Silicon Valley’s Loss of Assibayah; & BRIEFLY NOTED: For 2023-03-21 Tu

Where were the people volunteering to join a rescue syndicate for SVB?; Brad Setser on system risk exceptions; wiþ the NIMBYs; Scott Lemieux and David Glasner and Paul Kedrosky and Eric Norlin

FOCUS: Silicon Valley’s Loss of Assibayah:

A functional engineering community—like a functional army, or a functional state—requires what historian Ibn Khaldun called assibayah: a strong sense that it is all for one and one for all, that we can count on members of our group to, when the chips are down, pitch in and be willing to spend some of their capital and energy on making sure that the group flourishes. Such assibayah was nearly completely absent from Silicon Valley during the SVB crash.

And Sinead O’Sullivan takes the valley to task:

Sinead O’Sullivan: The fault, dear VCs, is not in your stars. It’s in you: ‘After more than a decade of venture capitalists insisting they provide more than just cash to their portfolio companies, the moment to prove that finally arrived. Then it went. As the news of the Silicon Valley Bank collapse reverberates through the technology ecosystem — and investors and founders alike furiously Google terms such as “available-for-sale” and “held-to-maturity” — even some of our most prominent financiers, like “PayPal Mafia” member David Sacks, are learning once again how banks work, the hard way. David Sacks: “The idea that depositors are creditors to a bank is an absurd and outdated notion. Everyone just wants a checking account, not to loan the bank money.” Meanwhile, side-eyes and fingers are starting to point within the investor community. Hushed DMs are flying. “Let’s take this offline” is appearing in group WhatsApp chats….

Who stirred the rumours that created the run that exposed the fundamental risk in the first place? Who screwed us over? Sentiment is one hell of a drug, and it should come as no surprise that venture capital, which has perfected the art of moving entire markets through its echo-chamber hype, has managed to hype its own rumours of a potential banking collapse to . . . collapse a bank…. Consider that VC has pumped and dumped nearly every industry it could get its hands on over the past decade. Now, with crypto exiting the market stage left, there is only one industry remaining to “disrupt”: venture capital itself. Even if accidentally. And in doing so, even the most ardently atheist investors have managed to find religion again. Except this time, their God is the federal government….

We’ve got “rugged individualism and capitalism on the way up, privatising the gains, then ‘we’re all in this together’ on the way down”. While most non-investors are horrified at the thought of bailing out investors of yet another high-risk industry, that doesn’t deter Bill Ackman: “The failure of @SVB_Financial could destroy an important long-term driver of the economy as VC-backed companies rely on SVB for loans and holding their operating cash. If private capital can’t provide a solution, a highly dilutive gov’t preferred bailout should be considered”…

You can argue that the PayPal Mafia is especially toxic—that the likes of David Sacks, Peter Thiel, and Elon Musk are really weird outliers. And they are. But while they were running away and telling others to flee while they could to avoid a small risk to their liquidity—for the U.S. government is not in the business of inflicting large haircuts on bank depositors, and it looks to me like the U.S. government will ultimately not have to contribute any money at all to the resolution of a probably genuinely illiquid-but-solvent bank—there was nobody running in the other direction volunteering to contribute to a rescue syndicate to inject capital.

“Banking isn’t their business”, you might well say. And, indeed, it isn’t. But Alexis de Tocqueville said back in the 1830s that the true genius of America was that while people pursued their self-interest, it was self-interest “rightly understood”—that they were, in a phrase, “long-term greedy”, and understood that their counterparties and the community they were in had to flourish if they were to succeed in the long run.

Maybe crypto was just too obvious a grift? And that poisoned the culture?

I do not know…

MUST-READ: Brad Setser on SVB Resolution:

There was real concern about deposit flight and funding-driven contagion to the extent that (a) nobody thought rescuing SVB’s depositors would be costly, and (b) nobody wanted to risk the consequences of impairing depositors’ liquidity, even if only a little bit and only for a little while:

Brad Setser: ‘The outline of the US government's response to the failure of Silicon Valley Bank is now clear, and the US didn't mess around. Clearly there was real concern about deposit flight and funding-driven contagion…. First, the FDIC invoked the systemic risk exception… allow[ing] the deposit insurance fund to cover any gap…. Two, the Fed (using its own authority) reduced haircuts on collateral offered at the discount window…. Three, the Fed and the Treasury used their 13-3 emergency authority to create a new bank funding facility that lends against Treasuries and Agencies for a year (longer than the discount window) at (critically) par…

