READING: Paul Krugman: Notes on Globalization & Slowbalization

November 2020

Pol Antràs has a nice paper <https://www.nber.org/papers/w28115> on globalization in the face of Covid-19, although the truth is that his paper doesn’t have much to do with the pandemic; it is, instead, about the forces that fueled the rapid growth in trade over the two decades prior to the 2008 crisis, and why they’ve abated. Anyway, reading him inspired me to write up some thoughts of my own on the long-run history of globalization and its future prospects.

Why do this now? To be honest, partly what I’m doing is taking a brief mental vacation from the pandemic and the ugliness of the political scene. But I’ve also been wanting for a while to write something challenging what I believe is a widespread view that the long-run trend must always be toward greater global integration, that unless protectionism intervenes the world is always getting flatter.

This is kind of the economic version of the Whig interpretation of history <https://wwnorton.com/books/9780393003185>, in which liberal values and the middle class are always rising. It’s a view that appealed to elite opinion in the heyday of Davos Man <https://www.cnbc.com/2018/01/19/who-are-davos-man-and-davos-woman.html>. But it was never well grounded either in history or in theory. Globalization isn’t necessarily the wave of the future; the share of trade in world GDP could quite easily be significantly lower in 2040 than it is now. And that might be OK!

In what follows I’ll briefly summarize the long-run history of globalization, then sketch out a stylized model that I think makes sense of this history. I’ll conclude with a few thoughts about the future.

1. History of the world, part I

Early in John Maynard Keynes’s The Economic Consequences of the Peace he offered an encomium to the extraordinary degree of global integration that, he argued, prevailed on the eve of World War I:

The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend. He could secure forthwith, if he wished it, cheap and comfortable means of transit to any country or climate without passport or other formality, could despatch his servant to the neighboring office of a bank for such supply of the precious metals as might seem convenient, and could then proceed abroad to foreign quarters, without knowledge of their religion, language, or customs, bearing coined wealth upon his person, and would consider himself greatly aggrieved and much surprised at the least interference.

Indeed, as I think most economists are aware, world trade grew hugely in the late 19th and early 20th century, and by 1913 reached a share of GDP that wouldn’t be surpassed again until the 1980s:

It was only after the mid-1980s that trade surged to unprecedented levels. And as Antràs says, at this point “hyperglobalization” looks like a one-time jump, mainly taking place over roughly two decades before leveling off — a leveling-off that some are referring to as “slowbalization.”

