Reviewing Charlie Maier’s Þe Project State & Its Rivals; & BRIEFLY NOTED: For 2023-04-14 Fr

Reviewing Charlie Maier; the IMF's view of the world economy; which risks should be socialized?; major economic powers; & Levine, Eskenazi, & Barro...

FOCUS: Reviewing Charlie Maier’s Þe Project State & Its Rivals:

My review of Charlie Maier’s brand-new The Project State & Its Rivals <https://www.amazon.com/dp/0674290143>—its publication is still a month away—is now out in Harvard Magazine <https://www.harvardmagazine.com/2023/05/montage-interpreting-politics>.

Charlie’s book is not about either modern plutocracy or modern… he politely calls is “populism”, but when I feel polite I call it “Cæsarism-fascism”, and when I feel impolite I call it “fascism-neonaziism”. But he does drop asides and clues to what he thinks in the book. And so I divert from my task of reviewing the book to disagree with him—which one always does only at one’s grave intellectual peril:

Here is what I have to say about modern Cæsarism-fascism-neonaziism:

With too much political voice in the hands of the super-rich, Maier suggests, politicians soft-pedal appeals to reforming the distribution of income. Political messages then become tuned either to enabling upward mobility by removing legacies of past injustice, on the left, or to the construction of a cross-class alliance based on the people vs. the strangers. As he writes:

Contemporary populist ideas [are]...that there exist...two sorts of people...a virtuous, usually ethnically uniform core and a collection of ultimately parasitic hangers-on, whether intellectuals or immigrants or politicians—a mass infestation of updated ‘caterpillars of the commonwealth.’...The ‘people’ are summoned into life when the nonpeople, the exploitative outsiders, somehow fundamentally alien, are conjured into existence....But populism involves a dipole in a further sense. It requires a people’s tribune or political entrepreneur, a would-be strong man, a leader waiting to summon the people or at least define it as a political group. Antiquity provided the model for Caesarism…

Maier calls this dipole both “essential” and “implausible,” and marvels at the strength in India of the forces that made the Hindu-identified “economically successful...sign... into a Hinduist movement whose rhetoric seemed designed to demonize them....”

But Maier’s confrontation with modern populism appears to end with him in fear. Perhaps, in his heart of hearts, he fears he has written the wrong history? Perhaps history is not so much about networks—of capital, of people committed to a project-state, and other such—but rather about the search for collective identity and the creation of collective loyalties, with people often becoming near-mindless puppets directed by a charismatic leader manipulating loyalties of tribe, race, and faith against those they cast on the roles of Enemies of the People.

If so, I would tell him to stay his course. I see much more continuity between the Trumps and the Orbans and the Modis of our day and past “Caesarist” leaders—extending, as Maier says, back to President Louis Bonaparte of the Second French Republic, who became Emperor Napoleon III of the Second French Empire, to Andrew Jackson, and all the way to Julius Caesar. But a populist leader who lowers the taxes of the rich? That has always been a delicate tightrope dance, requiring both personal magnetism on the part of the leader and an appeal to nonmaterialist values. It is easy for the charismatic leader to fall off the tightrope. And it is inevitable that the leader’s heirs and successors will.

I find myself very optimistic, much more so than I have been ever since 2008, in this year 2023.

Loyalties of tribe, race, and faith require charismatic boosting to make them politically powerful. The touchstones of political legitimacy are safety and prosperity, and perhaps a sense that your government is at the head of a truly worthwhile and valuable community. A democratic state committed to that project has a considerable edge over other types of régime, now and in the future.

And here’s what I have to say about modern plutocracy:

John Maynard Keynes thought that plutocracy would cease to be a problem when democratic governments that sought full employment applied his technocratic theories of economic management. A full-employment policy, he thought, would inevitably be a low-interest-rate policy. When interest rates were low, plutocrats had only two options: keep their wealth growing at a small rate by reinvesting all the interest, in which case the social power they normally exercised through their spending would be held in perpetual abeyance; or spend down their capital, in which case they would then cease to be plutocrats. This was, as Maier notes, Keynes’s “euthanasia of the rentier”—his prediction of the disappearance of dynastic wealth exercising dominion over society.

But Keynes was wrong: plutocracy returned. His first error was to overlook the fact that, even in his day, most plutocracy was not denominated as a capital sum in dollars or pounds, but rather in a claim to an income flow from monopoly, ownership of resources, or a well-capitalized enterprise. Of these, only the third would not see its capital value rise as interest rates declined. Keynesian low-interest rate policies would thus amplify plutocrats’ capital; with their incomes unchanged and their wealth magnified, the group’s power to shape society would, in fact, grow.

