(06:19) <https://watch.mmhmm.app/z_KqcyWGXQlWsXw0FbsRxO>

Some respected economists are talking as if the US economy is in serious inflationary trouble. But the current uptick in price growth is highly likely to be a largely benign consequence of the post-pandemic recovery.

BERKELEY – In the past three years, technological advances have provided about one percentage point of warranted US real wage growth each year – admittedly, only half the rate of earlier times, but still something. Yet, real wages are currently 4% below their warranted value from adding on the underlying fundamental productivity trend to the pre-pandemic real wage Employment Cost Index (ECI) level. Does that sound like a “high-pressure” labor market to you?

Those who believe that the US labor market is in some sense “tight” point out that the ECI increased by 3.7% in the year to September – well above its 3% annual growth rate in the pre-pandemic years of former US President Donald Trump’s administration. But, because US consumer prices have increased by 5.4% over the past year, the ECI-basis real wage has fallen by 1.7% in that period. In a high-pressure economy with a tight labor market, workers would have enough bargaining power to obtain real wage increases.

Nowcasting is extremely difficult, and hazardous. But the “now” that I see today is the one I forecasted two to three quarters ago. Yes, the recovering US economy, like a driver who suddenly accelerates, is leaving inflationary skid marks on the asphalt. But, as I argued in May, these should not concern us, because “burning rubber to rejoin highway traffic is not the same thing as overheating the engine.”

The US is not currently in a situation where too much money is chasing too few goods, which would result in a surfeit of demand for labor and likely trigger an inflationary spiral. This is despite the fact that the ongoing COVID-19 pandemic and its associated disruptions continue to cause a substantial undersupply of labor.

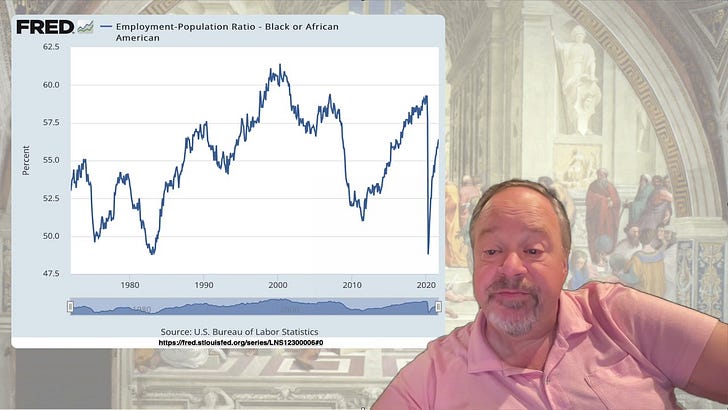

Today, the US economy’s overall employment-to-population ratio is three percentage points below what we used to regard as its full-employment level. The ratios for women, African-Americans, and workers without a college degree are, respectively, five, 4.5, and four percentage points below this level.

Yet, economists whom I respect talk as if the economy is in serious inflationary trouble. Jason Furman, a former chairman of President Barack Obama’s Council of Economic Advisers, thinks “the original sin was an oversized American Rescue Plan,” the $1.9 trillion recovery package that President Joe Biden signed into law in March. In Furman’s view, it would have been better to have less aggressive policy measures and thus a slower employment and growth recovery this year, because Biden’s plan “contributed to higher output but also higher prices.” And according to the same New York Times report, former US Treasury Secretary Larry Summers thinks that “inflation now risks spiraling out of control.”

The inflation worriers then argue that the COVID-19 crisis has permanently damaged the supply side of the economy by causing a lot of early retirements, as well as lasting disruption to the lean-and-mean supply chains on which a good deal of productivity and prosperity had depended. Perhaps. But similar arguments in the early 2010s, in the aftermath of the 2008 global financial crisis, aimed to justify policies that did not put the pedal to the metal and attempt rapidly to re-employ so-called “zero-marginal-product” workers. One consequence of this timidity was the election of Trump, whose rise was fueled by the rage of those who thought “elites” cared more about immigrants and minorities than they did about blue-collar workers whose economic opportunities had never recovered to pre-2008 levels.

Lastly, some claim that, regardless of whether or not the labor market is tight, inflation – whether driven by supply-side or demand-side factors – is high and salient enough that firms and households will swiftly incorporate it into their expectations. Thus, the inflationary snake has to be scotched now, while it is small, before it grows and devours everything of value.

But so far, rising inflation has not been incorporated into any of the “sticky” prices in the economy, according to the measure constructed by the Atlanta Federal Reserve. True, the financial market’s current 30-year breakeven inflation rate, at 2.35%, is more than half a percentage point above where it settled in the second half of the 2010s. But today’s rate is similar to that in the first half of the decade, and slightly below the level that would be consistent with the US Federal Reserve’s inflation target of 2% per year.

The current uptick in US inflation is highly likely to be simply rubber on the road, resulting from the post-pandemic recovery. There is no sign that inflation expectations have become de-anchored. The labor market is still weak enough that workers are unable to demand substantial increases in real wages. Financial markets are blasé about the possibility of rising inflation. And a substantial fiscal contraction is already in train.

Given these facts, why would anybody argue that the “original sin” was the “oversized American Rescue Plan,” and that tightening monetary policy starting right now is the proper way to expiate it? I, for one, simply cannot follow their logic.

Note: I still do not understand it: Everything I see still points to our inflation as not a durable and troubling spiral but simply proper and appropriate: rubber left on the road as we rejoin highway traffic at speed. I do not understand what many who say otherwise are thinking.

I agree completely. Bankers hate inflation because it makes it too easy to repay loans. Since they control our financial infrastructure, they have been keeping the economy in stasis for decades rather than accept the level of inflation necessary for non-financial economic growth. If the economy ever returns to its 1950s & 1960s growth rates, we're going to see serious skid marks.

I submit that the reason you cannot follow the "logic" of the inflation hawks is that there is none. It's scare-stuff designed to justify policies that keep workers down. The real question is "why would economists whom you respect be subscribing to morally bankrupt policy prescriptions."