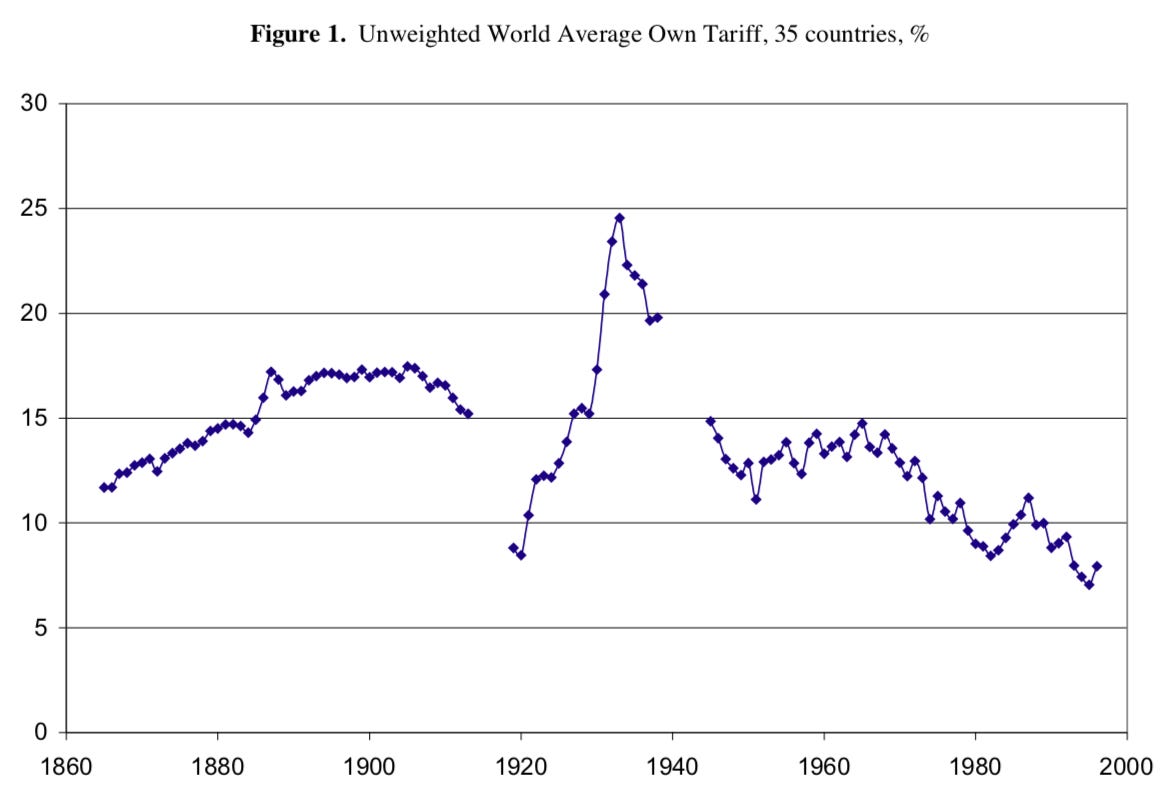

What drove these ups and downs in world trade? Protectionism is an important part of the story. Clemens and Williamson have a summary measure of average world tariffs that, while I’m sure it can be picked at (like the globalization measure), surely tells the main story:

That is, there was a surge in protectionism in the interwar years, then a gradual process of liberalization — mainly through trade agreements — after World War II.

Given this process of liberalization, it’s not surprising that world trade grew steadily faster than world GDP after 1950. What may seem surprising, if you believe that the world is always getting flatter, is that even though the world was less protectionist in the 1980s than it had been before World War I, trade as a share of output was basically the same as it had been 70 years earlier.

This failure of trade to grow between the 1910s and the 1980s is, you might say, the dog that didn’t bark. Wasn’t the world supposed to be getting smaller, as the technology of transportation and communication progressed?

The analytical answer is that rising globalization requires more than technological progress in transportation; it requires progress in transportation that is faster than technological progress in domestic production.

I think this point is most clearly made with a stylized little model — one that I worked out more than a decade ago, before the globalization slowdown, but which seems even more relevant now. Let me sketch this model out, then speculate about what this kind of thinking suggests for the future.

2. Globalization: A toy model

Assume, for a moment, that we have a can opener: the world consists of two symmetric countries, each of which has only one factor of production, labor. This labor can be used in each country to produce a single domestic good, which is an imperfect substitute for the good produced in the other country; it takes a units of labor to produce one unit of the good. Alternatively, t units of labor can be used to transport one unit of the foreign good to domestic consumers.

Assume also, for the sake of even more simplicity, that there is a constant elasticity of substitution σ between the domestic and foreign good in each country.

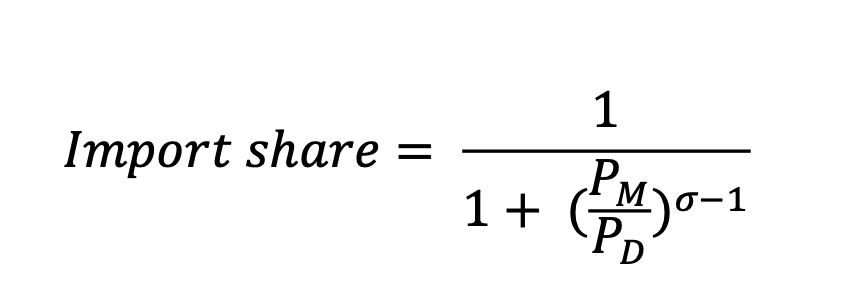

Given these assumptions, what is the share of imports in spending, which is also the share of world trade in world GDP? A bit of algebra shows that it depends on the ratio of the c.i.f. price of imports — i.e., including transport costs — to that of the domestic good, PM/PD:

But given our simple assumptions about production, PM/PD = 1 + t/a. That is, the trade share depends on how much labor is required to transport a good relative to how much is required to produce that good.

Technological progress reduces both t and a: e.g., container ships are a lot more efficient than windjammers, but modern technology also makes it possible for around 1 1⁄2 million farmers to feed America and much of the rest of the world. There’s no obvious law saying that t will fall faster than a, and hence no law saying that globalization must always rise.

This is obviously a hugely simplified model, but I think it gets at the main point: trends in globalization should be seen as the result of a race between the technology of transportation and the technology of production, and it’s by no means necessarily the case that transport technology will always win that race.

That said, there have been a couple of eras in which technological change was clearly biased in favor of globalization. Steam engines had widespread economic impacts, but their most dramatic effects came from steamships and railroads. During the era of hyperglobalization this process was more subtle, but it seems that the widespread adoption of containerization, probably combined with the use of information technology to coordinate geographically dispersed value chains, produced another relative productivity surge in transportation.