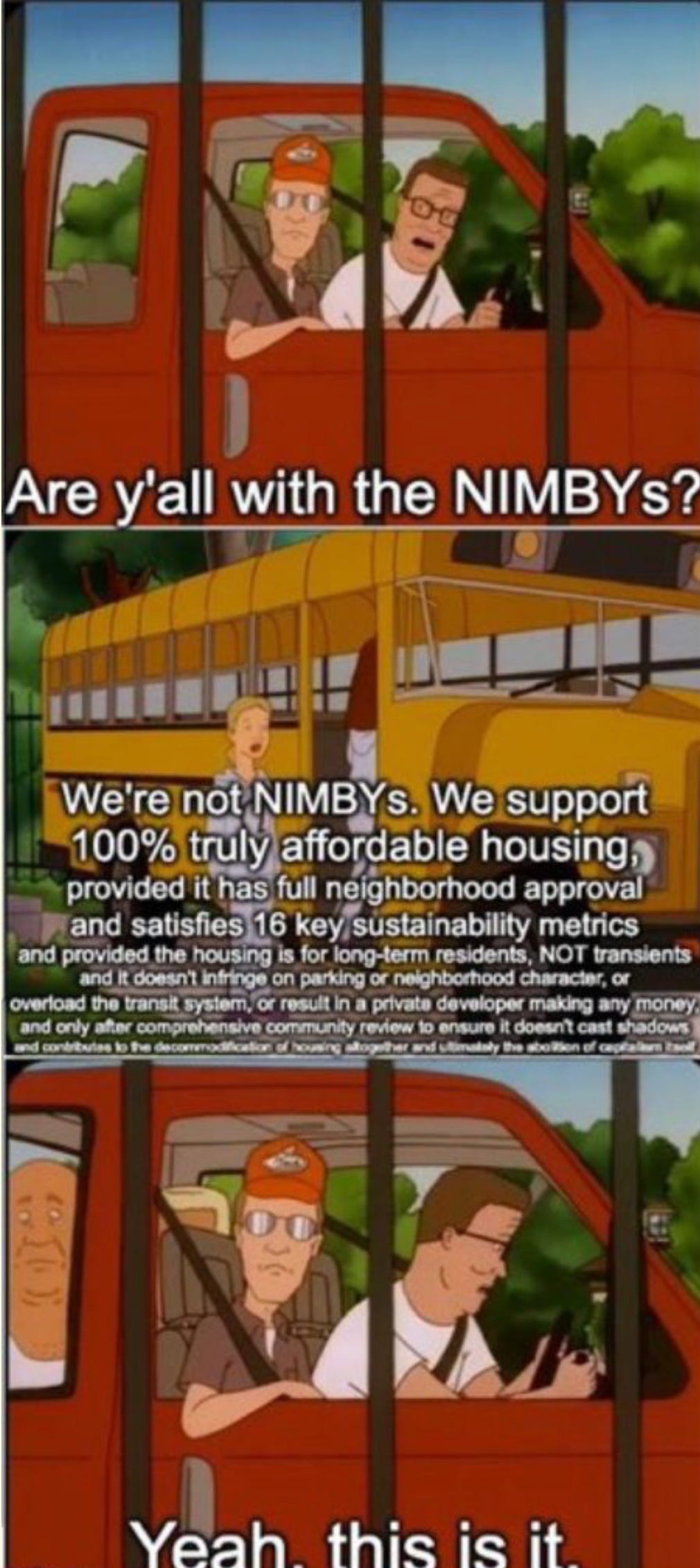

ONE IMAGE: Wiþ the NIMBYs:

Very Briefly Noted:

Nick Gruen: AI: is it coming for us? (No) Is it a big deal (Yes): ‘While teachers and lecturers around the world see AI as a threat to their ability to examine their students, Tyler's jumped out of the blocks in no time… his students… examine[ed]… on their ability to use AI for research assistance and collaboration...

John Authers: Markets Go Calm: A Lehman Pause or the Real Thing?: ‘ECB reassurances for AT-1 bondholders may prove key to confidence after the shock in Switzerland. But this banking crisis isn’t over yet…

Mark Gongloff: California’s Drought Is Over. Its Water Problems Aren't: ‘It will take a lot more than this year’s deluge of rain to replenish the state’s depleted groundwater…

Stephen Morris, James Fontanella-Khan and Arash Massoudi: How the Swiss ‘trinity’ forced UBS to save Credit Suisse: ‘The takeover of its local rival could end up being a generational boon for UBS. But the government-orchestrated deal has angered many investors…