Keynes’s second error was that he could not foresee the large and persistent (right now it seems eternal) gap that would arise between the rate of interest on bonds and the earnings yield on stocks. For those willing to grab for risk, rates of profit have remained high on average even while rates of interest have become low. It is true that by taking outsized risks, each individual plutocrat has a large chance of crapping out—of losing so much of their wealth that they no longer can shape governance or directly wield much social power. But for the plutocracy as a whole, outsized risk-taking is very profitable: the winnings of the small group who are truly lucky vastly outweigh the losses of the unlucky, and so the social and political power exercised by plutocracy continues to rise.

ONE VIDEO: Kristalina Georgieva on the IMF’s Global Policy Agenda:

MUST-READ: Ordinary & Extraordinary Risks:

I think the best way to resolve this is to look at the past and the present: what kinds of risk have people in the past often not guarded against, and what kind of risks are people, empirically, not guarding against now? To say that they “should have” when large numbers of them have not seems to me to be largely beside the point

Dan Davies: Ordinary & Otherwise: ‘Everyone will start from their own experience…. I think financial risks are sufficiently ordinary that tech companies ought to be set up to manage them, while a tech guy might think, for example, that cybersecurity is a basic competence and anyone hit by ransomware only has themselves to blame…. As the world grows and gets more complicated, it becomes more difficult to anticipate change; more things are “out of the ordinary”. That’s why there’s a structural tendency for the state to grow and for risks of all kinds to be socialised. One of the deepest questions of the modern state is to decide what is the ordinary course of business which people need to deal with on their own, and what is an out-of-the ordinary occurrence that needs to be handled collectively…

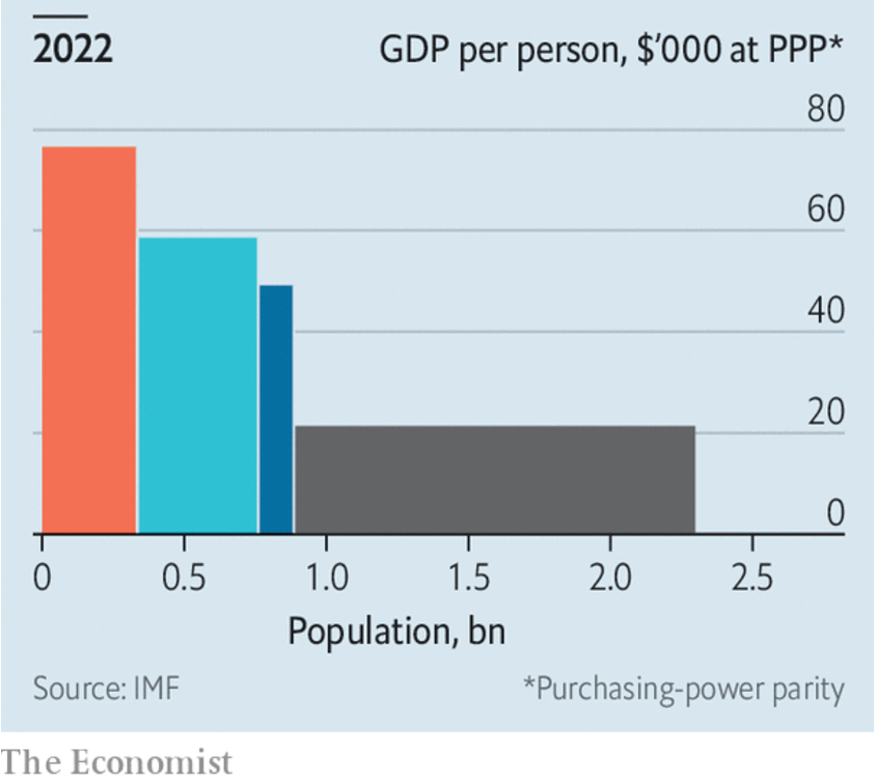

ONE IMAGE: Major Economic Powers, 2022: US, EU, Japan, China:

Very Briefly Noted:

Brian Albrecht: Does Price Discrimination Convey or Distort Information?: ‘The standard response is that price discrimination distorts knowledge, just as monopoly pricing distorts knowledge…. [But] upfront or fixed costs are everywhere, and prices need to convey that it is worthwhile to cover those fixed costs (not just marginal costs)…

Guido Lorenzoni & Iván Werning: Inflation is Conflict: ‘A stylized model…. Inflation arises despite the complete absence of money, credit, interest rates, production, and employment. Inflation is due to conflict…. Our main results provide a decomposition of inflation into “adjustment” and “conflict” inflation, highlighting the essential nature of the latter....