On the other hand, the fact that globalization was no more extensive in the 1980s than it had been in 1913, despite lower tariffs, at least suggests that over that 70-year period technological progress in transport, although it obviously continued, didn’t outpace and may have lagged progress in domestic production.

There aren’t any obvious examples of hyper-deglobalization — eras in which rapid technological progress outside transportation led to a sharp fall in world trade. But to see how it’s conceivable, let me invoke a whimsical example.

Manu Saadia’s Trekonomics <https://en.wikipedia.org/wiki/Trekonomics> argues that the essential feature of the fictional Federation economy is the replicator, which produces whatever you want costlessly, on demand. It’s hard to see why a world possessed of such devices would engage in much long-distance trade. If you can just say “Tea, Earl Grey, hot” and be presented with a steaming cup, why bother shipping stuff from India?

While nothing that drastic has happened, and the data don’t show a drastic turn away from trade, there is substantial anecdotal evidence of “reshoring” — individual firms bringing production from developing economies back to advanced countries. Nearly all of these anecdotes give a central role to automation — to being able to produce with far fewer workers than in the past thanks to robots or “cobots” (which work with human workers) that greatly reduce labor costs. In these cases, in other words, higher domestic productivity — lower a — leads to reduced trade in the absence of an offsetting rise in transportation productivity.

So which way will technology push us over the next few decades? Nobody knows. It’s easy to conjure up scenarios. Replicators aren’t coming anytime soon, but 3D printing is; will it replace much trade in manufactured goods? On the other hand, will many services — perhaps including much of health care — be delivered through telepresence by workers in other countries? (I’ve earned some fees during the pandemic by giving lectures in Europe and Asia, all of them delivered from my home office via Zoom, Webex, etc. I guess these count as U.S. service exports.)

But should we care whether globalization trends up or down? We’re talking about market responses to technology, not trade war, so does it matter? Possibly.

3. Upsides and downsides of slowbalization

Suppose that the technology race tilts against globalization for the next few decades. In my stylized model, this would be neither good nor bad, just the natural consequences of exogenous technological change. But step outside the model a bit, and it’s not hard to think of some potentially serious consequences for both good and evil.

The good consequences might be environmental. Global shipping is a significant emitter of greenhouse gases; but potentially more important, it’s probably one of the sectors where it’s hardest to eliminate fossil fuels. Running cars off electricity generated by wind and solar is relatively easy; doing the same with container ships probably much more difficult. So deglobalization could be helpful in limiting climate change. In fact, if we ever do impose something like carbon prices, this could in itself be a force for deglobalization.

The most likely bad consequences would involve development. Think of Bangladesh, a poor country that has nonetheless made significant progress, tripling real GDP per capita over the past 25 years, largely thanks to rising exports of apparel. What will happen to Bangladesh if robots lead to reshoring of the apparel industry?

At an even more fundamental level, it’s probably not a coincidence that the surge in world trade from the 1980s to the late 2000s coincided with substantial economic convergence, with rapid growth in some developing countries. It seems highly likely that complex global value chains lead, as a side consequence, to technological diffusion, aiding rapid development of poor nations.

And deglobalization could therefore hurt the process of global convergence; it could, in particular, hurt the prospects of countries, like much of sub-Saharan Africa, that got into the game too late.

But this is all loose speculation. The main point of this note is to debunk the Whig theory of globalization: no, the world economy isn’t destined to become ever more integrated.

(Remember: You can subscribe to this… weblog-like newsletter… here:

There’s a free email list. There’s a paid-subscription list with (at the moment, only a few) extras too.)

I was recently reading a post over at Construction Physics that did a similar analysis with regards to construction productivity. The stuff that buildings are made of is generally large and heavy, so transportation costs can be substantial. Unlike most industries, there are benefits to local production even if this limits the scale of production. Sometimes the gradient is so extreme that it makes sense to do manufacturing on site as opposed to at some efficient central or regional facility. (for example, concrete skyscraper floors)

>>This failure of trade to grow between the 1910s and the 1980s is, you might say, the dog that didn’t bark. <<

What I see from the chart is that WWII was a huge, huge event, and following it global trade has been on a meteoric rise, and has done so continuously for almost 80 years now.

So better to say that trade dropped catastrophically in the 1940s and despite very rapid growth, there are limits to how fast that growth can be under even the best of circumstances (e.g., oceanic containers are awesome, but you can only redesign ports, create a container shipping fleet and build a manufacturing base in China so fast).

So deglobalization requires the most destructive war in history, but other than that it's been a pretty steady upward process for approaching two centuries now? Do I have that right?