Paul Campos: Children of men: ‘I did not have “prominent Republican politician comes out in favor of unwed teen parenthood” on my Conservative Family Values bingo card…

Ellen Huet: The Real-Life Consequences of Silicon Valley’s AI Obsession: ‘Sam Bankman-Fried made effective altruism a punchline, but its philosophy of maximum do-gooding masks a thriving culture of predatory behavior…

Daniel Bashir: Don't "Plan for AGI" Yet: ‘It’s certainly worth imagining what your job will look like if you have a system like ChatGPT at your constant disposal (if your employer is permissive). Don’t expect ChatGPT to take your job too soon, though…

Scott Lemieux: The collapse of SVB and the partial repeal of Dodd-Frank: ‘Remember when Trump and the Republican leadership, in collaboration with a critical group of moderate and conservative Democrats, rolled back some of the regulations Dodd-Frank placed on regional banks?…

¶s:

Scott Lemieux: Authoritarianism: feature or bug?: ‘Shorter verbatim Andrew Sullivan: “Similarly, DeSantis may be overreaching on the anti-woke stuff…. But… his attempts at pushback are hardly the stuff of fascism. They’re almost poignant in their plain unconstitutionality. And it matters greatly that one of our political parties does not collude in the elevation of group rights over the individual, or place postmodern subjectivism over empiricism and science, or rely on emotional blackmail and coercion over discourse and compromise. We need a sane GOP. And DeSantis is not insane. If Biden falters, or if, God forbid, Harris takes over, he may be the only non-Trump option.” Fellas — is it fascist to violate the Constitution to punish your political enemies? OK. but what if I told you that this was done in the service of challenging WOKE? And when you think of Ron DeSantis, surely the first thing that comes to mind is “discourse and compromise?” After all, surely “emotional blackmail” is infinitely worse that “state coercion” could ever be! Seeing DeSantis stans converge on the idea that state censorship is necessary to protect liberal values is amazing but also frightening stuff…

Dave Glasner: Jason Furman Hyperventilates about Wages and Inflation: ‘Furman is correct that the January increase in core inflation was significant, and also correct to observe that the Fed shouldn’t overreact to a single data point. Unfortunately, he immediately reversed himself by demanding that the Fed respond to the January increase by quickly and significantly tightening policy, because core inflation, notwithstanding the assurances of “team transitory”, has not subsided much on its own. I can’t speak on behalf of team transitory, but, as far as I know, no one ever suggested that inflation would fall back to the Fed’s 2% target on its own. Everyone acknowledged that increased inflation last year was, at least partly, but not entirely, caused by macroeconomic policies that, during the pandemic and its aftermath, first supported, and then increased, aggregate demand…

Paul Kedrosky & Eric Norlin: Society's Technical Debt and Software's Gutenberg Moment: ‘Observers are missing… (1) Every wave of technological innovation has been unleashed by something costly becoming cheap enough to waste. (2) Software production has been too complex and expensive for too long, which has caused us to underproduce software for decades, resulting in immense, society-wide technical debt. This technical debt is about to contract in a dramatic, economy-wide fashion as the cost and complexity of software production collapses, releasing a wave of innovation.

While many markets have economies of scale, there hasn’t been anything in economic history like the collapse in, say, CPU costs, while the performance increased by a factor of a million or more.... What if the cost of producing software is set to collapse, for all the reasons we have discussed, and despite the internal Baumol-ian cost disease that was holding costs high? It could happen very quickly, faster than prior generations, given how quickly LLMs will evolve....

Entrepreneur and publisher Tim O’Reilly has a nice phrase that is applicable at this point. He argues investors and entrepreneurs should “create more value than you capture.” The technology industry started out that way, but in recent years it has too often gone for the quick win, usually by running gambits from the financial services playbook. We think that for the first time in decades, the technology industry could return to its roots, and, by unleashing a wave of software production, truly create more value than its captures.

Please unsubscribe me. Thanks, David Fedson

Sinead O’Sullivan is right. As I have remarked elsewhere, in the previous gilded age, that noted socialist J.P. Morgan arrested the panic of 1907 by deploying his own considerable (pace Rockefeller) resources but also by arm-twisting his fellows. But the new gilded age lacks the class solidarity of its predecessor; the self-styled visionaries with dreams of colonizing mars and living eternal life thought it more important to look clever in front of their friends than to preserve the system that sustains themselves. When SVB went looking for equity on March 15th, what was the amount? A little over $2bn? The main criticism was that they ought to have "gone big" and raised $5bn. That is couch cushion change for the PayPal Mafia. And yet here we are.