Matt Levine: Twitter Gets Into the Stock Business: ‘Imagine if Reddit [had] put a button next to each GameStop post saying “buy GME,” and if you clicked the button you could buy shares…. Anyway! “Twitter will let its users access stocks, cryptocurrencies and other financial assets through a partnership with eToro, a social trading company. Starting Thursday, a new feature will be rolled out on the Twitter app. It will allow users to view market charts on an expanded range of financial instruments and buy and sell stocks and other assets…

Economist: America’s economic outperformance is a marvel to behold: ‘The roots of America’s success as a technological innovator go deep; Silicon Valley was generations in the building. The reason why its wares were put to such productive use, though, are more easily seen, and still apply today. Simply put, they are skills, size and spunk…

Chris Anstey: It’s Yellen V. Georgieva as US, IMF Debate Growth Outlook…

Tim Burke: Academia: Skills That Make The Bills: ‘As Furstenberg observes, there isn’t really a “skills gap” that waits to be filled by universities that opt to follow Wingard’s empty slogans. Instead, business leaders still end up seeming to want to hire graduates who are good at critical thought, good at expressive self-presentation, generalists with a broad range of knowledge and skill. E.g., what liberal education already excels at—at least until people like Wingard set to work on it…

Dan Pfeiffer: Republicans are Losing the Culture War ...Badly: ‘As the Republicans squeeze more turnout from a shrinking base, the party’s position on cultural issues drifts further and further from the mainstream….. Abortion and marriage equality are now points of strength for Democrats… similar progress on other issues, including crime and the GOP’s anti-trans agenda…

Lou Ellen Davis: The Last Bug: ‘He died at the console,/of hunger and thirst./Next day he was buried,/face down, nine-edge first…

Matt Levine: Twitter Gets Into the Stock Business: ‘Bitcoin transactions are public, preserved forever and pseudonymous. In 2012, this meant that Bitcoin was a pretty good way to do crime…. In 2023, it means that Bitcoin is frankly kind of a bad way to do crime…. Law enforcement and blockchain analysis firms will be able to trace the movements of that Bitcoin forever, and any crypto exchange will do some know-your-customer checks… so when you turn your proceeds into cash the police will show up at your housewith a detailed permanent immutable public record of every transaction…. Also, though, it means that in 2023, Bitcoin is retrospectively a bad way to have done crime in 2012…

Joe Eskenazi: Arrest made in SF killing of Bob Lee—tech exec’s alleged killer also worked in tech: ‘If the police do have their man, this was not a… grievance between men who knew one another, which the suspect purportedly escalated into a lethal conflict. Lee’s death, however, was packaged in the media and on social media into a highlight reel of recent San Francisco misfortunes and crimes: large groups of young people brawling at Stonestown; the abrupt closure of the mid-market Whole Foods, leaving San Franciscans just eight other Whole Foods within city limits…

Josh Barro: The Arrival of 'Normal Politics' for the Debt Ceiling: ‘LA has a major problem with catalytic converter theft…. The Los Angeles City Council passed an ordinance that makes it a crime to possess a loose catalytic converter, unless you have proof that you actually own that…. The vote on the ordinance was 8-4. And the quotes from some of the city councilmembers who voted against the proposal are wild…. Some members of the council are more concerned about people who steal catalytic converters—how might being arrested affect their future efforts to rent apartments?—than they are about people whose catalytic converters are stolen—how might losing their catalytic converters affect their ability to get to work and pick up their kids from school? What will repairs cost?… The criminals get pity. Law-abiding members of the public get an airy argument that the city (i.e. taxpayers) should help them get made whole…. You saw something similar up in San Francisco last month, where John Hamasaki—a former member of the city’s police commission who lost a race for District Attorney last year—mocked another city resident who complained about car break-ins, saying “Is this what the suburbs do to you? Shelter you from basic city life experiences so that when they happen you are broken to the core?”… These viewpoints are apparently minority viewpoints in both San Francisco and Los Angeles—the catalytic converter ordinance passed, and Hamasaki’s campaign for district attorney failed. But they’re not marginal viewpoints: Hamasaki, for example, got 46% of the vote…

Even Keynes was not clever enough to foresee the absolute genius of the New Right: tax cuts cum deficits to drive up interest rates.

I hope I'm not misunderstanding this quote (because I haven't read the book): "Maier calls this dipole both “essential” and “implausible,” and marvels at the strength in India of the forces that made the Hindu-identified “economically successful...sign... into a Hinduist movement whose rhetoric seemed designed to demonize them....”" I can assure you that the "economically successful...sign" was far from the reality when they started out, back in the late 1980s, when they used to be on the periphery of politics. They started with what you want to google as the "Ram Rath Yatra." That's where they laid the foundation. And that's the well they still draw from. Not the economics.