI March 2023 Event:

“Bicycles for the mind”, as somebody-or-other liked to say. “From autopilot to copilot”, as Satya Nadella now says:

Very Briefly Noted:

Kristine Aquino: Bond wipeout: ‘The holders of Credit Suisse’s riskiest bonds — worth $17 billion — are set to be wiped out...

Dina Bass & Emily Chang: Microsoft to Bring OpenAI’s Chatbot Technology to the Office: ‘Word, PowerPoint and Outlook emails will get new AI assistants called Copilots…

Izabella Kaminska: The Blind Spot: ‘Ultimately a panic caused by too much ambiguity in the terms and conditions of AT1 contingent debt…. Conditionally allowed for the regulator to convert to zero before equity…. “A few who had ‘lines to regulators’ tried to stop the regulators doing this stuff, for exactly this reason…

Ben Thompson: Tech’s Two Philosophies: ‘In Google’s view, computers help you get things done — and save you time — by doing things for you.... technology’s second philosophy, and it is orthogonal… the computer enables you to do your work better and more efficiently…. Its greatest proponent… was Microsoft’s greatest rival…

Timothy L. O'Brien: Trump Sweats an Arrest. We Should Sweat a Second Term: ‘The former president’s efforts to mobilize his mob show how important it is to ensure he never occupies the White House again, and that will be up to the Justice Department, not the Manhattan district attorney…

Virginia Postrel: Is ChatGPT a mad genius?: "‘It sees only well-established patterns—autocomplete on steroids…

Dylan Patel: Amazon’s Cloud Crisis: How AWS Will Lose The Future Of Computing: ‘Nitro, Graviton, EFA, Inferentia, Trainium, Nvidia Cloud, Microsoft Azure, Google Cloud, Oracle Cloud, Handicapping Infrastructure, AI As A Service, Enterprise Automation, Meta, Coreweave, TCO…

Steve Clemons: 🟡 Semafor Principals: Trump investigations roil 2024 — again: ‘“We’ve engaged in good faith discussions to understand Senator Cassidy’s proposals,” a White House spokesperson told Semafor. “The President welcomes proposals from members of Congress on how to extend Social Security’s solvency without cutting benefits and without increasing taxes on Americans earning less than $400,000 a year”…

¶s:

Gary Gerstle: The Rise and Fall of the Neoliberal Order: ‘The growing inclination of [pseudo-classical semi-]liberals to privilege order over freedom [after 1900]—and to become, in the caustic words of Walter Lippmann, “apologists for miseries and injustices that were intolerable to the conscience”—is what prompted many dissenters to forsake liberalism altogether for new and more radical ideologies. Lippmann was among those who, as youth, immersed themselves in socialist thought and politics. The perceived failure of liberalism is what would make socialism, and later communism, one of the most prominent creeds of the twentieth century…

Matthew Yglesias: More energy would solve a lot of environmental problems: ‘While “grow the plants outside” is a very efficient energy strategy compared to vertical farming, it’s incredibly profligate in terms of basically everything else…. A vertical farm uses 5-10% of the water of a traditional farm. And that’s a huge deal. Whenever I talk about tripling the American population or just legalizing more apartment buildings in California, someone always asks about water. But urban areas only account for about 10% of California’s water use — agriculture is where all the water is going, and cutting the farm sector’s water requirements would be a huge deal for sustainability…

Alan Blinder: A Monetary and Fiscal History of the United States, 1961–2021": ‘New classical economics, with this “policy ineffectiveness” result, conquered vast swaths of academia in the 1970s and 1980s, but it never developed much of a following among central bankers or among the many PhD economists who worked for them…. Neither Arthur Burns nor Paul Volcker, the two Fed chairs for most of that period, ever believed in monetary policy ineffectiveness. More important, central bankers all over the world saw that both inflation and real economies were crushed by Margaret Thatcher’s excruciatingly tight money in the United Kingdom and by Volcker’s excruciatingly tight money in the United States. No real effects?…

Elle Griffin: Automation has already taken our jobs: ‘A “new industrial revolution,” it’s worth taking a peek at what happened during the first one…. Gordon… in 1870, 87% of jobs were considered “unpleasant” (which he defines as arduous, physically difficult, and dangerous—largely farming, mining, railroad building, manufacturing, construction, and other so-called “blue collar work”). Only 12% were considered “pleasant” (which he defines as professional, managerial, and other so-called “white collar work”). By 2009, those numbers had flipped—only 21.6% of jobs were “unpleasant” and 78.4% were “pleasant.”… Gordon credits this shift to technological change: robots replaced assembly line workers, irrigation systems and plows replaced farmers, machinery replaced manual digging and mining. In other words: we automated things—so much so that 45.9% of our workforce were farmers in 1870, and only 1.1% were in 2009. If automation took our labor jobs, we didn’t become unemployed in their absence…. ‘This time is different; AI is different,’ they say, but is it?”

I just got around to reading Samuel Wilkes' Risk Magazine piece, dated 15 March. It has something interesting that I had not seen before.

You are probably aware that the BCBS defines a measure called "Economic Value of Equity (EVE)" which, roughly speaking, is the net present value of all cashflows on a bank's balance sheet under a prescribed discount function (there are some details about bucketing and netting.) There are Basel regulatory requirements tied to the change in EVE under prescribed changes in the discount function. One of these reporting scenarios is a 200bp rise in rates; banks whose EVE declines by more than 15% of Tier 1 capital are to be subject to enhanced scrutiny.

The interesting thing is the change in SVB's EVE sensitivity over time. It will not surprise you that in 2021, SVB's sensitivity to a 200bp rate rise was -27.7%, implying 35.3% of Tier 1 capital. But in 2015, SVB's EVE sensitivity to the same rate shock was over *plus* 40%! 2019 was the first year in which it had a (small) negative sensitivity. So the business model of SVB was moving pretty fast, and I guess it broke some things.

Clemons: I which that Baden was able to signal his desire for a more progressive tax system w/o the no taxes on <$400,000. I precludes lost of good ideas like 1) switching from wage taxes to a VAT for financing the safety net 2) moving from "deductions" to partial tax credits for favoring certain kinds of expenditures, 3) Taxation of net emissions of CO2 even with rebate. And however flexible our mixture of tax policies, I doubt that we can reduce the deficit to zero (or even to the level of public investment) without collecting more revenue from people with incomes <$400,000.

Of course it is a lot better than a desire to _reduce_ taxes on those with incomes >$400,000 and >>$400,000. :)